Promoting sound financial standards and regulations

From the 1970s onwards, the BIS has become host to the main global standard setters for the financial system. The BIS member central banks and supervisory authorities, working through the Basel-based committees, have been the driving force behind this. The growing global outreach of the BIS over the last quarter century has been hugely beneficial to this process. However, the ultimate political responsibility for setting financial standards and regulations remains where it belongs: with domestic policymakers.

1930s – 1960s

A 1950s view of the Savoy Hôtel de l'Univers in Basel, where the BIS was headquartered from 1930 to 1977.

1971 – 1988

The failure of West Germany's Bankhaus Herstatt in 1974 raised concerns regarding cross-border banking crises. (photo © - Keystone)

1988 – 2004

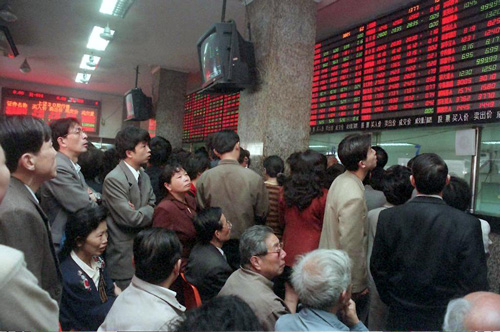

Stock exchanges across Asia were badly hit in the 1997-98 crisis. The Asia crisis prompted the establishment of the G20 and the Financial Stability Forum to better coordinate international efforts to strengthen financial stability. (photo © - Keystone)

2007 – 2020

Press conference by the Basel Committee on Banking Supervision in 2017 presenting the Basel III reform package. On the right: Stefan Ingves (Governor Sveriges Riksbank and Chair BCBS), Mario Draghi (President ECB) and William Coen (Secretary General BCBS).