Sustainable finance: trends, valuations and exposures

Demand for investment products classified as delivering environmental, social and governance (ESG) benefits is booming. The growth of the overall ESG market rides mostly on investors' focus on environmental considerations, particularly in fixed income markets. Both the general public and policymakers have encouraged market participants to support the transition to a low-carbon economy. At the same time, given the very fast growth of the new asset class, there are questions about the possibility that a bubble might develop unless market transparency can be ensured.

Both the general public and policymakers have encouraged market participants to support the transition to a low-carbon economy. At the same time, given the very fast growth of the new asset class, there are questions about the possibility that a bubble might develop unless market transparency can be ensured. Could a fundamentally welcome development – helping to finance the transition to a low-carbon world – generate significant financial imbalances? This box documents the pace of growth of ESG assets over recent years, considers their valuations, provides some indications of the size of investors' exposures, and sketches policy considerations relevant for the nascent regulatory framework.

Could a fundamentally welcome development – helping to finance the transition to a low-carbon world – generate significant financial imbalances? This box documents the pace of growth of ESG assets over recent years, considers their valuations, provides some indications of the size of investors' exposures, and sketches policy considerations relevant for the nascent regulatory framework.

While growth in ESG assets shows no signs of abating, lack of standardisation and the ensuing classification issues make it difficult to pin down precise amounts. One set of industry estimates relies on a broad definition that includes various approaches to integrating ESG criteria as well as "thematic", "impact" and "community" investing.

One set of industry estimates relies on a broad definition that includes various approaches to integrating ESG criteria as well as "thematic", "impact" and "community" investing. On this basis, some estimates indicate that ESG assets rose by nearly one third between 2016 and 2020 to $35 trillion, or no less than 36% of total professionally managed assets.

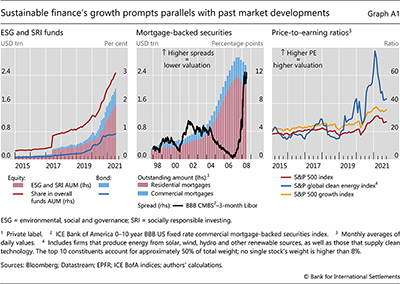

On this basis, some estimates indicate that ESG assets rose by nearly one third between 2016 and 2020 to $35 trillion, or no less than 36% of total professionally managed assets. Another set of estimates – based on a narrower definition and including only mutual funds and exchange-traded funds (ETFs) that self-report as having ESG or socially responsible investment (SRI) mandates – shows even faster growth but at lower levels (Graph A1, left-hand panel). The assets managed by these funds have soared over the past five years, more than tenfold, and now stand at approximately $2 trillion. ESG/SRI equity funds account for about 3% of total mutual fund and ETF assets under management, and ESG/SRI bond funds for about 1%.

Another set of estimates – based on a narrower definition and including only mutual funds and exchange-traded funds (ETFs) that self-report as having ESG or socially responsible investment (SRI) mandates – shows even faster growth but at lower levels (Graph A1, left-hand panel). The assets managed by these funds have soared over the past five years, more than tenfold, and now stand at approximately $2 trillion. ESG/SRI equity funds account for about 3% of total mutual fund and ETF assets under management, and ESG/SRI bond funds for about 1%.

Limited disclosure requirements result in an incomplete picture of which investors hold ESG assets, especially equity instruments. Current holdings of bonds with proceeds earmarked for environmental or social projects (ie bonds labelled as green, social or sustainable according to the International Capital Markets Association criteria) seem to amount to a small share of key financial intermediaries' balance sheets. They represent only about 1% of total bond portfolios for both US insurance companies and European banks (ECB, 2020). US pension funds stand out, with green bond holdings growing rapidly since 2017 and comprising about 4% of their current corporate credit exposure. By contrast, survey evidence indicates that these shares could be lower for hedge funds, as they lag behind other institutional investors in integrating ESG principles into their investment process.

US pension funds stand out, with green bond holdings growing rapidly since 2017 and comprising about 4% of their current corporate credit exposure. By contrast, survey evidence indicates that these shares could be lower for hedge funds, as they lag behind other institutional investors in integrating ESG principles into their investment process. That said, bond holdings underestimate ultimate exposures, which would include stocks and other asset classes such as private equity, where ESG considerations are also increasingly relevant.

That said, bond holdings underestimate ultimate exposures, which would include stocks and other asset classes such as private equity, where ESG considerations are also increasingly relevant.

Historical lessons from the investment volume and price dynamics in rapidly growing asset classes could be relevant for ESG securities. Assets related to fundamental economic and social changes tend to undergo large price corrections after an initial investment boom. Railroad stocks in the mid-1800s, internet stocks during the dotcom bubble and mortgage-backed securities (MBS) in the Great Financial Crisis (GFC) are cases in point. It is thus noteworthy that the pre-GFC growth and size of the private label MBS market are comparable with those recently observed for ESG mutual funds and ETFs Graph A1, centre vs left-hand panel).

There are signs that ESG assets' valuations may be stretched, although the available evidence stems from segments that are of indirect concern from a financial stability perspective. Even after a decline from their peak in January 2021, price-to-earnings ratios for clean energy companies are still well above those of already richly valued growth stocks (Graph A1, right-hand panel). Rich valuations in credit markets would be more relevant for assessing possible risks of financial distress, given the potential for defaults. More analysis would be needed to evaluate this possibility, including by estimating the size of any "greenium" or "socium" – ie the lower premium that market participants require for bearing financial risk when their investments support environmental or social causes – as it could signal market overheating.

These considerations suggest that it is worth closely monitoring developments in the ESG market. If the market continues to grow at the current pace, and more elaborate instruments emerge (eg structured products), it will be important not only to assess the benefits of financing the transition to a low-carbon world, but also to identify and manage the financial risks that might arise from a shift in investors' portfolios. The widespread search for yield that has been under way in financial markets adds to the usefulness of such an exercise. Proceeding in this direction would involve the collection of adequate data on holders and exposures, with special attention to those that are leveraged and may reside in the less transparent segments of the financial system. In turn, all this puts a premium on adequate disclosure and reporting arrangements, including more reliable taxonomies.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  IMF, "Sustainable finance", Global Financial Stability Report, October 2019.

IMF, "Sustainable finance", Global Financial Stability Report, October 2019.  A Carstens, "Transparency and market integrity in green finance", speech at the 2021 BIS Green Swan Conference, 2 June 2021.

A Carstens, "Transparency and market integrity in green finance", speech at the 2021 BIS Green Swan Conference, 2 June 2021.  F Berg, J Florian and R Rigobon, "Aggregate confusion: the divergence of ESG ratings", MIT Sloan Working Paper, 2020.

F Berg, J Florian and R Rigobon, "Aggregate confusion: the divergence of ESG ratings", MIT Sloan Working Paper, 2020. According to the Global Sustainable Investment Alliance (GSIA), thematic investing seeks exposure to sectors which will benefit from a greater focus on sustainability, such as efficient transportation. Impact investing finances specific projects that target environmental and/or social impacts. Community investing directs capital to traditionally underserved individuals or communities. See GSIA, Global Sustainable Investment Review 2020, 2021.

According to the Global Sustainable Investment Alliance (GSIA), thematic investing seeks exposure to sectors which will benefit from a greater focus on sustainability, such as efficient transportation. Impact investing finances specific projects that target environmental and/or social impacts. Community investing directs capital to traditionally underserved individuals or communities. See GSIA, Global Sustainable Investment Review 2020, 2021.  GSIA, ibid.

GSIA, ibid.  We use the BIS Sustainable Bonds Database to identify the green, social and sustainable bonds that are in the Refinitiv eMaxx database and are held by US insurance companies and corporate pension funds. Around 90% of these are green bonds. Data on euro area banks are from M Belloni, M Giuzio, S Kördel, P Radulova, D Salakhova and F Wicknig, "The performance and resilience of green finance instruments: ESG funds and green bonds", ECB Financial Stability Review, November 2020.

We use the BIS Sustainable Bonds Database to identify the green, social and sustainable bonds that are in the Refinitiv eMaxx database and are held by US insurance companies and corporate pension funds. Around 90% of these are green bonds. Data on euro area banks are from M Belloni, M Giuzio, S Kördel, P Radulova, D Salakhova and F Wicknig, "The performance and resilience of green finance instruments: ESG funds and green bonds", ECB Financial Stability Review, November 2020.  bfinance, ESG asset owner survey: how are investors changing?, February 2021.

bfinance, ESG asset owner survey: how are investors changing?, February 2021.  For a discussion and references, see D Larcker and E Watts, "Where's the greenium?", Journal of Accounting and Economics, vol 69, issues 2–3, 2020. For the greenium on German green bonds, see L Pastor, R Stambaugh and L Taylor, "Dissecting green returns", CEPR Discussion Paper, no 16260, 2021.

For a discussion and references, see D Larcker and E Watts, "Where's the greenium?", Journal of Accounting and Economics, vol 69, issues 2–3, 2020. For the greenium on German green bonds, see L Pastor, R Stambaugh and L Taylor, "Dissecting green returns", CEPR Discussion Paper, no 16260, 2021.