Basel III: Securitisation framework - Executive Summary

The Basel III securitisation framework is part of the Basel Committee on Banking Supervision's efforts to increase the resilience of the banking sector. In effect since January 2018, the framework addresses weaknesses that became apparent during the Great Financial Crisis. As a result, the revised framework is simpler, more risk-sensitive, more prudently calibrated and more broadly consistent with the underlying framework for credit risk. It also provides incentives to improve risk management and seeks to enhance transparency and comparability across banks and jurisdictions.

Securitisation exposures

To be eligible for the securitisation framework, the exposures must be part of structures that have at least two stratified risk positions (or tranches) with different levels of seniority, also known as senior/subordinated structures. In addition, the performance and/or the risk of the securitisation exposures must depend upon the performance of the underlying exposures. Moreover, securitisation exposures are those that transfer significant credit risk to third parties, allowing the originating bank to exclude the pool of exposures underlying a securitisation from its risk-weighted assets.

Securitisation exposures could be from traditional (or asset-based) securitisations where the assets are sold to a special purpose vehicle, or synthetic securitisations where only the risks are transferred through credit derivatives or guarantees.

In addition, re-securitisation exposures, which are securitisation exposures in which the risk associated with a pool of exposures is tranched and at least one of the underlying exposures is a securitisation exposure, are explicitly recognised under the revised framework. They have become subject to a regulatory treatment that is more conservative than the one applicable to other securitisation exposures.

Some traditional securitisation transactions, whether short term or longer term, may qualify with STC criteria (or those that are simple, transparent and comparable), making them eligible for a more favourable capital treatment if this has been implemented by the bank's jurisdiction.

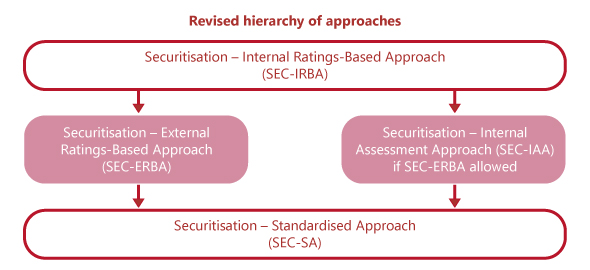

Revised hierarchy of approaches

The revised framework has the Securitisation - Internal Ratings-Based Approach (SEC-IRBA) at the top of the hierarchy of approaches (see illustration below). To use SEC-IRBA, banks must have a supervisory-approved IRB model for the type of underlying exposure in the securitisation pool and sufficient information to estimate the capital charge for these underlying exposures. This key bank-supplied input is denoted KIRB, which is the capital requirement for the exposures under the IRB model.

A bank that cannot determine KIRB for a securitisation exposure must use the Securitisation - External Ratings-Based Approach (SEC-ERBA), provided that this method is allowed by the national regulator. SEC-ERBA is based on external ratings of the exposure, or inferred ratings when possible. For certain exposures, such as unrated liquidity facilities and credit enhancements in asset-backed commercial paper programmes, banks may also use a Securitisation - Internal Assessment Approach (SEC-IAA) to determine capital requirements. However, SEC-IAA cannot be used when calculating the output floor. Instead, banks must use the Securitisation - Standardised Approach (SEC-SA).

When either the securitisation exposure is unrated or the use of SEC-ERBA is not recognised in the jurisdiction, the bank must use the SEC-SA. The SEC-SA uses KSA - the capital requirement for the underlying exposures using the Standardised Approach for credit risk - as an input. A more conservative version of SEC-SA is the only approach available for re-securitisation exposures.

A bank that cannot use any of these approaches for a securitisation exposure is expected to assign it a risk weight of 1250%.

Other changes to the securitisation framework

To limit reliance on external ratings, address cliff effects and improve risk sensitivity, a series of other changes are also introduced in the Basel III securitisation framework. These include additional risk factors, due diligence requirements, improved calibrations and risk-weight caps.

When compared with Basel II, the revised framework includes two new risk factors, which were imperfectly captured or not captured previously. These are the maturity of tranches and the thickness of non-senior tranches. Both risk drivers affect risk-weights associated with securitisation exposures. In particular, SEC-IRBA includes tranche maturity up to five years as an explicit risk driver, while SEC-ERBA includes tranche thickness, for non-senior tranches, as well as tranche maturity for all tranches.

A bank that fails to meet due diligence requirements must assign a 1250% risk weight to its securitisation exposures. The requirements ensure that the bank has a comprehensive and ongoing understanding of the risk characteristics of all of its securitisation exposures and of the underlying pools, access to timely performance information on these pools and a thorough understanding of all structural features of the securitised transactions.

Another set of revisions improves risk-weight calibrations. These changes deliver higher risk weights for senior exposures, with a supervisory floor risk weight set at 15% for securitisation exposures and 20% for re-securitisations (instead of 7% under Basel II), and more granular risk weights for mezzanine exposures. The latter limit cliff effects by smoothing risk weights across all mezzanine tranches and by limiting the scope of the 1250% risk weight to exposures that have a credit quality equivalent to a triple-C rating.

Finally, the revised framework also includes risk-weight caps and overall caps. The former ensure that individual senior securitisation exposures are not excessively capitalised when compared with the underlying pool. The latter ensure that the sum of the capital charges applied to all retained securitisation exposures is not excessive when compared to the total capital requirement for the underlying pool.

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.