ICS - Market-adjusted Valuation - Executive Summary

The Insurance Capital Standard (ICS) is a consolidated group-wide capital standard that applies to internationally active insurance groups (IAIGs). From 2020 to 2024 (the so-called monitoring period), the International Association of Insurance Supervisors (IAIS) will review the performance of the ICS before it is adopted as a Prescribed Capital Requirement. During the monitoring period, IAIGs will use a reference ICS that includes a Market-adjusted Valuation (MAV) for confidential reporting of their ICS results to group-wide supervisors.

Overview of the MAV

The MAV specifies how IAIGs should value their assets and liabilities as part of the ICS calculation. The MAV is based on audited, consolidated, general purpose balance sheets prepared under Generally Accepted Accounting Principles (GAAP) or Statutory Accounting Principles (SAP). The MAV specifies adjustments to these valuations to minimise artificial volatility of the solvency position of IAIGs that could arise from financial market movements, while meeting the ICS objective of establishing comparable risk-based measures of the capital adequacy of IAIGs.

Insurance liabilities

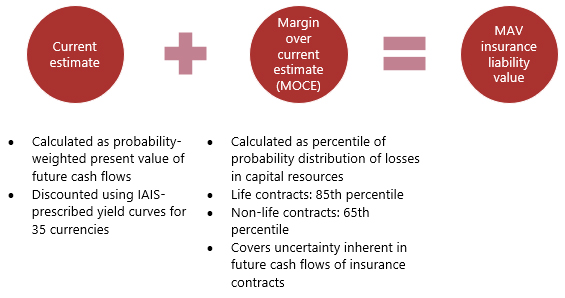

Insurance liabilities or technical provisions are usually the largest items on an insurer's balance sheet. Hence, the way they are calculated has a significant impact on an IAIG's financial position. A MAV insurance liability is calculated as follows:

Where future cash flows can be reliably replicated by certain financial instruments, the value of those insurance liabilities can be determined based on the market value of those instruments.

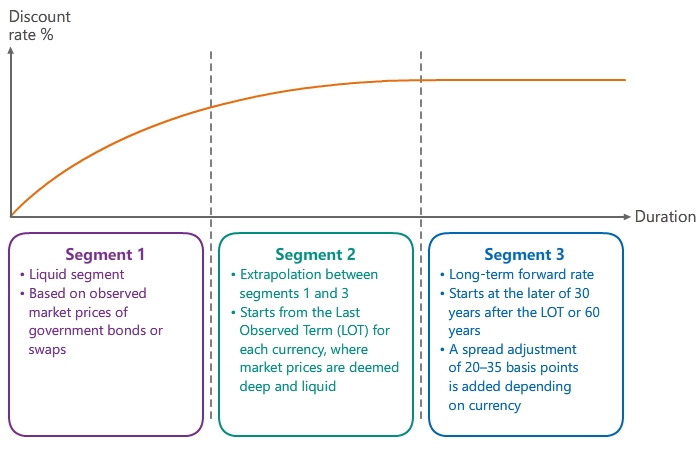

Discounting is one of the most significant drivers of the ICS results. A small change in discounting can potentially result in significant swings in an IAIG's ICS results. Hence, there has been considerable discussion on the technical design of the IAIS yield curve.

The construction of an ICS yield curve for each currency starts with a risk-free yield curve that comprises three segments as follows:

To mitigate excessive volatility that could arise in the ICS results of an IAIG from extreme credit spread movements, an adjustment is made to the risk-free yield curve based on a "three-bucket approach". This involves classifying insurance liabilities into three categories based on their nature and the assets backing them, and applying an uplift of discount rates as determined for each category.

Financial investments and instruments

Examples of MAV adjustments to financial investments and instruments:

· Properties and mortgages are adjusted to fair values.

· Deferred acquisition costs are adjusted to zero.

· Loans to policyholders are reported separately and are not offset against insurance liabilities.

· Financial liabilities are not adjusted for an IAIG's own credit standing after initial recognition based on GAAP valuation.

Interaction with other ICS components

The MAV interacts with other components of the ICS such as the capital requirement and capital resources. Certain asset and liability values are used as exposure measures in calculating the ICS capital requirement. The difference between assets and liabilities calculated based on the MAV specifications provides the foundation for determining ICS capital resources.

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.