ICS - credit risk charges - Executive Summary

The Insurance Capital Standard (ICS) is a consolidated group-wide capital standard that applies to internationally active insurance groups (IAIGs). During the monitoring period from 2020 to 2024, IAIGs are expected to confidentially report their ICS solvency ratios to supervisors. These are calculated by dividing qualifying capital resources by the standard method ICS capital requirement. The credit risk charge is one component of the standard method ICS capital requirement.

General methodology and scope

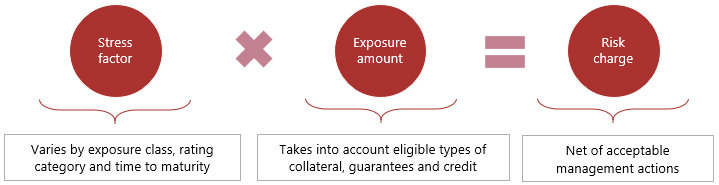

The standard method ICS credit risk charge is intended to cover unexpected changes in actual defaults of an insurer's counterparty and deterioration in any of its obligors' creditworthiness. The risk charge is calculated using a factor-based approach as follows:

The main exposure classes with each distinct set of stress factors are:

- Corporates: includes senior debt exposures to non-financial corporates, banks, securities dealers and commercial entities owned but not guaranteed by governments or municipal authorities

- Reinsurance (same stress factors as corporates): includes reinsurance assets, receivables and all credits recognised in the ICS risk charges due to reinsurance arrangements

- Public sector entities: includes regional governments, municipal authorities and other government entities whose debt is not issued or guaranteed by the national government

- Securitisation: includes asset-backed securities, including mortgage-backed securities

- Resecuritisation

In general, stress factors are determined based on the rating category and the time to maturity of the exposure classes. The ICS prescribes eight categories for rated, unrated and defaulted exposures. The time to maturity (also called effective maturity) of the exposure is calculated as the weighted timing of the cash flows (the weights being the cash flows).

In certain jurisdictions, supervisors may provide their own credit assessment for certain exposures. This is known as the supervisor-owned and controlled credit assessment (SOCCA) process. By the end of the monitoring period, the IAIS will decide if SOCCA processes will be part of the ICS standard method as a national discretion or included in "other methods", provided that certain specified criteria are met.

Eligible collateral, guarantees and credit derivatives held to mitigate credit risk could reduce the risk charge. Under the substitution approach, the risk rating of the exposure is replaced by the rating of the collateral, guarantee provider or credit derivatives underwriter for the portion covered. Under the haircut approach (which may be used in the context of non-proportional reinsurance), the exposure to the counterparty is reduced by the risk-adjusted amount of the collateral.

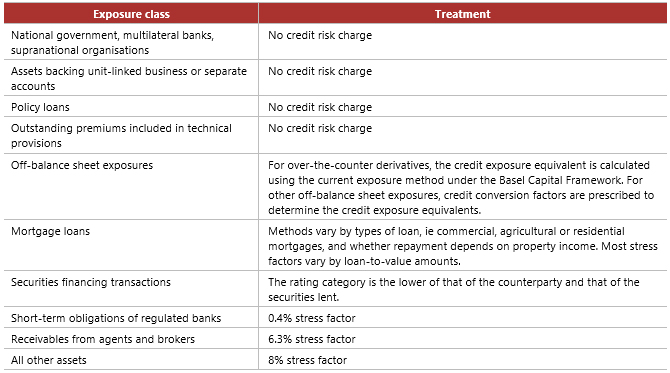

Other exposure classes

The table below sets out the credit risk charge for other exposure classes:

Stress factor examples

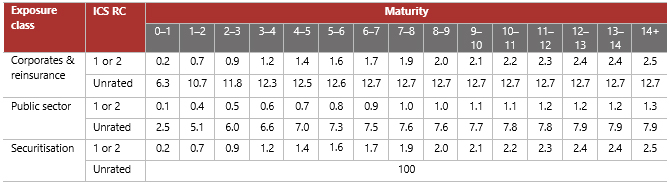

The table below provides a non-exhaustive selection of stress factors (in %) by ICS rating category (RC) and maturity (in years) for corporate, reinsurance, public sector and securitisation exposures:

For exposure classes in default, the stress factors are as follows:

- Public sector entities, corporates and reinsurance: 35%

- Securitisations and re-securitisations: 100%

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.