Private credit: recent developments and long-term trends

Non-bank investors are increasingly extending loans directly to firms, with limited involvement on the part of banks. Such lending is frequently referred to as private credit, to distinguish it from bank-intermediated credit.

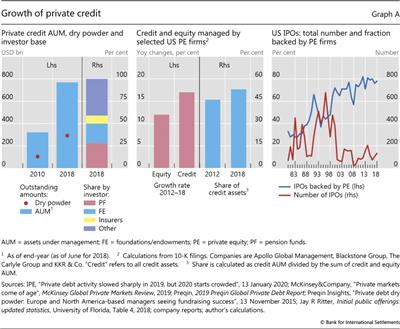

Private credit is typically offered to firms that are smaller, with earnings well below $100 million, than those borrowing through leveraged loans, which are originated mostly by banks. The outstanding amount of private credit grew from little more than $300 billion in 2010 to nearly $800 billion in 2018 (Graph A, left-hand panel, first two bars). The leveraged loan market is larger, yet the nearly $500 billion increase in private credit between 2010 and 2018 mirrored the approximately $600 billion rise in leveraged lending. The growth of private credit represented about 8% of the expansion in credit to non-financial corporates (NFCs) in advanced economies (AEs) over the 2010-18 period. Surveys indicate that roughly half of private credit asset managers invest predominantly in the United States, one fourth focus on the United Kingdom, and the remainder are spread around the world.

Private credit is typically offered to firms that are smaller, with earnings well below $100 million, than those borrowing through leveraged loans, which are originated mostly by banks. The outstanding amount of private credit grew from little more than $300 billion in 2010 to nearly $800 billion in 2018 (Graph A, left-hand panel, first two bars). The leveraged loan market is larger, yet the nearly $500 billion increase in private credit between 2010 and 2018 mirrored the approximately $600 billion rise in leveraged lending. The growth of private credit represented about 8% of the expansion in credit to non-financial corporates (NFCs) in advanced economies (AEs) over the 2010-18 period. Surveys indicate that roughly half of private credit asset managers invest predominantly in the United States, one fourth focus on the United Kingdom, and the remainder are spread around the world.

There are structural similarities between the private credit and leveraged loan markets. First, the respective investor bases overlap substantially. As of end-2018, insurance companies and pension funds together backed about one third of private credit (Graph A, left-hand panel, third bar) and one fourth of leveraged loans (either directly or through collateralised loan obligations (CLOs)). The combined exposure of these intermediaries to high-yield corporate loans totalled nearly $600 billion. Second, asset managers that oversee funds investing in private credit also manage CLOs and other leveraged loan funds. Third, lack of transparency in post-origination loan trading, together with the opacity of the leverage some investors take on, complicates the mapping of credit risk exposures.

While the growth in private credit is a decades-long trend, it accelerated after the Great Financial Crisis (GFC) of 2007-09. Banks had started retrenching from credit provision to the US corporate sector as early as the mid-1980s, and the current size of private credit and leveraged lending combined amounts to no less than about 90% of US banks' commercial and industrial loans. Post-GFC, the expansion of private credit was fuelled by the combination of stagnating bank asset growth and attractive private debt yields relative to syndicated loans. The 2% higher yield has been key in attracting investors such as pension funds and insurance companies, which added private credit to their portfolios of leveraged loans and CLOs. These investors have stronger incentives to reach for yield because they often need to meet absolute return targets.

Post-GFC, the expansion of private credit was fuelled by the combination of stagnating bank asset growth and attractive private debt yields relative to syndicated loans. The 2% higher yield has been key in attracting investors such as pension funds and insurance companies, which added private credit to their portfolios of leveraged loans and CLOs. These investors have stronger incentives to reach for yield because they often need to meet absolute return targets.

Even though banks are not involved in the origination of private credit, they are still exposed to developments in this market through the provision of leverage to private credit funds. Slightly less than 50% of portfolio managers reported borrowing against fund assets. Typically, the ratio of debt to equity is less than two. About 40% of portfolio managers borrowed using subscription credit lines, whose collateral is a fund's "dry powder", or undrawn capital commitments made by investors. Subscription credit lines are meant to reduce the frequency of capital calls, and are typically provided by banks. Private credit funds have nearly $300 billion of dry powder ready to be invested should suitable opportunities arise (Graph A, left-hand panel). As a result, subscription credit lines are a potentially significant channel of indirect bank exposure to private credit, echoing the indirect exposure of banks to CLOs that arises from prime brokerage financing to hedge funds.

Subscription credit lines are meant to reduce the frequency of capital calls, and are typically provided by banks. Private credit funds have nearly $300 billion of dry powder ready to be invested should suitable opportunities arise (Graph A, left-hand panel). As a result, subscription credit lines are a potentially significant channel of indirect bank exposure to private credit, echoing the indirect exposure of banks to CLOs that arises from prime brokerage financing to hedge funds.

Private equity (PE) firms have taken on an increasingly central role in private credit. In addition to financing mergers and acquisitions, PE firms traditionally provided equity to small or distressed firms for early development or restructuring, in the form of venture capital or buyouts. Besides gaining expertise in financing high-risk businesses, PE firms also built relationships with a broad set of potential borrowers. Indeed, private credit lenders expected that one third of future lending opportunities would arise from collaboration with PE firms. Building on their expertise and relationships, several PE firms expanded the number of credit funds they set up and manage, including those specialising in private credit. Among the main US PE firms, the assets under management (AUM) of their credit funds rose by 17% per year between 2012 and 2018, compared with 12% for their equity funds. In 2018, credit AUM stood at $430 billion and represented 53% of equity and credit AUM combined, up from 46% in 2012 (Graph A, centre panel).

PE firms took on a more prominent role in private credit at the same time as they grew their influence on early-stage equity financing. While the overall number of initial public offerings (IPOs) in the United States declined substantially between 1995 and 2018, from 461 to 134, a larger fraction of IPOs, from 47% to 78%, were by companies backed by PE firms in the form of venture capital or buyouts (Graph A, right-hand panel).

The emerging ecosystem of credit provision to small and medium-sized firms raises issues concerning financial stability and investor protection. Four stand out: first, the interaction between unexpectedly large losses and lender vulnerabilities; second, potentially heightened procyclicality in loan supply; third, possible conflicts of interest linked to the more prominent and multifaceted role of PE firms; and fourth, the relative opacity of certain strategies that raise effective leverage above reported values.

Unexpectedly large losses could have significant adverse effects on certain lenders. Much as in the market for leveraged loans, higher yields on private credit loans have attracted investors, and strong demand has been accompanied by deteriorating covenant protection. Roughly 30% of portfolio managers indicated that loan covenants had become less stringent in 2018, compounding the loosening observed during the previous three years. While much of private credit takes the form of secured loans, which have relatively high recovery rates, any repricing would be sharper if weaker covenants had lowered recovery rates. Sizeable losses could be particularly detrimental to some lenders, especially at times of limited access to wholesale credit. For instance, insurance companies could have difficulties meeting unusually large cash flow shortfalls with asset sales, even if these shortfalls were relatively small compared with their portfolios, due to asset-liability matching.

Private credit might prove strongly procyclical, as fund managers have incentives to time the (illiquid) market. Unlike mutual funds, private credit funds are typically closed-end and investors cannot withdraw capital in the event of persistently poor fund returns. However, AUM growth depends on past performance. To avoid losing future AUM to competitors, fund managers might scale back loan origination and dispose of existing loans at the first signs of a downturn, before already low market liquidity declines further. Funding costs for smaller firms would increase rapidly, unless appropriate hedges are in place, since most private credit loans have floating interest rates.

Conflicts of interest could arise if equity and credit funds managed by a PE firm invested in the equity and debt of the same company. In principle, private credit investors could, for instance, face the risk of unexpected losses in the event of debt restructurings unduly favourable to equity holders. To be sure, investors already benefit from the oversight of securities regulators on PE firms in both Europe and the United States. Even so, the intrinsic opaqueness of private credit borrowers, on top of market illiquidity, poor loan-price transparency and increasing deal leverage, could lead lenders to further minimise risks by consolidating assets at incumbent PE firms with an established reputation. As a result, smaller companies could have fewer funding options.

Private credit funds can employ certain strategies that increase effective leverage above reported leverage. For instance, business development companies (BDCs) are US funds that typically invest in loans to small companies. While subject to strict leverage limits, certain BDCs purchase loans through vehicles in which BDCs hold a subordinated interest, thus increasing the sensitivity of their returns to loan values, just as leverage would. Overall, these strategies can make it harder for investors in private credit funds to gauge risk accurately.

The views expressed are those of the author and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the author and do not necessarily reflect the views of the Bank for International Settlements.  This box focuses on corporate loans, but the term "private credit" is sometimes interpreted as also including other types of non-bank credit (for instance, infrastructure and real estate debt). The defining characteristic of the various types of private credit is the limited involvement of banks at origination.

This box focuses on corporate loans, but the term "private credit" is sometimes interpreted as also including other types of non-bank credit (for instance, infrastructure and real estate debt). The defining characteristic of the various types of private credit is the limited involvement of banks at origination.  Survey statistics on regional concentration are from Alternative Credit Council, "Financing the economy 2017", 2017.

Survey statistics on regional concentration are from Alternative Credit Council, "Financing the economy 2017", 2017.  Trends in bank lending are from Federal Deposit Insurance Corporation, "Leveraged lending and corporate borrowing: increased reliance on capital markets, with important bank links", FDIC Quarterly, December 2019.

Trends in bank lending are from Federal Deposit Insurance Corporation, "Leveraged lending and corporate borrowing: increased reliance on capital markets, with important bank links", FDIC Quarterly, December 2019.  Figures on fund leverage are from Alternative Credit Council, Financing the economy 2018, 2018.

Figures on fund leverage are from Alternative Credit Council, Financing the economy 2018, 2018.  See S Aramonte and F Avalos, "Structured finance then and now: a comparison of CDOs and CLOs", BIS Quarterly Review, September 2019, pp 11-14.

See S Aramonte and F Avalos, "Structured finance then and now: a comparison of CDOs and CLOs", BIS Quarterly Review, September 2019, pp 11-14.  See N Foley-Fisher and B Narajabad and S Verani, "Assessing the size of the risks posed by life insurers' non-traditional liabilities", FEDS Notes, 21 May 2019.

See N Foley-Fisher and B Narajabad and S Verani, "Assessing the size of the risks posed by life insurers' non-traditional liabilities", FEDS Notes, 21 May 2019.