Overview of Basel III and related post-crisis reforms - Executive Summary

The package of reforms commonly known as "Basel III" is a comprehensive set of measures developed by the Basel Committee on Banking Supervision (BCBS). It aims to increase the banking sector's ability to absorb shocks arising from financial and economic stress, maintain the provision of lending to the real economy, improve risk management and governance, and enhance bank disclosures and the robustness of banks' reported capital ratios.

Reinforcing bank regulation starts with regulatory capital

Basel III introduces higher minimum levels of capital (Common Equity Tier 1 (CET1), Tier 1 and total capital ratios) and improves its quality. Accordingly, CET1 becomes the predominant form of regulatory capital, with internationally harmonised adjustments.

The reforms improve risk coverage in all areas

The revisions to the risk-weighted framework - encompassing the full suite of risk categories including market risk and operational risk - are aimed at enhancing the robustness of the risk-based framework and at reducing excessive risk-weight variability. One example of the latter is the introduction of an output floor for banks using an internal ratings-based (IRB) approach. Its purpose is to ensure that an IRB bank's risk-based capital requirements cannot be lower than a predetermined percentage of the standardised approach requirement.

Additional measures complement the risk-based framework

The leverage ratio is designed to restrict banks' leverage and to complement the risk-based capital requirements. The large exposures standard imposes limits on risk concentration. The two liquidity standards help ensure that a bank maintains an adequate reserve of liquid assets to withstand unexpected outflows and operates with a stable funding structure in relation to its on- and off-balance sheet activities.

Other reforms also support Pillar 1. For example, the enhanced Pillar 2 approach for interest rate risk in the banking book (IRRBB) outlines supervisory expectations for how banks manage IRRBB and provides a standardised framework that banks and supervisors can use to assess the risk. The enhanced Pillar 3 framework brings together all regulatory disclosures in a comprehensive package that allows for more informed decisions by all stakeholders.

The reforms introduce a macroprudential overlay

The macroprudential overlay aims at promoting financial stability and limiting systemic risk. For example, the capital conservation buffer, built on top of the CET1 minimum requirement, creates a strong incentive for banks to limit discretionary distributions in times of stress. Basel III also introduces a countercyclical capital buffer that banks need to build during a period of excessive growth; a capital surcharge for global systemically important banks (G-SIBs) that reduces the probability of failure of these large, complex organisations; and the total loss-absorbing capacity (TLAC) requirement, which ensures that a G-SIB has sufficient loss absorption capacity on a gone-concern basis.

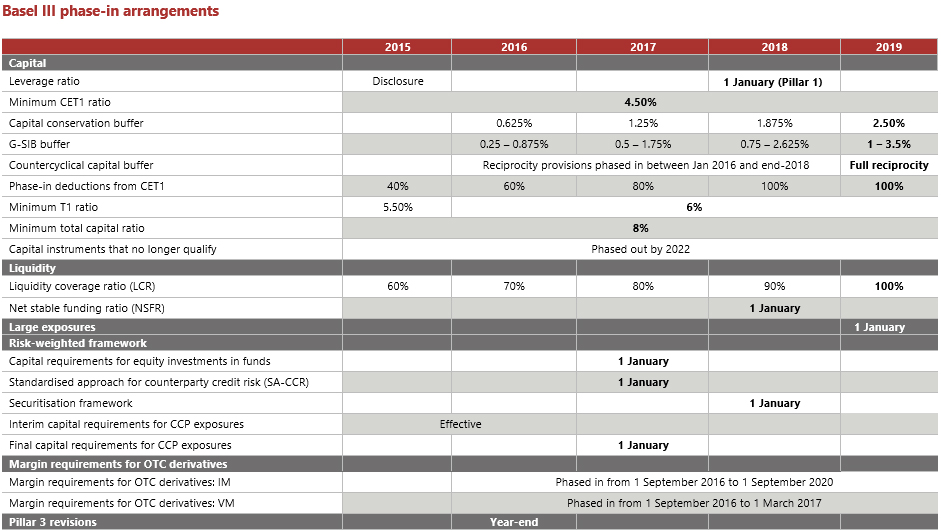

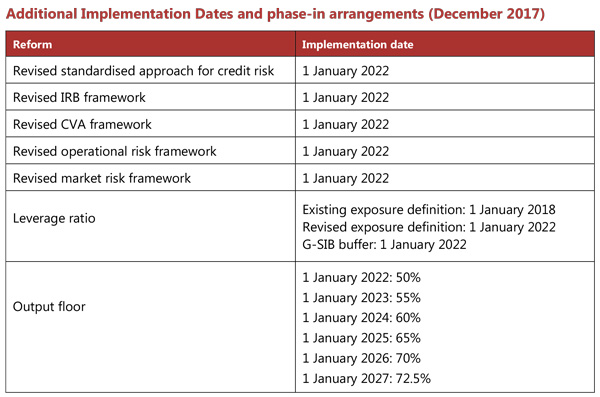

Many of the reforms are subject to a phase-in period

This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.