Property markets and real estate companies

(Extract from pages 6-7 of BIS Quarterly Review, September 2017)

The beginning of normalisation of monetary policy in the United States and the tightening of macroprudential measures in a number of emerging Asian countries seem to have helped slow credit growth in these economies over the past year. However, property prices have remained firm. In some jurisdictions, such as China and Hong Kong SAR, house prices have risen further, and this has coincided with a pickup in property developers' borrowing through bank loans and debt securities. This box discusses how property developers have contributed to rising property prices and to what extent their fast-growing activities could become a cause for concern for the authorities.

This box discusses how property developers have contributed to rising property prices and to what extent their fast-growing activities could become a cause for concern for the authorities.

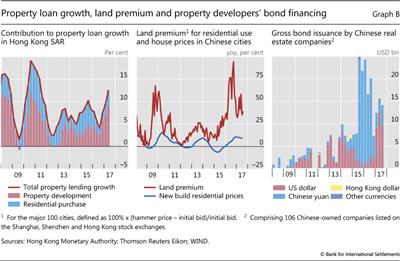

One channel through which property developers have propped up housing demand is the offering of financing schemes to potential buyers. For example, although between 2009 and 2015 the Hong Kong Monetary Authority (HKMA) introduced seven rounds of macroprudential measures to tighten mortgages, over the past two years property developers have increasingly offered attractive financing schemes to prospective buyers in an effort to boost sales. Often, the offers have not involved an assessment of borrowers' repayment ability. There is little information on how exactly these financing schemes are funded. But lending to finance property development has become the dominant contributor to the pickup in total property lending growth during this period (Graph B, left-hand panel). To protect banking sector stability, in June 2017 the HKMA tightened the limits on the maximum amounts that banks can lend with respect to the cost and site value of construction projects; from August, it also phased in higher risk weights for credit exposures to property developers.

To protect banking sector stability, in June 2017 the HKMA tightened the limits on the maximum amounts that banks can lend with respect to the cost and site value of construction projects; from August, it also phased in higher risk weights for credit exposures to property developers.

Lending to prospective buyers and fierce competition among developers have pushed up land prices. With demand for housing remaining strong, companies can afford to bid aggressively for land, as the higher cost can be passed on to home buyers. The land premium (the difference between the hammer price and initial bid) paid by property developers for plots in major Chinese cities has been quite high since mid-2015. In the past, this premium has tended to be a leading indicator of residential price inflation (Graph B, centre panel).

Overseas expansion of property developers could add an international dimension to the phenomenon. For example, Singapore reported that property developers (mostly foreign-owned) bid aggressively at land auctions in the first half of 2017. Companies paid on average 29% more for residential plots than for comparable sites sold in the past five years. Partly in response to these aggressive bids, the Monetary Authority of Singapore issued a warning that "the risk of a renewed unsustainable surge in property prices is not trivial".

Aggressive bids by developers that do not ultimately meet strong demand could pave the way for a sharp market adjustment. The profit margins of developers could then be squeezed, and homeowners could suffer significant valuation losses. In this context, a Singapore minister warned local residents in 2015 about the risk of oversupply when investing in the large residential projects then under construction in neighbouring Malaysia. The developers (dominated by a few Chinese companies) planned to establish a total of 336,000 new residential units, slightly more than the entire stock of private homes in Singapore in 2015.

Naturally, foreign currency borrowing could leave those property developers lacking corresponding revenues vulnerable to currency mismatches, unless these risks were hedged. Market data reveal that, among the 106 Chinese-owned listed real estate firms, many of which have been active outside China, gross bond issuance has increased sharply since 2012, reaching a peak of around $25 billion per quarter in late 2015 and early 2016. Since then, their bond issuance has moderated somewhat (Graph B, right-hand panel). The share of US dollar-denominated debt, which was initially very high, dried up between 2015 and 2016 but increased again sharply in 2017. The State Council's guidelines, approved on 18 August of this year, which aim to curb Chinese companies' seemingly overambitious investments abroad in a range of sectors, including property, should be seen against this backdrop.

The share of US dollar-denominated debt, which was initially very high, dried up between 2015 and 2016 but increased again sharply in 2017. The State Council's guidelines, approved on 18 August of this year, which aim to curb Chinese companies' seemingly overambitious investments abroad in a range of sectors, including property, should be seen against this backdrop.

To some extent, this is reminiscent of the run-up to the Spanish and Irish banking crises, where lending to property developers played an important part. See Bank of Spain, "Exposición de las entidades de depósito españolas al sector inmobiliario", Informe de Estabilidad Financiera, March 2010; and K Whelan, "Ireland's economic crisis: the good, the bad and the ugly", Journal of Macroeconomics, vol 39, June 2013, pp 424-40.

To some extent, this is reminiscent of the run-up to the Spanish and Irish banking crises, where lending to property developers played an important part. See Bank of Spain, "Exposición de las entidades de depósito españolas al sector inmobiliario", Informe de Estabilidad Financiera, March 2010; and K Whelan, "Ireland's economic crisis: the good, the bad and the ugly", Journal of Macroeconomics, vol 39, June 2013, pp 424-40. According to the HKMA definition, property lending consists of two main categories: (i) loans to finance property development and investment in properties (including uncompleted properties); and (ii) loans to individuals for the purchase of residential properties for own occupation or investment purposes.

According to the HKMA definition, property lending consists of two main categories: (i) loans to finance property development and investment in properties (including uncompleted properties); and (ii) loans to individuals for the purchase of residential properties for own occupation or investment purposes. Remarks by R Menon, Managing Director, Monetary Authority of Singapore, at the MAS Annual Report 2016/17 Media Conference, Singapore, 29 June 2017.

Remarks by R Menon, Managing Director, Monetary Authority of Singapore, at the MAS Annual Report 2016/17 Media Conference, Singapore, 29 June 2017. For example, in terms of market capitalisation, Chinese real estate firms account for around 50% of the sectoral total in the JPMorgan Chase Corporate Emerging Market Bond Index.

For example, in terms of market capitalisation, Chinese real estate firms account for around 50% of the sectoral total in the JPMorgan Chase Corporate Emerging Market Bond Index.