III. The next-generation monetary and financial system

Key takeaways

- Tokenisation represents a transformative innovation to both improve the old and enable the new. It paves the way for new arrangements in cross-border payments, securities markets and beyond.

- Tokenised platforms with central bank reserves, commercial bank money and government bonds at the centre can lay the groundwork for the next-generation monetary and financial system.

- Stablecoins offer some promise on tokenisation but fall short of requirements to be the mainstay of the monetary system when set against the three key tests of singleness, elasticity and integrity.

Introduction

The story of the monetary system, and its role in the economy, is one of continuous evolution. Throughout history, technological progress in the monetary system has gone hand in hand with major leaps in economic activity. The innovation of money recorded as book entries managed by trusted intermediaries gave rise to new financial instruments that helped trade and commerce flourish. Paper ledgers gave way to digital ones, bringing profound changes to the economy and society.

The past several years have seen a wave of digital innovation that opens up unprecedented possibilities for money and finance. This chapter discusses how central banks can light the path to the next generation of the monetary and financial system. This is a system designed to expand the quality, scope and accessibility of financial services by leveraging innovative technologies backed by sound regulation, while preserving the solid foundation of the existing system: central bank reserves as a trusted final settlement asset, supporting private financial sector innovation.

At the heart of this vision is the concept of tokenisation, the process of recording claims on real or financial assets that exist on a traditional ledger onto a programmable platform. Tokenisation represents the next logical progression in the evolution of the monetary and financial system, as it enables the integration of messaging, reconciliation and asset transfer into a single, seamless operation. Its potential lies in its ability to knit together operations encompassing money and other assets that would reside on the same programmable platform. This could be made possible by a new type of financial market infrastructure – a "unified ledger" – which may or may not use distributed ledger technology (DLT).1 By bringing together tokenised central bank reserves, commercial bank money and financial assets into the same venue, a unified ledger can harness tokenisation's full benefits.

Tokenisation is poised to both improve the old, by overcoming the frictions and inefficiencies of the current architecture, and enable the new, by opening up new contracting possibilities. In cross-border payments, tokenisation could replace the complex chain of intermediaries and the sequential updating of accounts in today's correspondent banking transactions with a single, integrated process. Together with state-of-the-art compliance tools made available on the platform, tokenisation would thereby reduce operational risks, delays and costs. Similarly, it would enhance capital markets by enabling the contingent execution of actions in terms of collateral management, margining adjustments and delivery-versus-payment arrangements.

Core to this vision of the future is trust in money. The foundation of any monetary arrangement is the ability to settle payments at par, ie at full value. Money is information-insensitive in that agents use it with "no questions asked", ie without due diligence. In this way, money underpins coordination in the economy through common knowledge of its value by all agents, just as a common language coordinates social interactions. If this common knowledge fails, so does coordination, and the monetary system becomes unmoored, with large societal costs. Common knowledge of the value of money has a shorthand – the "singleness of money" – where money can be issued by different banks and accepted by all without hesitation. It does this because it is settled at par against a common safe asset (central bank reserves) provided by the central bank, which has a mandate to act in the public interest.

In addition to singleness, practical considerations suggest two further tests for viability as the backbone of the monetary system. One is elasticity, referring to money being provided flexibly to meet the need for large-value payments in the economy, so that obligations are discharged in a timely way without gridlock taking over.2 The other is the system's integrity against financial crime and other illicit activity.

Modern real-time gross settlement (RTGS) systems are the canonical example of the need for elasticity. In a two-tier banking system, the central bank is ready to provide reserves to financial institutions elastically at the policy rate against high-quality collateral. When needed, the central bank can provide intraday settlement liquidity so that transactions can be settled in real time. Banks, in turn, can decide how much money (in the form of deposits) they want to provide to the real economy. Importantly, in a two-tier banking system banks can issue money without full bank reserve backing, whether in the form of gold or silver coins (as was the case in gold- or silver-backed monetary regimes) or as bank reserves (as is the case in today's fiat currency regime). The sheer size of payment values in a modern economy means that carting gold and silver coins, maintaining cash piles or retaining large holdings of pre-funded accounts to discharge obligations are simply impractical – they would be recipes for payment system gridlock.

Another concrete manifestation of elasticity is the banking system's role in creating money through lending activities, including overdrafts and lines of credit. Through overdrafts, payments with values that exceed deposit balances can be made at the payer's discretion, while lines of credit provide liquidity on demand. This allows complex interlocking obligations in the economy to be discharged in a timely manner.

The third test is that of the integrity of the monetary system against illicit activity. This imperative flows from the recognition that a monetary system that is open to widespread abuse from fraud, financial crime and other illicit activities will not command trust from society or stand the test of time. Considerations of monetary sovereignty (the ability of a jurisdiction to make decisions and exercise influence over the monetary system within its borders) in the face of potential currency substitution raise related issues.

Measured against the three tests, today's two-tier monetary system, with the central bank at its core, stands above other models in ensuring that money is fit for purpose. Central banks provide the highest form of money, support settlement finality and ensure stability and trust in the unit of account. Commercial banks and other private sector entities provide crucial services to support economic activity within and across borders, facilitating the means of payment that support economic transactions. There is, no doubt, considerable room for improvement in the current system. The vision outlined here gives a glimpse of what is possible. Nevertheless, the merits of the core architecture of the system with the central bank at its centre should be recognised and preserved.

The next-generation monetary system with central bank reserves at the core promises to deliver far-reaching benefits. A key step towards this transformation is the trilogy of tokenised central bank reserves, tokenised commercial bank money and tokenised government bonds, all residing on a unified ledger. Together, these elements could form the foundation of a vibrant tokenised financial system, unlocking new efficiencies and capabilities. Tokenised central bank reserves provide a stable and trusted settlement asset for wholesale transactions in a tokenised ecosystem, ensuring the singleness of money. They could also enable monetary policy implementation on a tokenised platform. Tokenised commercial bank money could build on the proven two-tier system, offering new functionalities while preserving trust and stability. Tokenised government bonds, as the cornerstone of financial markets, could enhance liquidity and support various financial transactions, from collateral management to monetary policy operations.

The role that cryptoassets and stablecoins will ultimately play in the next-generation monetary and financial system is an open question. Crypto instruments operate on strikingly different principles to those of the conventional monetary system. They strive to redefine money according to a decentralised notion of trust by repudiating intermediaries in favour of peer-to-peer transactions. In spite of this initial promise, unbacked crypto coins have given rise to an ecosystem where a new breed of intermediaries operating hosted wallets (ie cryptoasset wallets for which a third-party provider manages private keys and assets) play the dominant role. Moreover, with their large price gyrations, they do not resemble a stable monetary instrument, but rather a speculative asset.3

Stablecoins were designed as a gateway to the crypto ecosystem, promising stable value relative to fiat currencies (overwhelmingly the US dollar) while operating on public blockchains. As a transaction medium in the crypto ecosystem, and due in part to their backing mechanism, they exhibit some attributes of money. Their pedigree in the crypto ecosystem has also led to use cases as on- and off-ramps to cryptoassets and, more recently, as a cross-border payment instrument for residents in emerging market economies lacking access to the dollar. However, stablecoins perform poorly when assessed against the three tests for serving as the mainstay of the monetary system.

As digital bearer instruments on borderless public blockchains, stablecoins have been the go-to choice for illicit use to bypass integrity safeguards. The pseudonymity of public blockchains, where individual users' identities are hidden behind addresses, can preserve privacy but also facilitates illegal use. The absence of know-your-customer (KYC) standards like those of the traditional financial system exacerbates this issue.4 The bearer nature of stablecoins allows them to circulate without issuer oversight, raising concerns about their use for financial crime, such as money laundering and terrorism financing. While demand for stablecoins may persist, they perform badly against the integrity test at the system level.

Stablecoins also fare poorly on singleness and elasticity. As digital bearer instruments, they lack the settlement function provided by the central bank. Stablecoin holdings are tagged with the name of the issuer, much like private banknotes circulating in the 19th century Free Banking era in the United States. As such, stablecoins often trade at varying exchange rates, undermining singleness. They are also unable to fulfil the no-questions-asked principle of bank-issued money. Their failure on elasticity stems from their construction: they are typically backed by a nominally equivalent amount of assets, and any additional issuance requires full upfront payment by holders, which undermines elasticity by imposing a cash-in-advance constraint.

Stablecoins raise a number of other concerns. For one, there is an inherent tension between their promise to always deliver par convertibility (ie be truly stable) and the need for a profitable business model that involves liquidity or credit risk. Moreover, loss of monetary sovereignty and capital flight are major concerns, particularly for emerging market and developing economies. If stablecoins continue to grow, they could pose financial stability risks, including the tail risk of fire sales of safe assets. Finally, bank-issued stablecoins may introduce new risks, depending on their legal and governance arrangements – a subject of ongoing debate.

While stablecoins' future role remains uncertain, their poor performance on the three tests suggests they may at best serve a subsidiary role. One guiding principle in any such role would be to channel legitimate use cases into the regulated monetary system in a way that does not undermine financial stability nor the proven advantages of the current system. Illicit use will stay outside the regulatory cordon.

Society has a choice. The monetary system can transform into a next-generation system built on tried and tested foundations of trust and technologically superior, programmable infrastructures. Or society can re-learn the historical lessons about the limitations of unsound money, with real societal costs, by taking a detour involving private digital currencies that fail the triple test of singleness, elasticity and integrity. Bold action by central banks and other public authorities can push the financial system along the right path, in partnership with the financial sector.

As the stewards of monetary and financial stability, central banks need to drive this transformation. They can do so in four ways. First, they can articulate a vision of which key features of today's financial system must be replicated in a tokenised ecosystem. Second, they can provide the necessary regulatory and legal frameworks to ensure the safe and sound development and adoption of tokenised finance. Third, they can provide the basic foundational assets and platforms required for a tokenised financial system. Most importantly, such a system will require settlement in a tokenised form of central bank reserves. Finally, they can foster public-private partnerships to encourage joint experimentation and coalesce industry efforts.5

Money and trust

Money is a social convention fundamental to the functioning of any modern economy. It is sustained by a shared expectation that money accepted for payments today will also be accepted for payments tomorrow. This requires trust in money, its stability and its ability to scale with economic activity.

The linchpin of modern monetary arrangements is ultimate settlement at par, meaning that the price of money relative to the unit of account is fixed at one. Sometimes referred to as the singleness of money, this is the key coordination mechanism of the economy that sustains the social convention of money. When singleness is maintained, money is information-insensitive in that agents in the economy accept it at par without due diligence, ie with no questions asked.6

In modern monetary systems, the settlement of payments at par is supported by a two-tier structure, with central bank reserves and commercial bank money playing complementary roles. Central banks ensure trust in money, a fundamental public good, by providing the ultimate safe medium for settling transactions in the form of central bank reserves. In the case of short-term liquidity pressures, central banks also serve as lenders of last resort to banks.7 Meanwhile, commercial banks issue money to the private sector in the form of deposits.8 Prudential regulation and supervision ensure their safety and soundness, with deposit guarantee schemes protecting depositors in the event of bank failures. This division of roles ensures stability and banks' ability to respond rapidly to private sector needs. Moreover, it underscores the importance of the system's ability to provide money elastically and in a discretionary way – a key stabilising mechanism in the monetary system. In modern economies, central banks can expand their liabilities, easing stress for agents who use those liabilities as money; commercial banks can expand their own liabilities to ease credit constraints for agents using bank liabilities as money.

History shows that private sector innovation thrives on the stability of central banks, whose foundational role remains as critical as ever. By virtue of being guarantors of singleness, central banks act as anchors sustaining coordination and common knowledge in the value of money. Critically, the trust in central banks allows for this coordination and common knowledge to be achieved at scale, meeting the needs of a growing, diverse and decentralised market economy.

The singleness of money is not a statement about the credit risk embedded in bank deposits but a statement about the payment. Any payment goes through at par because it can be settled with central bank reserves. In other words, singleness of money does not imply that all commercial bank liabilities are or should be equal in value. For example, negotiable certificates of deposits or bank bonds can and often do trade at varying spreads to government bonds. But payments always go through at par, because the central bank homogenises the credit risk of deposits from different banks, making them into a uniform payment instrument.

The emphasis on payments and the two-tier structure of the monetary system helps dispel a common misunderstanding of how modern money operates. "Sending a payment" often evokes the image of a transfer of an object or funds flowing from one place to another, by analogy with the relatable experience of handing over a banknote or coin for payment. However, in a typical payment transaction, when a customer of one bank pays a customer of another bank, no physical object changes hands. No money "flows". Rather, a series of updates are made on the accounts maintained by intermediaries and the central bank. In a domestic payment, there are three account updates: the sender's bank debits the sender's account, the receiver's bank credits the receiver's account and the central bank credits the receiver's bank and debits the sender's bank. (In a cross-border payment, there are more steps, as described below.) The receiver does not acquire a claim on the sender's bank. Singleness is achieved in this context because the final settlement happens on the central bank's accounts. In effect, the payment is made using central bank reserves, with finality. This allows the payee to have more deposits in her account (ie a larger claim on her bank) rather than any new type of claim. As discussed in more detail below, this contrasts with the situation when a stablecoin payment is received.

Trust in money extends beyond its acceptance at par and the execution of payments. It also requires confidence in money's stable value over time. Price stability, achieved through low and predictable inflation, and financial stability, which prevents large-scale defaults and disruptions to the functioning of the financial system, are essential for sustaining this trust.9 Strong institutions underpin these goals. Central bank independence ensures monetary policy frameworks focused on price stability, and sound financial regulation and macroprudential measures provide further safeguards. On a deeper level, trust in money relies on fiscal sustainability, as the state's ability to tax and maintain a credible fiscal position ultimately backs the value of money. History shows that without these foundations, monetary regimes can collapse. This underscores the importance of modern arrangements that have successfully delivered stability in most major economies, despite recent global inflationary pressures.10

New technologies do not change the economics of these arrangements, but they bring important opportunities to strengthen the features of money. The persistent demand for new functionalities of money signals societal appetite for the benefits that such technologies promise. Public authorities may neglect this reality at their peril. The advent of tokenisation can change how records of ownership and transfers of claims are done. In this respect, new programmable platforms that leverage tokenisation of money, such as unified ledgers, could be as transformative as the move from physical to digital ledgers.11 However, maintaining trust, underpinned by the singleness of money, requires constant striving on the part of the central bank and other public authorities. Achieving this transformation responsibly will require bold experimentation and significant cooperative efforts by the public and private sectors.

Stablecoins and the integrity imperative

How do new forms of digital money fare when assessed against the lessons just discussed? It remains to be seen what role innovations like stablecoins will play in the future monetary system. They do offer novel programmability functions, easy access for new users and pseudonymity features. But stablecoins do not stack up well against the three desirable characteristics of sound monetary arrangements and thus cannot be the mainstay of the future monetary system. Despite their limitations, some inherited from crypto more broadly, there is significant demand for stablecoins (see below). As such, they signpost where policy responses may help to foster more efficient and resilient financial systems to reap the benefits of technological innovations. Such policy responses can ensure that legitimate use cases are appropriately regulated, and that illicit use is blocked to protect the monetary and financial system. However, adequate regulation can only go so far in addressing some important structural flaws that are likely to persist, such as the limitations placed by cash-in-advance constraints. Accordingly, even a future of well regulated new forms of money would still require proper anchors of trust to underpin sound monetary arrangements.

The genesis of stablecoins was the quest for a different foundation for monetary arrangements, away from trusted intermediaries and towards decentralisation. Unbacked cryptoassets like bitcoin emerged from this same pursuit.12 Despite the idea's initial allure, crypto falls short on several core features of money. As such, unbacked cryptoassets have established themselves as a speculative asset rather than a means of payment.13 Additionally, the inherent characteristics of blockchains generate a key trade-off between decentralisation, security and scalability. Blockchains work by appending blocks of transactions through consensus in the decentralised network of validators, who must be compensated to perform this role since validation is costly. This generates a tension between setting rigorous standards on what counts as consensus and having a system that reaches that consensus at scale (Box A).

Stablecoins emerged as an on- and off-ramp to the crypto ecosystem and a means to enable transactions on the blockchain without the inherent volatility of other forms of crypto. In a nutshell, they are crypto tokens that live on decentralised ledgers and promise to always be worth a fixed amount in fiat currency (eg one dollar). Unlike unbacked crypto coins, most stablecoins are issued by a single, central entity. The issuer's reserve asset pool backing the stablecoins in circulation and its capacity to meet redemptions in full back this promise.14 Stablecoins can differ by the type of asset backing. There are three main variants for such backing: fiat-denominated short-term assets, crypto collateral and algorithmic arrangements.15 The discussion here focuses on the first variant, which accounts for the lion's share of the market.

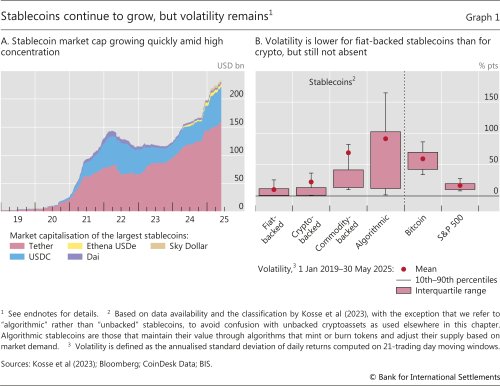

Despite the frequent inability of stablecoins of various stripes to live up to their promise of par convertibility, they continue to attract demand. This is evident in their remarkable growth, concentrated in the two largest stablecoins, USDT (Tether) and USDC (Circle) (Graph 1.A). Demand for stablecoins is a function of both users' motivations and some of their features, including accessibility, privacy, their role as an alternative to the current financial system, their ability to facilitate access to foreign currencies and their attractiveness in cross-border payments.

First, stablecoins are traded on public, permissionless blockchains, allowing anyone with an internet-connected device to access them. Many users do so through hosted wallets provided by crypto exchanges that perform onboarding processes, which in principle should be similar to banks. But it is also possible to access stablecoins directly via unhosted wallets, which are readily available to any user with an internet connection. These eschew interactions with any intermediary (whether from the crypto or the traditional financial system) and thus are not subject to any KYC checks. With an unhosted wallet, users transact without identification and have sole control through a password (private key).

Second, once on a public blockchain, transactions are pseudonymous, with individual users' identities hidden behind wallet addresses. Unlike traditional bank accounts, which require personal information, stablecoins rely on wallet addresses as a substitute for identity. While useful for protecting privacy, pseudonymity can also lead to a lack of accountability and raises financial integrity concerns (see below).

Third, stablecoins provide access to foreign currencies – to date, overwhelmingly the US dollar. They present an attractive alternative for users in countries with high inflation, capital controls or limited access to dollar accounts. Individuals and firms that face restrictions on accessing dollar-based international payment networks may find stablecoins particularly appealing for cross-border payments and trade settlement. However, the widespread use of stablecoins could undermine affected jurisdictions' monetary sovereignty. Currency competition can create impediments for monetary policy implementation.16

Fourth, stablecoins' technological attributes mean they can potentially offer lower costs and faster transaction speed, especially for cross-border payments. There is anecdotal evidence of lower costs for some corridors than with traditional channels.17 Moreover, funds can be transferred directly between wallets without intermediaries, regardless of banking hours or public holidays. This can make them appealing to consumers with limited access to traditional financial systems, such as migrant workers. However, risks to consumer protection remain significant, while lower costs and faster speed are not always guaranteed given high fees for validation.

How do stablecoins measure up as money?

Stablecoins fall short on the three key tests for money. This subsection discusses each in turn and closes with a discussion of additional concerns.

Stablecoins and the singleness of money

Asset-backed stablecoins are akin to digital bearer instruments. They behave like financial assets and typically fail the test of singleness.18

In this light, when a payee receives a stablecoin as payment, it is the liability of a particular stablecoin issuer. In other words, she checks her phone and sees she has received 10 "red dollars", which add to her balances of, say, 10 "blue dollars" and 10 "white dollars". The issuers of these various dollars will differ, and the payee will hold bilateral claims against each one only by accepting payment. Moreover, in the background, there is no settlement on the central bank balance sheet. Therefore, singleness cannot be guaranteed: red dollars might trade at a discount or premium to blue or white dollars, depending on the relative creditworthiness of their issuers.

To date, stablecoins are traded in secondary markets at an "exchange rate" that can deviate from par, similar to deviations observed between the price of exchange-traded funds (ETFs) and the net asset value of the portfolio they reference. Granted, small deviations from par could be viewed as consistent with a somewhat looser definition of singleness. But deviations from par undermine the no-questions-asked principle. And money-like claims that are not able to circulate with no questions asked cannot really function as money. More generally, in contrast to predictable deviations arising from frictions such as fees, stablecoins of various stripes have seen substantial deviations from par (Graph 1.B), highlighting the fragility of their peg.19

Stablecoins and elasticity

Stablecoins also fail the elasticity test. This is because the issuer's balance sheet cannot be expanded at will.20 Any additional supply of stablecoins thus requires full upfront payment by its holders – ie a strict cash-in-advance setup with no room to create leverage when it is required for the functioning of the system. This differs fundamentally from banks, which can elastically expand and contract their balance sheets within regulatory limits.

Two examples illustrate the critical importance of the elastic provision of liquidity. Both are based on large-value payments rather than retail applications. Large-value payments require substantial liquidity for settlement, and banks, supported by central banks' standing facilities, are uniquely positioned to provide this liquidity.

The first example of the importance of elasticity comes from the workings of RTGS systems. The requirement to settle large amounts in real time heightens the need to have the required settlement assets (reserves) at the right time, place and quantity. Compared with, for example, deferred net settlement systems, this increases liquidity demands. The way the system meets this challenge is through the central bank's provision of credit to banks (against collateral), particularly with intraday overdrafts. Without such on-demand liquidity resources, the system could not operate smoothly. Of course, a system with tokenised central bank reserves would also be able to offer this benefit.

The second example comes from the role of loans and loan commitments (ie arrangements for firms to borrow money on demand), particularly during stress. The importance of elasticity is particularly evident for the manufacturing sector, where the prevalence of supply chains makes high demands on liquidity. Unused loan commitments offer the flexibility to meet a payment obligation immediately, and are substantial in both advanced and emerging market economies. In 2025, such unused loan commitments became a crucial lifeline for firms faced with tariffs. This led to a spike in unused loan commitments for affected sectors.21

Stablecoins and the integrity of the monetary system

The integrity of the payment system is a crucial imperative. Precisely because money and payments are widely accessible, there must be safeguards to combat fraud, financial crime and the financing of illicit activities. Criminal organisations, terrorist groups and malicious state actors are continually looking for ways to move, hide and launder money. In today's system, a large apparatus is in place to help combat financial crime and sanctions evasion. Anti-money laundering and combating the financing of terrorism (AML/CFT) regulation puts the onus on banks and other intermediaries to uphold KYC rules, file suspicious activity reports and have the capacity to stop payments. These safeguards are necessary in any monetary system, but not all forms of money lend themselves equally well to integrity against financial crime.

Stablecoins have significant shortcomings when it comes to promoting the integrity of the monetary system. As digital bearer instruments, they can circulate freely across borders onto different exchanges and into self-hosted wallets. This makes them prone to KYC compliance weaknesses. Transactions originating from self-hosted wallets are traceable on public blockchains. Nevertheless, this traceability can be disrupted using mixers, which amalgamate funds from multiple users and subsequently distribute them to newly generated addresses. Individuals may maintain anonymity until they encounter KYC requirements when converting stablecoins into fiat currency. But holders of a stablecoin are probably not the customers of its issuer, who may not know if holders have had their identity verified. More worryingly, stablecoins may be sent to individuals who have definitely not verified their identities. Importantly, stablecoins' KYC limitations are also problematic in the light of geopolitical constraints (such as sanctions) on existing payment systems.22

Currently, the burden is on authorities to seek out and stop illicit stablecoin flows. To be sure, stablecoin issuers and exchanges can undertake AML/CFT measures by freezing balances, and have occasionally done so. Blockchain analytics companies work with law enforcement to track financial crime on public blockchains. This can be useful for high-profile cases (like ransomware attacks on prominent targets). Still, it probably cannot realistically scale for billions of AML/CFT checks in everyday payments. In practice, stablecoins are attractive for use by criminal and terrorist organisations.23

In contrast, in a deposit-based system, or even in the case of non-bank electronic money (e-money), the onus for maintaining integrity is on customer-facing intermediaries, who know their customers better than public authorities. Penalties and reputation risk for the intermediary are key to ensuring that they have thorough KYC protocols and AML/CFT measures. The non-bearer nature of the two-tier system, where transactions occur through account updates, means that all clients must be onboarded in line with KYC rules. The receiver needs the explicit update from her intermediary to be credited with a payment. Thus, controls are far better maintained.

Technological improvements can enhance the integrity of the current system. AI and data integration advances, particularly through the development of machine learning tools, present opportunities to help combat financial crime. These innovations help reduce false positives (ie legitimate transactions flagged as illicit) and increase detection of fraudulent transactions. Box B explores how machine learning algorithms can be applied to filter transactions for AML/CFT compliance. It also discusses how nascent AI agents can serve as co-pilots, enhancing the efficiency of human efforts in reporting transactions related to money laundering or the financing of terrorism.

Additional concerns around stablecoins

There is an inherent tension between stablecoin issuers' ability to fully uphold their promise of stability and their pursuit of a profitable business model. When issuers invest in assets with some credit or liquidity risk, they cannot fully guarantee stability under all possible contingencies, since holders can redeem their stablecoins at short notice. This reflects the status quo, where promises are generally – but, importantly, not always – honoured, and the business model remains highly profitable, as assets yield at least risk-free rates and liabilities pay zero. Alternatively, stringent liquidity risk management implies that reserve assets must be held in highly liquid risk-free assets – in the extreme, unremunerated central bank reserves.24 In such a scenario, stablecoins would operate as fully backed payment instruments, with a business model largely based on payment fee income that is likely to deliver thin profits relative to the status quo.

The prospect of broader use of stablecoins for payments and real economy transactions raises at least three additional concerns.

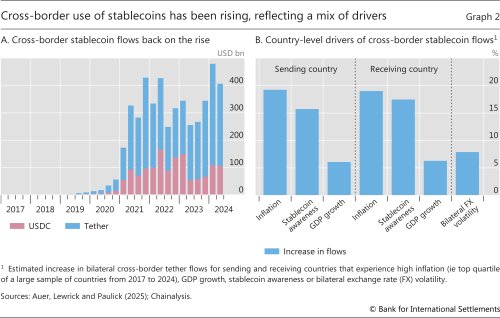

First, jurisdictions may face challenges to their monetary sovereignty. Over 99% of stablecoins are US dollar-denominated, with a growing cross-border presence (Graph 2.A). Cross-border transaction volumes tend to rise following episodes of high inflation and foreign exchange volatility in sending and receiving countries (Graph 2.B). Stablecoins could thus enable stealth dollarisation, with users relying on the dollar for transactions and financial contracts. Of course, in economies that suffer from unstable monetary conditions, this is understandable from a user perspective. Factually, such currency competition will heighten the importance of committing to price and financial stability and upholding fiscal sustainability.

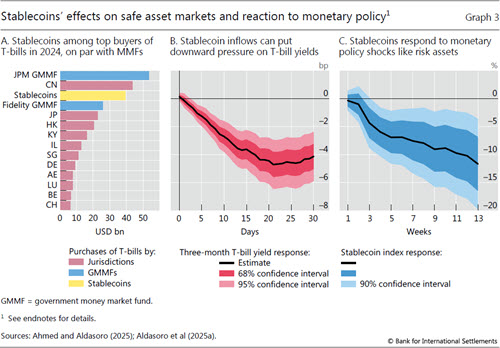

Second, if stablecoins continue to grow, they are poised to have a large footprint in the markets in which they are invested, especially under stress conditions. Major stablecoins invest largely in safe assets, and their expansion risks crowding out other investors. Currently, their investment in US Treasury markets stands on par with large jurisdictions and government money market funds (MMFs) (Graph 3.A). Continued growth could put additional downward pressure on yields: evidence suggests that a $3.5 billion increase in stablecoin market capitalisation can already depress Treasury yields by around 2.5–5 basis points (Graph 3.B), with effects up to three times larger in absolute terms during redemption episodes. Their expanding market presence thus also creates a tail risk of fire sales. This can be exacerbated because stablecoins have so far reacted negatively (ie exhibited larger redemptions) to monetary policy tightening, similar to risky assets such as stocks (Graph 3.C).25

Third, with rising interconnectedness, there may be new channels for risks to spill over to the traditional financial system. If banks issue stablecoins, there are risks associated with a new class of liabilities that circulate on public blockchains, without clarity as to whether and how they would benefit from deposit insurance. Particularly in times of stress, there may be rapid and unpredictable flows between different types of bank liabilities. More generally, if banks and other existing financial institutions become active in crypto markets, there is the risk of spillovers that undermine banks' ability to lend to households and businesses, trade in traditional markets and perform their role in supporting the real economy.

Policy approaches to stablecoins

Securing the stability and integrity of an evolving financial system requires active, technology-neutral regulation based on the principle of "same activities, same risk, same regulatory outcomes". Targeting specific technologies risks distorting the playing field for years to come.26 Recent international guidelines on crypto and stablecoin regulation provide a solid starting point for designing regulatory frameworks in a rapidly evolving tokenised environment.27

Addressing integrity and financial crime is a priority, beginning with proper KYC compliance for hosted wallets. Many jurisdictions already require crypto exchanges and wallet providers to meet standards similar to banks, custodians and other payment intermediaries. Some enforce the so-called travel rule for unhosted wallets (where users have full control over their private keys), requiring that key information, such as beneficiary names, is transmitted. Engagement with blockchain analytics firms and stablecoin issuers can help to monitor and, if needed, block or freeze funds in cases of known infractions. However, these measures only mitigate – not eliminate – risks to the monetary system's integrity.28

Regulation should also mandate AML/CFT compliance. Most stablecoins can block specific addresses from holding their tokens. By defaulting to a system where all addresses are blocked unless KYC compliance has been verified, these stablecoins could be brought within the scope of AML/CFT frameworks. However, stablecoins' borderless nature complicates regulatory efforts. Without global coordination, there is the risk of a race to the "weakest regulatory links".

Stabilisation mechanisms also need attention. Their stability hinges on the quality and transparency of their reserves, as well as the credibility of the issuing entities. Lessons from pre-funded payment service providers (PSPs), which provide useful payment services and bring greater competition to payment markets, could inform stablecoin regulation.29 While regulatory regimes differ, they generally must hold sufficient safe and liquid assets to ensure they can always honour commitments to clients. These PSPs are generally prohibited from paying interest.30 These institutions have been regulated in a way that promotes singleness of money and market integrity, and thus play an ancillary role to bank deposits in the monetary system.

Regulators remain focused on the quality of assets backing stablecoins and the appropriate level of reserves. Requiring reserves of high-quality liquid assets can help to mitigate risks, while transparency measures, such as regular audits and public disclosure requirements, can support accountability. Parallels with government MMFs, which feature a similar balance sheet structure, offer useful insights.31 BIS Project Pyxtrial highlights the potential for technology to supervise compliance with reserve-related regulation. Aligning stablecoins with existing frameworks, such as those for MMFs or e-money, could provide consistent oversight, guided by the principles of proportionality and technology neutrality.

Already in 2023, the yearly BIS survey of central banks on digital currencies found that more than 60% of responding jurisdictions had or were developing regulatory frameworks for stablecoins.32 Many focus on asset backing, disclosure, investor and consumer protection, financial stability, countering illicit activities and ensuring fair and transparent markets. Beyond the scope of the survey, some jurisdictions prohibit paying interest to stablecoin holders, whereas others have left this possibility open. This can help align regulatory requirements for stablecoins with those of MMFs, e-money or related financial instruments.33

Still, regulating stablecoins is not straightforward. Because they circulate on public permissionless blockchains, the regulatory surface is narrower than for traditional intermediaries. There are, to date, fewer forms of recourse to address regulatory concerns. There is also a lack of mechanisms to stop or reverse mistaken or fraudulent payments; given the immutable nature of blockchains, an inadvertent payment or the loss of a private key means that funds are irretrievable.

Moreover, stablecoins' borderless nature poses significant challenges to national regulatory frameworks, making it difficult to manage cross-border risks effectively. Some jurisdictions, such as the European Union, Japan and Singapore, require stablecoin issuers to obtain authorisation from supervisory authorities and establish locally incorporated entities.34 This approach helps to place unregulated, overseas-issued stablecoins outside the regulatory perimeter, thereby minimising the risks they may pose. Still, without international coordination regulatory gaps could arise, particularly in jurisdictions with limited oversight capacity.

Notwithstanding the challenges stablecoins present and their links to traditional markets, they have brought to the fore the value of technological development, most notably tokenisation. Making these functions available on a sounder footing could hold significant potential. The next two sections chart this path.

The promise of tokenisation

Tokenisation stands to be the next logical step in the evolution of money and payments. Tokens are not merely digital entries in a database. Rather, they integrate the records of the underlying asset with the rules and logic governing the transfer of that asset. Tokenisation enables the contingent performance of actions, meaning that specific operations are triggered when certain preconditions are met.

The canonical example of the contingent performance of actions is delivery versus payment (DvP). With DvP, the transfer of an asset is a precondition for payment, and vice versa. DvP can greatly enhance the efficiency of securities markets by reducing counterparty risk and removing the need for escrow and other mechanisms. It can also reduce the need for reconciliation and other post-trade operations. But beyond this, contingent actions can enable entirely new use cases, particularly by automating different types of financial transactions. Households and businesses can benefit from the contingent execution of actions. For example, businesses can better manage cash flows through DvP. Efficiencies in capital markets can increase the returns on household investments, for instance in their pension savings.

Recent proposals for a unified ledger provide a blueprint for the tokenised financial system of the future. The key elements of the blueprint are tokenised central bank reserves, tokenised commercial bank money and other tokenised claims on financial and real assets, brought together in a new type of financial market infrastructure. By providing an enhanced representation of money in the same venue as other claims, such a blueprint enhances the functionalities of money and other financial assets. The full benefits of tokenisation can be harnessed in a unified ledger through settlement finality in central bank reserves.

A unified ledger transforms intermediary interaction by addressing frictions in standard transactions like cross-border payments. By combining programmability and transaction bundling ("composability"), it integrates and automates sequences of financial transactions. This eliminates delays and reduces manual interventions and reconciliations arising from the traditional separation of messaging, clearing and settlement. Instantaneous settlement in central bank reserves reduces credit risk and ensures the singleness of money and payment finality. Tokenisation further enhances this system by enabling seamless integration of trading activities, such as pre-trade collateral verification and post-trade payment flows, into single automated actions. Tokenisation enables the creation of new contracting outcomes, such as an insurance contract triggered by predefined conditions, transferring the ownership of collateralised assets without manual intervention. Such innovations streamline processes and create new financial instruments. Much like the unforeseen growth of smartphone app ecosystems, the financial system's evolution will be limited only by the creativity of developers building on this foundation.

Tokenisation of the two-tier monetary system

Tokenised money allows for a sea change in the monetary and financial system. Today, even a simple domestic payment is made up of several operations involving intermediaries at distinct stages. Tokenisation enables the joint execution of three previously separate steps: the debiting of the payer's account, the crediting of the receiver's account and settlement on the central bank balance sheet. This allows for atomic settlement (ie synchronous exchange of assets, such that the transfer of each occurs only upon transfer of the others) and other new functions, while removing the need for separate messaging and reconciliation. And it does so while preserving the core features of the two-tier monetary system.

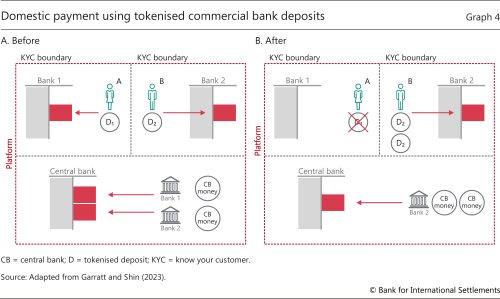

A simple example illustrates this possibility, using tokenised commercial bank money issued by commercial banks on a programmable platform. In this example, the platform enables atomic settlement of all components of a domestic payment. Graph 4 shows how tokenised commercial bank money can be used for domestic payments.35 Panel A shows the situation before a payment is made from person A (Maria) to person B (Sven). Maria banks with Bank 1, and Sven with Bank 2. Three partitions (indicated by grey dotted lines) represent the respective domains of a unified ledger maintained by the two private tokenised money issuers and the central bank. Ownership of claims is denoted with red arrows. Graph 4.B illustrates a payment from Maria to Sven. The token previously held by Maria (D1) is deleted, and Bank 2 issues a new token (D2) to Sven. Deleting and creating private money tokens entails a corresponding movement of central bank reserves in the central bank's partition. Both central bank reserves ("CB money") tokens belong to Bank 2 in Graph 4.B. Central bank reserves can be transferred, as both commercial banks have accounts at the central bank.

A central feature of this model is that no new credit exposures are created across institutions. Payments between individuals simply alter the balance sheets of their banks, which then settle in central bank reserves. Unlike bearer instruments such as stablecoins, there is no transfer of private liabilities. Settlement in central bank reserves ensures that the wholesale portion of the payment is executed at par and singleness is respected.

Singleness between private tokenised money and cash would be supported in the same way it is now for commercial bank deposits. This requires that all private tokenised money issuers comply with the same regulatory standards and have access to the same safeguards (including access to the lender of last resort). Singleness between the private tokenised money issued by non-banks (eg e-money) and cash could also be maintained under the proper arrangements. Broader access by non-bank financial institutions to central banks' balance sheets, coupled with proper regulation and supervision, would help promote competition and greater financial inclusion.

Tokenisation and next-generation correspondent banking

Separating messaging, reconciliation and settlement creates additional frictions in international payments. Cross-border transactions require not only domestic but also international messaging systems. Differences in operating hours and/or holidays and inconsistencies across operating systems can cause delays, increasing settlement risk.36 Errors may remain undetected longer, increasing resolution costs and operational risk.

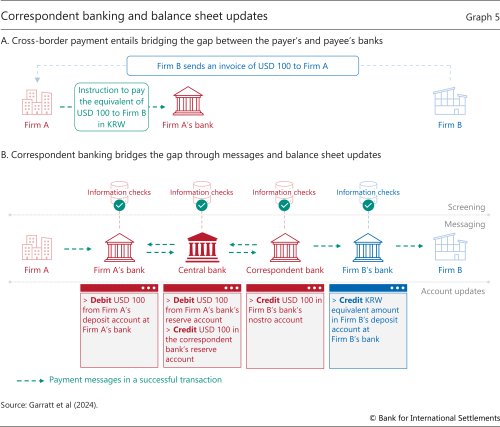

To understand and address these inefficiencies, it helps to examine how cross-border transactions work today. Most rely on correspondent banking, where commercial banks transact through a network of so-called nostro and vostro accounts. Sending a cross-border payment involves no movement of any physical or digital object. Instead, intermediaries in different jurisdictions make a series of account updates. Specifically, the payer's bank sends the payment instruction to another bank in the home jurisdiction with a correspondent banking relationship with a bank in the payee's jurisdiction. The correspondent bank, in turn, sends the instruction to the payee's bank. Each step involves separate account updates. Since different fiat currencies are involved, no single settlement asset can be used throughout the transaction chain.

Graph 5.A provides an illustrative example.37 Firm A, a US manufacturer, receives a 100 US dollar (USD) invoice from Firm B, its Korean supplier. Firm A instructs its bank to process the payment. If Firm B has a US bank account, the process is straightforward: the payer's bank debits Firm A's account, the payee's bank credits Firm B's account, and the central bank (the Federal Reserve) settles between the two banks by transferring reserve balances. The Clearing House Interbank Payments System (CHIPS) may play a role in the settlement by clearing and netting the transaction. CHIPS is a private, large-value payment system that facilitates the clearing and netting of US dollar payments between its participants. CHIPS processes payments through a real-time netting mechanism, where multiple transactions between participants are offset to determine a single net amount owed to or receivable by each participant. While CHIPS clears and nets the payments, ultimate settlement occurs at the Federal Reserve via the Fedwire Funds Service. This is because CHIPS uses a deferred net settlement (DNS) model, which requires participants to fund their net debit positions at the end of the day using their accounts at the Federal Reserve.38 However, if Firm B requires the payment in Korean won (KRW) in its Korean bank account, the process becomes more complex, involving foreign exchange conversion and cross-border settlement.

Graph 5.B shows how correspondent banks enable cross-border payments. Firm A's bank pays USD 100 to its correspondent bank, a domestic transaction settled via the Federal Reserve, increasing the correspondent bank's reserve balance by USD 100. The correspondent bank credits the Korean bank's account with USD 100, which the Korean bank confirms before crediting Firm B's account in KRW. Importantly, no money moves across borders; settlement in central bank reserves occurs entirely within the United States. Coordinating these balance updates requires multiple message exchanges.

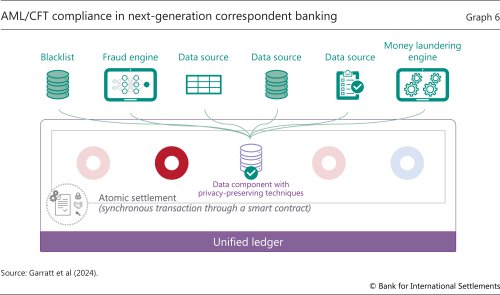

A next-generation correspondent banking system would leverage tokenisation and the unified ledger to streamline the sequential nature of cross-border payments. Such a platform brings together tokenised forms of central bank and commercial bank money to perform all critical functions involved in cross-border payments, including payment instructions, settlement and post-transaction monitoring. It would require flexibility from the outset to accommodate different jurisdictions' needs and regulatory approaches. At the same time, it would need to ensure sufficient harmonisation to achieve composability and atomic transactions.

A unified ledger for correspondent banking would harness three new capabilities.

First, it would merge payment instructions and account updates into a single transaction. Leveraging the programmable nature of the unified ledger (Graph 6), all parties in a cross-border transaction would collaborate to gather the necessary data for payment execution and perform account updates. Instead of relying on separate systems to exchange information through messaging networks, a single set of contingent transactions, represented by composable smart contracts, would be executed to initiate the payment.

Second, the platform would settle all the steps in the payment atomically rather than sequentially. When several intermediaries are involved, either all accounts are updated as an atomic transaction or none are. Transactions require approval from all parties before settlement, including pre-screening AML/CFT checks. Only after collecting payment data and securing necessary approvals does atomic settlement take place. While data collection guarantees that the relevant parties to a transaction are properly identified, atomic settlement eliminates the risks associated with partial or failed transactions. This feature enhances trust and reliability, particularly in scenarios involving multiple parties.

Third, the platform would make available platform resources to enhance AML/CFT compliance and promote "integrity by design". Parties to a transaction could collaborate on the platform to gather and utilise information needed for pre-screening and post-transaction monitoring. Screening for sanctioned individuals often encounters the challenge of false positives, which can occur when someone has the same name or similar identifying details as a sanctioned person. Supervised AI can analyse historical transaction patterns to address this issue of false positives to differentiate genuine matches from errors.

Enhancing AML/CFT efforts to identify suspicious networks and illicit fund flows can be achieved through two distinct approaches. One involves centralising transaction data within a secure infrastructure. Here, the unified ledger would contain the entire network of transactions. The other adopts a more decentralised model using federated learning, where local data are analysed and only aggregated information is shared, preserving privacy and supporting data sovereignty.39 The latter method has been explored in initiatives like Project Aurora,40 which aims to enable cross-border collaboration while respecting jurisdictional data requirements.

In strengthening AML/KYC compliance, next-generation correspondent banking builds on innovations in compliance technology. The BIS Innovation Hub has explored pre-screening capabilities, showcasing the potential to encode jurisdiction-specific policies and regulatory requirements within a unified protocol for cross-border applications. Project Mandala is one example.41 In next-generation correspondent banking, further efficiency can be achieved by embedding pre-screening checks directly into the payment instruction and compliance reporting capabilities through AI agents (Box B).

Notwithstanding the benefits, any platform underpinning next-generation correspondent banking must grapple with governance and data management imperatives. These involve two key principles. First, central banks must retain final say over access to their payment balances, and hence over the use of their currency. Having final say entails, among other things, keeping control of how their balance sheet is accessed in any transaction. Therefore, policies on access to central bank settlement accounts are critical. Second, data should be managed consistently with proper governance arrangements. This includes respecting the constraints of legal frameworks across jurisdictions.

Technological choices for the platform therefore depend on the governance imperatives. Unlike the case of purely domestic payments, monetary control and data governance loom large as key concerns in the international context – especially with several central banks (each with its own currency) and stringent data governance requirements for each jurisdiction. This is even more pressing in cases involving multiple asset classes and, thus, multiple financial sectors and their regulators in different jurisdictions.

Data protection is critical for designing unified ledgers, especially for applications across borders. Data protection laws differ across jurisdictions, with the most stringent policy choices requiring data to be physically stored within the jurisdiction. In such cases, cryptographic techniques are unlikely to be sufficient to assuage concerns about data protection and location. Architectural options for unified ledgers can be placed on a continuum ranging from a single shared ledger at one extreme to separate ledgers connected through bridges at the other (Box C). The choice along this continuum will need to balance the benefits of a centralised design for ease of programmability against the governance requirements towards some degree of separation between domains on the ledger.

Project Agorá is a concrete example of next-generation correspondent banking. It brings together tokenised central and commercial bank money from seven jurisdictions. In addition to seven central banks, it includes 43 regulated financial institutions and is thus a hallmark of public-private joint experimentation on money and payments.42 The project concluded its conceptual phase and is moving towards the building phase of a prototype.

Data and governance considerations will be a key factor in the choice of architecture in Project Agorá, given the breadth of approaches across the various jurisdictions. More specifically, some level of distributed governance and data needs to coexist with a unified approach for transactions involving multiple parties. Governance requirements, particularly around data access, suggest the use of a permissioned DLT platform that can implement the appropriate level of controls.

Importantly, the project builds on the foundations of the existing financial system, while innovating on the technology. It maintains the established roles of institutions such as central banks and commercial banks, ensuring the benefits of the two-tier system. Money in Project Agorá passes the three tests outlined above. Central bank reserves and commercial bank deposits would remain unchanged from today.

Beyond money: tokenisation of government securities

A unified ledger marks a transformative step in modernising payment systems and revolutionising securities markets. It does so by uniting the components of a financial transaction – money and assets – in the same venue. In this system, financial claims become "executable objects" transferable through programming instructions. At its core is a trilogy of tokenised central bank reserves, tokenised commercial bank money and tokenised government bonds, forming the backbone of a tokenised financial system. Central bank reserves ensure trust and settlement finality, acting as the ultimate monetary anchor. Together with central bank reserves, commercial bank deposits ensure the singleness of money and the elasticity needed to support the real economy. Finally, government bonds serve as the benchmark safe assets, underpinning financial markets and enabling collateralised transactions essential for liquidity, risk management and monetary policy operations.

Sixty years ago, purchasing a security or using it as collateral required a physical certificate. Interest payments involved literally clipping off pieces of the physical certificate (coupons). Transactions settled in five days.43 While this system functioned for decades, the growing scale of securities markets made physical settlement impractical and risky. This led to electronic bookkeeping at central securities depositories (CSDs) and settlement across electronic books at securities settlement systems. The process first involved "immobilising" securities by securely storing the physical certificates in a central location and creating electronic records. They were then "dematerialised", meaning that physical certificates or documents of title were eliminated, so that securities existed solely as accounting records. These records were governed by a legal framework ensuring ledger updates reflected ownership changes.

Today, securities trading and settlement involve a complex web of intermediaries, messaging instructions, reconciliation efforts and money flows. CSDs provide securities accounts, central safekeeping services and asset services for securities either directly or through custodians. Buyers and sellers rely on brokers to initiate trades and custodians to settle and hold securities. The separation of trading and settlement exposes parties to replacement cost risk during the settlement cycle, which can take up to two business days. Verifying account holder identities and reconciling transactions with clearing agents adds further complexity.

A unified ledger could simplify securities settlement by hosting tokenised money and securities on a shared programmable platform. Contingent execution of actions would allow atomic payment and ownership transfer, reducing risks and costs associated with separate ledgers. With nearly $80 trillion in outstanding amounts of government bonds, even modest efficiency gains could yield significant benefits.

Securities markets are especially fertile ground for harnessing the capabilities of the contingent performance of actions enabled by tokenisation. In a unified ledger, complex collateral operations could be automated, enabling participants to issue programming instructions without account manager intervention. Collateral transfers, for instance, could include continuous verification of counterparty collateral criteria, such as eligibility to satisfy margin calls. Through atomic settlement, the simultaneous execution of delivery and payment can mitigate principal risk and expand the scope of DvP arrangements. In particular, it can reduce counterparty dependencies and accelerate reconciliation and confirmation times.44

There are different possible approaches to tokenising government securities. These build on existing financial infrastructure to varying degrees. One implies tokenising securities which reside with CSDs off-platform. In this case, the holder of the token has a claim on the immobilised asset at the CSD, with many of the asset servicing functions remaining embedded in the existing infrastructure. However, leveraging the full benefits of tokenisation requires including "native" assets that are both issued and reside on the platform. Departing from existing infrastructure, this enables full use of the platform's programmable features, such as automated servicing (eg interest payments, valuation) or instantaneous transfer of collateral to creditors in case of borrower defaults.

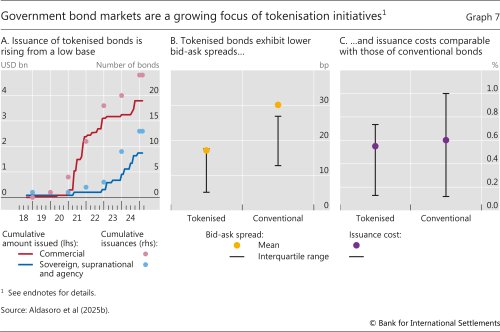

The tokenisation of government bonds is still in its infancy but has been gaining momentum in recent years (Graph 7.A). Several sovereigns, supranationals and agencies (SSAs) have issued tokenised securities. To date, more than 20 tokenised SSA bonds have been issued, amounting to over $4 billion across nine different currencies. While most issuers have used private permissioned DLT, some have explored alternative technologies.45

Despite being in an experimental phase, initial evidence suggests that tokenised bonds have issuance costs and liquidity like those of conventional bonds, with liquidity potentially improving. A comparison shows tighter bid-ask spreads for tokenised bonds (17 basis points versus 30 basis points) and no significant differences in issuance costs (Graphs 7.B and 7.C).46 While liquidity and cost do not appear to be barriers, legal and regulatory uncertainty and limited market experience remain challenges. These can be addressed through regulatory reforms and will probably diminish as market participants gain more experience with tokenised bonds.

Markets for repurchase agreements ("repos"), where government bonds are a key collateral source, are the next natural setting to apply the tokenised trilogy. Repos are borrowing arrangements where one party sells securities (as collateral) to another party, with an agreement to repurchase them at a specified price and date in the future (eg a day or week ahead). They are heavily used to invest or raise cash at short notice and help support liquidity in the underlying securities markets.

A key advantage of tokenised repos lies in their ability to facilitate intraday transactions by enabling instant transfer of collateral simultaneously with the payment. Such functionality, largely absent in conventional repo markets, can reduce risks and support financial institutions' liquidity management, eg meeting intraday margin calls. Margin calls have become increasingly significant due to more prevalent margin requirements. Given the size of the repo market and the critical role repos play in funding and liquidity management, even small efficiency improvements could translate into substantial cost savings.47 Accordingly, industry and public initiatives have been exploring ways to make use of programmability to enhance automation, speed and efficiency beyond what traditional repo transactions offer.48

Central banks have started to explore tokenisation's potential and implications for their operational frameworks. The aim is to shape future market design while keeping up with technological developments. Many initiatives build on central banks' expertise in cross-border cooperation, as facilitated and supported, for instance, by the BIS Innovation Hub. A prime example of cooperation is Project Promissa. It shows how traditional paper-based governmental promissory notes – used eg in member states' funding of multilateral development banks – could be turned into tokenised assets issued on a DLT platform.49 This would sidestep time-consuming and error-prone manual handling of promissory notes and frequent reconciliation requirements, streamlining the notes' entire life cycle from issuance to payment and archiving. These features would enhance transparency and robustness, enabling secure multiparty collaboration while preserving all participants' ownership, control and decision-making authority.

At a broader scale, the prospect of a tokenised trilogy could significantly shape monetary policy implementation. As discussed below, initial findings from experimental applications suggest that gains are tangible for market participants, central banks and the system as a whole – generating benefits that can be passed on to end users of financial services.

Assessing the benefits of a tokenised financial system

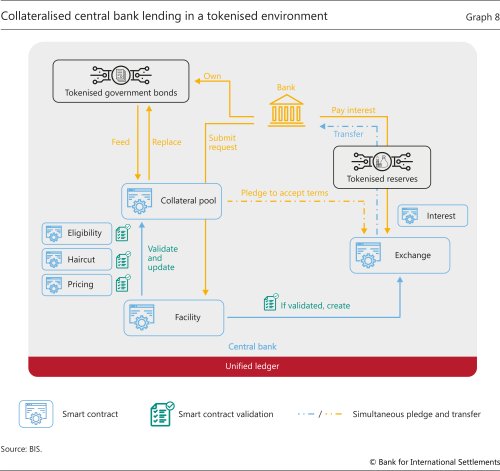

Project Pine, a joint initiative of the New York Federal Reserve and the BIS Innovation Hub, illustrates the potential benefits of a fully tokenised financial system.50 The project shows, in a simulated setting, how monetary policy implementation could be carried out when central bank reserves, commercial bank deposits and other financial assets are tokenised. By using smart contracts on a programmable platform, central banks can calculate, accrue and pay interest, and exchange tokens to create the facilities that create or absorb liquidity in the wholesale financial system today.

In this setup, a tokenised repo transaction as part of the central bank's monetary policy operations could take the form shown in Graph 8. For example, banks needing liquidity could request tokenised reserves and pledge tokenised collateral (eg government bonds). They could do so through a collateral pool contract as part of the central bank's standing facility. The central bank's facility contract would validate the request by checking the bank's access rights, the eligibility of the collateral and its post-haircut value, using dedicated smart contracts that interact with each other. Upon approval, the central bank would establish an exchange contract for the repo that locks the collateral in the collateral pool contract for the duration of the transaction. It would transfer the tokenised reserves to the bank instantly. While the repo exchange contract is active, pricing contracts would continuously update the market value of pledged collateral and eligibility. If the central bank made any changes, haircut contracts could adjust values. If the bank wanted to change its collateral during the repo, it could do so, assuming there was sufficient value. At maturity, banks would repay the reserves with interest, triggering the release of the collateral.

This example illustrates how tokenisation could offer flexibility and speed in monetary policy operations. Smart contracts enable central banks to instantly create and adjust their tools (eg deploy new facilities, adjust parameters like interest rates or collateral requirements). The availability of standardised and consolidated unified ledger data, protected by effective privacy measures, could unlock even more benefits. For example, combining a view of market participants' financial positions in real time with the flexibility and speed provided by smart contracts could enhance central banks' capacity to respond to adverse market shocks, such as sudden shifts in liquidity demand.

Tokenisation could also improve operational efficiency and promote automation in back office tasks. For example, Project Pine automated collateral management and interest accrual on reserves. Today, many central banks publish collateral eligibility and haircut schedules in PDF or Excel files. Integration into smart contracts effectively combines the publication with the automated operational task of checking eligibility and applying the haircut transparently and efficiently. These efficiencies might bring staffing benefits, allowing more time to be spent on monitoring and policy evaluation. And finally, as tokenised platforms could, in principle, operate continuously, smart contracts could support extended or even 24/7 market operations.

To be sure, the transition to a fully tokenised financial system is not without its challenges. Interoperability between existing account-based systems and emerging tokenised infrastructures must be ensured.51 Changes to existing systems will be needed, including adjustments to booking and reconciliation processes or messaging standards.52 Fragmentation across both legacy and new networks poses a key challenge in this context. Obstacles to collateral mobility are a case in point. The emergence of tokenised repo transactions, including intraday or multi-currency repo arrangements, adds to demands on sound collateral management.

Central banks and the official sector more broadly will need to coordinate industry efforts to promote sound innovation. The findings from Project Pine illustrate how central banks can play such a catalytic role, by supporting trust to encourage private sector participants to adopt tokenised systems with confidence in their reliability and the soundness of their governance. By offering tokenised central bank reserves and facilities, central banks could lay the foundation for the adoption of tokenised money and securities across financial markets. This could ensure that these arrangements align with public policy objectives such as financial stability and efficient monetary policy implementation.

Conclusions

Trust in money remains crucial for the economy's functioning, regardless of technological change. Money is the coordination device for the economy, subject to important network effects. The singleness of money sustains this coordination. Elasticity and integrity are further crucial features that ensure money is fit for purpose.

Technology offers many paths forward, but not all are equally promising. The issuance of private currencies like stablecoins satisfies a demand for new technological features. Yet even with regulation, stablecoins' limitations cast serious doubts about their ability to be the mainstay of the monetary system. There are better ways to meet the legitimate demand for new functions in the monetary and financial system. Innovation built on unified ledgers is promising, unlocking efficiency gains and new contracting possibilities. The tokenisation of central bank reserves, deposits and government securities could represent stepping stones towards the next-generation monetary and financial system.

To make this future a reality, central banks must play a catalytic role. Where new forms of money are demanded for a tokenised system, central banks have to be the ones providing them. More broadly, central banks can articulate their vision of the future monetary system to provide a guidepost for all stakeholders. They can also help align regulatory frameworks and standards to ensure interoperability across jurisdictions and minimise hurdles in coordination.53 By fostering trust and public-private collaboration, central banks can also help ensure that unified ledgers are designed to meet the needs of diverse entities while upholding robust governance, resilience and compliance standards. Central bank leadership is essential to unlocking the full potential of tokenised systems safely, efficiently and inclusively.

The BIS is not just theorising but is working with central banks to develop these ideas. BIS Innovation Hub projects, including Agorá, Mandala, Pine and Promissa, demonstrate innovative technology's potential for the monetary and financial system. Central banks and private sector innovators are drawing on the lessons from this work to build the future financial system.

Endnotes

1 On tokenisation, see Aldasoro et al (2023); on the unified ledger, see BIS (2023).

2 Gridlock refers to a situation in which participants are each waiting for others to pay first. See Chapters 15–17 in Leibbrandt and De Teran (2022).

3 The advent of cryptoassets, marked by the mining of the first bitcoin in 2009, was heralded as the start of a new era in money and payments. Bitcoin was conceived as a peer-to-peer payment system operating independently of central banks and trusted intermediaries. However, almost 20 years later, it is clear that it is not a currency in any meaningful sense. Unbacked cryptoassets are not widely used for payments nor do they serve as a unit of account. They are better understood as speculative assets, characterised by large price swings that attract investors in search of yield (Auer et al (2025)). These deficiencies have limited their utility and raised questions about their role in the financial system.

4 While many users go through hosted wallets of a crypto exchange that are tasked with onboarding customers, much like a bank, it is also possible to access the crypto ecosystem directly through unhosted wallets (ie cryptoasset wallets where the user has complete control over their private keys and assets), widely available in smartphone app stores. Unhosted wallets give users direct access to the public blockchain without relying on an intermediary, with no KYC checks.

5 Historical experience shows how central banks leading the way have helped the private sector in adopting new technologies – see Desch and Holden (2024) for a discussion of how the Federal Reserve promoted the adoption of new technologies in financial markets. In recent years, central banks have been piloting public-private initiatives to advance the tokenisation agenda. These include, among many others, Project Helvetia in Switzerland, exploring the settlement of tokenised assets using tokenised reserves; Project Guardian in Singapore, assessing the design of open and interoperable digital asset networks based on tokenised real economy assets; and Projects Genesis and Ensemble in Hong Kong SAR, studying the use of tokenisation for securities, including green bonds, and real-world assets.

6 On the role of settlement at par, see Borio (2019). On money as a record of goods sold or services rendered in the past, see Kocherlakota (1998) and his timeless motto, "money is memory". On the role of common knowledge in sustaining coordination (in settings beyond money), see Morris and Shin (2012). On the no-questions-asked principle, see Holmström (2015). For a general discussion about the role of information sensitivity in financial crises, see Dang et al (2020).

7 For the classic reference on this, see Bagehot (1873).

8 In many jurisdictions, there is also a role for non-bank electronic money (e-money) as a complement to bank deposits. However, in most instances e-money issuers do not hold accounts at the central bank, but hold funds with commercial banks, which in turn have access to central bank reserves.

9 Price stability is crucial given long-term nominal debt contracts, and even multi-year salary contracts, and the implied stability of associated purchasing power in real terms. The value of financial stability has been repeatedly demonstrated by its absence: in the severe economic and social costs of financial crises.

10 See Carstens (2018) for an overview of the role of central banks in the age of digital money, and Borio (2019) for a broader discussion of the role of price and financial stability. For the critical role of central bank independence, see Carstens (2025). Bell et al (2024) discuss the importance of credible and sustainable fiscal backing. Amatyakul et al (2023) assess the contribution of central banks' monetary policy in containing the recent inflation surge.

11 See BIS (2023).

12 For the seminal work on decentralised trust, see Nakamoto (2008).