Michele Bullock: Big banks and financial stability

Speech by Ms Michele Bullock, Assistant Governor (Financial System) of the Reserve Bank of Australia, at the Economic and Social Outlook Conference, Melbourne, 21 July 2017.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Thanks to David Orsmond, Penny Smith, David Norman and Dilhan Perera for assistance with this speech.

Good afternoon and thank you to the Melbourne Institute for the invitation to speak at this interesting conference. The theme of new directions in an uncertain world certainly has resonance at the moment in any manner of ways - political, economic, social and environmental. Many of these themes have been examined during the course of the conference. The theme of this session is: are the banks too big? What I will attempt to do in the next 20 or so minutes is take the banking system structure as given and talk about the implications of this for the stability of the Australian financial system.

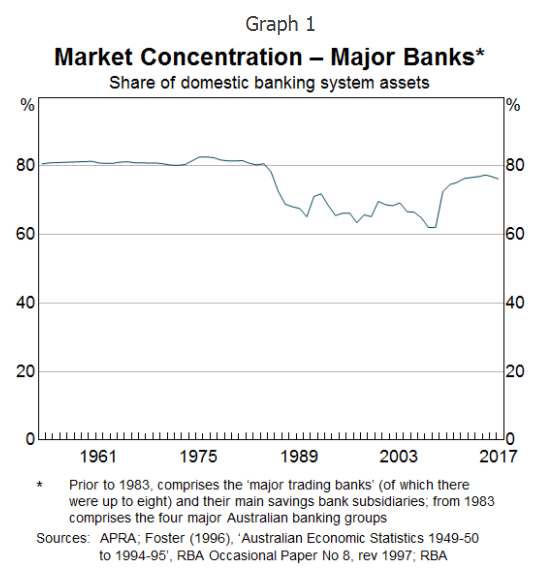

First, a bit of background. Australia has always had a fairly concentrated banking system. Through the 1960s and 1970s, the major banking groups, of which there were up to eight, accounted for around 80 per cent of banking assets in Australia (Graph 1). This share declined to around 65 per cent following deregulation and the entry of foreign banks in the mid 1980s. It remained around this level until the global financial crisis when the share of the major banks, of which there were now only four, rose back to around 80 per cent.

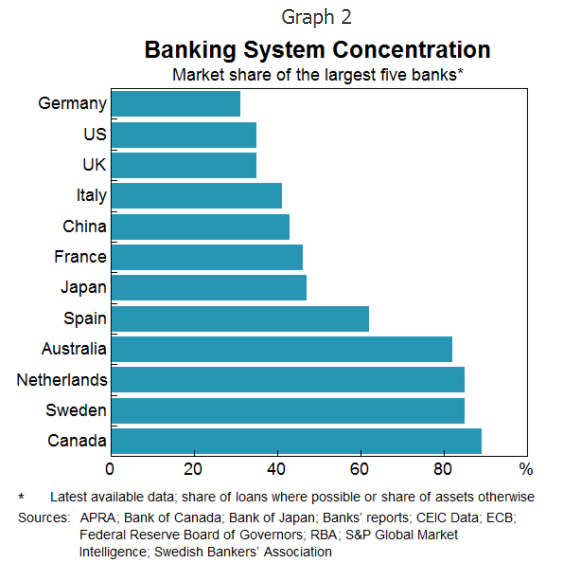

The concentration of the banking system in Australia is not unique internationally but it is at the high end. There are other countries that have similar levels of concentration to Australia, even a bit higher, including Canada and Sweden (Graph 2). But there are many countries that have much lower levels of concentration including the United States, the United Kingdom and a number of European countries.

Aside from the concentration, there are a couple of features of the Australian banking system that are worth highlighting.

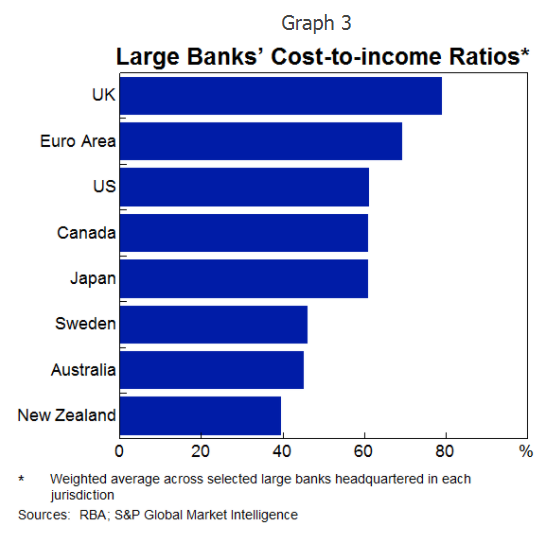

First, if we look at cost-to-income ratios, Australian banks seem to be fairly efficient (Graph 3). On average, the four major Australian banks have a cost-to-income ratio of around 40 per cent, at the lower end of cost-to-income ratios for a selection of banks in other countries. It's likely that this reflects, in part, differences in the business models of the banks. Banks like the Australian banks, with a greater emphasis on traditional lending activity, tend to have lower cost-to-income ratios than banks with a greater focus on other activities, such as investment banking and wealth management.

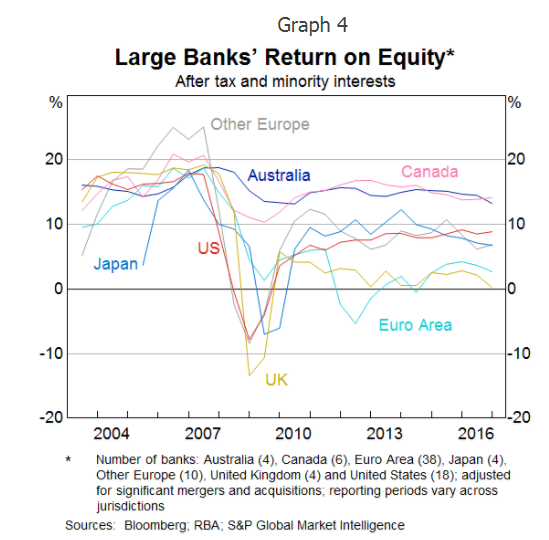

Second, the major Australian banks are very profitable (Graph 4). Apart from a brief period after the global financial crisis, returns on equity for the major Australian banks have consistently been around 15 per cent and even higher in some years. Their performance has been helped by a long run of consistent economic growth in Australia - we haven't had a recession in over 25 years. So our banks haven't had to deal with substantial credit losses that have impinged so heavily on the profits of many overseas banks following the global financial crisis. This profitability has also meant that the banks have found it relatively easy to build capital in response to international moves to improve the resilience of the banking system worldwide.

So while we have a concentrated banking system, the major banks appear relatively efficient and strong. What, then, can we say about the implications of this structure for financial stability? Does having a relatively concentrated banking system promote financial stability? Or does it make the system more susceptible to shocks? The answer to this question is not straightforward.

One view is that a concentrated banking system promotes financial stability in a number of ways. It is sometimes argued, for example, that if a concentrated banking system implies less competition, the large banks will be more profitable and able to generate capital organically, increasing their resilience. This argument therefore suggests that a concentrated banking system will promote financial stability. Having a few large banks might also promote financial stability in other ways. Larger banks might be more diversified in the risks they take on and have more sophisticated risk management systems. It could also be argued that it is easier for our prudential regulator, the Australian Prudential Regulation Authority (APRA), to supervise and regulate a small number of large banks.

On the other hand, an alternative view is that a concentrated banking system results in large banks that are too big to fail. According to this argument, this is not good for financial stability if this implicit guarantee encourages the banks to take on excessive risk in the knowledge that they will not be allowed to fail. Furthermore, if the large banks all have very similar business models, as they do in Australia, problems in one bank might portend problems in the others and hence a large systemic issue. If anything, the major Australian banks' business models have become more similar over the years since the global financial crisis. They are all now more focussed on housing lending and some are pulling back from wealth management and international operations. Finally, it could also be argued that a large bank is, by its nature, more complex and hence more difficult to supervise than a set of smaller banks.

The academic literature doesn't provide much guidance on which of these views is likely to be of more relevance for Australia. But is there anything we can say from experience over the past couple of decades since deregulation? Has increasing competition from new entrants had an impact on financial stability? Has the concentration of the system resulted in concerns about financial stability? I will take both these issues in turn.

The issue of competition in Australia's banking system has generated a lot of interest. There have been a myriad of reviews and inquiries over the years. Indeed, another inquiry into competition in the financial system, undertaken by the Productivity Commission, has just kicked off. And the Australian Competition and Consumer Commission has recently been tasked with keeping a watching brief on competition in the financial system.

The Bank supports the Productivity Commission's work on competition. But in the context of what competition might mean for financial stability, it is worth making three points. First, concentration of itself does not necessarily imply a lack of competition. Indeed, indicators of market structure such as measures of concentration are not regarded as a very accurate measure of competition. In principle, four large banks could still compete very actively among themselves. So if you have a concern that competition could lead to financial instability, having a concentrated system will not necessarily address the issue.

Second, competition tends to be pro-cyclical. Competition on the lending side tends to hot up during the good times. Lending for housing, for example, has been pretty competitive over the past few years. In tougher times, however, competition for some types of funding, particularly more stable types, tends to increase. Post-crisis, for example, banks looked to increase the amount of deposit funding relative to wholesale funding, increasing competition for deposits, and in particular, term deposits. Regulators therefore need to be aware of this and take it into account when considering financial stability.

Third, at least some sectors of the market do appear to be contestable, as demonstrated by the impact that new entrants have periodically had on the competitive landscape. The arrival of the mortgage originators in the 1990s, for example, resulted in more competition in the housing lending space. And foreign bank branches have utilised intragroup funding and wholesale deposits to compete in areas such as institutional lending. Despite the dominance of the four major banks in the market for deposits, competition has increased in this space as well. Foreign banks have introduced innovative online saving accounts, allowing them to compete for deposits without having a large physical presence. More recently, financial technology brings the possibility of even more contestability in the financial system. Competition and innovation are to be encouraged. Regulators nevertheless need to be alert to developments and any potential implications for financial stability. There is, consequently, a great deal of interest internationally on whether developments in financial technology will have implications for financial stability.

While competition can, at times, pose challenges for stability of the financial system it is also true that large banks pose particular risks. A strong framework of prudential regulation and proactive supervision are therefore necessary regardless of the specific structure of the system.

The actions taken on housing lending in Australia over the past few years are an example of how active supervision can address risks that might arise in an environment of heightened competition. Over the past few years, the regulators had observed very strong growth in lending to investors for housing. Furthermore, a large share of that lending was interest only for the first 5-10 years of the loan - that is, the loans were not being amortised for a very long time. And this behaviour was being fuelled by competition between the banks. Individual banks were reluctant to pull back because if they did so, the business would go to their competitors.

This raised concerns about the financial stability implications if this behaviour continued. So in late 2014, with the support of the Council of Financial Regulators, APRA introduced a 10 per cent 'speed limit' on growth in investor housing credit as well as tighter lending standards. The Australian Securities and Investments Commission supported this with work on responsible lending. This was followed up in March this year with a limit on the share of interest-only loans and further guidance on lending standards. As Wayne Byres (the Chairman of APRA) recently highlighted, the concerns that prompted action were not about competition on interest rates or customer service standards. Rather, the concern was that competition was manifesting itself in an erosion of lending standards. Not only were the banks taking on more risk, but households were carrying a higher level of debt that they would have to service, which could be particularly concerning in the event of a shock. In other words, it was a financial stability issue not only because of its potential impact on banks' balance sheets, but also because it was increasing the vulnerability of the household sector.

The importance of the major banks for financial stability is also explicitly recognised in the regulatory framework. Since the financial crisis there has been a major international effort to increase the resilience of the global financial system, and Australia has been an active participant both in the policy debate and in implementation. There have been a number of elements to this work - raising capital levels, increasing liquidity buffers, identifying and regulating systemically important financial institutions and addressing the issue of 'too big to fail'.

The implementation of capital requirements in Australia has been driven by the international move to higher capital ratios as well as a desire to ensure that the Australian banks are 'unquestionably strong'. The Financial System Inquiry (FSI) set out the rationale for Australian banks to achieve this. It noted that the concentrated nature of the system and the similar business models of the major banks could exacerbate contagion if one major bank experienced difficulties. With capital levels increasing around the world, the FSI therefore concluded that it was important that the Australian regulatory framework continued to evolve to ensure confidence in the Australian banks. It also suggested that higher capital ratios would help to reduce the value of any implicit government guarantees.

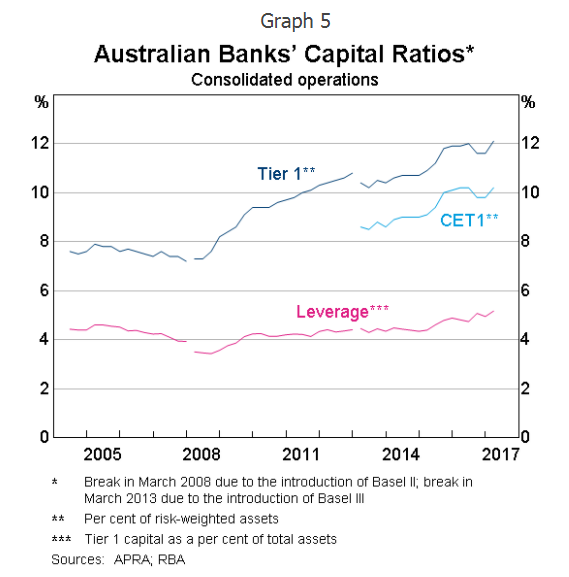

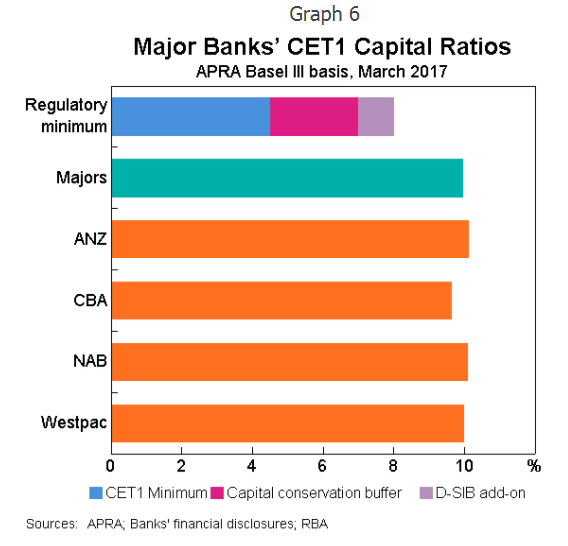

Australian banks' capital levels have therefore risen substantially in recent years, both relative to the past and in relation to international peers (Graph 5). Furthermore, consistent with the Basel framework for domestic systemically important banks (D-SIBS), APRA has determined that due to their size, interconnectedness, substitutability and complexity, the major banks should be required to hold more capital against their risk-weighted assets than smaller financial intuitions. Specifically, they are required to hold an additional 1 per cent of their risk-weighted assets as common equity Tier 1 (CET1) capital, bringing the minimum CET1 capital requirement for the major banks to 8 per cent (Graph 6). All of the major banks are currently comfortably above this minimum. But APRA's announcement earlier this week on unquestionably strong capital ratios means that the larger banks, in particular, will need to build their capital a little further over coming years. As D-SIBS, the major banks are also subject to more intense supervision by APRA.

The higher capital levels and greater intensity of supervision provide confidence that, notwithstanding the systemic importance of the major banks, the Australian financial system is more resilient to shocks than it was in the past. But there is still a need to consider what might happen in the event of a bank failure. Global initiatives in this area have focused on developing appropriate resolution frameworks and on addressing too big to fail.

The centrepieces of this work are the Financial Stability Board's Key Attributes of Effective Resolution Regimes for Financial Institutions (Key Attributes) and total loss absorbing capacity (TLAC) for global systemically important financial institutions (G-SIFIs). The intention is that the relevant authorities should be able to resolve failing global financial institutions in an orderly manner without taxpayer exposure to loss from solvency support. TLAC helps to operationalise the Key Attributes for G-SIFIs, by ensuring that there are sufficient resources to recapitalise a failing institution. This includes securities that could be 'bailed in' in the event that losses were large enough to reduce the capital below certain minimum levels.

It is still too early to determine how effective the new arrangements for resolution are likely to be. Most countries are developing their frameworks for resolution, although if the institution being resolved is a large, interconnected, international bank, the process will be complex and difficult regardless, especially given the cross-border issues associated with resolution. Most countries are also still to finalise their TLAC regimes, so how this might work in practice is not clear at this stage. But many financial institutions are issuing securities with TLAC-like features and there have been recent examples in Europe where these types of securities have played a role in resolving troubled banks.

In Australia, we are working on improvements to our resolution framework in line with the Key Attributes and legislation is being drafted to give APRA stronger crisis management powers. But the issue of an appropriate regime to enhance banks' loss absorption and recapitalisation capacity, as recommended by the FSI, is still being considered. We will be watching developments overseas on this issue closely to determine the most appropriate regime for Australia.

In conclusion, I want to reiterate that the concentration of the banking system in four major banks in Australia does not necessarily provide financial stability benefits. Nor is it necessarily detrimental to financial stability. But the systemic importance of the four major banks in Australia does mean that they need to have a proportionately greater supervisory focus. The strengthening of capital and liquidity standards post crisis, and the use of proactive and intensive supervision, has certainly improved the resilience of the major banks in Australia, and the financial system more broadly. The success of other global initiatives to address the issues that arise when a bank fails, however, remain to be seen.

Thank you.

References

RBA (Reserve Bank of Australia) (2014), 'Submission to the Financial System Inquiry', Submission to the Financial System Inquiry, 2 April.

Davis K (2007), 'Banking Concentration, Financial Stability and Public Policy', in Kent C and J Lawson (ed), The Structure and Resilience of the Financial System, Proceedings of a Conference, Reserve Bank of Australia, Sydney, pp 255-284.

Byres W (2017), 'Opening Statement', Opening Statement at the Roundtable Hearing for the Productivity Commission Inquiry into the State of Competition in the Australian Financial System', 29 June.

Byres W (2017), 'Fortis, Fortuna, Adiuvat: Fortune Favours the Strong', Keynote address at the AFR Banking and Wealth Summit 2017, 5 April.

FSB (Financial Stability Board) (2014), Key Attributes of Effective Resolution Regimes for Financial Institutions, October.