John Iannis Mourmouras: Recent monetary and financial developments in Greece

Speech by Professor John Iannis Mourmouras, Deputy Governor of the Bank of Greece, at the Governors' Club, a forum comprising the Governors and Deputy Governors of the central banks of sixteen Southeast European and Asian countries, 30 October 2016.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Thank you Madam Chair,

Governors,

Ladies and Gentlemen,

It is an honour to be here with you in the holy city of Jerusalem and I would like to thank the Governor of the Bank of Israel, Karnit Flug, for inviting me to this high-profile meeting. In the same Governors' Club meeting in Shanghai in May 2015, I was given the chance to comment on the latest economic developments in Greece. Then I raised the alarm against the government's delaying the negotiations with our lenders. Two months after my speech in China, Greece unfortunately witnessed the cost of backtracking, namely the deposit outflows which destabilised the banking system, called into question our country's eurozone membership and resulted in the introduction of capital controls, a bank holiday, bank recapitalisation and, of course, the recession in 2015 and this year.

A. The real economy

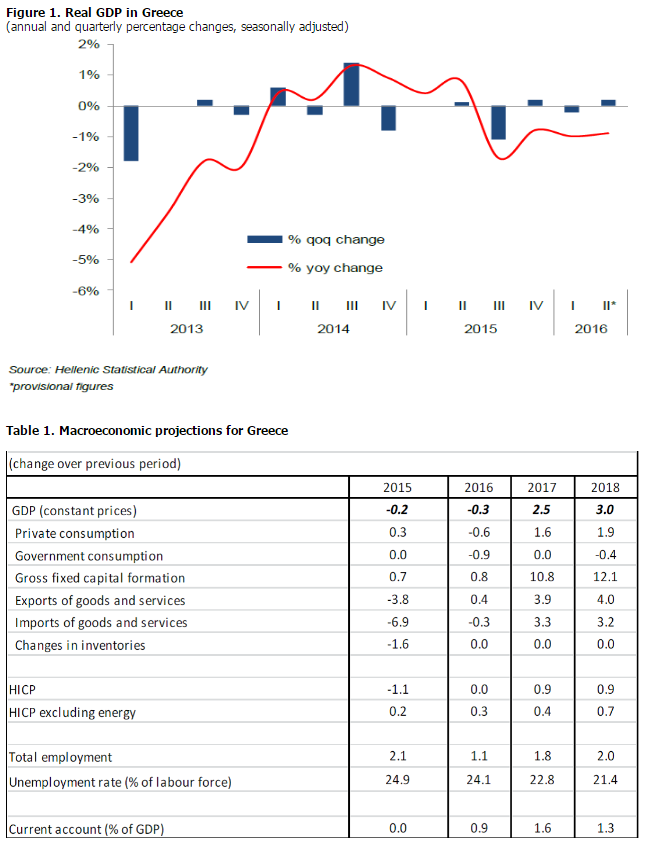

However, it is fair to say that the situation has stabilised since the conclusion of the Third Memorandum agreement in September last year. Economic activity picked up in the last two quarters of this year, from a negative growth rate in 2015, to reach positive territory (+0.2% year-on-year) in 2016 especially if receipts from tourism remain buoyant. Bank of Greece estimates for next year show an increase in real GDP by 2.5% and 3% in 2017 and 2018 (Figure 1 and Table 1). The key drivers of growth are expected to be private investment and exports of goods and services.

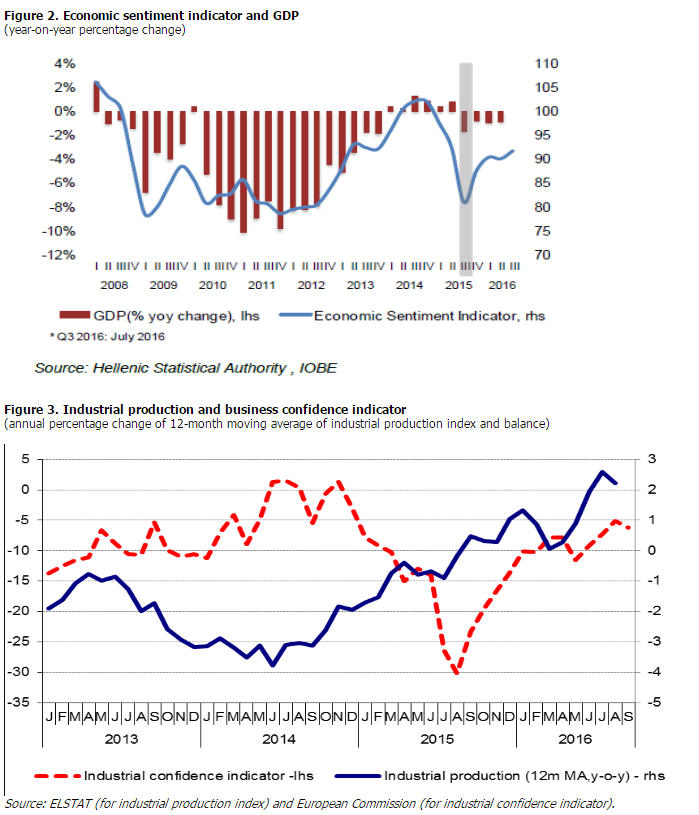

Both the economic sentiment indicator (Figure 2) and the industrial confidence indicator (Figure 3) have recovered in the second and third quarter of this year, while in the first half of July 2016 the number of tourist arrivals in airports in Greece increased by 7% and is expected to reach an unprecedented total of about 25 million visitors in 2016, which is more than double the Greek population.

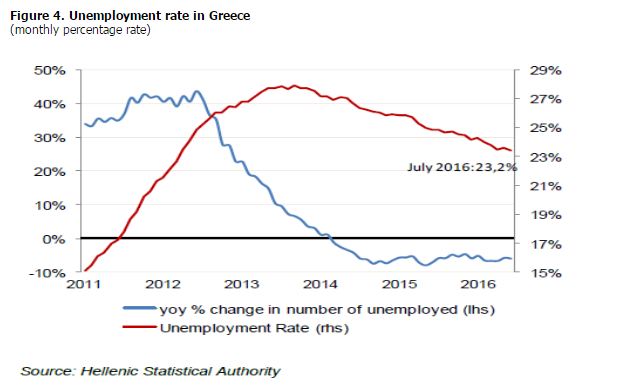

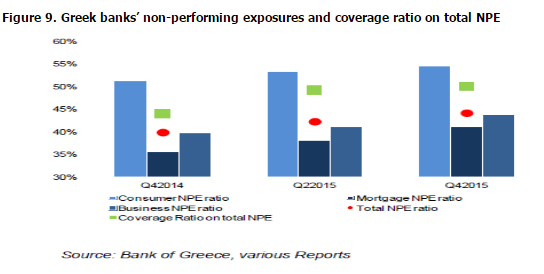

The unemployment rate remains elevated (23.2% in July 2016 and 23.1% in the second quarter of 2016), posing significant threats to social cohesion, while youth unemployment also remains alarming (at 38.1% in the age category of 15-29 years in the second quarter of 2016), intensifying the "brain drain" that deprives the economy of high-skilled human capital. Further de-escalation of the unemployment rate and an increase in the employment rate depend to a large extent on the stabilisation of economic sentiment, economic growth as well as the implementation of structural changes. Active employment policies and training programmes will contribute to curbing the unemployment rate (Figure 6). The Greek banking system has undergone intensified liquidity pressures, following the massive deposit outflows recorded from October 2014 and until the introduction of capital controls in late June 2015. The completion of bank recapitalisation in December 2015, whereby private investors subscribed capital of about €9 billion, as well as the completion of the first review in June 2016 represent important steps towards the restoration of confidence in the Greek banking system which will facilitate the gradual recovery of bank deposits. In the period between the June 2015 capital controls and July 2016, a total of €6.8 billion of capital placed by Greek residents (firms and households) in financial assets abroad, i.e. deposits (worth €4.6 billion) and equities including mutual fund shares (worth €2.2 billion), has been repatriated. The rise in bank deposits now amounting to €123.9 billion stems mainly from the corporate sector, while the increase in household deposits was more contained. In addition, banks' reliance on Emergency Liquidity Assistance (ELA) progressively declined in the first eight months of 2016, from €77.5 billion in December 2015 to €47.6 billion in September 2016 (Figure 9). In this context, liquidity conditions are expected to progressively improve as confidence is gradually restored, following the completion of the first review and the release of the sub-tranche of €7.5 billion. In view of the above, the decision of the European Central Bank on 22 June 2016 to reinstate the waiver of the minimum credit rating requirements for Greek marketable debt instruments, which entered into force on 29 June 2016, allows Greek banks to obtain funding from the ECB at a lower cost.

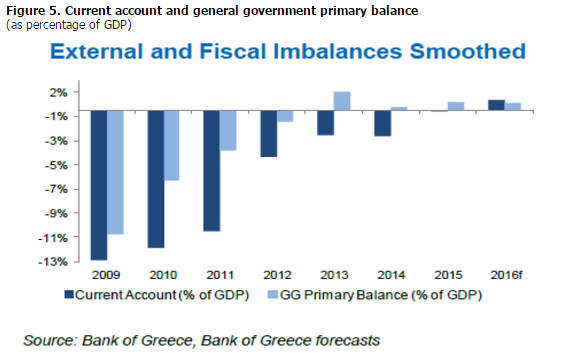

However, the brighter outlook is depicted in the improvement of both fiscal and external imbalances. In particular, 2015 marked a turning point when Greek economy registered a zero balance in current account, and a primary surplus in the general government (GG) budget, while the decline in the primary budget deficit in the 2009-2015 period accounted for 10 percentage points of GDP! Moreover, in 2016 Greece's fiscal balance and external position are both further improving as the general government primary budget should exceed the target set for the year (0.63% of GDP according to the draft budget, against a target of 0.5%), while the current account surplus is expected to stand at 0.9% of GDP (Figure 5). The materialisation of short-term debt relief measures, already agreed at the May 2016 Eurogroup meeting, is of great significance for boosting investors' confidence. This is because it signals that the debt servicing burden will be moderate in the short term, thus releasing available resources needed for economic growth and alleviating the consequences of a strict fiscal adjustment.

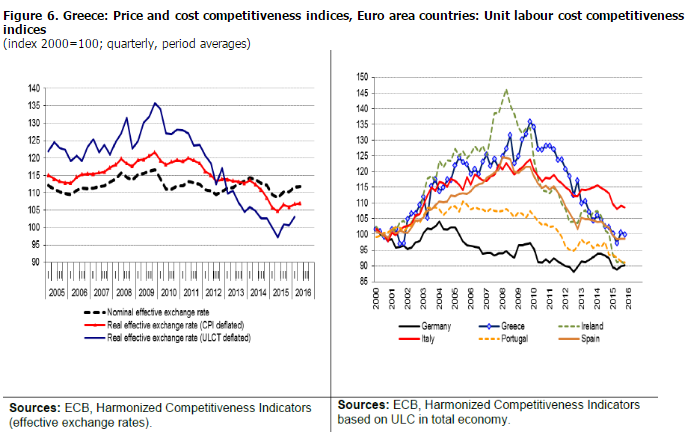

Last but not least, the Greek economy significantly benefited from improved competitiveness. In part, this development reflects the effect of structural reforms on the labour market, allowing more flexibility in the process of wage bargaining. More analytically, labour cost competitiveness has improved by 23.8% from 2009 to 2015 due to substantial labour market reforms and sizable declines in wage costs due to the prolonged recession. As a result, the cumulative loss in labour cost competitiveness between 2000 and 2009 has been recovered. Its improvement is estimated by the Bank of Greece at 3.7% in 2015 and at 0.5% in 2016. Improvements in price competitiveness are also evident and faster increases in the prices of tradables relative to non-tradables provide incentives for producers to move into tradable sectors. Indeed, price competitiveness has been gaining momentum from 2012 onwards as the inflation differential with Greece's main trading partners has been negative. Its cumulative improvement from 2009 to 2015 is estimated at 12.1%. Its improvement for 2015 is estimated at 4.5% by the Bank of Greece or 5.1% by the ECB (Harmonised Competitiveness Indicators (HCIs)) (Figure 6). According to ECB-HCIs, the price competitiveness index in 2016: Q1 was still 7.0% above its 2000 level. In 2016 Bank of Greece estimates price competitiveness to remain virtually stable (0.1% improvement). However Greece still ranks at the lower end of advanced economies and progress has since stalled or even retreated. In particular, the World Bank Doing Business report for 2015 ranked Greece 60th among 189 countries (a fall by two places) while according to the IMD World Competitiveness Yearbook 2016, Greece fell by six places and is ranked 56th among 61 countries. More recently, the World Economic Forum's Global Competitiveness Report 2016-2017 ranked Greece 86th among 138 nations, which corresponds to a fall by 5 places. But it should be noted that Greece has achieved high rates of responsiveness to OECD recommendations consistently since 2011 (OECD, Going for Growth 2013 & Going for Growth 2015).

B. Monetary and Banking Developments

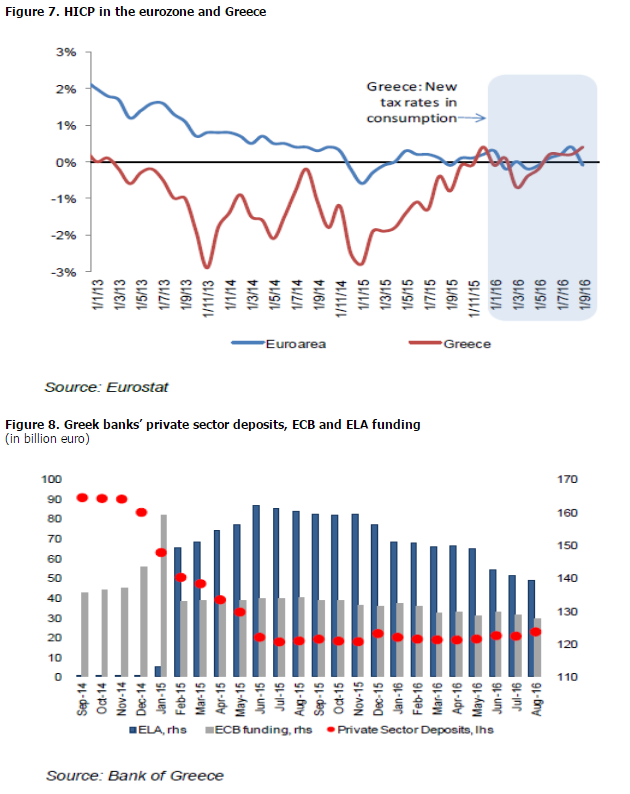

On the other hand, HICP harmonised inflation was marginally negative in September (-0.1%), having remained negative for the previous fourteen consecutive quarters, despite some marginally positive monthly spikes (in July and August) as a result of VAT increases in a wide range of products and services (Figure 7). The convergence of HICP between Greece and the euro area is mostly attributed to the higher indirect taxes imposed on the Greek economy.

Furthermore, according to Greek banks' latest financial results for the first half of 2016, their capital adequacy was preserved at 18%, comfortably above the EU average.

At the end of June 2016, non-performing exposures (NPEs) remained relatively flat around 45.1%, about eight times the European average which is around 5.7%, while in absolute terms the total amount of NPEs reached €108 billion, an 9% increase compared with the end of 2014. By sector, the highest ratios of non-performing exposures were recorded in the sectors of agriculture (59%), commercial properties (55%) and tourism (54%). Among the four main loan segments, the respective ratios for consumer, large business, SMEs and mortgage loans reached 55.3%, 29.1%, 59.9% and 44.7%, respectively (Figure 8). Loans in delay of more than 90 days accounted for 30% of NPLs, while this evidence is an early warning signal for credit risk developments in the banking system. Despite the size of the problem, the capital base of the banking system - as mentioned above - remains strong, while in terms of provision coverage Greek banks are well placed compared to peers (50.1% vs. 46.1% EU average). If one adds to this the value of collateral pledged, total risk coverage comes to 101%, one of the highest in the EU.

Concluding, NPLs represent perhaps the most significant problem for the Greek banking sector along with liquidity (the two are of course interlinked). The Bank of Greece in its capacity as supervisor together with the SSM took a set of measures over the last two years including a code of conduct for banks for the effective and flexible treatment of borrowers facing difficulties in servicing their debt obligations. Moreover, the Bank of Greece adopted Executive Committee Acts Nos 82/2016 and 95/2016 detailing the licensing framework for credit servicing firms, striking a balance between speed, transparency and borrower protection. It also decided to set binding operational targets for all Greek banks with a view to ensuring a reduction of NPLs over a horizon of three years. More specifically, according to the targets of the four systemic banks, NPLs should be reduced by 40% or €41 billion by 2019. This reduction is expected to result from: firstly, the economic recovery envisaged in the Adjustment Programme and the ensuing return to profitability for a large majority of businesses and secondly, successful debt forbearance/restructuring whereby non-performing loans become performing again and a number of NPLs are sold to funds.

C. One milestone-pending issue

Looking ahead, in terms of economic policy, the steps forward are clear and dictated by the Memorandum between the Greek authorities and our official international lenders which goes through the completion of the second review of Greece's Adjustment Programme by the end of this year, the specification of debt restructuring measures agreed-upon in the Eurogroup meeting of 24 May 2016 which are the precondition for Greece's participation in the ECB's public sector asset purchase programme (PSPP), best-known as the "QE programme".

In terms of the mechanics, and applying the ECB's 33% issuer limit and subtracting the Eurosystem holdings of Greek government bonds, the maximum allowed purchases are €3.8 billion. Some could argue that the above amount is a mere pittance compared with the total Eurosystem's purchases. Even in this respect, the signaling effect of Greece's inclusion in the QE programme will be strong enough for GGB prices to recover, accompanied by a significant fall in volatility, as the overall financial environment is normalised and Greece is no longer an outlier in the euro area.

D. Political stability as a crucial precondition for a sustainable recovery

First of all, long-lasting political stability, strong governance and leadership are required to regain the confidence of foreign investors in my country, both in terms of portfolio and Greenfield investment. There should be no slackening of efforts on reforms and privatisations, but less austerity, and no complacency by the authorities. They should remain vigilant.

Greece needs a new growth paradigm based on extroversion and innovation as major drivers of productivity and sustainable economic growth. Let me at this point draw a parallel between my country and our host country today, Israel, another small, open economy. It is known that during the period of 1973-1985, Israel had a chronic high inflation, fiscal and external imbalances, indexed contracts, etc. and an exorbitant public debt of almost 300% of GDP, which has now been reduced to a record low of 64.8%. It was the emergence of Israel's export-based high-tech sector in the early 1990s that really put the country's economy on track, with annual GDP growth accounting for at least 4%. Israel's innovation laurels are several - the highest gross expenditure on R&D, the biggest number of companies listed on NASDAQ outside of North America, the highest level of venture capital as a share of GDP. Currently, Tel Aviv has evolved into one of the world's leading hubs for technology and innovation and is a prime destination for entrepreneurs, investors, international R&D facilities and innovation centres. Between 1995 and 2004, Israel increased its spending on R&D, calculated as a percentage of GDP, from 2.7% to 4.6%, a rate higher than any other OECD country. Despite the brain drain, Greece still has a highly qualified human capital (mostly educated in UK, European and US universities), which is young and dynamic. Greece should resemble Israel, for instance, in terms of start-up high-tech companies, a sector in which Israel has shown the way as a true champion. This may be the solution for the Greek youth's high unemployment problem, the poor job creation record and the subsequent problem of a jobless recovery.

In closing, let me look forward into the future and end my speech on a note of optimism. It is less than five years until the milestone year of 2021, a year with lots of sentiment and symbolism for the Greek people. It will mark the 200th anniversary of the Greek war of independence against the 400-year Ottoman rule, which led to the creation of the modern Greek state. I am confident that if we persist with reforms in the next four years and take decisive measures, our country will come out of the woods and the Greek people will look to the future with confidence, being able to celebrate this important anniversary within a truly modern European state with jobs, prosperity and social cohesion that our great nation quite rightly deserves.