ICS - non-life insurance risk charges - Executive Summary

The Insurance Capital Standard (ICS) is a consolidated group-wide capital standard that applies to internationally active insurance groups (IAIGs). During the monitoring period from 2020 to 2024, IAIGs are expected to confidentially report to supervisors their ICS solvency ratios, which are calculated by dividing qualifying capital resources by the standard method ICS capital requirement. Non-life insurance risk charges are components of the standard method ICS capital requirement.

General methodology and scope

The standard method ICS non-life insurance risk charges cover premium and claims reserve risks. The premium risk charge is intended to address unexpected losses from insured events that have not occurred, whereas the claims reserve risk charge covers incurred claims, including those that have yet to be reported. Premium risk factors do not include the impact of catastrophe events since catastrophe risk is a separate risk within the ICS.

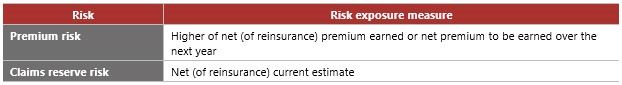

The risk charges are calculated using a factor-based approach by multiplying prescribed risk factors with specified risk exposures. The risk exposure measures are:

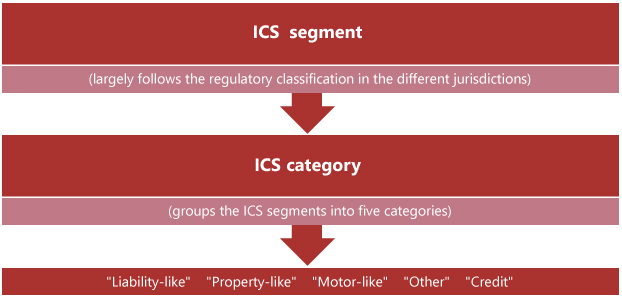

An IAIG first needs to categorise its business as follows:

Aggregation steps

To recognise diversification effects within and between the different non-life insurance risks and across geographical regions, the following steps are taken to aggregate the risk charges:

- Step 1: For each ICS segment (except mortgage and credit business), aggregate the premium and claims reserve risk charges by applying a 25% correlation factor.

- Step 2: Aggregate the ICS segments within each ICS category by applying correlation factors of 50% for "liability-like" and "property-like" categories, 75% for "motor-like" and 25% for "other".

- Step 3: Aggregate the ICS categories within each of the following five regions: European Economic Area (EEA) and Switzerland, United States and Canada, China, Japan, other developed markets and other emerging markets using a 50% correlation factor.

- Step 4: Aggregate across the regions using a 25% correlation factor.

Mortgage and credit business are aggregated across all regions and then aggregated with risk charges for real estate and credit risks, respectively.

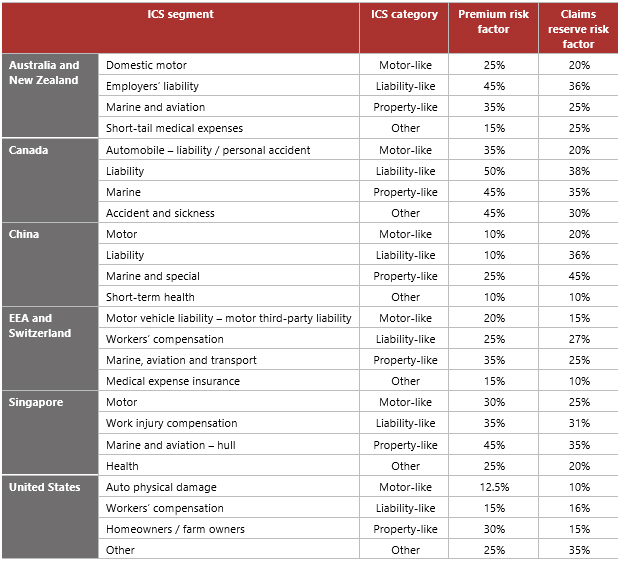

Examples of risk factors

The table below provides a non-exhaustive selection of risk factors:

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.