Basel Committee publishes more details on global systemically important banks

- The Committee provides additional information regarding the end-2020 G-SIB assessment.

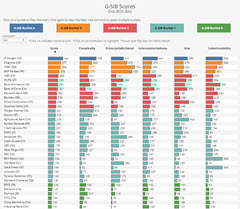

- Further details include global denominators and individual bank indicators.

- The release accompanies the Financial Stability Board's updated G-SIB list.

The Basel Committee on Banking Supervision today published further information related to its 2021 assessment of global systemically important banks (G-SIBs), with additional details to help understand the scoring methodology.

The publication accompanies the Financial Stability Board's release of the updated list of G-SIBs and includes:

- the denominators of each of the 12 high-level indicators used to calculate banks' scores;

- the 12 high-level indicators for each bank in the sample used to calculate these denominators; and

- the cutoff score used to identify the G-SIBs in the updated list and the thresholds used to allocate G-SIBs to buckets for the purpose of calculating the specific higher loss-absorbency requirements.

The Committee's methodology assesses the systemic importance of global banks using indicators calculated from data for the previous fiscal year-end (2020) supplied by banks and validated by national authorities. The final scores are mapped to corresponding buckets that determine the higher loss absorbency requirement for each G-SIB.

Basel Committee's G-SIB interactive dashboard has been updated to reflect the latest results.

In July 2018, the Committee concluded a review of the G-SIB framework and published a revised assessment methodology that is expected to be implemented in member jurisdictions by 2022.