Mojmír Hampl: Monetary policy and the current macroeconomic environment in the developed world

Speech by Mr Mojmír Hampl, Vice Governor of the Czech National Bank, at the Deutsche Bank Prague Client Conference, Prague, 25 October 2016.

The views expressed in this speech are those of the speaker and not the view of the BIS.

Ladies and gentlemen,

Good afternoon. Thank you very much for inviting me again to your flagship event. It is my utmost pleasure to be here. Actually, this is the third time in a row I have had the chance to speak here.

In 2014 my topic was, quite expectedly, the exchange rate commitment and its introduction in November 2013. I recently looked at my slides from 2014, and I would not change anything about them. Only the timing of the exit has changed - quite radically, I have to admit.

The following year, 2015, the obvious topic was a comparison of the Czech and Swiss cases. This was especially interesting given the abrupt and completely surprising Swiss exit from their exchange rate commitment in January 2015.

I thought to myself: "What would be a natural candidate for this year?" I put my mind to work and suddenly a topic appeared: our own Czech exit, our own way of abandoning the exchange rate commitment, which is almost three years old now.

However, I somehow feel that the exit will be a key topic for your questions and comments. So, I eventually decided to speak about something else, something more abstract and may be a bit more general: the constraints on monetary policy in the developed world. As I see the Czech Republic a part of the developed world, I believe this is a topic that is relevant to the Czech National Bank.

The key constraint or dilemma - or even puzzle, if you will - for us in the central banking community has been one key real variable which we believe is beyond the reach of central bankers. That variable is the real equilibrium, or natural, interest rate.

We believe that this variable is absolutely key for the economy and that it is exogenous (i.e. not in hands of anybody, or at least not central bankers). At the same time, it critically influences both the financial sector and the real economy.

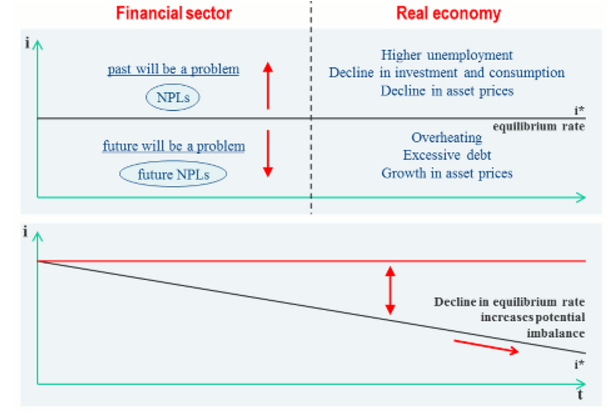

I have tried to depict what I want to say on this very stylised chart (Chart 1).

Chart 1: The role of the equilibrium interest rate

It basically shows that if you have got the natural real equilibrium interest rate at a certain level - and, of course, it is not directly observable, we can only estimate it, like the output gap, for instance - monetary policy must take this variable into account and must in fact respect it. Given the inflation outlook, the movements of nominal interest rates or policy rates should, in an ideal world, imitate those of the equilibrium rate. Or at least they should not deviate much from equilibrium.

Why? Because this interest rate interconnects the future, the present and the past. It puts all three into equilibrium, in terms of savings and investment, current and future labour employed, current and future preferred leisure, etc.

If monetary policy does not in broad terms "respect" the evolution of the real interest rate, it can create imbalances one way or the other.

If you go too high above the real interest rate and the actual real interest rate is above the natural one, you create recessions, unemployment, falling investment and declining asset prices. And if you go lower or substantially below the equilibrium interest rate, you create overheating, excessive debt and rapidly increasing asset prices.

Even more importantly, moving the statutory interest rate has fundamental effects on the financial sector. The financial sector is a time-transforming sector - every second, it transforms the present into the future (short-term liabilities into long-term assets - typically done by banks) or vice versa (long-term liabilities into short-term assets - typically done by insurance or pension companies). Whenever you take the policy rate above the equilibrium interest rate, you create a problem out of what happened in the financial sector in the past. Whenever you go substantially below, you create problems in the future.

I have chosen non-performing loans as an example that is, I believe, quite easy to understand. If you substantially increase rates now, many projects from the past become unviable and non-performing. If you go substantially below, many of the currently new projects will become unviable in the future when rates return to equilibrium.

In other words, the financial sector as a time-transforming sector is especially sensitive to the movement of real rates and to discrepancies between the actual real rate and the natural rate.

To make all this even more complicated, try to imagine that the equilibrium or natural real rate of interest is not constant, but is itself moving in one direction. Then, as a central banker, you have to go down even more than you thought conceivable.

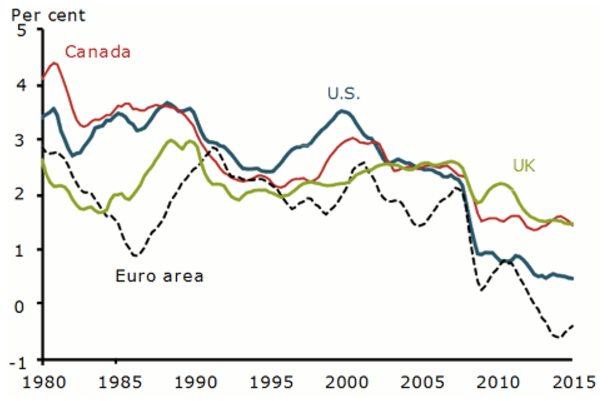

This is exactly what we believe has been happening in the developed world for quite some time now (Chart 2). Here are some famous estimates made by John Williams at the San Francisco Fed, but you can find similar estimates elsewhere.

Chart 2: Real equilibrium rates in the developed world have been falling steadily (Holston et al., 2016)

Why is that? Nobody knows for sure. But I tend to explain it using a famous quote from the French poet Paul Valéry - "The future is not what it used to be". Probably due to factors such as demography, we are tending to look differently at the future. We have a different "discount factor", if you will, which is leading us on average to prefer future consumption to current consumption (on average, of course, not individually).

This basically changes everything for monetary policy, which is a policy based on the relationship between real interest rates and demand.

Once central banks in the developed world hit the zero lower bound on nominal statutory interest rates, they tried - and have been trying ever since - to respond to this perceived or detected decline in the natural interest rate by doing other things, such as QE, forward guidance and exchange rate commitments. Some have even tried negative nominal interest rates.

If this whole story is realistic, and central bankers tend to believe it is, what they did - or have been doing - is nothing other than keeping their economies in equilibrium by other means. This might have side-effects, of course, and there are trade-offs, but the main story is this.

In broader terms, it is still a fight to keep the value of money stable, but this time around not by fighting inflation, but by combating the deflationary tendencies stemming from weak current demand, as demand is tending to move further and further into the future - which is just another way of expressing the decline in the equilibrium natural interest rate.

Let me make a small detour to the financial sector. Many are arguing that low nominal interest rates are killing the financial sector and are calling for higher rates as soon as possible. But if this model is right, higher rates would not help either, as rates substantially above equilibrium would mean that demand for loans from banks would decline sharply and the riskiness of future projects would increase, and even currently viable projects might turn into unviable, non-performing ones.

But let's go back. What is a real problem, and take it as a criticism of our own club, is that we are unable to explain this story, this narrative. I have long pondered why this is the case. Recently, I caught a glimpse of an answer in the work of the young German economist Benjamin Braun. Like him, I feel that people have simply stopped understanding us. After 2008 we started to tell a different "monetary story" - a different narrative about money and central banks - to the one people were used to. Public confidence in the monetary system was and is grounded in the previous narrative, which in turn is based on three building blocks. One, the central bank is the sole creator of money and thus has perfect control over the quantity of money; money is therefore exogenous, to use the language of economics. Two, commercial banks do not create money but merely convert existing deposits passively into loans. And three, the lower the growth in the price level, the better. This narrative, which some would term imprecisely "monetarist", did a very good job of reconciling public preferences and central bank decisions when bankers were fighting inflation and subsequently working successfully to stabilise it, i.e. generally before 2008.

Unfortunately, though, this simplified story stopped working as a bridge between the public and central banks when central bankers started to combat weak demand and the risk of deflation. It is hard for us to explain that the building blocks of our former widely communicated narrative are not working in practice. In fact, they never did work. They were merely part of a myth that no one wanted to bust for fear of throwing a spanner in the works. In a fractional reserve system, commercial banks - not just the central bank - create a large part of the money in circulation. Commercial banks therefore do not merely convert loanable funds passively into loans, but in reality create new deposits. The central bank does not and cannot have full control over the quantity of money in the system. That quantity varies. Indeed, it has to vary if the purchasing power of money is to be kept broadly constant over the cycle.

What is more, deep an persistent deflation is just as disruptive to the economy as high inflation, often even more so. All this is undermining the previous widely communicated story of "good money" and giving rise to a growing lack of understanding and a widening communication gap between bankers and the public. Most of all, they are stoking fears of a fall in the purchasing power of money, paradoxically at a time when inflation (the key measure of the purchasing power) in developed countries is lower on average than it has been for years!

Put simply, we have been warning about the risk of flooding for so long that we are now unable to explain that drought can be just as big a problem and that at times of drought you have to water the garden, not keep draining it dry. If the hosepipes are blocked, moreover, you have to use other means to supply the plants with water.

If we do not succeed here, we central bankers will have great difficulty being credible in the future.

Literature:

Holston, K., Laubach, T., & Williams, John C. (2016): "Measuring the natural rate of interest: International trends and determinants," Working Paper Series 2016-11, Federal Reserve Bank of San Francisco.