New correspondent banking data - the decline continues*

- Correspondent banking relationships are declining globally.

- The correspondent banking network is increasingly concentrated.

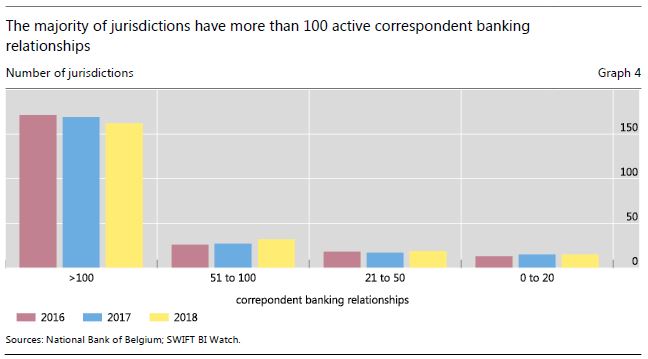

- The majority of jurisdictions have more than 100 active correspondent banking relationships.

Cross-border payments are vital for global trade and for migrants who send remittances home, yet they are generally slower, more expensive and more opaque than domestic payments. Most cross-border payments flow through the "correspondent banking network" - a network that is reportedly shrinking and becoming more concentrated. To help monitor these trends, the CPMI will, for the next five years, publish an annual quantitative review based on payment message data that SWIFT has kindly agreed to provide.1 The review includes: (i) this commentary, highlighting key trends; (ii) a chartpack; and (iii) the underlying data. It builds on similar analyses by the CPMI and FSB.

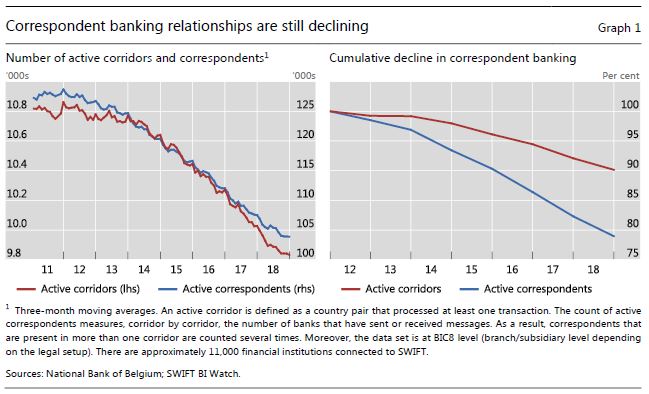

The total number of active correspondent banking relationships and active corridors continues to decline. The year 2018 saw declines in active relationships and corridors of about 3.5% and 2%, respectively (Graph 1). Over the last seven years, active relationships in the global correspondent banking network have declined by about 20% and the number of active corridors has fallen by roughly 10%.

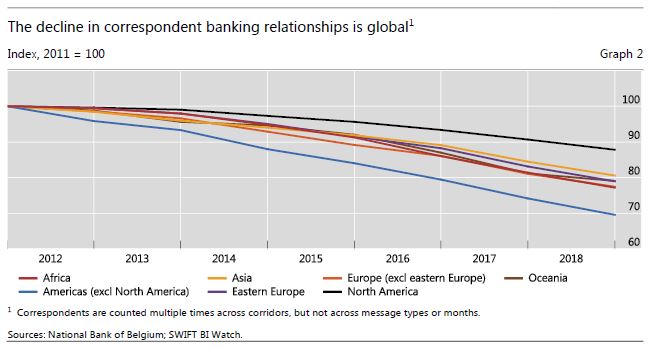

The decline in correspondent banking relationships is universal, yet it is more pronounced in some regions than others. For example, the Americas (excluding North America) have experienced a decline of their active correspondent banking relationships by 30% since 2012, whereas North America has seen a decline of 10% (Graph 2).

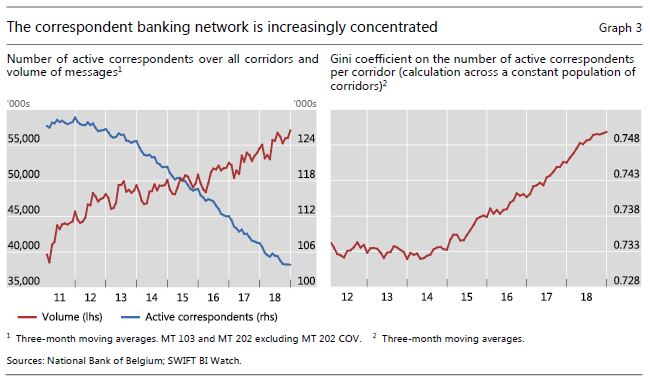

Despite the decline in the number of active correspondent banking relationships, total message volumes have been rising over the same period, resulting in an increase of concentration in the network (Graph 3).

The SWIFT data show that a decline and concentration of correspondent banking is broad and global, felt more acutely in some regions over others. However, the majority of jurisdictions have more than 100 active correspondent banking relationships (Graph 4). In 2018, 15 jurisdictions had fewer than 20 relationships. Some these 15 are countries on sanctions lists that have very low Transparency International scores.2 The majority, however, are small island dependent territories, with an average population below 200,000.

Various studies show that, underlying the broad trends seen here, there are idiosyncratic and complex factors at play.3 And although correspondent banks currently account for a large share of cross-border payments, new and diverse payment methods are emerging. For those investigating correspondent banking, a wider perspective may help capture other developments taking place.

What is the international community doing?

The continuing decline in the number of correspondent banking relationships in many countries around the world remains a source of concern. In affected jurisdictions, there may be an impact on the ability to send and receive international payments, which could push people into using unregulated and potentially unsafe "shadow payments" with further consequences for growth, financial inclusion and international trade.

For these reasons, the international community established a four-point action plan. With the primary components of the action plan largely in place, attention has now turned to monitoring of implementation of the action plan.

* This analysis was prepared by Henry Holden, Member of Secretariat, Committee on Payments and Market Infrastructures.

1 SWIFT, as the most commonly used messaging platform for cross-border payments, captures a meaningful amount of correspondent banking activity and the data likely deliver an accurate picture of the trends in correspondent banking payment traffic between jurisdictions. But financial institutions have multiple means of exchanging information about their financial transactions, and SWIFT message flows therefore do not represent complete industry statistics.

2 See the "Corruption Perception Index" provided by Transparency International.

3 For example, recent publications by the World Bank Group