Prudential treatment of cryptoasset exposures – Executive Summary

The rapid evolution of cryptoassets and their growing interaction with mainstream finance could raise financial stability concerns and accentuate the microprudential risks of banks. Although the cryptoasset market remains small relative to the size of the global financial system and banks' exposures to cryptoassets are currently limited, the market's absolute size is still meaningful. Moreover, certain cryptoassets have exhibited a high degree of volatility and may intensify risks for banks as exposures increase, including credit, market, liquidity and operational (including fraud and cyber) risks; money laundering/terrorist financing risks; and legal and reputation risks.

Against this backdrop, the Basel Committee on Banking Supervision (BCBS) finalised its standard on the prudential treatment of cryptoasset exposures in December 2022. The standard outlines minimum regulatory, supervisory review and disclosure requirements of banks' cryptoasset exposures under

Pillars 1, 2 and 3 of the Basel Framework. Internationally active banks in BCBS member jurisdictions are expected to adopt the standard by 1 January 2025.

Cryptoasset classification

Cryptoassets are a type of private sector digital asset that depends primarily on cryptography and distributed ledger or similar technology. Such assets are a digital representation of value that can be used for payment or investment purposes or to access a good or service. There are a range of different types of cryptoassets, and their underlying risks vary based on their characteristics. Accordingly, the prudential treatment of a bank's cryptoasset exposures varies according to the prudential classification of the cryptoassets. To determine this classification, cryptoassets must be reviewed regularly and categorised into two broad groups, initially by banks but subject to supervisory review. These groupings, as noted below, are used as the basis to apply the Basel Framework to banks' cryptoasset holdings:

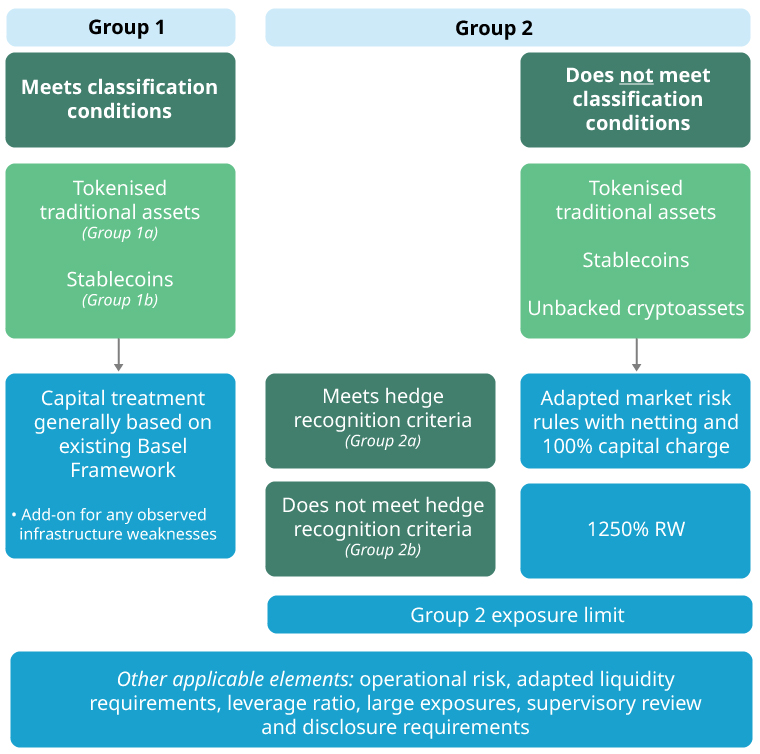

- Group 1 cryptoassets include tokenised traditional assets (Group 1a) and cryptoassets with effective stabilisation mechanisms (Group 1b). To qualify, all Group 1 cryptoassets must meet the full set of classification conditions as specified in sections SCO 60.8–19 of the standard. These conditions include a redemption risk test for cryptoassets with a stabilisation mechanism (ie stablecoins). This is to ensure that the reserve assets are sufficient to enable the cryptoassets to be redeemable at all times for the peg value, including during periods of extreme stress. Furthermore, only stablecoins issued by supervised and regulated entities are eligible for inclusion in Group 1b.

- Group 2 cryptoassets include all unbacked cryptoassets and tokenised traditional assets and stablecoins that fail to meet any of the Group 1 classification conditions. Cryptoassets that meet hedging recognition criteria1 (as specified in SCO 60.55 of the standard) are allocated to Group 2a and receive limited hedge recognition. Others are allocated to Group 2b where hedging is not recognised.

Cryptoassets and application of the Basel Framework

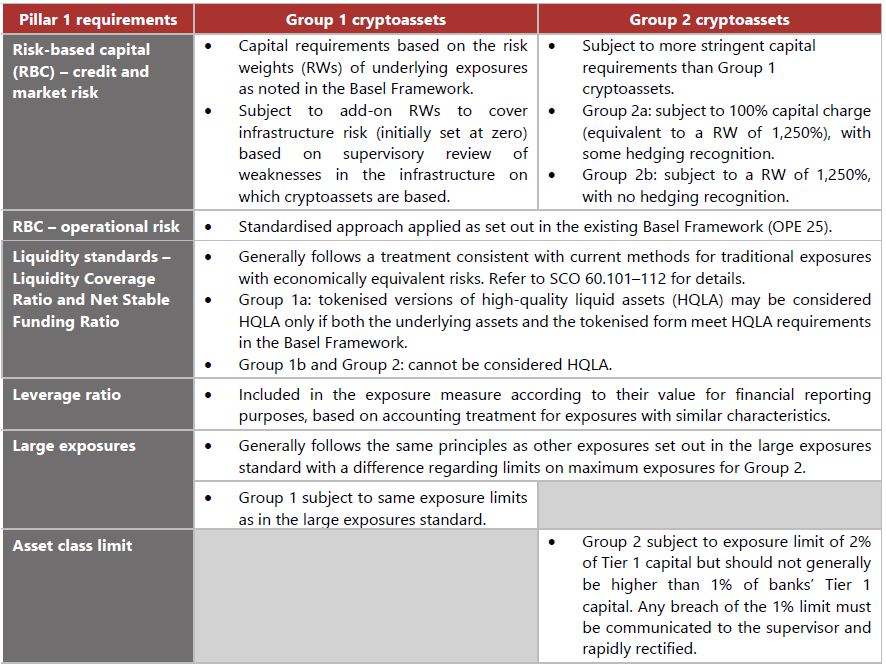

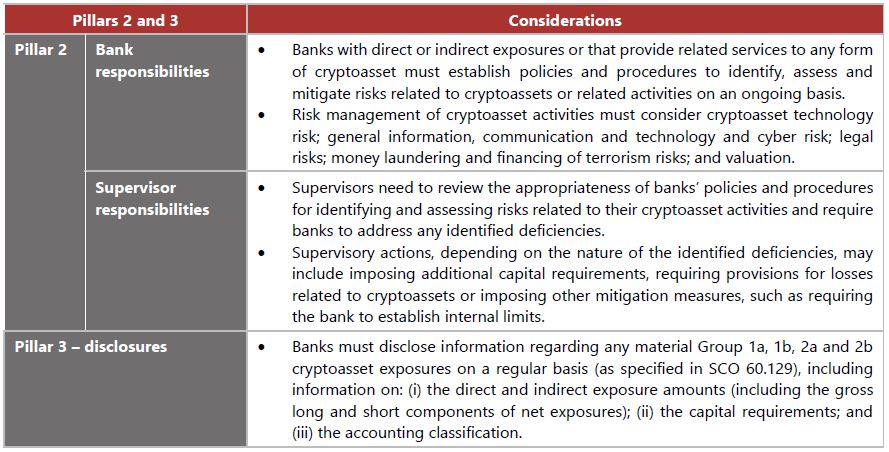

The tables below summarise the applicability of Pillars 1, 2 and 3 of the Basel Framework to cryptoassets.

Cryptoassets standard – an illustration

The following diagram provides a high-level overview of the BCBS's cryptoasset prudential standard, including its application to Group 1 and Group 2 cryptoasset exposures.

This Executive Summary and related tutorials are also available on FSI Connect, the online learning tool of the Bank for International Settlements.

1 The criteria include various thresholds relating to market capitalisation, trading volume and price observations.