FSB proposed framework for the international regulation of cryptoasset activities – Executive Summary

In October 2022, the Financial Stability Board (FSB) announced a comprehensive set of proposals for regulating and supervising cryptoasset activities, which are collectively referred to as the "proposed framework for the international regulation of cryptoasset activities". The FSB invited the public to submit feedback on the recommendations and on a set of questions1. The proposed framework is a part of the FSB's ongoing efforts to address the potential financial stability risks posed by cryptoassets2, including so-called "stablecoins."

Cryptoasset markets are fast evolving and could reach a point where they represent a threat to global financial stability due to their scale, structural vulnerabilities and increasing interconnectedness with the traditional financial system. The FSB holds that an effective regulatory framework must ensure that cryptoasset activities are subject to comprehensive regulation, commensurate with the risks they pose, while harnessing potential benefits of the technology behind them. In broad terms, where cryptoassets and intermediaries perform an equivalent economic function to the one performed by instruments and intermediaries in the traditional financial system, they should be subject to regulations in line with the principle of "same activity, same risk, same regulation."

The core components of this framework are proposals for (i) recommendations that promote the consistency and comprehensiveness of regulatory, supervisory and oversight approaches to cryptoasset activities and markets; and (ii) revised high-level recommendations for the regulation, supervision and oversight of "global stablecoin" (GSC) arrangements.

The two sets of recommendations are closely interrelated, reflecting the interlinkages between stablecoins and the broader cryptoasset ecosystem. They have been developed as standalone documents but are intended to work together in light of these interlinkages and to be consistent where they cover the same issues and risks.

1. Regulation, Supervision and Oversight of Crypto-Asset Activities and Markets – Consultative report

The FSB consultative report examines regulatory and supervisory issues raised by cryptoasset activities with a focus on addressing financial stability risk. In particular, the publication:

- describes essential activities and analyses the interconnectedness of cryptoasset markets

- provides an overview of applicable international standards and describes regulatory and supervisory approaches to cryptoasset activities in FSB member and non-FSB member jurisdictions represented on FSB Regional Consultative Groups

- identifies issues and challenges related to cryptoasset activities, as well as potential gaps in regulatory, supervisory and oversight approaches

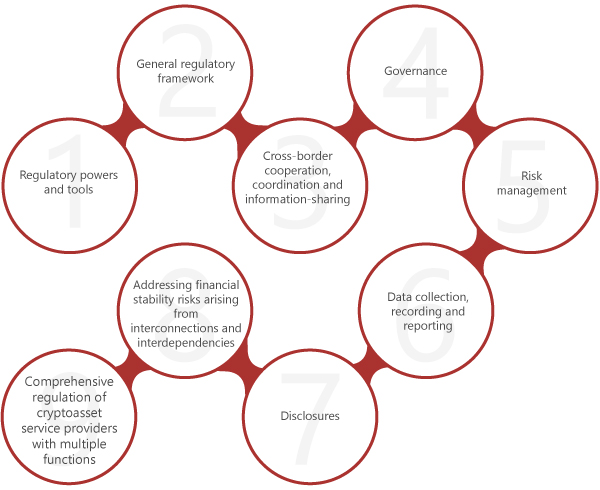

- proposes a set of nine high-level recommendations for the regulation, supervision and oversight of cryptoasset activities and markets

The nine high-level recommendations seek to promote the consistency and comprehensiveness of regulatory, supervisory and oversight approaches to cryptoasset activities and markets and to strengthen international cooperation, coordination and information-sharing. The recommendations, as proposed, would apply to any type of cryptoasset activity, associated issuers and service providers that may pose risks to financial stability, and they complement the high-level recommendations on GSC arrangements.

The nine high-level recommendations

The FSB has been working closely with the International Monetary Fund, the World Bank, the Basel Committee on Banking Supervision, the Committee on Payments and Market Infrastructures, the International Organization of Securities Commissions and the Financial Action Task Force to ensure that the work under way on the monitoring and regulation of cryptoasset activities and markets is coordinated and mutually supportive.

2. Review of the FSB High-level Recommendations of the Regulation, Supervision and Oversight of "Global Stablecoin" Arrangements – Consultative report

The term "stablecoin" has no universally agreed legal or regulatory definition, and it is not intended to imply that its value is stable. The FSB uses the term because market participants and authorities commonly use it.

The FSB distinguishes stablecoins from other cryptoassets based on two characteristics: the existence of a stabilisation mechanism and useability as a means of payment and/or store of value. In addition, GSC arrangements are further differentiated by their potential reach and adoption across multiple jurisdictions. High regulatory standards are required, in particular, for cryptoassets – such as stablecoins – that could be widely used as a means of payment and/or store of value, as they could pose significant risks to financial stability.

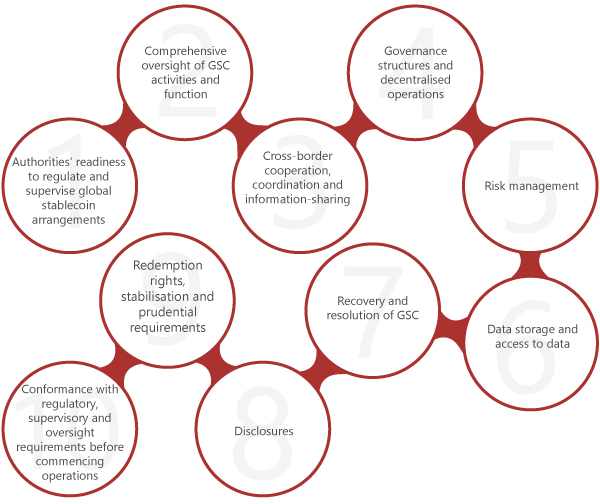

In October 2020, the FSB issued a report with a set of 10 high-level recommendations on the regulation, supervision and oversight of so-called "GSC arrangements". The Group of Twenty (G20) endorsed these recommendations, and in October 2021, the FSB provided a status update on the progress made on their implementation.

In 2022, the FSB, in consultation with relevant international standard-setting bodies (SSBs) and international organisations, reviewed the recommendations, including how any gaps identified could be addressed by existing frameworks, considering recent market and policy developments. The resulting report describes the findings from this review, covering:

- recent market developments and the characteristics of existing stablecoins

- recent policy developments, including regulatory initiatives and recent work of the SSBs

- proposals to revise the GSC recommendations

The high-level GSC recommendations seek to promote consistent and effective regulation, supervision and oversight of GSCs across jurisdictions. The recommendations aim to address the potential financial stability risks posed by such arrangements, both at the domestic and international level, while supporting responsible innovation and providing sufficient flexibility for jurisdictions to implement domestic approaches.

The ten high-level GSC recommendations

1 International Regulation of Crypto-asset Activities: A proposed framework – questions for consultation (fsb.org).

2 Cryptoassets, as defined by the FSB, are a type of private sector digital asset that depend primarily on cryptography and distributed ledger or similar technology.

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.