Mario Marcel: The Monetary Policy Report and the Financial Stability Report

Presentation by Mr Mario Marcel, Governor of the Central Bank of Chile, before the Finance Committee of the Honorable Senate of the Republic, Santiago de Chile, 19 December 2016.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Introduction

Mr. President of the Senate's Finance Committee, Senator Andrés Zaldívar, honorable members of this Committee, ladies and gentlemen,

Thank you for your invitation to present the views of the Board of the Central Bank of Chile on the recent macroeconomic and financial developments and prospects and their implications for monetary and financial policy. This vision is contained in detail in our Monetary Policy Report of December 2016 and our Financial Stability Report of the second half 2016.

On this occasion, our reports feature a special characteristic: they were prepared mostly under the direction of the Bank's outgoing Governor, Rodrigo Vergara, and are being presented by an incoming Governor. Interestingly enough, this is rather anecdotic, since our reports rely on the work of the Bank's technical team and the Board's deliberations, regardless of the Governor in charge. This attests to the continuity that characterizes a sound institution with permanent responsibility for the Chilean economy's monetary and financial stability, and that must inspire confidence in economic agents and in the population at large.

This is remarkable, in my view, as the soundness and reliability of institutions is a matter of growing concern in Chile these days. Still, we must be aware that accumulated trust does not suffice; in our present world such trust must be renewed every day, on the basis of the ability to respond to new demands and challenges. I will comment on some of these challenges towards the end of my presentation.

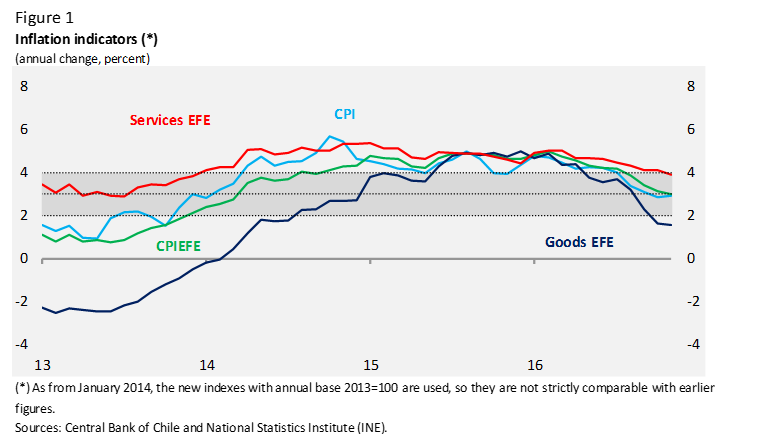

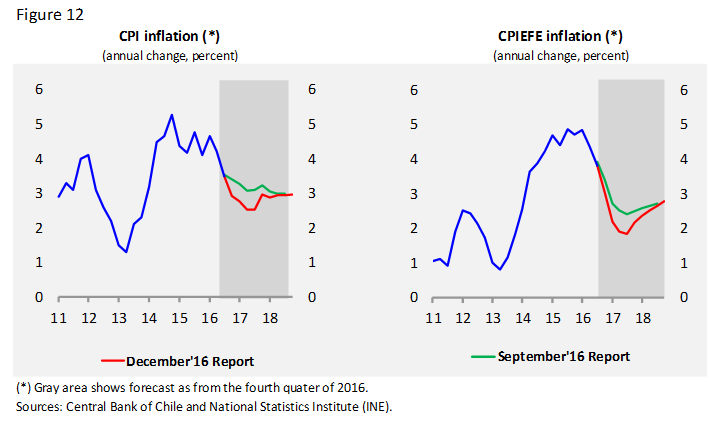

On the recent evolution of the economy, the most noticeable event has been the drop in inflation. After several quarters in which the annual CPI variation was above 4%, in recent months it fell sharply to 3%, placing y-o-y CPI inflation at 2.9% in November.

We had foreseen inflation declining at a slower pace. In the Monetary Policy Report we presented to the Senate last September, we projected that annual headline inflation would close this year at 3.5%. Today, private expectations-as well as our own-put it a little under 3%. In addition, in the baseline scenario I will be describing in a moment, we assume that this decline will continue, such that during most of 2017 annual CPI inflation will stand in the lower part of the tolerance range, to start converging back to the target by year's end.

Domestic activity has also shown some surprises. It grew in line with forecasts in the third quarter and even somewhat better in sectors not related with natural resources-what we call Other GDP. However, it began the fourth quarter quite poorly. The decline in mining activity weighed significantly, as has been the trend throughout the year, and so did some specific industry lines. However, the lower dynamism estimated for the last quarter of the year leads us to expect that 2016 growth will be in the lower bound of the range projected in September. Going forward, we estimate that the economy will return to near-potential expansion rates towards the end of 2017, although at a somewhat slower pace than we estimated in September.

Abroad, the biggest news has been the changes in financial markets after the US election. The movements that followed took a toll on financial conditions, despite that they are still expansionary from a historical standpoint. Last week the Federal Reserve raised the policy rate for the second time, a decision that was widely expected by the markets. The surprise was the confirmation of a slightly faster withdrawal of the monetary stimulus, which has shaken the financial markets in recent days. As for activity and inflation, they continue to show advances in the developed world, while they are tending to stabilize in the main emerging economies. We see some improvement in the terms of trade in the near future.

Considering all the above and its effects on the medium-term outlook, the baseline scenario of this MP Report has revised the 2017 inflation trajectory from September downward. This is because core inflation-what we call the CPIEFE (i.e. excluding foods and energy)-is expected to drop significantly, due to the important weight in inflation of import-related prices. The normally more persistent services inflation will also fall, although considering the basis of comparison effect, the impact of lower inflation on indexed prices and its own inertia. All this in a context where, despite some widening, the output gaps are still bounded and the expected external impulse facing the Chilean economy over the next two years shows no big change from September.

Still, beyond these changed projections, what merits the most attention is that the range of risks has increased.

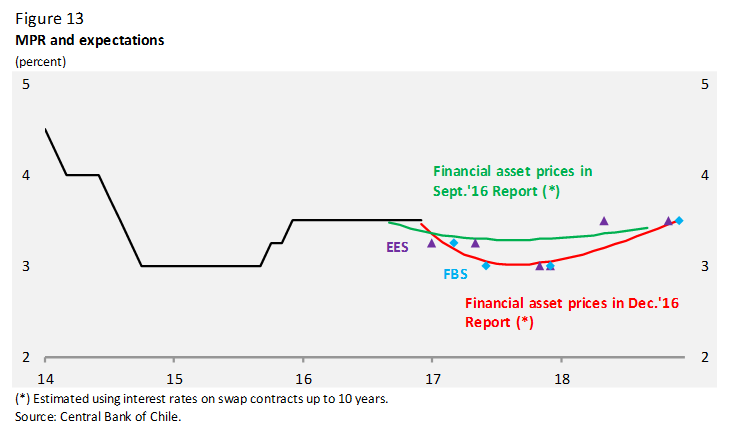

In this context, in our latest monetary policy meetings we have held the monetary policy interest rate (MPR) unchanged at 3.5%. At the same time, while acknowledging the effects that the changes in the macroeconomic scenario are having on the medium-term inflation outlook, in our last meeting we noted that, for us to meet our objective of placing inflation at 3% in two years, a higher monetary impulse might be necessary.

Let me now present to you the details of our vision of the macroeconomic scenario and the projections contained in our Monetary Policy Report.

The Monetary Policy Report

As I said, in November the CPI posted an annual variation of 2.9%, almost half of a percentage point less than we had estimated in September. This sharper decline in inflation is mainly related to those goods most closely related with the exchange rate and some foodstuffs. Thus, goods CPIEFE inflation fell to 1.6% in November, that is, 2.1 percentage points less than in July, in a context where the exchange rate has fluctuated-give or take-between 650 and 680 pesos per dollar. Services CPIEFE inflation has declined at a more measured pace, in line with the moderate expansion of capacity gaps and its high content of indexed prices. In any case, it has accumulated a decline of a little over one percentage point in ten months. The low inflation for fresh fruits and vegetables was a surprise because of its atypical behavior compared with the known seasonal patterns (figure 1).

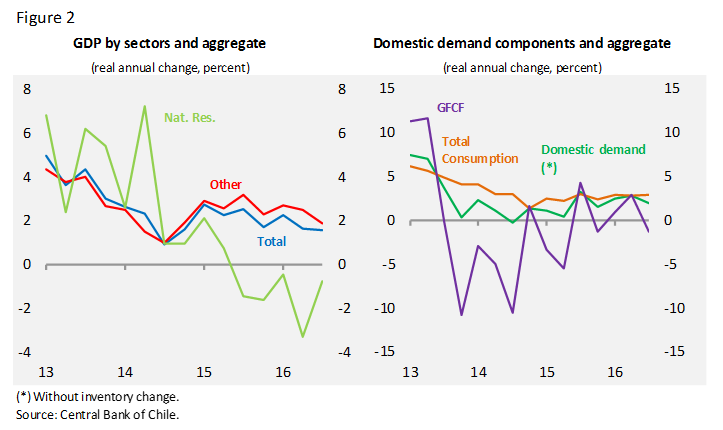

Third-quarter activity figures continued to reveal limited strength. During the first three quarters of the year, sectors other than natural resources (i.e. Other GDP) grew slightly less than 2.5% annually, driven by services and trade, while construction and, especially, manufacturing performed rather poorly.

Meanwhile, in the first three quarters, domestic demand-excluding inventory change-grew in tandem with Other GDP, driven by private and government consumption. Investment was better than expected, but in annual terms it was negative again, particularly due to the further deterioration of construction and other works (figure 2).

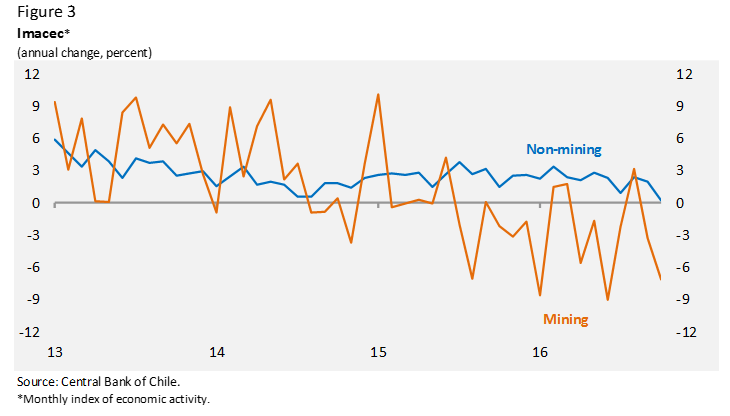

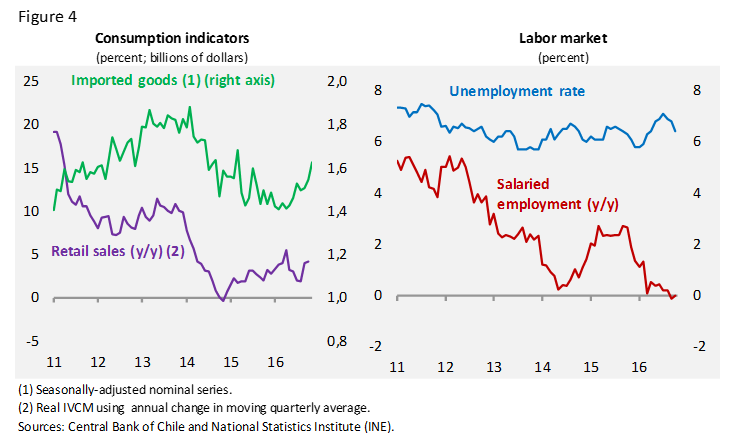

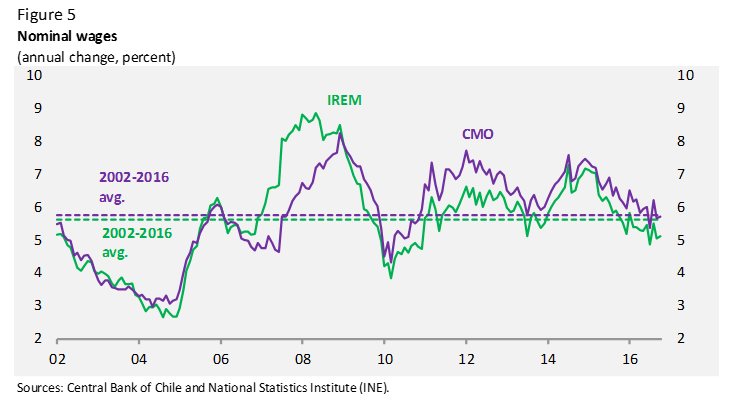

The negative annual variation of the Imacec in October was unexpected. Beyond the volatility of month-to-month figures, the result is still strongly influenced by the poor performance of mining, coupled with the weak performance of some industry lines (figure 3). Even though this figure is not a trend setter, it is sufficient to reduce fourth-quarter growth, which in turn weighs in the revision of estimated 2016 growth, which now stands at 1.5%, i.e., the floor of the forecast range we estimated in September. Despite the performance of activity in October, partial fourth-quarter data suggest that the behavior of domestic spending has not changed significantly. This, in an environment where the labor market is adjusting gradually, with an unemployment rate that remains low (although strongly influenced by increased self-employment) (figure 4). In turn, although with monthly fluctuations, wages show annual expansions around their historical averages. Bear in mind that the decline in inflation has accelerated growth in the wage bill in real terms (figure 5).

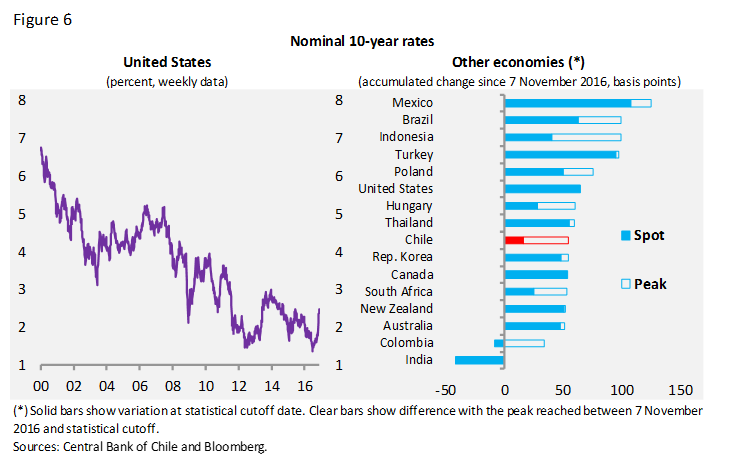

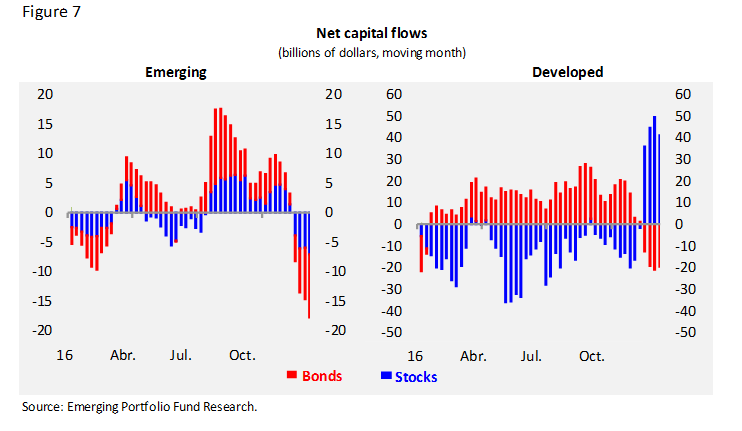

As I said, the main event abroad was the American election. It opened a number of questions about the external economic outlook, characterized by highly expansionary monetary policies in the developed world. One such question is about the potential effects of a fiscal package in the US, which the financial markets estimate to be very likely. This yielded the way to increased inflation expectations, prospects of a not-so-expansionary monetary policy, a strengthening of the dollar and reduced appetite for longer-term securities. Thus, long-term interest rates have increased substantially in the US, and have been replicated in the rest of the world with varying intensities. In this context, financial conditions facing emerging economies have tightened, although they remain positive from a historic standpoint (figure 6). This deterioration of financial conditions owes not only to increased funding costs, but also to capitals outflows towards the developed world (figure 7).

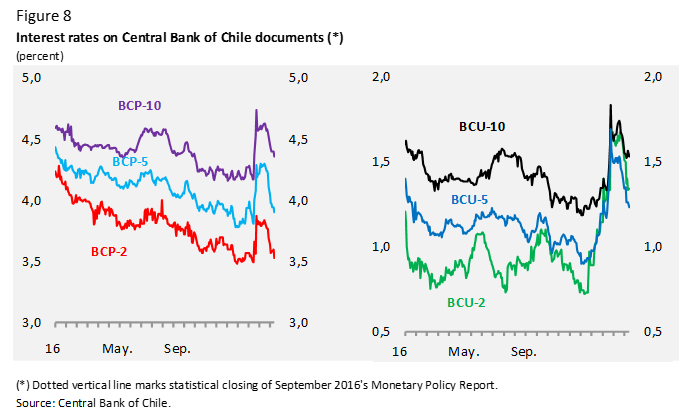

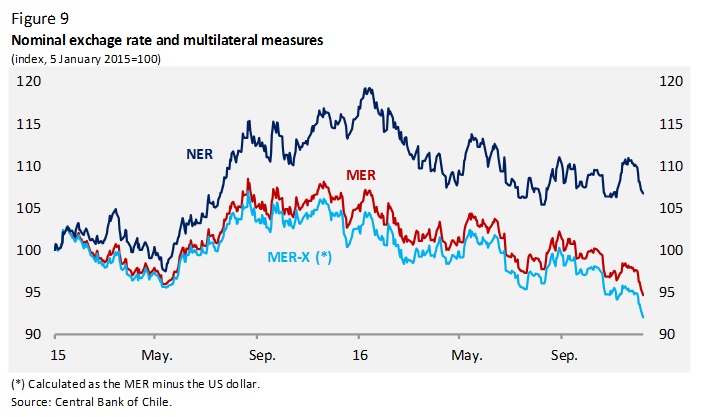

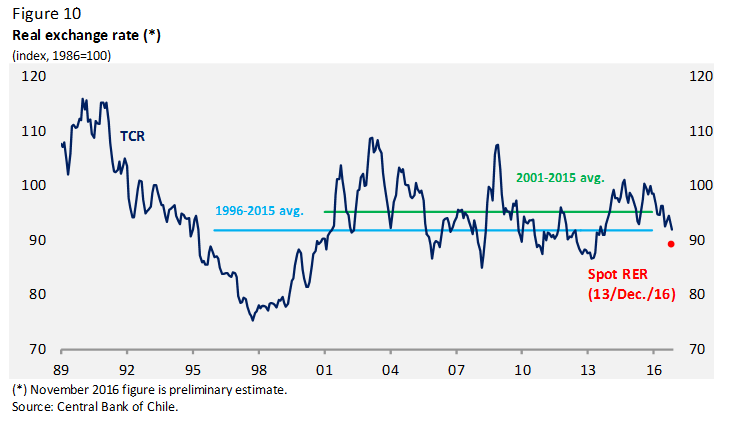

In Chile, the markets' first reaction to the American election outcome mirrored that of the rest of the world, with a significant increase in nominal and indexed long-term interest rates and a depreciation of the currency. Most recently, however, these trends have been reversed. The 10-year BCP rate, which rose about 60 bp in the wake of the election, stood at 4.4% at the Monetary Policy Report's statistical cutoff date, that is, 20 bp above its pre-election level (figure 8). Meanwhile, at this Report's closing, the nominal exchange rate was near 650 pesos per dollar, after trading around 680 CLP/USD on some days in November. Thus, considering the average of the ten days prior to this and the last Report's statistical closing, the peso-dollar parity has almost stayed the same, but in multilateral terms it has appreciated close to 3.5% (figure 9). Immediately after the statistical cutoff, and after the decision of the Fed, the dollar appreciated again globally, and the peso followed suit. Thus, in recent days the nominal exchange rate has traded above 670 pesos per dollar. The evolution of the multilateral parity, combined with the behavior of inflation, domestic and external, and the copper price, have resulted in a lower real exchange rate (RER) compared with a few months back. Thus, at the statistical cutoff date it was within the range of estimated short-term fundamentals, but below its 15- to 20-year average. The baseline scenario uses as a working assumption that the real exchange rate will depreciate steadily throughout the projection horizon, reflecting the interest rate differential with the US rates (figure 10).

Abroad, incoming figures for output and inflation show no big changes in these tendencies so far. In the United States, activity and labor indicators point to a strong economic performance. In other developed economies, there are signs of an incipient recovery. As regards emerging economies, China's growth is stable and Latin America shows heterogeneity. In this context, the need for further monetary stimulus in Europe and Japan is not so urgent anymore, and the expectation of a new policy rate increase by the Fed has consolidated. As I said earlier, this decision occurred after we had stopped the presses for this Report. It is worth noting that the Fed announced that the withdrawal of the monetary stimulus would be slightly faster. The copper price was fairly stable up to early November, when it jumped from around 2.2 dollars per pound to nearly 2.6. Nonetheless, this movement seems excessive given the evolution of its fundamentals. Oil, in turn, over the past few months, has fluctuated between 45 and 50 dollars per barrel most of the time. Most recently, after OPEC agreements and announcements by other producers that they would limit production, it is trading around 55 dollars per barrel.

I now turn to our projections and associated risks.

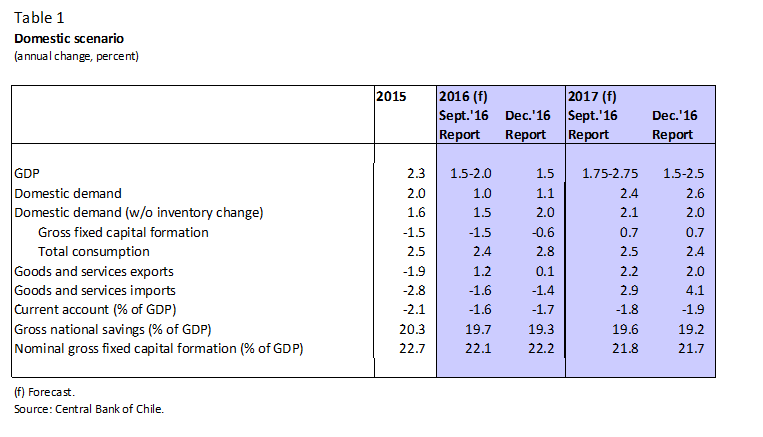

In the baseline scenario of the MP Report I present today, this year's growth is estimated at 1.5%. As I said, this is the lower bound of the range we estimated in September, considering the slower growth foreseen for the fourth quarter. About 2017, the slower initial pace, in a context of higher risks and still very pessimistic confidence levels, we foresee that activity will take longer to resume near-potential growth. Accordingly, our growth estimate for 2017 has been adjusted to a range between 1.5% and 2.5% (1.75% to 2.75% in September). This higher growth in 2017 compared with 2016 is based on the fact that the economy does not present any imbalances, the mining sector will not to repeat the sharp drops of previous years, and investment will post some increase after three years in a row falling in annual terms. The effects of these changes will be seen more clearly in the second half of the year. All this, in a context where the fiscal consolidation announced by the government continues and monetary conditions remain expansionary.

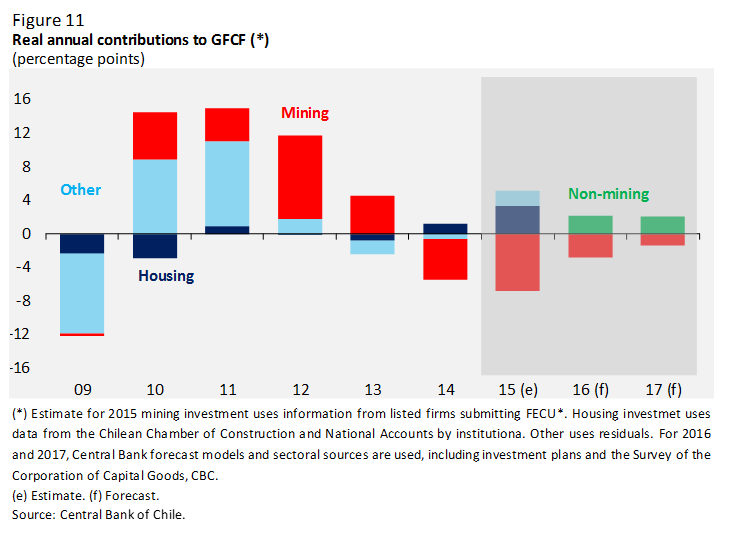

Excluding inventories, domestic demand will grow 2% in 2017. Just as in 2016, we expect private consumption to boost expenditure, considering a further gradual adjustment of the labor market and lower inflation driving real wages. Plus the already mentioned fact that November's consumer goods imports showed a rebound and that, while still pessimistic, consumer expectations have shown some increase in recent months, especially for durables. About investment, in the near future we see no significant projects, low activity in housing construction and still bad business expectations. Nevertheless, this component is expected to post positive growth in 2017, as assumed in September, after contracting for three years in a row (figure 11). Thus, the baseline scenario estimates that, as a percentage of GDP, gross fixed capital formation will continue to drop in both real and nominal terms, to 22.9% and 21.7% of GDP, respectively (22.6 and 21.8% in September).

As for the external scenario, a current account deficit is expected with no major changes between 2016 and 2017, very close to September estimates: 1.7% and 1.9% of GDP, respectively. However, as this figure contemplates an improvement in the terms of trade, at trend prices the current account deficit is bigger than was implicit in the last Report, by about half a percentage point in 2017. Our current account forecast assumes that Chilean exports volume will grow about 2% in 2017, after a fairly flat 2015 and a down-sloping 2015. By sectors, we expect increased volumes of both mining and non-mining shipments (table 1).

In this scenario, annual inflation will decline further, to less than 3% during most of 2017, and remain stable through the rest of the projection horizon. This course reflects a significant reduction in the CPIEFE in 2017, owing to different elements. On one hand, the exchange rate trajectory will continue to contribute to reduce imported goods inflation. On the other hand, beyond the effects of comparison basis related to the stamp tax, services inflation is expected to continue to decrease gradually, especially because the reduced inflation at the end of 2016 will affect indexed prices during the early part of 2017. This, in a context where medium-term inflationary pressures are bounded, and where capacity gaps will continue to exist during the entire projection horizon. Meanwhile, energy and foods inflation is expected to rise, partly offsetting the effects of the aforementioned elements on headline inflation (figure 12).

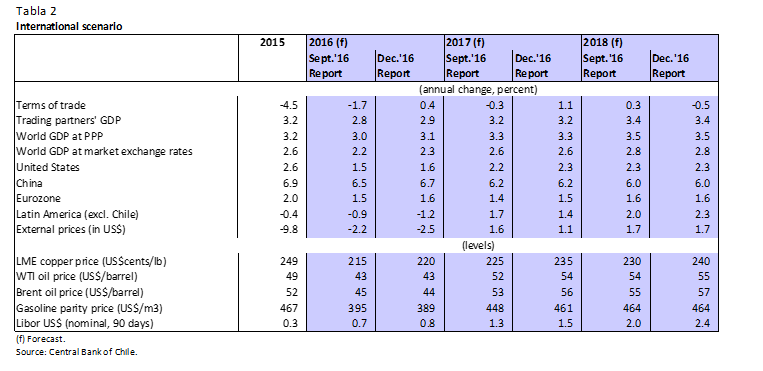

Beyond the presence of higher risks, this forecast assumes that the external impulse facing the Chilean economy will be as estimated in September. In particular, external financial conditions will be less favorable, but better terms of trade are expected. The baseline scenario projects a copper price of US$2.35 and US$2.40 per pound in 2017 and 2018, respectively, in line with forecasts by market analysts and with an environment marked by an appreciated dollar and higher interest rates. The oil price, in turn, is revised slightly upward from September, to an average of 55 dollars per barrel in 2017-2018. Growth projections for the world and our trading partners show no changes on aggregate and point to some acceleration in 2017 and 2018 (table 2).

As regards the MPR, the baseline scenario uses as a working assumption that it will follow a trajectory comparable to the one assumed in the various expectations indicators. This ensures that monetary policy will remain expansionary throughout the projection horizon. As always, the implementation of monetary policy and any possible adjustments to the policy rate will be conditional on incoming information and its effects on the projected inflation dynamic (figure 13).

On the external front, although the market anticipates an increase in the fiscal impulse in the United States, with planned infrastructure works, tax cuts and measures generally intended to boost growth, their details are still unknown, as is the time it will take to carry them out. In that sense, there is the possibility of a significant fiscal package that results in higher economic growth in the US and the rest of the world. However, another possibility is that the impulse disappoints and financial markets deteriorate, ending up in dominating negative effects. The US inflation outlook also poses risks, as it could precipitate a more aggressive behavior of the Fed. For now, after the meeting of last week, the Fed announced a slightly faster withdrawal of the monetary stimulus. The effects of potential protectionist measures on world activity and trade has to be considered as well. All this, with Brexit's effects still in the dark and with several major European economies preparing election processes. Plus doubts surrounding the soundness of some European banks.

Financial conditions facing the emerging world have worsened, and there is the risk of a sharper deterioration. In China, despite stabilizing activity, risks remain, especially in its financial system. In Latin America, there are still economies in need for adjustments and others making changes that could create some turbulence.

At home, the inflationary surprises of recent months concentrate in prices linked to the exchange rate and foodstuffs, but some delay in inflation's convergence to 3% cannot be ruled out, especially if capacity gaps widen more than forecast. Meanwhile, the evolution of the peso will continue to be subject to a high degree of uncertainty, which could affect short-term inflation in either direction.

Regarding activity, the most recent figures put a note of caution, even considering the volatility of month-to-month data and that demand-side information at hand has been more favorable. Also, the deterioration of external financial conditions could have a stronger than anticipated impact. Conversely, the baseline scenario considers that the level reached by the price of copper in recent weeks will not remain over the projection horizon. This, because there has not been any corresponding change in its fundamentals and because its increase has gone counter to the evolution of global interest rates and the value of the dollar. However, it is possible that the current prices of the metal will last for longer than expected, which could boost domestic spending once again -for example by an earlier recovery of investment in the sector- or because it could improve confidence sooner.

All considered, the Board estimates that the balance risk is unbiased for both activity and inflation.

Summing up, we now face a scenario where inflation has dropped faster than expected- but will stand at 3% at the end of the projection horizon-and where activity continues to grow slowly. Both domestic and external risks have increased.

Let me now turn to the issues we explored in our Financial Stability Report.

The Financial Stability Report

Our Financial Stability Report, which we publish in June and December of each year, presents recent macroeconomic and financial developments that might influence the financial stability of the Chilean economy.

On the external front, the risks presented in the FS Report are the same of the Monetary Policy Report I just described. Worth mentioning is the uncertainty surrounding how the worsened external financial conditions and the Chinese situation will affect us. In China, private credit is still on the rise, as is the banks' exposure to the real estate sector, where house prices continue to grow at two-digit rates in the high demand cities. The quality of banks' portfolios has deteriorated further, in line with the poor behavior of the corporate sector. This situation could worsen further with a rise in financial costs, again if international trade policies move towards protectionism, given the still high dependence of the Chinese economy on its exports.

At home, the effects of the higher external interest rates on local rates and on the valuation of mutual and pension funds, especially fixed-income-intensive ones (e.g., the E pension fund) are worth noting. In the particular case of mutual funds, significant withdrawals have been observed in medium- to long-term funds, which undid part of the increases reported in previous FS reports. Although so far there have been no significant hikes in money market rates, the greater dependence of medium-sized banks on financing coming from these funds is one risk worth keeping an eye on.

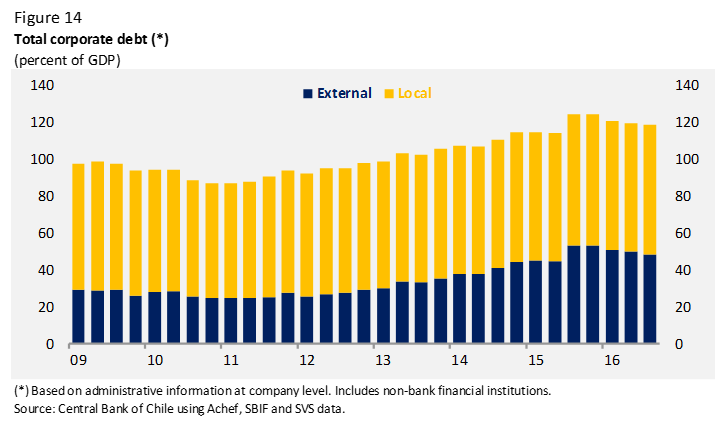

The financial situation of domestic firms has not changed much from earlier FS reports. Corporate debt has fallen a little, to 119% of GDP at the third quarter, but it is still near peak levels. A large part of the variation owes to the peso appreciation against the dollar during the period (figure 14). The profitability of domestic firms also kept its downward trend at the close of 2015. A similar pattern is seen for a group of companies reporting to the Superintendence of Securities and Insurance (SBIF) which maintain low profits and high indebtedness by historic standards. Meanwhile, various indicators reveal that the exchange rate risk remains bounded. Finally, firms' bank debt repayment default remains stable and relatively low, although the increase in the substandard commercial portfolio reflects a slight decrease in borrowers' capacity to keep their repayments up to date. This situation could worsen in the face of a more adverse economic scenario resulting from slower economic activity or increased financial expenses. The latter could be seen if the increases in funding costs were transmitted to the local lending rates, thus affecting firms needing to renegotiate their liabilities. Our estimates, however, suggest that a deterioration in activity would have a greater impact on firms' financial strength than would an increase in financial expenses.

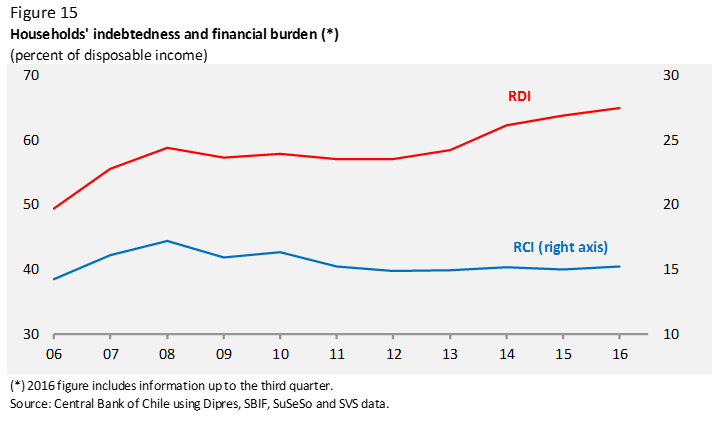

Household risk indicators remain fairly stable, in line with the gradual adjustment of the labor market. Aggregate household indebtedness continues to increase because of a higher share of mortgage loans. The lower interest rates seen up to September helped to maintain the aggregate financial burden relatively stable around 15% (figure 15). At the same time, delinquency in both consumer and mortgage loans remained bounded with no major variation from the previous half. Some exceptions include consumer loans granted by Clearing and Family Allowance Houses and bank mortgage credits in the northern regions, where credit quality has fallen. Thus, one risk identified in the FS report is that a worsening of labor indicators could hinder the repayment capacity of households.

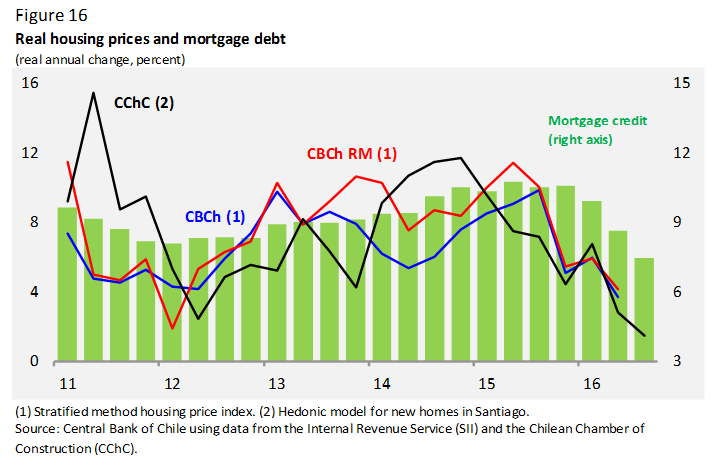

Turning to the real estate sector, both housing prices and mortgage credit have moderated their growth rates. Several housing price indicators posted lower growth rates than in previous quarters, reflecting the dynamics of their components (figure 16). Data from real estate companies reporting to the SBIF show no increase in withdrawal rates at the third quarter of 2016. It is worth noting, however, that this risk persists because a large part of promised projects in 2015 were due to be delivered between the last quarter of 2016 and the year 2017. Lately, there has been an increase in the down payment required by the banks to grant a mortgage loan, which could result in more withdrawn promises by those households that were unable to meet the necessary savings to comply.

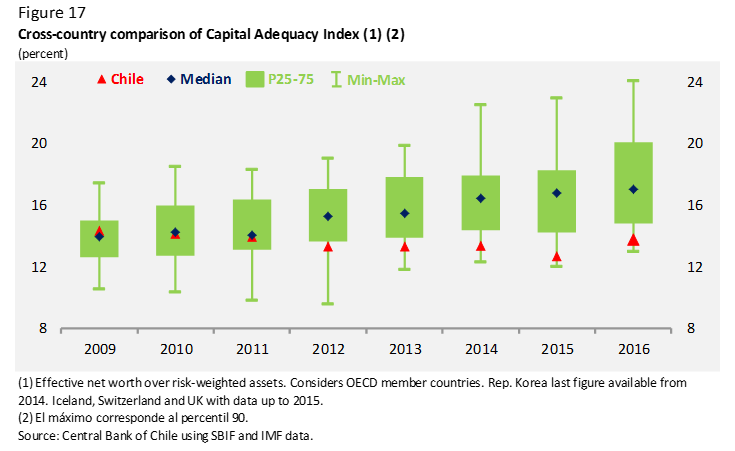

Profitability of the banking system has dropped, as interest spreads have reduced their contribution. This can be explained by a change in composition of the credit portfolio towards lower relative return products-fewer consumer and more mortgage loans-and by the migration towards less risky clients, who are offered lower interest rates. At the same time, the capitalizations of the first half of 2016 drove up the banking system's capital adequacy ratios (CAR), strengthening their position to deal with adverse economic scenarios. In fact, stress tests indicate that banks have the sufficient capital to face severely stressful conditions. All in all, capital gaps are similar to those in comparable countries. Although several capital increases have been made lately, no changes in banks' dividend withholding policies have been observed that would allow increasing the capital base endogenously. In an international context, the CAR level of the banking system remains below the 25th percentile in both OECD countries and in the region. Accordingly, it is important to advance in the discussion of legislative initiatives that help to strengthen the banking system's capitalization, in line with the efforts that other countries have made to converge with Basel III requirements (figure 17).

In summary, although in this Financial Stability Report we conclude that there are no fundamental changes in our risk outlook, we do see that local agents' financial strength has diminished steadily during the past few years due to weakening economic activity. Household and corporate debt has increased moderately but persistently, non-financial firms' profitability has fallen together with the limited expansion of output-reducing their capacity to deal with greater financial expenses-and the banks' profits and capitalization have dwindled. Although the lower interest rates have helped these developments not to translate into financial stress, the agents' capacity to deal with an adverse external scenario is now lower than it was a few years ago, especially if such scenario causes further economic slowdown. In this context, it is very important that some of the trends of recent quarters, such as the lower growth in corporate debt and higher bank capitalization, consolidate.

I would like to end this presentation-my first as the Governor of the Central Bank of Chile-by sharing some thoughts about the achievements and challenges facing the institution I have now begun to lead.

Final thoughts

Let me begin by stressing that I have been handed an institution that can show great strengths and unquestionable achievements. As I said, the last inflation figure was 2.9% in twelve months, practically right on the monetary policy target. Financial risks are well contained and the Chilean economy has successfully weathered a period of significant slowdown without much trouble.

As an institution, the Bank inspires credibility and trust. Over the past several years, inflation expectations two years out have remained stable at the policy target. Also, the voice of the Bank has been heard when it has identified risks emerging in the financial sector, and its model of organization and autonomy has inspired every agent searching for institutional schemes granting a transparent and equitable operation in key functions.

It is important to recognize the contribution of the Central Bank of Chile's staff, Board members and Governors that came before me to achieving those high standards.

Getting to this point wasn't easy, in either substantive or institutional terms. During the past few years, the evolution of the economy has been determined largely by the swings in the world economy. The end of the so-called commodity boom, the persistence of very expansionary monetary policies-both conventional and unconventional-, deflation replacing inflation as a macroeconomic risk and the profound transformations that the Chinese economy has experienced, among others, are some of the large-scale phenomena that have generated major, even atypical, changes in the external scenario facing the emerging economies.

These changes have been perceived especially clearly in Chile. During the years of highly-priced commodities, especially when they were coupled with particularly low interest rates, our economy grew more than 5% annually, the real exchange rate dropped substantially, and investment boomed. Despite this, they were years of particularly low inflation, driven by the drop in many tradable goods' inflation.

The situation changed dramatically in late 2013, when Chile's terms or trade reversed significantly. Since then growth has been near 2% and investment has receded, as has the current account deficit. Between 2013 and 2015 the peso depreciated largely, pushing inflation above the tolerance range for longer than expected.

The transition from high growth and low inflation to low growth and high inflation is certainly uncomfortable for any central bank. More so if this transition features an autonomous confidence shock as happened in our case. But we do not choose the shocks that hit us. What we can do is to deal with them and cushion their impact on the overall economy. This has been possible, to a great extent, because of our appropriate policy framework.

This framework consists of an inflation-targeting monetary policy with a floating exchange rate. This makes it possible to adjust the monetary impulse so that projected inflation two years out stands at 3%, allowing relative prices to adjust to changes in external conditions. In the context of the end of the long cycle of high commodity prices, this policy framework helped the economy to walk the path of the necessary adjustments it had to make, which required low real interest rates and a depreciated currency. Thus, although inflation soared in the years 2014 and 2015, monetary policy was eased, because despite the higher inflation, we saw that medium-term pressures were pushing down.

This countercyclical operation of monetary policy was accompanied by a policy of structural fiscal balance that allowed the budget's automatic stabilizers to act. The combination of both elements and their rigorous application throughout the cycle allowed to attenuate its inherent volatility, and therefore its social costs. But as the fiscal policy framework assumes a rather passive role for it, monetary policy has been, and will continue to be, the first line of defense.

The continuity of the monetary policy framework and its fiscal counterpart over sixteen years has proven effective during booms and busts, passing difficult economic and political tests. Thus, the continuity with the outlines that our Central Bank has built is not only an expression of its soundness as an institution, but a logical course of action, when its objectives have been clearly achieved.

Continuity provides a sound base to face new challenges and to build and strengthen the institutions. The innovations that the Central Bank of Chile has incorporated into all its areas of action, from monetary policy to its own corporate management, from generating statistics to the management of circulating money, are proof that a sound institution is not necessarily immutable. Also, that an autonomous organization can develop beyond its legal mandates.

The challenges facing the Bank in the future, in both the macroeconomic and the institutional fields must not be underestimated. The confidence that our citizens put in this institution is not an insured capital but something that, again, needs to be earned day by day in each one of its areas of responsibility.

These challenges involve, first and foremost, applying the inflation targeting framework in a changing macroeconomic context, both externally and internally. The business cycle has stopped behaving as it was traditionally understood-with a certain regularity between economic activity in the United States and the emerging economies; between the value of the dollar and commodity prices; between the money supply and market interest rates. International trade and investment have been slow to recover, which has been especially damaging for exporters of natural resources, such as Chile.

China's economic prominence, the integration of financial markets and the accumulation of liquidity globally have amplified the contagion mechanisms across countries and sectors. Deep social and demographic changes have altered household behavior in terms of work, saving and consumption, while technological development, the densification of value chains and changes in consumer preferences broaden the range of firms' choices about how and for whom to produce.

All this will force the Central Bank to multiply its efforts to generate new data and analyses, to better understand the international transmission mechanisms, the financial behavior of households, the sources of systemic risks in the banking industry and the operation of key markets, such as those for financial derivatives and mortgages, among others.

A better understanding of expectations-building mechanisms and the bases of consumer and business confidence can also help the Bank fine-tune the mechanisms to communicate its policy decisions so that it can provide reliable guidance to the markets. But the need for greater transparency does not end in monetary and financial policy, because the Central Bank, being a public institution, must be able to adapt its standards of transparency to the changing needs of markets and to the demands of Chilean citizens.

It must also be able to identify and prevent new perils threatening the performance of its various functions. At this point, it is particularly important to ensure the continuity of the payment systems and operations whereby monetary policy takes place, because of the great technological developments in this area and the high costs of any failure. Equally important are the risks associated with the circulation of banknotes and coins and the lesser value means of payment that are part of the day to day lives of every Chilean.

The autonomy of the Central Bank also means that the quality of its institutional management is a special responsibility. Although it is not part of the State's administration, it is equally owned by every Chilean, who rightfully demand an efficient use of their resources.

To undertake all these tasks, it is important to recognize that trust in a central bank also rests on its prudence. An institution responsible for price stability and financial stability cannot afford to improvise or experiment.

In this regard, it is important to acknowledge the potential, but also the limits of monetary policy. In particular, we must reaffirm that it does not have the capacity to affect the medium-term trends of the economy and not even completely eliminate the cyclical variations that affect it. Our main contribution to the country's development is, in line with the mandate of our Organic Law, to keep inflation low and stable, reducing economic volatility and financial risks, with the expectation that by reducing uncertainty we will facilitate investment, employment and consumption decisions that shorten the cycle.

The right mix of prudence and determination is not easy to calibrate. Prudence is necessary to correctly assess the implications of changes in the economic environment, resisting the temptation to look for the easy way out, which can prove very costly in the medium term. Determination is necessary in order to act in a timely way, because an untimely monetary policy will delay the convergence of inflation to the target or will do so at an unnecessary cost.

In practice, this means making robust monetary policy decisions in uncertain conditions. Thus, in our last monetary policy meeting we communicated that, in the most likely scenario, a bounded easing of the monetary impulse would be needed.

The search for the right combination of prudence and determination is also necessary in the other fields where the Central Bank operates. To monitor the financial sector without restricting its ability to innovate; to develop instruments and facilities that are attractive to the market, and to improve risk management and transparency without compromising efficiency and timeliness.

Identifying the new challenges facing the Central Bank and finding the answers that best balance prudence and determination requires organized and systematic efforts. As an expression of it, in the coming months we will develop a new institutional strategic planning exercise. We intend to consult with various players, both public and private, including, of course, this Committee.

The purpose of this exercise, of the initiatives we undertake, and the conduct of our regular policy decisions must be particularly explicit. What we ultimately aspire is to continue to strengthen the Central Bank of Chile as an institution of excellence, that our fellow Chileans can trust.

Thank you.