ICS - market risk charges - Executive Summary

The Insurance Capital Standard (ICS) is a consolidated group-wide capital standard that applies to internationally active insurance groups (IAIGs). During the monitoring period from 2020 to 2024, IAIGs are expected to confidentially report to supervisors their ICS solvency ratios, which are calculated by dividing qualifying capital resources by the standard method ICS capital requirement. Market risk charges are components of the standard method ICS capital requirement.

General methodology and scope

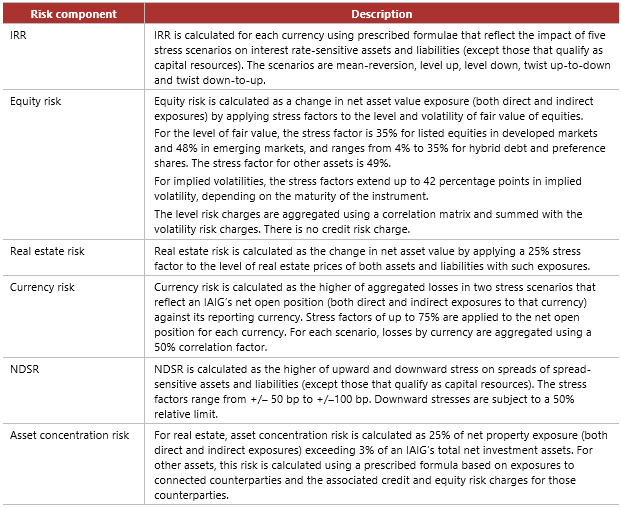

The standard method ICS market risk charges cover six risks: interest rate risk (IRR), equity risk, real estate risk, currency risk, non-default spread risk (NDSR) and asset concentration risk. Except for asset concentration risk, the risk charges are calculated using a stress approach where prescribed stress factors are applied on balance sheet items, and the resulting decrease in capital resources is taken as the risk charge. For asset concentration risk, a factor-based approach is applied by multiplying prescribed factors by specific exposure measures.

The market risk charges are calculated as follows:

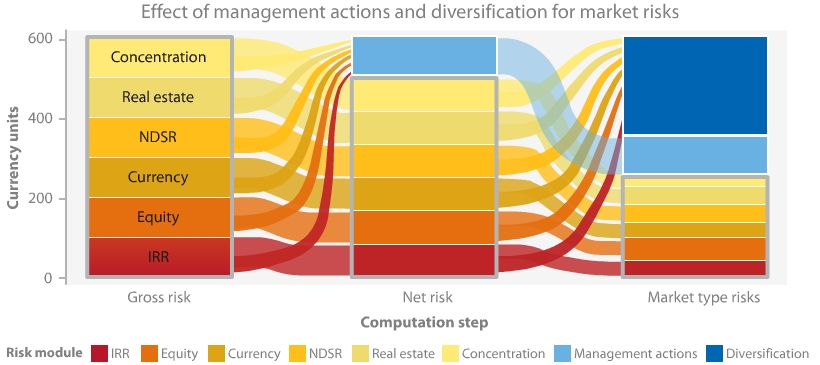

- Step 1: Calculate the risk charge for each risk, taking into account direct impacts of the prescribed stress scenarios on the value of assets and liabilities and indirect impacts arising from potential changes in policyholder behaviour. In the chart below, this is the "Gross risk", before allowing for management actions and diversification.

- Step 2: Calculate the risk charge to reflect management actions that meet specified criteria,

eg actions that are evidenced by current business practice and strategy. This is shown as "Net risk" in the chart below, after allowing for management actions but before diversification. The difference between steps 1 and 2 is the effect of management actions. - Step 3: Aggregate the risk charges using a prescribed correlation matrix to derive the total market risk charges, shown as "Market type risks" in the chart below, after allowing for management actions and diversification. The difference between steps 2 and 3 is the effect of diversification.

Components of market risk charges

The table below describes components of the market risk charges:

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.