Climate and environmental risks - guide for supervisors - Executive Summary

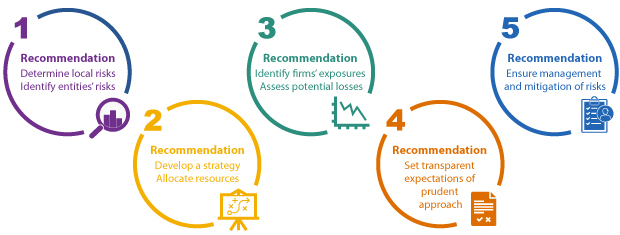

To help meet the goals of the 2015 Paris Agreement, the Network for Greening the Financial System (NGFS) aims to ensure that financial firms manage their climate-related and environmental risks. In May 2020, it published its Guide for Supervisors – Integrating climate-related and environmental risks into prudential supervision. The guide's recommendations provide authorities with a roadmap to integrate climate-related and environmental risks in supervisory frameworks and includes five recommendations.

Recommendation 1

Supervisors should determine how climate-related and environmental risks transmit to their economies and financial sectors and identify material risks for supervised entities.

The scope of risks includes climate-related, environmental and liability risks. Climate-related risks include physical and transition risks. Physical risks arise from costs and losses due to the increasing severity and/or frequency of weather events. These can be acute and result from extreme weather events, or chronic events, arising from progressive shifts in weather patterns. Transition risks arise from policies aiming to reach "net zero"1 carbon emissions by a specified date and that will transform the economy, with the implication that assets in certain sectors may lose value. Environmental risks arise from exposures to activities that may cause or be affected by environmental degradation, such as pollution. Liability risks may arise from legal claims seeking compensation for losses suffered because of actions/inactions of governments or corporations.

Recommendation 2

Authorities need to develop a strategy and an internal organisation that is adequately resourced to support the integration of these risks in supervisory work.

The process starts with the commitment of the supervisory authority's board and the need for it to provide clear direction and support to integrate climate-related and environmental risks into supervisory work. It also includes selecting the type of organisation to put in place.2 The next step involves capacity building and leveraging knowledge. Within an authority, this includes briefing management, sharing knowledge across divisions and acquiring the necessary skillsets through hiring and/or training programmes. Leveraging knowledge internationally involves participating in international organisations and fora.3 Other tools include seminars and roundtables with external risk experts and internal communication channels. A further consideration is the need to raise awareness, starting with dialogues between financial institutions and their supervisors, followed by system-wide meetings through roundtables or conferences.

Recommendation 3

Supervisors should identify financial institutions' exposures and assess their potential losses.

A system-wide assessment of exposures typically includes a preparation phase to define objectives, scope the project and identify risks and data gaps. The analytical phase that follows assesses exposures and vulnerabilities through stress tests. The publication of a report and its findings ends the process. A survey among NGFS members found that it takes up to a year to complete such a project.

Key determinants of physical risks include the activities of an institution's customers, their geographical locations, exposure tenors and whether these exposures are insured. A starting point is to map exposures against sectors and industries. This is followed by precisely locating activities, properties, assets and collateral.

Supervisors use carbon intensity and energy efficiency as proxies to assess the sensitivity of corporate and mortgage exposures. To measure the carbon intensity of corporate exposures, detailed information is needed on its composition (balance sheet data) and on the carbon emissions of its constituents (emissions data). Emissions may be reported at three different levels: direct, indirect and those derived from the firm's value chain. Determining the energy efficiency of a mortgage portfolio implies assessing it against a target or against minimum standards. While energy efficiency definitions vary across countries, efforts are under way to introduce more standardisation.

The distinct features of climate risks require the use of scenario analysis.4 However, accurate assessments require large amounts of highly granular data. While data gaps for larger corporates may be filled over time, those related to smaller corporates and to other financial assets may persist. As a result, supervisors need to rely on external data provided by environmental agencies and other data providers in addition to supervisory reporting and publicly disclosed data.

Recommendation 4

Clear supervisory expectations need to be set, with these expressed through guidance and reflecting industry good practices. An authority also needs to consider the granularity and the proportionality of its expectations. These include expectations with regards to the following:

- governance arrangements, including the need for financial institutions' (i) to assign management responsibilities for climate and environmental risks, board-level responsibilities, and fit and proper requirements for senior executives and board members; (ii) define clear policies, procedures and processes; and (iii) ensure adequate resourcing

- strategy, which covers the need for financial institutions to adjust their business models to reflect the impact of climate and environmental risks and to test their resilience and capital adequacy against a plausible set of future scenarios and stress tests

- risk management, with financial institutions needing to have policies and procedures to identify, assess, monitor, report and manage all material climate and environmental risks as part of their financial risk categories

- forward-looking methodologies and tools, such as scenario analysis and stress testing, with institutions expected to develop and use them to assess their climate and environmental risks and address the inherent uncertainties of these risks

- public disclosures, which should provide adequate insight into the risk exposures, risk management and capital adequacy of financial institutions5

Recommendation 5

Supervisors need to ensure adequate management of climate-related and environmental risks by financial institutions and take mitigating action where appropriate.

Climate-related and environmental risks are drivers of existing financial risk categories, such as credit, market, operational, liquidity and underwriting risks. Existing supervisory frameworks, such as the BCBS's Core Principles for Effective Banking Supervision and the IAIS's Insurance Core Principles (ICPs), can provide the basis for incorporating these risks. Effective supervision requires the use of forward-looking assessments of institutions' risk profiles, with assessments proportionate to firms' systemic importance. Frameworks for banks and insurers expect supervisors to initiate escalation measures when vulnerabilities or cases of non-compliance with requirements are detected.

The Supervisory Review Process (SRP), one of the key parts of the Basel Framework, and its equivalents in insurance supervision, assess business model viability and review a firm's governance arrangements, risk management, internal controls, financial condition, conduct of business, overall risk profile and capital adequacy. This takes place either through a bank's internal capital adequacy assessment process or through an Own Risk and Solvency Assessment that an insurance firm must conduct under the Solvency 2 Standard in the European Union.

Currently, in the absence of an international standard that recognises climate and environmental risks and of laws or regulations that establish minimum requirements, no regulatory capital requirements apply to these risks. Embedding them into requirements could be achieved through Pillar 1 options, which are mandatory minimum requirements imposed upon all financial firms in a jurisdiction, or through Pillar 2 options, which are capital surcharges imposed through discretionary supervisory powers upon an institution to reflect its specific risk profile.

1 Net zero refers to an objective where, by a predetermined date, there is no net carbon dioxide released into the atmosphere by an economy considered as a whole.

2 The main types of organisation to consider are a flexible internal network that promotes information sharing and coordination; a "hub and spokes approach" that combines a central team (the hub) with correspondents in the authority's main divisions (the spokes); or a more centralised approach with a dedicated unit coordinating climate and environmental risk issues.

3 International organisations and fora include the NGFS, the Financial Stability Board (FSB), the Sustainable Insurance Forum, the International Association of Insurance Supervisors (IAIS) or the Basel Committee on Banking Supervision (BCBS).

4 Scenario analysis is used for analysing future events by considering alternative scenarios and their outcomes. Unlike an economic or risk model, scenario analysis does not present a single picture of the future. Instead, it presents a range of outcomes derived from possible and plausible futures. The distinct features of climate risks requiring the use of scenario analysis include long-term horizons, uncertain timing of changes, complex transmission channels and the limited use of historical data.

5 In doing so, supervisors often refer to the recommendations of the Task Force on Climate-Related Financial Disclosures, which was established by the FSB in 2015 to develop voluntary guidance to support consistent climate-related financial disclosures.

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.