Financial benchmarks - Executive Summary

Interbank offered rates (IBORs) are widely used as an index for almost all financial instruments, including derivatives, securitised products, loans, floating rate bonds, credit cards and deposits.

Following the Great Financial Crisis, and in response to the declining volume of transactions in key interbank unsecured funding markets and to cases of attempted manipulation in relation to key IBORs, several reforms were launched by the Financial Stability Board (FSB) and the International Organization of Securities Commissions (IOSCO).

The FSB review and recommendations

The FSB undertook a fundamental review of IBORs that produced recommendations to strengthen the existing rates and to develop alternative, nearly risk-free rates (RFRs). Also, based on an initiative by market participants, the FSB recommended the strengthening of IBORs by anchoring them, where possible, to a greater number of transactions, improving the processes and controls around submissions, and identifying alternative RFRs. It also encouraged market participants to shift new contracts to an appropriate RFR.

Since 2014, the FSB has published a series of progress reports assessing implementation of the recommendations by its jurisdictions. In October 2020, the FSB published a global transition roadmap for the London Interbank Offered Rate (LIBOR), according to which firms should be prepared for LIBOR to cease by the end of 2021. In June 2021, the FSB updated the guidance, issuing statements to support a smooth transition away from LIBOR by the end of the year. In March 2021, the UK Financial Conduct Authority, which oversees LIBOR, confirmed that representative LIBOR rates will formally cease for most currencies at the end of that year and for some US dollar LIBOR tenors in June 2023.

The IOSCO Principles for Financial Benchmarks

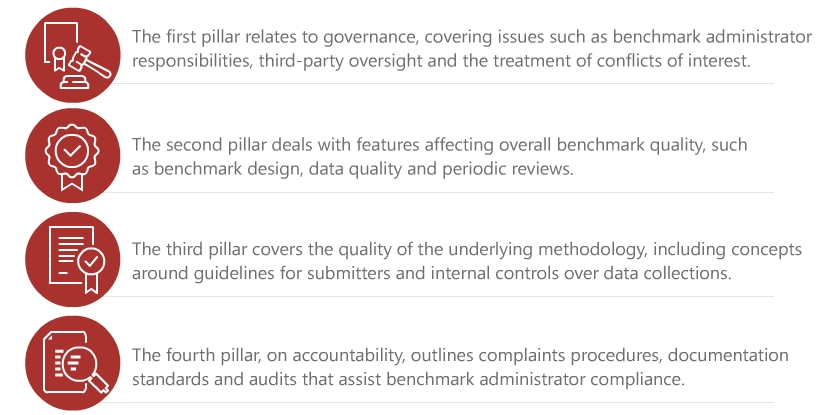

The IOSCO's 2013 Principles for Financial Benchmarks provide guidance to benchmark administrators on the benchmark-setting process and risks associated with these instruments. They are arranged around four pillars.

Transitional issues

Supervisors should determine how climate-related and environmental risks transmit to their economies and financial sectors and identify material risks for

There are some practical challenges associated with the transition from IBOR-linked to RFR-linked contracts.

One relates to legal challenges associated with the contractual provisions for replacing the referenced IBOR once it is no longer available, known as fallback language. If this language is unchanged after the IBOR's cessation, there could be adverse outcomes.

Amending contracts often requires the approval of counterparties or clients. Modifications of fallback provisions in derivatives contracts are being coordinated by the industry. For cash products, a case-by-case approach is required, and some guidance has been put forward by industry-led groups.

Special attention needs to be devoted to so-called tough legacy contracts, ie contracts that cannot be converted or amended to include fallback provisions ahead of LIBOR discontinuation. As there is no "one size fits all" approach to dealing with such special cases, ad hoc approaches are under development in key jurisdictions.

Transitional issues also emerge from the structural differences between IBORs and RFRs. For example, RFRs are fully transaction-based and are overnight rates, whereas IBORs are partially transaction-based, involve expert judgment and have multiple tenors. Moreover, RFRs are usually set on a secured basis, whereas IBORs are unsecured. Finally, RFRs do not include a credit risk component reflecting the risk of a lender bank.

Private sector and other standard-setting body (SSB) involvement

Market associations and SSBs have cooperated to coordinate benchmark transition efforts. The FSB has collaborated with the International Swaps and Derivatives Association (ISDA) on enhancing contractual robustness to prepare derivatives markets for the discontinuation of widely used interest rate benchmarks. For instance, and in addition to its work on fallback provisions, in October 2020, the ISDA published a supplement amending its 2006 definitions to incorporate new fallback language on uncleared derivatives that refers to adjusted versions of the RFRs. These amendments are to be incorporated into newly issued IBOR contracts maturing after 2021.

Concerning the SSBs, in 2020, the Basel Committee on Banking Supervision (BCBS) provided feedback to market participants, regulators and supervisors about the possible impact of the benchmark rate reforms on elements of the prudential framework for banks. In general, the BCBS has encouraged banks to be aware of the areas of the regulatory framework that are affected by IBOR reform. Those areas are definition of capital, market risk, operational risk, counterparty credit risk and liquidity.

In addition, the International Accounting Standards Board has set out a two-phased plan to tackle the potential accounting issues arising from IBOR reform. In Phase 1, it focused on financial reporting during the period before LIBOR is no longer published. In Phase 2, it outlined the accounting implications for financial statements when an entity replaces the old interest rate benchmark with an alternative benchmark rate as a result of the reforms.

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.