How did markets react to bank distress in Europe?

(Extract from pages 4-5 of BIS Quarterly Review, September 2017)

Four banks in Italy and Spain failed or were recapitalised in June and July. This box takes a closer look at those events and the spillovers to market conditions for banks in Europe.

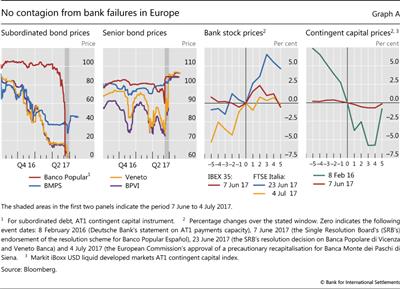

Investors did not fully anticipate the failure of the Spanish bank, Banco Popular Español. On 7 June, it was the first bank to be put into resolution under the Bank Recovery and Resolution Directive of the European Union. It was acquired by Spain's Banco Santander (for a symbolic sum) the following day. Equity and subordinated debt prices had weakened in the run-up to the event. Yet subordinated Additional Tier 1 (AT1) debt was still trading at 70 cents to par at the end of May, a few days before the start of the resolution process that was to wipe the bank out (Graph A, first panel). Prices for unsecured debt, on the other hand, decreased relatively little and actually increased after 7 June (Graph A, second panel).

For the Italian banks, by contrast, problems had been unfolding for several months and markets had already priced in a significant debt writedown ahead of the announcements of official intervention. On 23 June, European authorities decided that Banca Popolare di Vicenza (BPVI) and Veneto Banca would be wound up under normal Italian insolvency proceedings, coupled with state aid to facilitate market exit. Equity and subordinated debt, which had already been trading at depressed levels since late 2016, were written down to zero, while senior bondholders and depositors were spared (Graph A, first two panels). Discussions on how to deal with Banca Monte dei Paschi di Siena (BMPS) had been under way since the end of December 2016, when the bank had failed to raise private capital and equity trading had been suspended. By June, subordinated debt holders had already anticipated much of the losses they would face and the prices of the securities they held rose after the European Commission approved the precautionary recapitalisation on 4 July (Graph A, first panel). Prices of senior debt instruments also rose from the beginning of June, when it became clear that they would not be written down (Graph A, second panel).

Discussions on how to deal with Banca Monte dei Paschi di Siena (BMPS) had been under way since the end of December 2016, when the bank had failed to raise private capital and equity trading had been suspended. By June, subordinated debt holders had already anticipated much of the losses they would face and the prices of the securities they held rose after the European Commission approved the precautionary recapitalisation on 4 July (Graph A, first panel). Prices of senior debt instruments also rose from the beginning of June, when it became clear that they would not be written down (Graph A, second panel).

Following these events, the reduced uncertainty seemed to support the outlook for other banks in Europe (Graph A, third panel). Spanish banks' equity prices rose somewhat in the few days after the announcement of Banco Popular's takeover by Banco Santander. While the authorisation of the precautionary recapitalisation of BMPS on 4 July had a muted impact as it was aligned with market expectations, Italian bank shares rose substantially after the liquidation of Veneto Banca and BPVI. Overall, the FTSE Italia All Share Banks index climbed by 10% from the beginning of June to the end of July, outperforming the STOXX Europe 600 Banks index, which returned nearly 5%.

Despite the first ever conversion of AT1 instruments, there was also no evidence of contagion in the market for contingent convertible instruments after the failure of Banco Popular (Graph A, fourth panel). The developed markets AT1 CoCo index reacted little compared with early 2016, when Deutsche Bank had sparked market anxiety because of the potential for a suspension of coupon payments. After edging down in the week of Banco Popular's failure, the index went up by 2% from the beginning of June to the end of July. Moreover, European banks continued to issue contingent capital instruments, with around €15 billion successfully sold from April to August 2017.

While losses were covered by bonds being written down in all three cases, retail junior debtholders can apply for compensation under certain eligibility criteria.

While losses were covered by bonds being written down in all three cases, retail junior debtholders can apply for compensation under certain eligibility criteria.