China and Russia join the BIS locational banking statistics

(Extract from pages 25-26 of BIS Quarterly Review, December 2016)

China and Russia have started to report to the BIS locational banking statistics (LBS), taking the number of LBS-reporting countries from 44 to 46. A total of 12 EMEs now report to the LBS, along with 12 offshore financial centres and 22 advanced economies. Expanding the LBS-reporting population had been identified as a priority as part of the enhancements to the banking statistics agreed by the Committee on the Global Financial System in 2012 as well as the Data Gaps Initiative launched by the IMF and FSB in 2009 with the endorsement of the G20.

A total of 12 EMEs now report to the LBS, along with 12 offshore financial centres and 22 advanced economies. Expanding the LBS-reporting population had been identified as a priority as part of the enhancements to the banking statistics agreed by the Committee on the Global Financial System in 2012 as well as the Data Gaps Initiative launched by the IMF and FSB in 2009 with the endorsement of the G20.

The LBS reported by China are compiled from nearly 650 deposit-taking institutions located on the mainland, while those reported by Russia are compiled from about 700 institutions. Many of these institutions are affiliates of banks headquartered abroad: the reporting banks in China represent some 35 nationalities, and those in Russia nearly 30 countries. In China, foreign banks are allowed to operate through branches or subsidiaries, but in Russia they can operate only through subsidiaries.

Many of these institutions are affiliates of banks headquartered abroad: the reporting banks in China represent some 35 nationalities, and those in Russia nearly 30 countries. In China, foreign banks are allowed to operate through branches or subsidiaries, but in Russia they can operate only through subsidiaries.

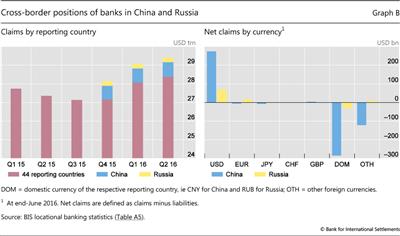

The claims and liabilities of domestic and foreign banks located in China and Russia have been included in global aggregates in the LBS since end-December 2015. At end-June 2016, banks in China reported outstanding cross-border claims of $778 billion and liabilities of $918 billion, while banks in Russia reported claims of $240 billion and liabilities of $171 billion (Graph B, left-hand panel). This makes China the 10th largest cross-border creditor in the international banking market, and Russia the 23rd largest.

The inclusion of China and Russia resulted in a 3.8% increase in the global total for LBS-reporting banks' outstanding cross-border claims at end-December 2015 and a 4.8% rise in outstanding cross-border liabilities. For some individual borrower countries, the impact was much larger. For example, the addition of China and Russia resulted in double-digit increases in the outstanding claims of LBS-reporting banks on some offshore centres and developing countries in Africa and eastern Europe. That said, the bulk of the two countries' cross-border claims was on advanced economies.

Turning to the currency composition of their cross-border claims and liabilities, at end-June 2016 banks in both China and Russia were net lenders of US dollars, with dollar claims exceeding dollar liabilities by $275 billion (claims: $549 billion; liabilities: $274 billion) and $69 billion (claims: $163 billion; liabilities: $94 billion), respectively (Graph B, right-hand panel). Domestic currency-denominated cross-border liabilities of banks in Russia were $54 billion, more than double their cross-border claims in roubles ($24 billion). However, $358 billion, or 39%, of Chinese banks' cross-border liabilities were denominated in renminbi. Renminbi-denominated cross-border claims of banks in China stood at $73 billion, much less than their cross-border liabilities.

Turning to positions with local residents, at end-June 2016 banks in Russia reported local claims of $1.1 trillion on all borrowers, equivalent to 80% of GDP and about four times greater than their cross-border claims. About 76% of these local claims were denominated in roubles, and the rest mainly in US dollars. The US dollar liabilities of banks in Russia to Russian residents exceeds their US dollar lending to residents by $18 billion. China does not yet report local positions to the BIS.

Chinese and Russian banking groups are spreading their networks globally. Chinese banks operate in more than 20 of the 46 LBS-reporting countries and Russian banks in 15 reporting countries. Based on the (incomplete) data currently reported to the BIS by LBS-reporting countries that host Chinese and Russian banks, the cross-border claims of Chinese banks, including intragroup positions, totalled about $1,480 billion at end-June 2016 and those of Russian banks about $230 billion. This makes Chinese banks the eighth largest lenders in the international banking market and Russia banks the 19th largest.

These changes were implemented after the preliminary release of the LBS for the second quarter in October 2016.

These changes were implemented after the preliminary release of the LBS for the second quarter in October 2016.  Committee on the Global Financial System, Improving the BIS international banking statistics, CGFS Papers, no 47, November 2012.

Committee on the Global Financial System, Improving the BIS international banking statistics, CGFS Papers, no 47, November 2012.  For more information about the LBS reported by China, see H Hu and P Wooldridge, "International business of banks in China", BIS Quarterly Review, June 2016, pp 7-8.

For more information about the LBS reported by China, see H Hu and P Wooldridge, "International business of banks in China", BIS Quarterly Review, June 2016, pp 7-8.