Project Promissa: tokenisation of promissory notes

Updated 23 April 2025

To address the global challenges of the 21st century, the G20 wants to deliver better, bigger and more effective multilateral development banks, through substantially increasing their financing capacity.

Today, many multilateral development banks are partly funded by financial instruments known as promissory notes, most of which are still paper based. While the current system provides the operational controls for member nations to make subscription and contribution payments to institutions like the World Bank, the custody of outstanding promissory notes can be digitised to address operational challenges and enhance efficiency.

The volume of promissory notes across international financial institutions is significant: for example, two of the World Bank's largest entities, the International Bank for Reconstruction and Development (IBRD) and the International Development Association (IDA), both have a substantial amount of notes pledged by member nations.

The BIS Innovation Hub Swiss Centre, the Swiss National Bank and the World Bank successfully concluded a project that aimed to build a proof of concept (PoC) of a platform for digital "tokenised" promissory notes. The International Monetary Fund participated in the project as an observer.

Using distributed ledger technology, Project Promissa explored how to simplify the management of the notes and provide a single source of truth for all counterparties throughout the notes' lifecycles while preserving confidentiality and sovereignty – the ability of each party to preserve ownership, control, and decision-making authority over their promissory notes.

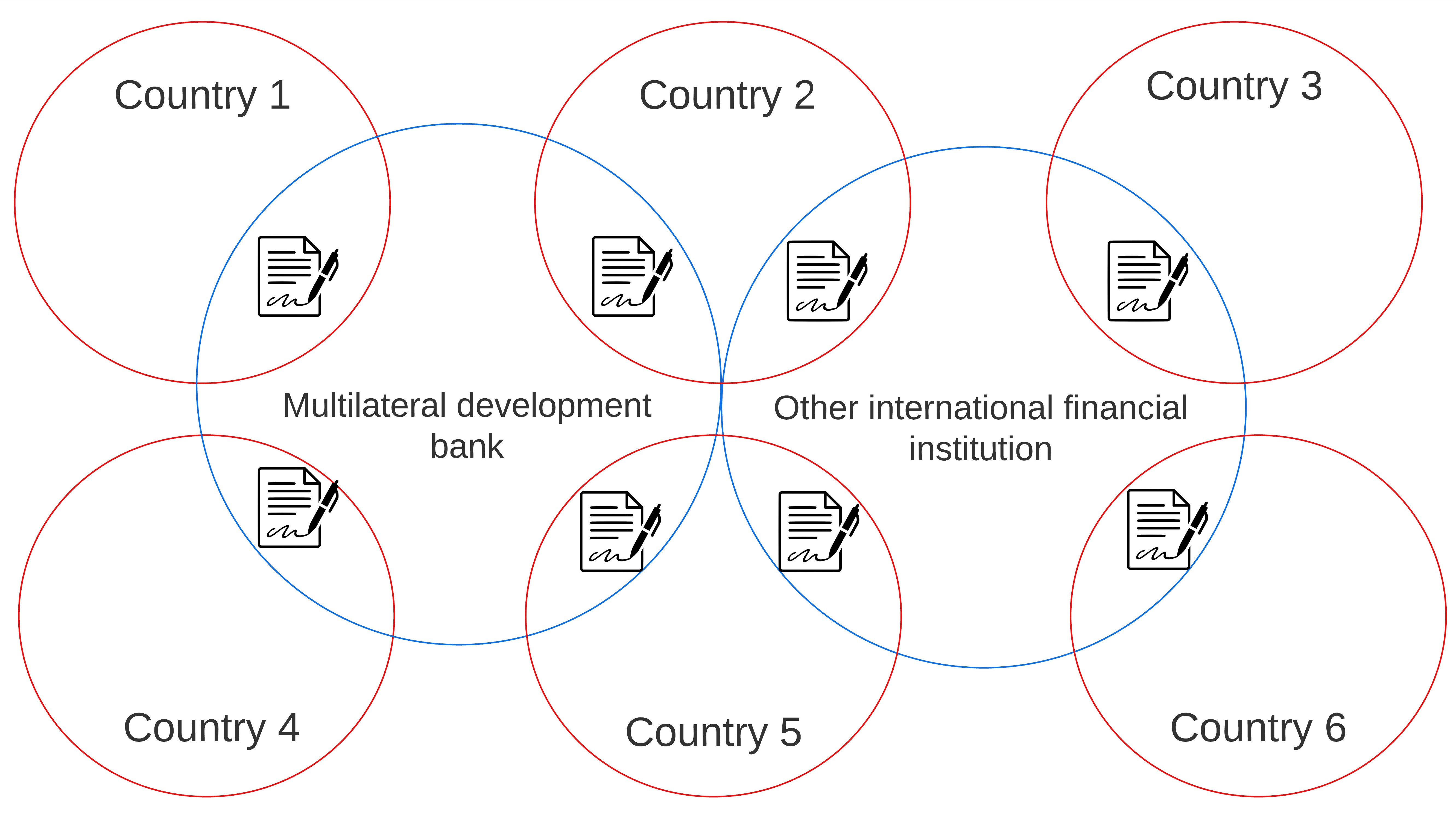

That means that the government of a member nation and its central bank, acting as the designated custodian, could have a comprehensive overview of all notes outstanding with different international financial institutions. And, vice versa, international financial institutions, such as the multilateral development banks, could have uniform visibility of the outstanding notes held by different central banks.