The Basel Core Principles - Executive Summary

The Core principles for effective banking supervision (CPs) are the minimum global standards for the sound prudential regulation and supervision of banks. Initially published in 1997, and updated in 2006 and 2012, they contain 29 principles. All are universally applicable, partly because the CPs embed the concept of proportionality, thus accommodating a range of banking systems and a broad spectrum of banks (from large internationally active banks to small, deposit-taking institutions).

Prudential authorities use the CPs as a benchmark to assess the quality of their regulatory and supervisory frameworks and to help inform future work priorities. They are also used by the International Monetary Fund and the World Bank to evaluate the effectiveness of countries' systems of banking supervision as part of their Financial Sector Assessment Program. This Executive Summary outlines the preconditions needed for effective supervision and the 29 CPs that are deemed essential to support a sound supervisory system.

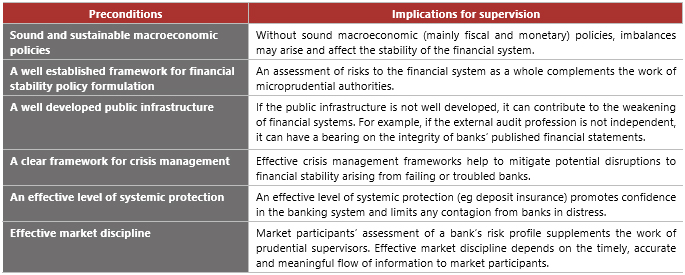

Preconditions for effective banking supervision

The CPs identify six preconditions that can have a bearing on the conduct of supervision. While these preconditions are generally outside the control of supervisory authorities, supervisors should work with the government and applicable organisations to address any identified concerns.

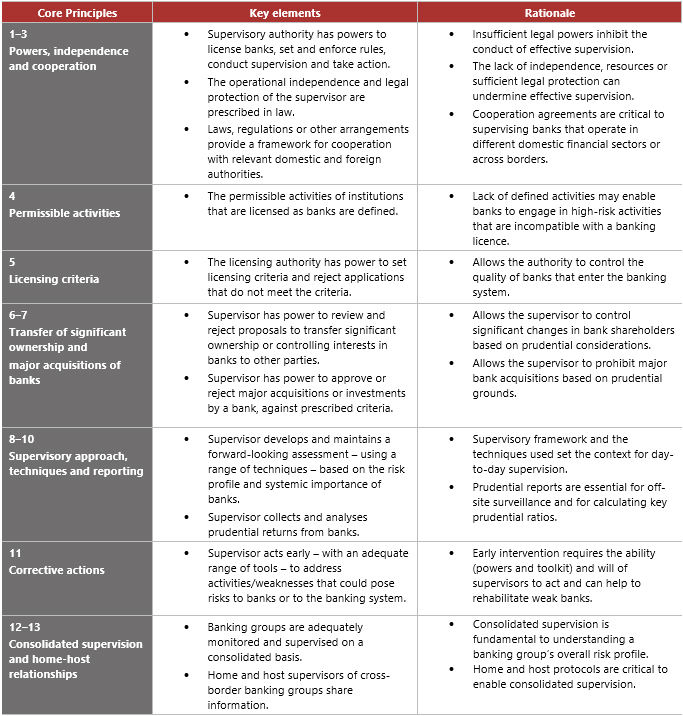

Powers, responsibilities and functions of supervisors (CPs 1-13)

Principles 1-13 focus on what supervisors themselves do, covering their powers, responsibilities and functions. Within this group, CPs 1-7 deal with the legal and regulatory powers and institutional setup needed to properly licence, oversee and intervene against banks. Meanwhile, CPs 8-13 address various aspects of on- and off-site supervision.

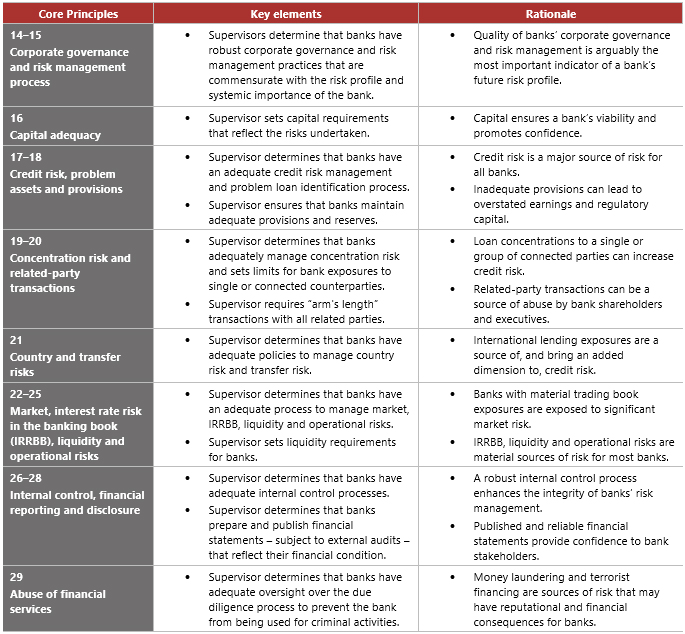

Prudential regulations and requirements for banks (CPs 14-29)

Principles 14-29 cover supervisory expectations for banks, emphasising the importance of good corporate governance and risk management, as well as compliance with various supervisory standards. One way to think about this set of principles is to consider that sound corporate governance, risk management and internal controls (CPs 14, 15, 26) underpin the safety and soundness of banks and banking systems. These need to be augmented with robust capital requirements (CP 16) and standards on how banks identify, measure and control their material risks (CPs 17-25, 29). In aggregate, the quality of corporate governance, capital adequacy and the management of material risks determine a bank's overall risk profile, which, in turn, is ultimately reflected in its published financial statements (CPs 27 and 28).

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.