ICS - overview - Executive Summary

The Insurance Capital Standard (ICS) is a consolidated group-wide capital standard that applies to internationally active insurance groups (IAIGs).1 The ICS is part of the broader Common Framework for the Supervision of Internationally Active Insurance Groups (ComFrame). ComFrame and the ICS are part of a package of reforms completed by the International Association of Insurance Supervisors (IAIS) in response to the Great Financial Crisis of 2007-09.

Objectives of the ICS

The main objectives of the ICS are to establish a common language for supervisors to discuss solvency of IAIGs and to enhance global convergence among the group capital standards that are in place. Currently, large, global insurance groups are subjected to different capital standards that make it difficult to compare their solvency positions. The ultimate goal of the ICS is to establish a single ICS that includes a common methodology that achieves comparable outcomes across jurisdictions.

Main components of the ICS

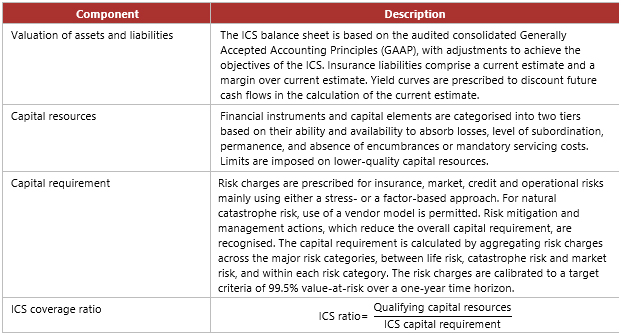

The table below provides a high-level overview of the main components of the reference ICS:

Timeline

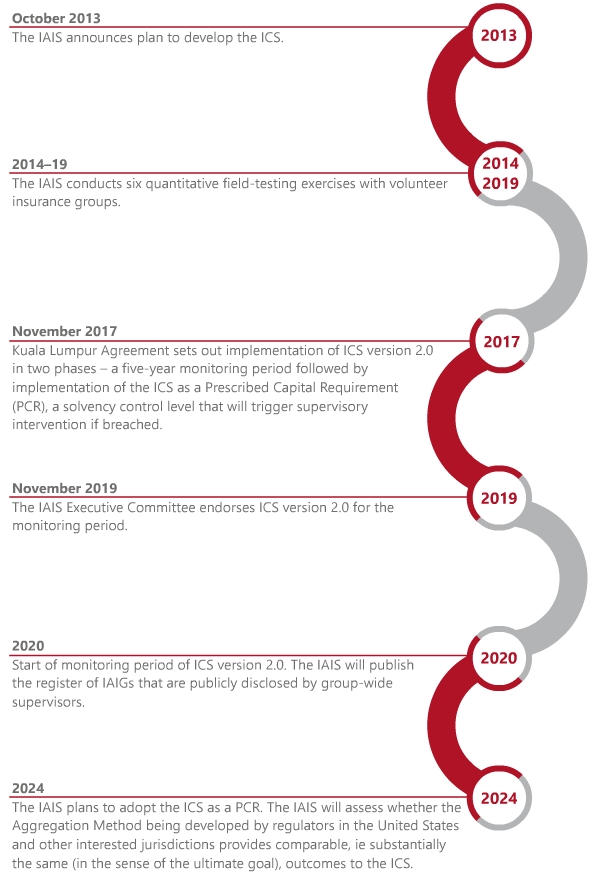

Monitoring period 2020-24

The purpose of the monitoring period is to assess the performance of the ICS over a period of time and not the capital adequacy of IAIGs. The feedback received from supervisors and industry stakeholders during the monitoring period will be used to further improve the ICS. Starting in 2020, the IAIS will annually review participation of IAIGs in the monitoring period.

In addition, during the monitoring period, the IAIS will consult on the ICS as a PCR, undertake an economic impact assessment of the ICS, and assess whether the Aggregation Method provides outcomes comparable to those of the ICS.

Implications for supervisors of IAIGs

During the monitoring period, supervisory colleges of IAIGs will discuss their ICS results. However, they will not be used to trigger any supervisory action. In practice, this could mean that an IAIG's ICS capital resources may be less than its ICS capital requirements without attracting any supervisory intervention.

In addition, group-wide supervisors and supervisory colleges are expected to:

- compare the ICS with existing group capital standards or calculations under development;

- assess the extent to which material risks of IAIGs are captured in the ICS calculation;

- assess appropriateness and practicality of the calculations required;

- identify any difficulties faced by IAIGs or supervisors in implementing the ICS specifications; and

- provide feedback to the IAIS on added value of the ICS within supervisory colleges.

Once the ICS is agreed as a PCR at the end of the monitoring period in 2024, group-wide supervisors are expected to implement the ICS as a minimum standard, taking into account their specific market circumstances.

Implications for IAIGs

Starting in 2020, IAIGs are expected to submit annual confidential reporting of the reference ICS and any additional reporting as required by the group-wide supervisor. Examples of additional reporting are ICS calculations based on the GAAP with an adjustments approach or other methods of calculating ICS capital requirements, such as internal models. IAIGs are not expected to manage their businesses with regard to the ICS during the monitoring period. There will be no supervisory repercussion if their ICS coverage ratio falls below 100%.

1 The IAIS defines an IAIG as an insurance group that writes premiums in three or more jurisdictions with at least 10% of the group's total gross written premiums underwritten outside its home jurisdiction and that has total assets of at least USD 50 billion or gross written premiums of at least USD 10 billion.

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.