Revised market risk framework - Executive Summary

In January 2016, the Basel Committee on Banking Supervision (BCBS) published revised standards for minimum capital requirements for market risk (Standards). The Standards replace the existing requirements for market risk. National supervisors are expected to implement the Standards by January 2019 and to require their banks to report under the Standards by the end of 2019.

Rationale for the revisions

Significant weaknesses in the Basel capital framework for trading activities resulted in materially undercapitalised trading book exposures in the lead-up to the Great Financial Crisis (GFC). In response, the BCBS undertook a fundamental review of the trading book to improve the overall design and coherence of the capital standard for market risk, drawing on the experience of "what went wrong" in the build-up to the GFC.

Key enhancements

The following key enhancements were incorporated in the Standards to address the identified weaknesses in the existing framework:

- a revised boundary between the trading book and banking book

- a revised internal models approach (IMA)

- a fundamentally overhauled standardised approach (SA)

- a shift from value-at-risk (VaR) in the IMA to an expected shortfall (ES) measure of risk under stress

- a means of incorporating the risk of market illiquidity

Standardised approach (SA)

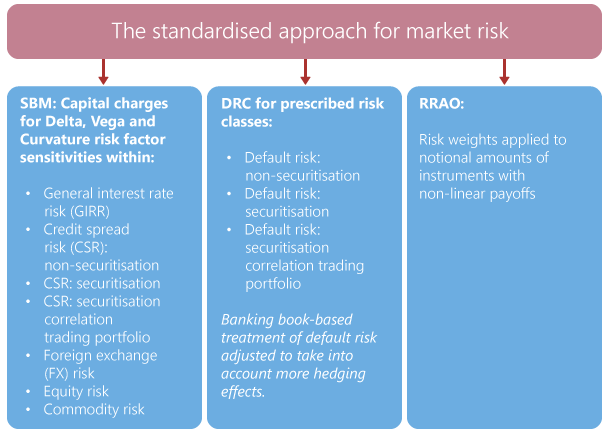

The SA comprises three main blocks: the sensitivities-based method (SBM), the default risk charge (DRC) and the residual risk add-on (RRAO). Each block covers specific types of risk that are relevant in the context of market risk. A risk charge is computed for each of the three blocks, the sum of which is the overall risk charge for market risk under the SA. No diversification benefits are allowed across the three blocks.

Internal models approach (IMA)

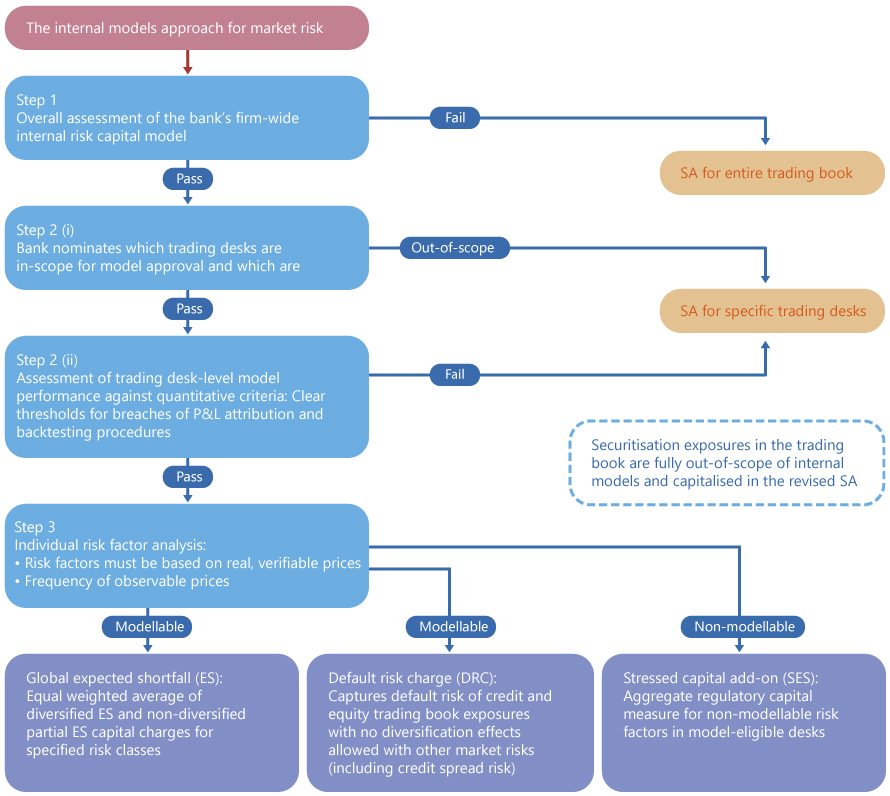

The process and policy design of the IMA are illustrated in the diagram below. Supervisory approval for using the IMA to determine capital requirements for non-securitisations in the trading book can be given at the level of an individual trading desk or for an entire firm. For a bank with firm-wide internal model approval, the total IMA capital requirement would be an aggregation of ES, the default risk charge (DRC) and stressed capital add-on (SES) for non-modellable risks.

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.