BIS Annual Report 2017 - media briefing by Claudio Borio and Hyun Song Shin

Claudio Borio's remarks | Hyun Song Shin's remarks

On-the-record remarks by Mr Claudio Borio, Head of the Monetary and Economic Department, 21 June 2017

What a difference a year can make. As last year's Annual Report went to print, gloom prevailed, in markets and policymaking alike. Stock markets were moving sideways and bond yields were sinking towards historical lows, as markets saw the global economy stuck with feeble growth into the distant future. Policymakers were talking about an "anaemic recovery". It was not long before the unanticipated outcome of the UK vote to leave the European Union initially dealt another blow to sentiment. Things changed substantially thereafter. Gloom gave way to confidence. It was another political event - the US presidential election - that marked a watershed in financial markets. In its wake, markets became more buoyant, and volatility drifted to very low levels - normally a clear sign of high risk appetite. And while the "reflation trade" has lost a lot of momentum since the beginning of the year, its imprint is still visible, especially on equity markets.

The hard data have improved, but not as much as sentiment has. We had already stressed last year that the rhetoric being used to describe the global economy was too downbeat. Thus, one good year has been sufficient for economic conditions to become the most favourable since the Great Financial Crisis (GFC). Growth has strengthened considerably and is forecast to return to long-term averages soon. Economic slack in the major economies has diminished further; in some, unemployment rates have fallen back to levels consistent with full employment. And inflation has moved closer to central bank objectives.

Still, one may legitimately ask whether sentiment has swung too far. The doubts about the future derive from tensions that will have to be resolved at some point and from long-term developments that may eventually threaten growth. There is tension between readings of financial market volatility, which have plummeted, and indicators of policy uncertainty, which have surged. There is tension between stock markets, which have soared, and sovereign bond yields, which have not risen much as economic prospects have brightened. And, unfortunately, the unwelcome long-term developments we termed "the risky trinity" in last year's Report are still with us: unusually low productivity growth, unusually high debt, and unusually narrow room for policy manoeuvre.

Against this backdrop, in this year's Report we evaluate in some detail four medium-term risks to the outlook: a possible flare-up of inflation; financial stress linked to the contraction phase of financial cycles; weaker consumption not offset by stronger investment; and a rise in protectionism.

With slack diminishing or vanishing, and not just in some of the major economies, it is only natural to ask whether an inflation flare-up might force central banks to tighten and thus smother the expansion. After all, this has been the most common pattern for much of the postwar era. Still, such concerns may be overdone. The link between domestic measures of slack and inflation has proved surprisingly weak and elusive for at least a couple of decades now. Wage pressures remain remarkably subdued. And increases in unit labour costs have not been very helpful in predicting inflation in advanced economies. The reasons for these developments are not well understood. We have suggested that globalisation, and possibly technology, have played an underappreciated role: they have made labour and product markets much more contestable and hence reduced the likelihood of a repeat of the wage-price spirals of the past. I will elaborate on these issues in my presentation on Sunday. If those deep forces have not yet fully run their course, the end of the current expansion may be different.

That end may come to resemble more closely a financial boom gone wrong, just as the latest recession showed with a vengeance. Leading indicators of financial distress point to financial booms that in a number of economies look qualitatively similar to those that preceded the GFC. The countries involved are not those that were at the centre of the crisis: there, the financial cycle expansion is younger. Rather, the countries affected comprise a number of emerging market economies (EMEs), including some of the largest, and some advanced economies largely spared by the GFC. In this group, protracted strong credit expansion, often alongside rising property prices, signals the build-up of risks. That said, so far unusually low interest rates have generally kept debt service ratios below critical thresholds. The strong post-crisis growth of foreign currency debt adds to vulnerabilities in some countries. Indeed, given the dominant global role of the US dollar, dollar funding remains a potential pressure point in the international monetary and financial system.

Maturing financial cycles and high debt levels raise the risk of potential weakness in consumption and, in some cases, investment. In many economies, the expansion has been consumption-led. The empirical evidence indicates that such expansions are less sustainable. Our analysis suggests that a number of economies where household debt is historically high can be vulnerable, especially should interest rates rise considerably. For its part, could the recent welcome pickup in investment fail to strengthen enough? So far, the rise in indicators of policy uncertainty does not seem to have had much of an impact. Given the strong increase in domestic and foreign currency corporate debt, investment may be vulnerable in a number of EMEs.

Harder to assess, but potentially more devastating, would be a retreat of globalisation owing to a rise in protectionism. This is why we devote a whole chapter to globalisation in the Report. Hyun will develop some of the analysis shortly, especially with reference to the underestimated link between real and financial globalisation. Let me just say here that, post-crisis, protectionist arguments have been gaining ground - and this despite the fact that globalisation has been a major force lifting large parts of the world out of poverty and raising living standards. To be sure, the gains from globalisation have not been evenly distributed, not least because countries have not always been able to adjust to it. And financial openness can pose challenges for financial stability that need to be addressed. But rolling back globalisation would be as foolhardy as rolling back technological change.

The policy challenge is to take advantage of the current tailwinds to put the expansion on a sounder footing. First and foremost, that requires building resilience, domestically and globally. Resilience means strengthening the economy's capacity to absorb shocks, to adapt to long-term trends and to avoid the build-up of financial imbalances - the root cause of the GFC and a key source of risks ahead. Domestically, this calls for rebuilding policy space in fiscal and monetary policies and for implementing with urgency structural reforms - the only strategy that can raise growth on a sustainable basis. Lightening the burden on monetary policy is essential. Globally, it calls for reinforcing the multilateral approach to policy, in financial regulation, crisis management, trade, taxation and even monetary policy. Fortunately, we still live in a deeply interconnected world. The problems we face are global; the solutions must be global too. It would be illusory to think and act otherwise.

On-the-record remarks by Mr Hyun Song Shin, Economic Adviser and Head of Research, 21 June 2017

The philosopher René Descartes famously argued that the nature of the mind is distinct from that of the body, and that it is possible for one to exist without the other. Similarly, in debates about globalisation, there is sometimes a tendency to draw a sharp distinction between real and financial openness, coupled with the claim that real openness, associated with trade and investment, can be achieved without financial openness.

In practice, it turns out to be exceedingly difficult to prise apart real and financial openness. Real globalisation entails a very substantial amount of financial globalisation, and the benefits of real globalisation cannot be had without a great deal of financial globalisation.

Having said this, it is also true that the global financial system is subject to procyclicality and excesses, just like the domestic financial system is. If left unchecked, the build-up of financial excesses can result in costly financial crises. Growth suffers and inequality worsens, undermining the support for greater openness that underpinned increasing prosperity. A resilient financial system is necessary for the durable benefits from globalisation. These are some of the key lessons to emerge from the special chapter on globalisation in this year's Annual Report.

On how difficult it is to prise apart real and financial openness, just take one example from international trade. Trade in manufactured goods has driven the increase in global trade. In turn, the growth in manufactured goods trade reflects the growing importance of multinational firms and of global value chains. In the case of the United States, existing estimates suggest that around 90% of trade is accounted for by multinational companies, and around 50% is within-firm trade - that is, trade between affiliates of the same company.

Long and intricate global value chains need much greater financial resources to knit the production process together, as I will explain in more detail in my video presentation to be posted on Monday. It is normally banks that supply financing, and very often in dollars; and if financing conditions become less easy, and banks pull back dollar funding, global value chains suffer.

Financing of international trade is a small part of global finance, but it is only the beginning of a cascade of financial relationships that follow. For exporting firms, if the product is invoiced in dollars, such as for oil firms, it makes sense to borrow in dollars to finance real investment. Indeed, we have seen substantial dollar bond issuance of large emerging market economy oil firms in recent years.

The cascade of financial relationships goes further. Take the perspective of advanced economy asset managers. They have obligations to domestic beneficiaries or policyholders in yen, euros or Swiss francs. But any diversified global portfolio of assets will have a large representation of dollar assets, precisely because borrowers have borrowed in dollars. These asset managers will then hedge the currency risk. The counterparty is a global bank, which will then need to lay off the currency risk. It can do so by borrowing dollars, as the short dollar position counteracts the long dollar position from the hedging services. In this way, new financial claims cascade from existing real economy transactions.

The traditional approach to international finance is to treat each country as an island. We measure GDP on each island, and the trade balance determines net external assets. In practice, global finance is more a matrix of interlocking balance sheets than a group of islands. The matrix does not respect geography. The mapping between the nodes of the network to the islands is not a neat one.

This brings us to the debate on deglobalisation, which we cover in depth in the aforementioned special Annual Report chapter. It addresses the debate about "peak finance", the claim that the world has seen peak global finance and that financial deglobalisation has begun. The proponents of peak finance point to the decline in cross-border banking as evidence.

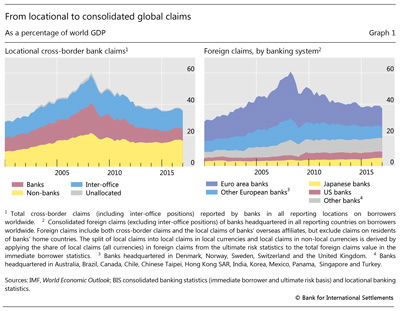

The left-hand panel of Graph 1, taken from the Annual Report (Graph VI.B.1), does indeed show a decline since the crisis. Cross-border claims declined from a peak of 60% of global GDP in 2007 to less than 40% recently. But cross-border claims can be misleading for the same reason that the "islands" view of the global economy misleads. If a bank lends to an Asian company by first shifting funds to its London branch, then there would be double-counting of the loan amount to the ultimate borrower in the cross-border banking numbers. They show up in the cross-border banking statistics twice, as the transactions hop from one island to another. The lending and borrowing between affiliates of the same bank are known as inter-office positions, and are represented by the blue area in the left-hand panel of Graph 1. It's a big chunk of the total.

A more informative measure of lending to final borrowers comes from the consolidated banking statistics, which measure positions at the banking group level. To get the full picture, we can net out the inter-office positions, but add back items that reflect the true nature of the bank's global footprint. This is shown in the right-hand panel as "foreign claims". The consolidated perspective makes clear that the shrinkage of international banking is largely confined to European-headquartered banks. The other banking systems actually increased foreign claims in relation to world GDP.

In sum, the lesson is not that financial globalisation has stalled. Rather, the banks headquartered in Europe are continuing their consolidation after the crisis. This is more a story of cyclical consolidation after a previous unsustainable expansion, rather than a shift in the trend. By distinguishing the trend from the cycle, we see that globalisation has not been in headlong retreat.

Nevertheless, Graph 1 also underscores the fact that the global financial system is subject to procyclicality and excess, just as the domestic financial system is. Financial crises cast a long shadow on the global economy, for years at a time. Ensuring a resilient financial system is the best way to reap the benefits of real globalisation. International cooperation towards resilience is more important than ever.