Graeme Wheeler: Some thoughts on New Zealand's economic expansion

Speech by Mr Graeme Wheeler, Governor of the Reserve Bank of New Zealand, to Development West Coast, Greymouth, 8 December 2016.

The views expressed in this speech are those of the speaker and not the view of the BIS.

1. Introduction

Thank you for inviting me to meet with you again. It's always a pleasure to be here and exchange views on how the economy is performing.

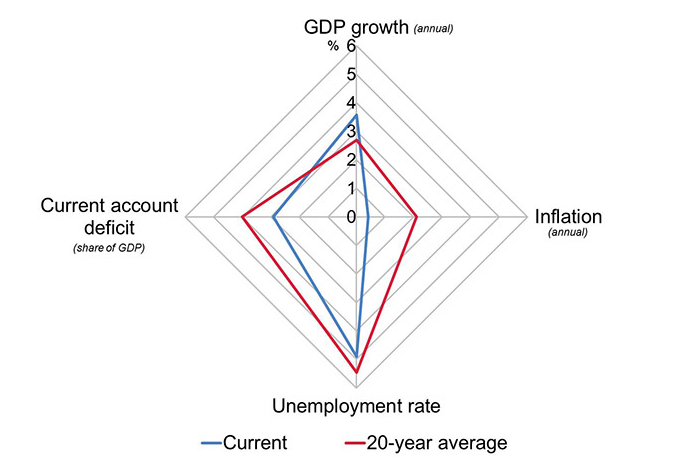

In many respects the economy is performing well. Relative to the trends over the past two decades, we are experiencing stronger economic growth, lower inflation, and a lower unemployment rate - even with record levels of labour force participation. And the Achilles heel of many New Zealand expansions - a large current account deficit - has not eventuated (figure 1).

Figure 1: Summary Macro-economic Indicators relative to trend

Source: Statistics New Zealand.

Economists are well known for their two-handed assessments, and it won't surprise you if I mention that not everything is as positive. The overall expansion, now entering its eighth year, is weaker than other post-WWII expansions. GDP growth on a per capita basis has been slow and labour productivity growth has been disappointing. House price inflation is much higher than desirable and poses concerns for financial stability, and the exchange rate is higher than the economic fundamentals would suggest is appropriate.

New Zealand is not alone in encountering these challenges. Most of the advanced economies and several emerging market economies are experiencing weaker than normal expansions, slow labour productivity growth, and high house price inflation. In a world of weak trade growth and rising protectionism, many would prefer to have a more competitive exchange rate.

I will return to some of these issues in discussing:

- some of the characteristics of the current expansion,

- the prospects for continued expansion and the key economic risks we face, and

- the role that monetary policy can play going forward.

2. Characteristics of New Zealand's Current Economic Expansion

i) The expansion has taken place in a difficult global economic climate

Global economic growth in 2015 and 2016 is around 3 percent - the weakest since 2009 and below its long-term average of 3¾ percent, despite unprecedented global monetary stimulus and a major decline in oil prices. Global trade, normally a catalyst for the global economy, remains weak. Merchandise trade growth over the past five years has been the slowest since the early 1980s, and protectionist measures in G20 countries and elsewhere are on the rise. Economies are grappling with the spillovers from unconventional monetary policies and heightened political uncertainty has also been making households and businesses more cautious.

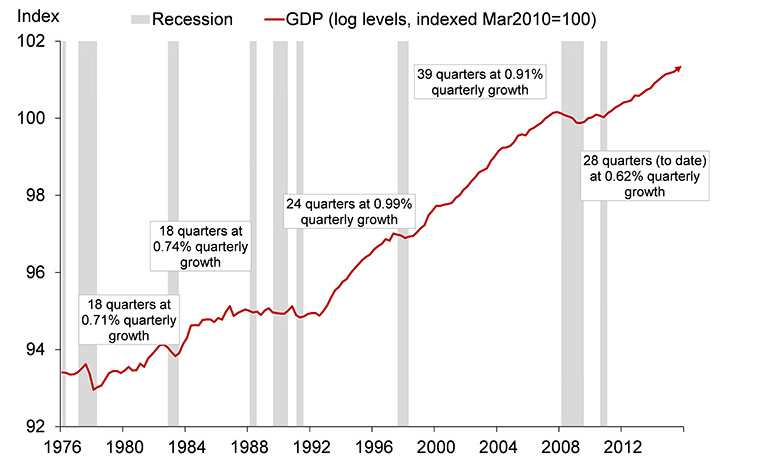

ii) The current expansion is longer, but also weaker than previous expansions

At 28 quarters, the current economic expansion is the second longest in the past 40 years. Annual real GDP growth has averaged 2½ percent during the expansion, making it the weakest expansion during that time. Over the past year however, annualised GDP growth has accelerated to a little over 3½ percent (figure 2).

Figure 2: Real GDP growth over New Zealand business cycles

Source: Statistics New Zealand, RBNZ. Recessions are defined as two or more consecutive quarters of negative quarterly growth.

iii) The drivers of the expansion have changed

Initially the expansion was driven by improving terms of trade (which improved steadily from September 2009 and reached a 40-year high in June 2014), growing trade with China under the Free Trade Agreement, and the stimulus from the 575 basis point decline in the official cash rate (OCR) between mid-2008 and mid-2009.

Increased construction investment, initially linked to Canterbury earthquake reconstruction, and the strong surge in migration and tourism have offset the effects of the 8 percent fall in the terms of trade since mid-2014 and contractionary fiscal policy since 2012. Monetary policy continues to be accommodative with the OCR remaining well below the estimated neutral interest rate, which is currently just below 4 percent.

These factors continue to be the main drivers of the expansion, although Canterbury reconstruction is no longer a contributing factor.

iv) Record migration, record tourism, and historically high labour force participation

In annual terms, net immigration has been the strongest since 1860. Net permanent and long-term migration of 172,000 working age people has increased the labour supply by 5 percent since 2012. Annual potential GDP growth has more than doubled to around 2.9 percent from its 2010 trough of 1.2 percent, primarily because of this labour force expansion.

Private consumption is being boosted by the strong growth in migration, record tourist inflows and the 11¼ percent increase in employment over the past 3 years. At 70.1 percent, the labour force participation rate is at an all-time high and the second highest among the advanced economies after Iceland.

v) Labour productivity growth has been particularly weak

New Zealand's trend rate of labour productivity growth is in the bottom third of OECD countries. There are many reasons for this including: distance from markets; size of the domestic market; small size of most New Zealand firms; limited participation in global value chains; and lower volumes of capital per worker. But, as with most of the advanced economies, labour productivity growth has been below its historical trend in the current expansion.

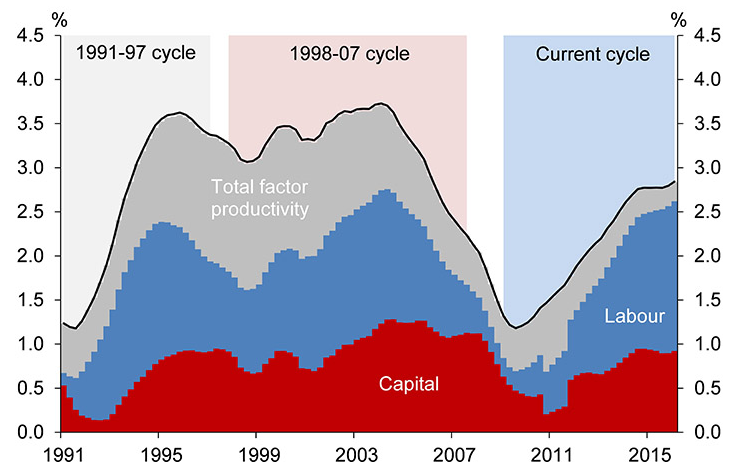

In the advanced economies, the decline in labour productivity growth is due to a slowdown in the growth of investment per hour worked (reduced capital deepening) and lower total factor productivity growth (TFP).1 In New Zealand, the slowdown in labour productivity growth is mainly due to the reduced contribution from TFP - the average contribution of TFP to potential output growth in the current cycle has been less than half that of the previous two cycles (figure 3 - TFP is a measure of how efficiently and intensively other factors of production are being utilised).

Figure 3: Contribution to annual potential GDP growth in recent business cycles

Source: RBNZ estimates.

vi) The economic impact of high migration has been different from earlier cycles

Migration inflows affect aggregate demand and supply in the economy. In earlier cycles the short-term demand impacts (in terms of spending and inflationary pressures) tended to dominate the effect of increased labour supply in raising potential output in the economy. Earlier periods of sizeable migration inflows, such as 2001-3, were quite quickly reflected in capacity and price pressures, and a strong pick-up in house price inflation.

House price inflation has been accentuated by the strong migration inflows in the current cycle, but the impact on consumer price inflation has been weaker than anticipated. This more muted impact on spending is likely due to the higher proportion of younger cohorts in the migrant flows, and the fact that many migrants are returning from a weaker labour market in Australia and may be more cautious in their spending.2, 3

vii) The impact of wealth effects on private consumption has been weaker in the current cycle

Growth in real consumption per capita has averaged 1.6 percent pa in the current economic cycle - about ½ percentage point below the post-1993 average growth rate of 2.1 percent, despite the rapid increase in housing wealth. Although there are recent indications that per capita consumption is increasing, the lower propensity to consume out of household wealth and the increase in household saving have contributed to weaker than expected inflation. This more cautious consumer behaviour may reflect a reassessment of the 'permanency' of capital gains from household assets, and greater caution about the level and durability of future income growth.4

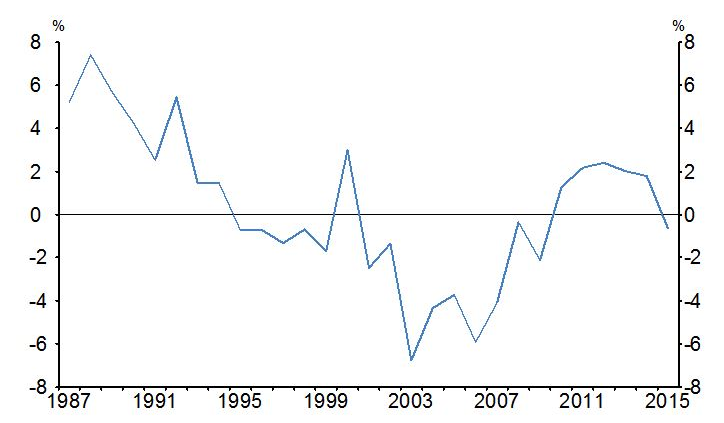

viii) New Zealand's terms of trade and the real exchange rate have been higher in this cycle

Global commodity prices were on a downward trend from early 2012 and fell sharply after mid-2014. They began to pick up early this year. New Zealand's terms of trade began falling in the second half of 2014, but the real effective exchange rate has generally remained high reflecting New Zealand's higher economic growth and interest rates and the positive investment climate here compared to many other advanced economies. Figure 4 shows the average real effective exchange rate and average terms of trade during the past three domestic expansions.

Figure 4: New Zealand's Terms of Trade and Real Exchange Rate

Source: Statistics New Zealand, RBNZ estimates. The real effective exchange rate is a measure of competitiveness that adjusts the nominal effective

exchange rate by correcting for differences in relative inflation rates (or relative unit labour costs) between New Zealand and its major trading partners.

ix) The recovery in household savings is reflected in an improved current account position and lower external debt ratios

New Zealand's household net savings rate improved by 8 percentage points in the period 2008 to 2013 (from minus 6 percent to positive 2 percent of household disposable income (figure 5)). Over this period, New Zealand's overall savings rate (ie including savings by the business and public sectors) increased by around 5 percentage points, and this has been an important factor behind the improvement in New Zealand's ongoing current account deficit and the decline in net external liabilities as a share of GDP (this ratio has declined from 84 percent of GDP in 2009 to around 63 percent of GDP currently).

Figure 5: Household net saving rate (percent of disposable income)

Source: Statistics New Zealand.

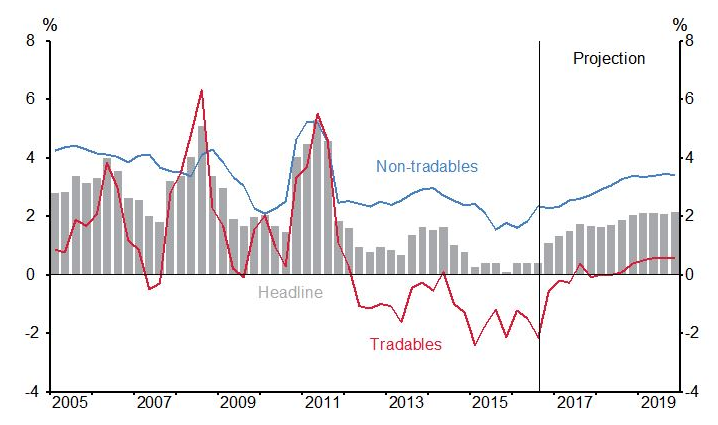

x) The period of negative tradables inflation has been very long

Over the past five years, annual CPI inflation has averaged 1.1 percent. During this period, inflation in the tradables sector (those industries exposed to international competition) has been negative - averaging minus 0.8 percent annually, compared to positive 1.2 percent in the prior two decades. This means that pricing outcomes in the tradables sector have been a drag on inflation, lowering annual CPI inflation, on average, by around 0.4 percent (figure 6).

While relative prices continuously adjust to market forces, New Zealand is unlikely to have experienced such a prolonged period of falling tradables inflation since the Great Depression. Declining tradables prices reflect the combined impact of the global over-supply of manufactured and capital goods, falling technology costs, weak commodity prices, and the appreciation in the New Zealand dollar exchange rate.

Figure 6: Traded goods inflation has been negative for five years

CPI Inflation and components (annual)

Source: Statistics New Zealand, RBNZ.

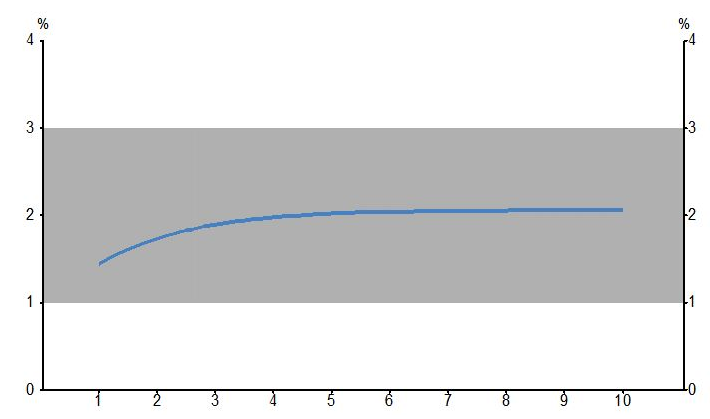

xi) Long-run inflation expectations have remained anchored at 2 percent

A positive feature of the current expansion is how longer-term inflation expectations have remained well-anchored at the mid-point of the Reserve Bank's target range (figure 7). This is despite low headline inflation that has pulled down short-term inflation expectations, and some evidence that inflation expectations respond to past inflation outcomes more than before the GFC (ie, they have become more adaptive and less forward-looking).5

Figure 7: Inflation Expectations Curve (annual, by number of years)6

Source: RBNZ.

3. Prospects for Continued Economic Expansion

In the absence of major unanticipated shocks, prospects look good for continued strong growth over the next 18 months, driven by construction spending, continued migration, tourist flows, and accommodative monetary policy. Our November 2016 MPS forecasts show annual real GDP growth of around 3¾ percent over the next 18 months, with inflation approaching the mid-point of the target band, the unemployment rate continuing to decline, and the current account deficit remaining within manageable levels.

Historically, expansions in small open advanced economies come to an end due to one or more factors:

- global economic growth weakens or slows in major trading partners and affects the terms of trade and export growth;

- a major domestic policy correction is needed to address a deteriorating fiscal or current account deficit;

- long-term interest rates rise significantly in response to offshore movements triggered by higher inflation expectations and/or increased risk premia in major economies. Alternatively, domestic short-term rates may need to rise sharply to moderate inflation pressures associated with growing supply and demand imbalances.

The main risks to the current expansion lie with future developments in the global economy, and a deterioration in the imbalances in the domestic housing market.

i) Global risks

On the downside, the main risks are:

- the Euro-area economy remains subdued or deteriorates, with consumer and business confidence affected by developments relating to Brexit, migration and anti-globalisation sentiment;

- the incoming US Administration follows through on pre-election rhetoric relating to trade barriers, and abandons or renegotiates existing trade agreements;

- economic growth in China slows following a period of financial disruption linked to the very rapid build-up in corporate (mainly SOE) debt over the past 7 years, and a rising level of bad debts in the formal and shadow banking sectors.

The main upside risk is that the US economy in 2017 grows more rapidly than the 2 - 2¼ percent growth currently projected by the IMF, OECD and BIS, due to substantial personal and corporate tax cuts and a large increase in infrastructure spending (with no major moves to raise trade barriers).

ii) Risks in the domestic housing market

Numerous measures indicate that New Zealand house prices are significantly inflated relative to usual valuation indicators.

IMF data show that New Zealand had the third highest real increase in house prices among 64 countries in the year to June 2016.7 New Zealand also had the greatest deterioration in the median house price to median income ratio of 31 advanced countries in the period 2010 to mid-2016.8 OECD data indicates that, relative to their long-term averages, New Zealand has the highest house-price-to-rent ratio, and the second highest house-price-to-income ratio among the OECD economies.9

Several cross-country studies have assessed the economic implications of housing market downturns. This research tends to show that almost half of the housing booms end in a bust, with downturns lasting around four to six years10. In addition, soft landings in the residential investment cycle are rare, with most collapses leading to protracted falls in private consumption and investment, especially construction investment.11

Even though it is too early to be sure, there are some indications that house price inflation in Auckland and other regions may be moderating. This may be a result of the increase in loan-to-value restrictions, higher funding costs being experienced by banks, and tighter credit criteria being applied by banks in connection with financing apartment development and house purchases by offshore residents.

4. Monetary Policy Considerations

We enter 2017 with considerable political and economic uncertainties. These include: the policies of the incoming US Administration - particularly in regard to fiscal policy and trade policy; the UK Government's strategy in triggering Article 50 and how the European Community will respond; the build-up of corporate debt and rising bad debts in the Chinese banking system; the nature of the future political and economic relationships between the US, China, Japan and Russia; and the possible outcome of important upcoming elections in Western Europe. Central banks monitor these developments carefully, and their impact on business and consumer sentiment and asset prices.

New Zealand's economy has been growing faster than potential output for five years, and the Bank's forecasts suggest that we now have a small positive output gap. Long-term inflation expectations remain well-anchored at around 2 percent and short-term inflation expectations have been rising slowly. The low point for CPI inflation has probably passed and, supported by the improvement in global commodity prices in recent months, we expect the December quarter 2016 CPI data to confirm that annual CPI inflation is moving back within the 1 to 3 percent target band.

The central interest rate projections contained in the November Monetary Policy Statement (MPS) indicated that the OCR is likely to remain at its current level for some time. These projections are highly conditional and based on a range of key assumptions that relate to: trading partner GDP growth and inflation; developments in oil and dairy prices; exchange rate adjustment; migration and house price inflation; and judgements as to how the latter two factors might affect spending and CPI inflation. Different outcomes from those assumed in the MPS could imply a different policy path. In the MPS we assessed the overall balance of risks to be on the downside.

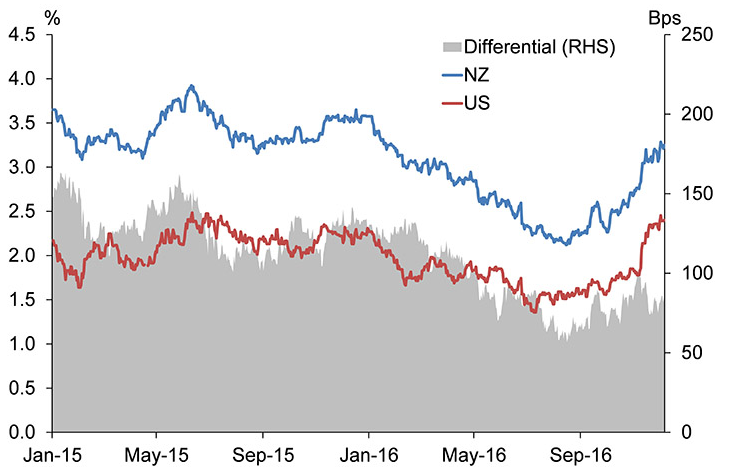

Since the US election there have been important global and domestic developments. Ten-year bond yields in the US have risen by 50 basis points and the US real effective exchange rate has appreciated by almost 5 percent and reached a 14-year high as financial markets assess the implications of a possible large fiscal stimulus for economic growth, inflation and the level of outstanding US government debt. Ten-year government bond yields have increased by 40 basis points in New Zealand (figure 8).

Figure 8: 10 Year Government bond yields

Source: Bloomberg, RBNZ.

The factors behind the rise in US rates have increased market expectations that the Federal Reserve will raise policy rates at its meeting on 13-14 December 2016, and tighten more rapidly in 2017.

Prospects of stronger growth in the US and the resulting spillovers through trade, commodity prices and relative exchange rate movements should be positive for New Zealand and a welcome development from a monetary policy perspective. However, while the 5 percent appreciation in the US dollar in recent weeks is helpful for New Zealand exporters, the TWI currently lies above its level in June 2015, despite the terms of trade being 6 percent lower and seven reductions in the OCR.

As has been the case in several other countries, monetary policy has been made more challenging in New Zealand by low global inflation and zero or negative policy rates in several major economies. This has put downward pressure on our interest rate structure and contributed to asset price inflation and upward pressure on the New Zealand dollar. This trend may finally be turning.

Another major change is the 7.8 strength Kaikoura earthquake. Early indicators are that reconstruction work, including by government, could be in the order of $3 - $8 billion, or around 1-3 percent of GDP. This is much smaller than the $40 billion associated with Canterbury reconstruction, and would occur at a time when the domestic economy is at or near full capacity. The supply disruptions are unlikely to have a major impact on overall economic growth. Some increase in construction cost inflation is likely as this is already running at 7.9 percent in Auckland and 6.3 percent nationally due to capacity bottlenecks within the sector. Increases in freight costs are also expected.

At this stage these developments do not cause us to change our view on the direction of monetary policy as outlined in the November MPS. We expect monetary policy to continue to be accommodative, and that the projected policy settings will help generate sufficient growth to have inflation settle near the middle of the target range.

5. Conclusion

Expansions in small open advanced economies often come to an end because of developments in the global economy that are transmitted through the terms of trade, long-term interest rates and the exchange rate.

At this stage, the prospects for a continuation of New Zealand's economic expansion with above-trend growth, strong employment and rising inflationary pressures look promising. The main domestic risk (and one that could be triggered by developments offshore) is a significant correction in the housing market. At this stage, however, the greatest threat to the expansion lies in possible international political and economic developments and their implications for the global trading environment.

1 Furman, J (2015) 'Productivity Growth in the Advanced Economies: The Past, the Present, and Lessons for the Future'. Remarks delivered to the Peterson Institute of International Economies, July 9, 2015.

2 Vehbi, T (2016) 'The macroeconomic impact of the age composition of migration', RBNZ analytical note, AN2016/03.

3 Armstrong, J and McDonald, C (2016) 'Why the drivers of migration matter for the labour market'. RBNZ analytical note AN2016/02.

4 Bascand, G (2016) 'Changing Dynamics in Household Behaviour: What do they mean for Inflationary Pressures?' Sir Leslie Melville Lecture: A speech delivered to Australian National University in Canberra, Australia, 22 November, 2016.

5 Karagediki, O and McDermott J (2016) Inflation expectations and low inflation in New Zealand', RBNZ discussion paper, DP 2016/09.

6 Lewis, M (2016) 'Inflation Expectations Curve: a tool for monitoring inflation expectations', RBNZ analytical note, AN2016/01.

7 IMF, November 2016 'Global Housing Watch'.

8 IMF, November 2016 'Global Housing Watch'.

9 OECD, 2016 'Focus on House Prices', and Global Economic Outlook, June 2016.

10 Bordo, M and Jeanne, O (2002) 'Monetary Policy and Asset Prices : Does Benign Neglect make Sense', IMF working paper WP/02/223, IMF World Economic Outlook 2003.

11 Reinhart, C and Rogoff, K (2008) 'This Time is Different - Eight Centuries of Financial Folly' (Princeton University Press). IMF World Economic Outlook 2003.