Signs of recovery in structured finance and leveraged loan markets

(Extract from page 4 of BIS Quarterly Review, December 2014)

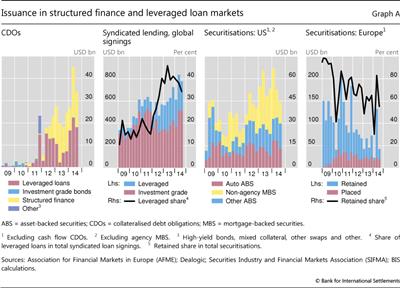

The search for yield revived segments of structured finance markets and drove leveraged loan issuance to unprecedented levels. Issuance of collateralised debt obligations (CDOs) recovered strongly in the first three quarters of 2014 (Graph A, left-hand panel). These instruments package portfolios of assets into a new security, offering higher yields with relatively diversified assets as collateral. Before the crisis, the bulk of CDOs were collateralised by asset-backed securities. Recently, around 55% of CDOs consisted of leveraged loans. Structured finance thus boosted the investor base for these loans, which accounted for approximately 40% of syndicated lending in recent years (Graph A, second panel). Activity in the leveraged loan markets even surpassed the levels recorded before the crisis: average quarterly announcements during the year to end-September 2014 were $250 billion, well above the average of $190 billion during the pre-crisis period from 2005 to mid-2007. In contrast, recent issuance volumes of CDOs remained well below the record high amounts issued in 2006 and 2007.

Securitisation markets have also shown signs of a revival in recent years, especially in the United States (Graph A, third panel). Total US securitisation issuance (excluding agencies) in the first three quarters of 2014 reached $164 billion, well above the levels during similar periods in 2009 and 2010. The increase was the most pronounced for non-agency mortgage-backed securities, reflecting improvements in US housing and mortgage markets. The recovery of securitisation markets has been much more subdued in Europe, where issuance between January and September 2014 increased compared with the same period in 2013, but remained significantly below the amounts issued in earlier years. But there has been an important change in the composition of issuance, as retained securitisations have given way to publicly placed issues (Graph A, right-hand panel). Retained issues are not placed in capital markets, but kept on the issuer's balance sheet for collateral purposes in central bank liquidity operations. The share of retained issues in total issuance fell from 97% in the first three quarters of 2009 to 56% over the same period in 2014, reflecting greater participation of private investors in European securitisation markets.