Dollar funding of non-US banks through Covid-19

Non-US banks' on-balance sheet dollar liabilities rose in 2020 despite the decline in funding from US and offshore money market funds (MMFs). Other non-bank financial institutions were behind this increase, as they drove the strong rise in deposits booked inside and outside the United States. Non-US banks' issuance of international debt securities in US dollars remained resilient in 2020. Additionally, the currency composition of banks' total bond issuance tilted towards the dollar after March. Overall, our findings point to changes in funding relationships that could have long-lasting effects on the functioning of dollar funding markets.1

JEL classification: G15, F30, G21.

The "dash for cash" episode during the height of the Covid-19 crisis in March led to severe strains in dollar funding markets (FSB (2020), BIS (2020)). A prompt and forceful policy response by central banks through emergency lending programmes and central bank swap lines averted a dollar funding crisis (Cetorelli et al (2020)). Subsequent developments indicate that this episode triggered large shifts in how non-US banks source funding in US dollars.2

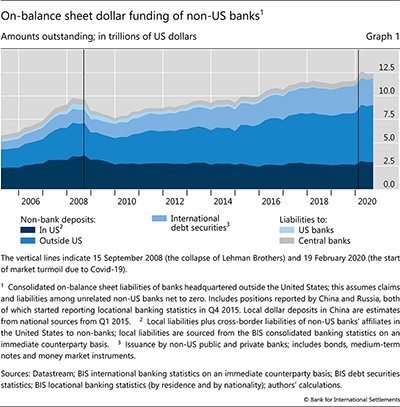

On-balance sheet dollar liabilities of non-US banks reached record levels over the first three quarters of 2020.3 At end-Q3 2020, they stood at $12.4 trillion – $800 billion above their pre-pandemic level at end-2019. This is in contrast with the Great Financial Crisis (GFC), when these liabilities declined substantially and in a sustained manner. To show the sectors and instruments that drove these headline numbers, this article combines the BIS banking and international debt securities statistics, money market funds' (MMFs) portfolio holdings, bank balance sheet data and central counterparty (CCP) disclosures.

Key takeaways

- Non-US banks' sources of US dollar funding shifted from US and offshore money market funds (MMFs) to other non-bank financial institutions during 2020.

- Funding from MMFs did not recover between March and December 2020, with Japanese and Canadian banks – the largest recipients before the crisis – experiencing the biggest declines.

- International debt securities issuance in US dollars remained resilient and banks increased the share of dollar-denominated bond issuance after the March 2020 market turmoil.

The rest of the article is organised as follows. We first provide a bird's eye view of the evolution of non-US banks' on-balance sheet dollar liabilities over 2020. We then zoom in on three key segments of dollar funding: (i) that provided by MMFs, both in the United States and offshore; (ii) deposits by non-banks, with a focus on the booking location and the sector of the funding provider; and (iii) dollar debt securities issuance, relative to issuance in other currencies. Two boxes document emerging developments since the pandemic: one on the balance sheets of the US affiliates of non-US banks, and another on CCPs' dollar deposits at banks.

On-balance sheet dollar liabilities of non-US banks

Non-US banks' dollar liabilities grew substantially in 2020.4 At end-Q3 2020, they stood comfortably above their pre-pandemic level (Graph 1). Deposits booked inside and outside the United States5 – which as of end-Q3 2020 accounted for 24% and 49% of dollar liabilities, respectively – explained most of the rise in 2020. Debt securities issuance, which also made up a significant share (23%), remained largely unchanged in 2020.

To better understand the terms and stability of funding, we leverage detailed information about funding providers and instruments. BIS banking and international debt securities statistics give a high-level overview and offer splits by instrument and by sector. In addition, wherever possible, we refine our analysis using detailed MMF portfolio holding data and individual bond issuance data. These are contained in the aggregate figures reported in Graph 1. For example, MMF funding through repos and certificates of deposit is part of non-bank deposits in the BIS locational banking statistics. In turn, MMF funding through commercial paper and bond issuance enter the BIS debt securities statistics.

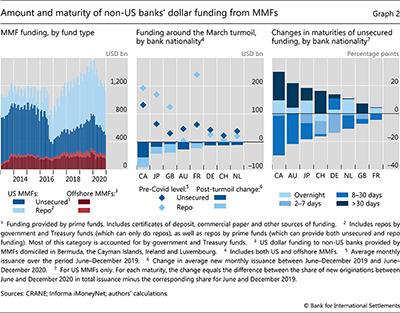

The decline in MMF funding

The March turmoil illustrated once again that MMFs are an important, yet flighty, dollar funding source. Non-US banks lost a substantial amount ($300 billion) of MMF dollar funding between end-2019 and end-2020 (Graph 2, left-hand panel).6 Around 85% of the decline was unsecured funding, booked either inside or outside the United States.7 The contraction was particularly intense during the "dash for cash" episode in February and March 2020, when MMFs reduced their dollar funding by around $207 billion – close to 2% of non-US banks' aggregate on-balance sheet dollar funding. MMF funding did not recover even as market conditions normalised.

Some national banking systems lost more funding than others. Unsecured funding contracted the most for Canadian, Japanese and Australian banks (Graph 2, centre panel, dark blue bars), all of which were among the largest recipients going into the pandemic (dark blue diamonds). In contrast, French banks faced only a limited decline. While their repo borrowing declined somewhat, they remained the largest repo counterparties to MMFs among non-US banks (light blue diamonds).

The maturity structure of funding by US MMFs changed both during the March turmoil and later in 2020. At the peak of the market turmoil, the reduction in the volume of this funding went hand in hand with a maturity shortening (Eren, Schrimpf and Sushko (2020), Avalos and Xia (2021)). In the second half of 2020, banks were able to lengthen the maturity of some of the funding they obtained from US MMFs (Graph 2, right-hand panel, dark blue bars). Notably, however, the share of more flighty overnight unsecured borrowing also increased for many banks (light blue bars).

Non-bank deposits inside and outside the United States

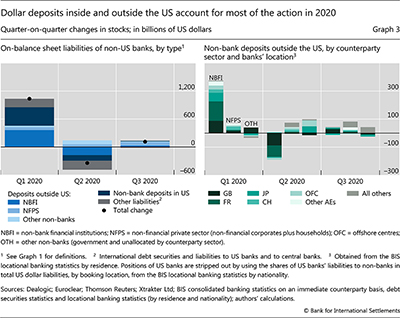

Even as MMFs retrenched, other non-banks increased their dollar deposits, driving the rise in non-US banks' dollar liabilities over the first three quarters of 2020. At $1 trillion, this rise was particularly stark in the first quarter (Graph 3, left-hand panel).

The sizeable growth in deposit funding could reflect the drawdown of committed credit lines, which mechanically leads to a grossing-up of balance sheets (Acharya and Steffen (2020)). In Box A, we estimate that credit line drawdowns accounted for 53% of the increase in loans granted by the US affiliates of non-US banks in Q1 2020. Such drawdowns are unlikely to lead to structural changes in funding for banks, as balance sheets contract when these loans are repaid. Indeed, as the extraordinary turbulence abated, the second quarter saw a partial reversal – indicating net credit repayment – and changes in the third quarter remained small (Graph 3, left-hand panel).

The increase in deposits could also stem from MMFs being replaced by other non-banks as dollar funding providers.8 Because of data limitations, very little is known about these changes to dollar funding relationships and the attendant impact on the funding's maturity structure. That said, post-GFC regulatory reforms increased the transparency of one type of non-bank – CCPs. In Box B, we document that US and non-US CCPs' dollar deposits responded differently to the stress episode.9

Further reading

The bulk of non-bank deposits were booked in a handful of advanced economies. Non-banks placed about $400 billion and $450 billion in non-US banks' affiliates inside and outside the United States, respectively. Banks located in France, the United Kingdom and Japan obtained much of the latter amount, despite reversals during the period (Graph 3, right-hand panel). The majority of this funding – which expanded sharply in Q1 and shrank in Q2 – was provided by non-bank financial institutions (NBFIs). In contrast, deposits by the non-financial private sector (NFPS) (ie corporates and households) were more evenly distributed across booking locations and, most importantly, did not exhibit the ups and downs observed for NBFI deposits.

Box A

US branches and subsidiaries of non-US banks and the Covid-19 shock

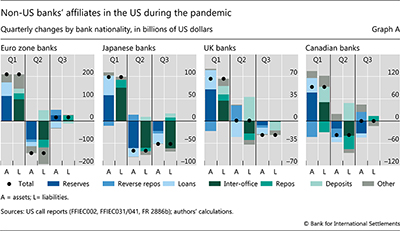

US affiliates play an important role in the management of non-US banks' US dollar operations.  This box uses call report data to document how such affiliates responded to the Covid-19 shock.

This box uses call report data to document how such affiliates responded to the Covid-19 shock.

The balance sheets of the US affiliates of non-US banks expanded in the first quarter and reverted only partly afterwards (Graph A). On the asset side, reserves at the Federal Reserve increased overall but loans declined in Q2 and Q3, reflecting net credit repayment. The Senior Financial Officer Survey conducted by the Federal Reserve suggests a precautionary motive behind increased reserves during the first half of the year. Nearly all of the foreign banks surveyed said that "preparing for potential drawdowns of committed credit lines" was the most important reason behind reserve build-up (FRB (2020)). On the liability side, deposits account for most of the increase during 2020 – as foreshadowed by Graph 1 and the left-hand panel of Graph 3. Most of these deposits were vis-à-vis non-banks, including non-bank financial institutions. The increase in deposits was particularly large for Canadian banks (+$88 billion), which reduced their repos (–$53 billion). Euro zone, Japanese and Swiss banks, in turn, increased their repos (+48 billion combined).

Indeed, the drawdowns of contingent credit lines dominated balance sheet changes in the midst of the Covid-19 dollar funding crisis and its immediate aftermath. These drawdowns by non-banks lead to simultaneous increases in loans and deposits (Glancy et al (2020)). In the first quarter of 2020, they amounted to $101 billion, out of a total of $189 billion in loans by non-US banks' US affiliates. For some of the largest banking systems a significant share of the change in loans during Q1 2020 can be accounted for by drawdowns: for euro zone, UK and Canadian banks, this share stood at 63.5%, 62.7% and 72.4%, respectively. The footprint of central bank swap line use was, in turn, visible in the changes in inter-office liabilities and reserves during the first two quarters of 2020 (Aldasoro, Cabanilla, Disyatat, Ehlers, McGuire and von Peter (2020)).

out of a total of $189 billion in loans by non-US banks' US affiliates. For some of the largest banking systems a significant share of the change in loans during Q1 2020 can be accounted for by drawdowns: for euro zone, UK and Canadian banks, this share stood at 63.5%, 62.7% and 72.4%, respectively. The footprint of central bank swap line use was, in turn, visible in the changes in inter-office liabilities and reserves during the first two quarters of 2020 (Aldasoro, Cabanilla, Disyatat, Ehlers, McGuire and von Peter (2020)).

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  Previous stress episodes left a visible trail in these balance sheets. Examples are the large shifts in inter-office claims and liabilities observed during the euro area sovereign crisis and the FDIC assessment of banks' managed liabilities in 2011, as well as when the branches and agencies of foreign banks in the US ran down their holdings of excess reserves at the Federal Reserve in the aftermath of the US MMF reform of 2016.

Previous stress episodes left a visible trail in these balance sheets. Examples are the large shifts in inter-office claims and liabilities observed during the euro area sovereign crisis and the FDIC assessment of banks' managed liabilities in 2011, as well as when the branches and agencies of foreign banks in the US ran down their holdings of excess reserves at the Federal Reserve in the aftermath of the US MMF reform of 2016.  This reflects net drawdowns, or the change in unused commitments to provide liquidity. It combines information on drawdowns with changes in committed amounts.

This reflects net drawdowns, or the change in unused commitments to provide liquidity. It combines information on drawdowns with changes in committed amounts.

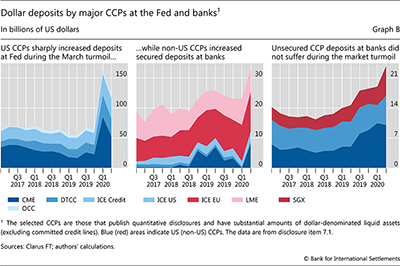

Box B

Dollar deposits of central counterparties

Central counterparties (CCPs) accumulated an extraordinary amount of liquid assets via initial margin calls amid the March 2020 turmoil.  Global CCPs' initial margins increased by 50% in Q1 2020, reaching $831 billion at end-March 2020 (ISDA (2020)). For CCPs that clear US dollar-denominated products, a substantial part of these liquid assets are dollar-denominated.

Global CCPs' initial margins increased by 50% in Q1 2020, reaching $831 billion at end-March 2020 (ISDA (2020)). For CCPs that clear US dollar-denominated products, a substantial part of these liquid assets are dollar-denominated. All CCPs can deposit these assets at banks, in either unsecured or secured form, via reverse repos.

All CCPs can deposit these assets at banks, in either unsecured or secured form, via reverse repos. Alternatively, CCPs eligible for deposit accounts at the Federal Reserve can place their funds there. This box uses CCP quantitative disclosures to assess how their dollar deposits responded to the pandemic.

Alternatively, CCPs eligible for deposit accounts at the Federal Reserve can place their funds there. This box uses CCP quantitative disclosures to assess how their dollar deposits responded to the pandemic.

Deposits at the Fed by qualified US CCPs ballooned in Q1 2020, while their secured deposits at banks – mainly reverse repos – contracted significantly. The contrast was particularly stark for CME: its deposits at the Fed increased from $23 billion at end-2019 to $85 billion at end-March 2020 (Graph B, left-hand panel). At the same time, it halted its repo activity with banks, which recovered sharply thereafter (centre panel, dark blue area). Large yet less dramatic changes were observed for other US CCPs, such as DTCC, ICE Credit and ICE US.

Despite the decline in secured deposits by US entities, CCPs' overall secured deposits at banks remained unchanged in Q1 2020 at $23 billion. This is because non-US CCPs, which have no deposit accounts at the Fed, increased their secured dollar deposits at banks in Q1 2020 (Graph B, centre panel, red areas). In contrast to secured deposits, the changes in unsecured deposits were relatively small in Q1 2020 (right-hand panel).

The substantial shift of US CCPs from secured deposits with banks towards deposits at the Fed underscores the importance of continuous monitoring of the interconnectedness between CCPs and other financial market participants. The shift in March could reflect multiple factors, including high volatility and low rates in repo markets – which were equal to the deposit rate at the Fed at end-March – as well as potential operational convenience (eg instantaneous settlement). The growing footprint of CCPs heightens the need to better understand these factors.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  Eight CCPs in our sample have substantial dollar-denominated liquid assets. Five are US CCPs: Chicago Mercantile Exchange (CME), Depository Trust & Clearing Corporation (DTCC), Intercontinental Exchange Clear Credit (ICE Credit), Intercontinental Exchange Clear US (ICE US) and Options Clearing Corporation (OCC). The three non-US CCPs are: Intercontinental Exchange Clear Europe (ICE EU), London Metal Exchange (LME) and Singapore Exchange (SGX).

Eight CCPs in our sample have substantial dollar-denominated liquid assets. Five are US CCPs: Chicago Mercantile Exchange (CME), Depository Trust & Clearing Corporation (DTCC), Intercontinental Exchange Clear Credit (ICE Credit), Intercontinental Exchange Clear US (ICE US) and Options Clearing Corporation (OCC). The three non-US CCPs are: Intercontinental Exchange Clear Europe (ICE EU), London Metal Exchange (LME) and Singapore Exchange (SGX).  Some jurisdictional regulations restrict CCPs' unsecured deposits at banks.

Some jurisdictional regulations restrict CCPs' unsecured deposits at banks.

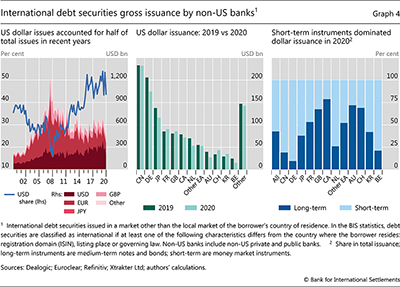

Debt securities issuance

The debt securities market is another sizeable source of non-US banks' dollar funding (Graph 1). These banks' issuance of dollar-denominated international debt securities grew steadily in the past five years, driving the dollar share in total issuance from 38% at end-2015 to 44% at end-2020 (Graph 4, left-hand panel).10

Gross dollar debt securities issuance did not suffer significantly due to the March market turmoil. In aggregate, non-US banks issued $1.1 trillion in dollar debt securities in 2020, versus $1.2 trillion in 2019. The decline was driven largely by Japanese and German banks. For most banking systems, however, gross issuance in 2020 was on a par with that in 2019 (Graph 4, centre panel). For example, Chinese banks – currently the largest issuers of dollar-denominated debt securities11 – issued $232 billion worth of such securities in 2020, in line with their 2019 issuance.

Short-term instruments dominated dollar debt issuance in aggregate, yet with substantial variation across nationalities. Such instruments accounted for 57% of the aggregate debt securities issuance in 2020 (Graph 4, right-hand panel). This share was higher than 70% for Chinese, Dutch and German banks. By contrast, short-term instruments accounted for less than 20% of the total issuance by Canadian and Australian banks.

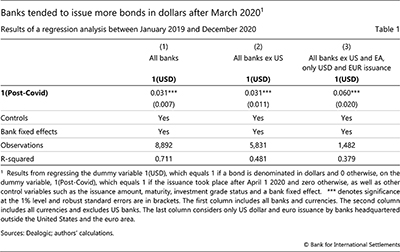

While aggregate debt issuance data are useful, they could be driven by a few large issuers. In order to tease out how the Covid-19 episode affected banks' currency choice of bond issuance, we use bond-level data that include domestic and international issuance. We can thus take into account bond characteristics – such as issuance amount, maturity and investment grade status – as well as bank characteristics that do not vary over time.

We find that, relative to the period between January 2019 and March 2020, the currency composition of banks' total bond issuance tilted towards the dollar between April and December 2020. This is a robust result: it holds true across all banks in the sample (Table 1, first column) as well as when we exclude US banks (second column). Furthermore, when we only compare the dollar and euro issuance of non-US and non-euro-area banks, the result is even more pronounced (third column).12 On average, banks were 3–6 percentage points more likely to issue dollar bonds after March 2020.

Conclusion

Banks' dollar funding underwent substantial readjustments after the March 2020 market turmoil. Despite the decline in MMF dollar funding, non-US banks' total on-balance sheet dollar liabilities reached a peak of $12.7 trillion at end-Q1 2020. As of end-Q3 2020, they stood comfortably above their pre-pandemic level. Dollar deposits outside the United States – especially from NBFIs – and, to a lesser extent, inside the United States accounted for this rise. At the same time, debt securities issuance remained resilient. Banks strengthened their preference for dollar bond issuance after the pandemic. Overall, these findings indicate that the dominance of the dollar in international finance and the attendant policy issues are likely to endure (CGFS (2020)).

It is too early to say if the shift of funding sources away from MMFs and towards other NBFIs will persist. If it does, further investigating the terms of the new funding and the specific NBFI sectors that it comes from will be essential. While its stability is still to be tested, this funding is currently more opaque than that from MMFs.

References

Acharya, V and S Steffen (2020): "The risk of being a fallen angel and the corporate dash for cash in the midst of Covid", NBER Working Paper, no w27601.

Aldasoro, I, C Cabanilla, P Disyatat, T Ehlers, P McGuire and G von Peter (2020): "Central bank swap lines and cross-border capital flows", BIS Bulletin, no 34, December.

Aldasoro, I, T Ehlers, P McGuire and G von Peter (2020): "Global banks' dollar funding needs and central bank swap lines", BIS Bulletin, no 27, July.

Avalos, F and D Xia (2021): "Investor size, liquidity and prime money market fund stress", BIS Quarterly Review, March, pp 19–31.

Bank for International Settlements (2020): Annual Economic Report 2020, June.

Borio, C, R McCauley and P McGuire (2017): "FX swaps and forwards: missing global debt?", BIS Quarterly Review, September, pp 37–54.

Cetorelli, N, L Goldberg and F Ravazzolo (2020): "Have the Fed swap lines reduced dollar funding strains during the Covid-19 outbreak?", Federal Reserve Bank of New York Liberty Street Economics, May 22.

Committee on the Global Financial System (CGFS) (2020): US dollar funding: an international perspective,CGFS Papers, no 65.

Eren, E and S Malamud (2021): "Dominant currency debt", Swiss Finance Institute Research Paper, no 18-55.

Eren, E, A Schrimpf and V Sushko (2020): "US dollar funding markets during the Covid19 crisis – the international dimension", BIS Bulletin, no 15, May.

Federal Reserve Board (FRB) (2020): September 2020 Senior Financial Officer Survey.

Financial Stability Board (FSB)(2020): Holistic review of the March market turmoil, November.

Glancy, D, M Gross and F Ionescu (2020): "How did banks fund C&I drawdowns at the onset of the COVID-19 crisis?", FEDS Notes, 31 July.

Huang, W and E Takáts (2020): "The CCP-bank nexus in the time of Covid-19", BIS Bulletin, no 13, May.

International Swaps and Derivatives Association (ISDA) (2020): "Global IM collected for derivatives in the first quarter of 2020", ISDA Research Notes, July.

1 The authors thank Claudio Borio, Christian Cabanilla, Stijn Claessens, Jenny Hancock, Bryan Hardy, Patrick McGuire, Hyun Song Shin, Takeshi Shirakami, Nikola Tarashev and Philip Wooldridge for valuable comments and suggestions, and Kristina Mićić, Albert Pierres Tejada, Swapan-Kumar Pradhan and Marjorie Santos for excellent research assistance. The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 For a comprehensive overview of US dollar funding markets prior to the pandemic and during the March turmoil, see CGFS (2020).

3 This article focuses on on-balance sheet dollar funding. Data limitations hinder the analysis of off-balance sheet liabilities such as FX swaps (Borio et al (2017)). Estimates of FX swap dollar funding for non-US banks ranged from $630 billion to $855 billion as of end-2019 (Aldasoro, Ehlers, McGuire and von Peter (2020)).

4 Dollar liabilities represent about a quarter of non-US banks' total liabilities (including in domestic currency) and close to 57% of their foreign currency liabilities. The Covid-19 crisis did not materially affect these shares.

5 Irrespective of where the deposits are booked, the holders may reside anywhere, including the United States.

6 With around $1.4 trillion, US and offshore MMFs represented around 12% of the on-balance sheet funding for non-US banks at end-2019.

7 This decline reflects, in part, sustained investor redemption from US prime MMFs – funds that can invest in unsecured instruments but cannot offer stable net asset values to investors (see Avalos and Xia (2021) in this issue). It could also reflect a shift in banks' funding models and demand for MMF funding.

8 In the light of the decline in both US and offshore MMF funding documented earlier, the increase in non-bank funding documented in this section did not stem from positions with MMFs.

9 CCPs accumulated a large amount of (dollar-denominated) liquid assets due to substantial initial margin calls during the March turmoil (Huang and Takáts (2020)). Their secured and unsecured deposits represent a small, but growing, share of banks' dollar funding from non-banks.

10 International debt securities in the BIS statistics are those issued in a market other than the local market of the country where the borrower resides, ie issued in any market by a non-resident. The data cover short-term (ie money market) and longer-term (ie medium term notes and bonds) instruments issued by public and private banks.

11 In terms of amounts outstanding, banks headquartered in the United Kingdom account for the largest share (15.8% as of end-2020), followed by Chinese (9.5%) and Japanese (8.7%) banks.

12 Eren and Malamud (2021) show similar issuance patterns for NBFIs and non-financial corporates. They argue that firms' currency choice depends on whether the currency depreciates in global downturns over typical debt maturities – hence providing the best hedge as the value of the nominal debt declines with the depreciation. They show that the dollar fits this description better than other major international currencies, both historically and during the Covid-19 episode.