Launch of the first US bitcoin ETF: mechanics, impact, and risks

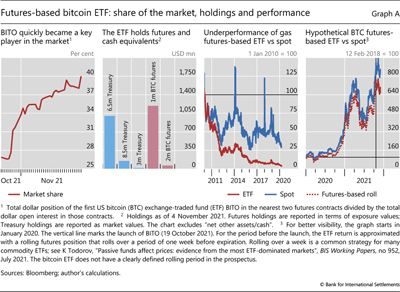

The first US bitcoin (BTC) exchange-traded fund (ETF), "BITO", started trading on 19 October 2021. The fund debuted as one of the most heavily traded ETFs in market history, attracting more than $1 billion in assets in the first few days. Subsequently, the ETF accumulated a significant share of all short-term bitcoin futures contracts, reaching about one third of the underlying futures market just 10 days after its launch (Graph A, first panel). This box explains how the futures-based structure of BITO differs from that of more traditional, non-futures-based equity ETFs and analyses the possible implications for prices and risks.

- Related Special Feature: Pandemic twist and inflation challenge markets

Background

So far, the Securities and Exchange Commission (SEC) has delayed or declined applications to launch an ETF investing directly in bitcoin, due mainly to concerns that the asset is predominantly traded on non-regulated exchanges.  BITO is the first SEC-approved bitcoin ETF, largely because the fund is based on futures contracts that are traded on the regulated Chicago Mercantile Exchange (CME).

BITO is the first SEC-approved bitcoin ETF, largely because the fund is based on futures contracts that are traded on the regulated Chicago Mercantile Exchange (CME).

A futures contract is a legal agreement to buy or sell a particular asset at a predetermined price at a specified time in the future. Such a contract allows investors to take positions without holding the underlying asset. Since holding that asset gives rise to cost of carry – which may be positive in the presence of storage costs or negative due to a convenience yield – the futures price is typically different from the asset's spot price. In the particular case of BITO, the asset is bitcoin and the cost of carry tends to be positive,  thus implying that the futures price is generally above the spot price, and that the futures curve tends to be upward-sloping (long-term futures contracts are more expensive than short-term ones).

thus implying that the futures price is generally above the spot price, and that the futures curve tends to be upward-sloping (long-term futures contracts are more expensive than short-term ones).

How it works

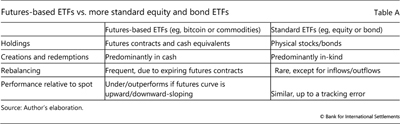

To obtain bitcoin exposure, BITO enters into long positions in near-term (one-month) CME bitcoin futures contracts. As the contracts near expiration, the fund gradually sells them and buys longer-dated contracts – a strategy called "roll". In addition, BITO holds a liquid pool of cash or cash equivalents, such as Treasury bills (Graph A, second panel). When the bitcoin price goes up, BITO uses the gains from the futures contract to expand its liquid pool. Conversely, when the bitcoin price goes down, BITO uses some of its liquidity to pay for the losses on the futures contract. This structure is different from that of traditional bond or equity ETFs, which simply hold bonds and stocks, but is similar to the way commodity or VIX ETFs are structured (Table A).

The rebalancing strategy of BITO can erode performance over time in a similar way to that seen in other commodity futures-based ETFs. Facing an upward-sloping futures curve, BITO pays "roll costs" when it rebalances its positions by selling expiring short-term contracts to buy long-term ones. Commodity futures-based ETFs provide examples of substantial cumulative erosion due to an upward-sloping futures curve (Graph A, third panel). Likewise, had it been launched in 2018, BITO would have underperformed spot prices by about 18% on a cumulative basis over the following four years to date (fourth panel).

Impact on prices and risks

In general, a futures-based ETF is likely to affect prices in two main ways. The first effect works through flow rebalancing: when an ETF buys futures contracts in response to inflows, it pushes futures prices up, and vice versa for outflows. The second effect works through calendar rebalancing: as the ETF gradually sells futures contracts before expiration, their prices fall. At the same time, as the ETF buys longer-dated futures contracts, their prices increase.  The predictable rebalancing behaviour of the ETF may also give rise to "front-running" incentives, motivating investors to purchase longer-dated bitcoin futures in anticipation of the ETF rolling into those contracts. The price impact in the futures market can also spill over to spot prices through investors' hedging behaviour, especially for assets with physical settlements of the futures contract and large storage costs. A prominent example is the drop of oil spot prices into negative territory in April 2020, when futures-based ETFs probably contributed to the increase in storage costs and the subsequent decline in spot prices.

The predictable rebalancing behaviour of the ETF may also give rise to "front-running" incentives, motivating investors to purchase longer-dated bitcoin futures in anticipation of the ETF rolling into those contracts. The price impact in the futures market can also spill over to spot prices through investors' hedging behaviour, especially for assets with physical settlements of the futures contract and large storage costs. A prominent example is the drop of oil spot prices into negative territory in April 2020, when futures-based ETFs probably contributed to the increase in storage costs and the subsequent decline in spot prices.

The bitcoin ETF may amplify volatility in prices and create risks for investors if the fund is a large share of the futures market. Experience suggests that futures-based ETFs can exacerbate price movements and create additional volatility when they have a large footprint in the underlying asset. For example, heavy ETF-induced trading unsettled VIX futures prices and contributed to the spike in VIX in February 2018. This led to investor losses and subsequent delisting of the largest inverse VIX ETF. The trading by BITO could also spill over to fixed income markets through its holdings of cash equivalents. If the ETF were to liquidate these instruments in response to bitcoin depreciation or excessive outflows, that could put pressure on bond markets. At present, BITO is unlikely to cause such disruptions, as it holds mostly highly liquid short-term Treasuries and it is small relative to the market for these instruments.

This led to investor losses and subsequent delisting of the largest inverse VIX ETF. The trading by BITO could also spill over to fixed income markets through its holdings of cash equivalents. If the ETF were to liquidate these instruments in response to bitcoin depreciation or excessive outflows, that could put pressure on bond markets. At present, BITO is unlikely to cause such disruptions, as it holds mostly highly liquid short-term Treasuries and it is small relative to the market for these instruments.

The views expressed are those of the author and do not necessarily reflect the views of the BIS. The author thanks Claudio Borio, Stijn Claessens and Nikola Tarashev for valuable comments.

The views expressed are those of the author and do not necessarily reflect the views of the BIS. The author thanks Claudio Borio, Stijn Claessens and Nikola Tarashev for valuable comments.  Spot-based bitcoin ETFs predated BITO in several non-US jurisdictions, including Canada and some European countries.

Spot-based bitcoin ETFs predated BITO in several non-US jurisdictions, including Canada and some European countries.  This is presumably due to a negative convenience yield, related to demand from investors using futures to lever up.

This is presumably due to a negative convenience yield, related to demand from investors using futures to lever up.  See K Todorov, "Passive funds affect prices: evidence from the most ETF-dominated markets", BIS Working Papers, no 952, July 2021.

See K Todorov, "Passive funds affect prices: evidence from the most ETF-dominated markets", BIS Working Papers, no 952, July 2021.  See S Aramonte and K Todorov, "Futures-based commodity ETFs when storage is constrained", BIS Bulletin, no 41, April 2021.

See S Aramonte and K Todorov, "Futures-based commodity ETFs when storage is constrained", BIS Bulletin, no 41, April 2021.