The changing landscape of renminbi offshore and onshore markets

(Extract from pages 72-73 of BIS Quarterly Review, December 2016)

Torsten Ehlers, Frank Packer and Feng Zhu

Encouraging the growing international use of the renminbi (RMB) has been a long-standing element of China's FX liberalisation strategy. As part of this strategy, many new instruments are permitted first to develop in the offshore RMB market. RMB offshore trading in non-deliverable forwards (NDFs) first emerged in Hong Kong SAR in 1996 and then in Singapore, where the offshore RMB business was subsequently mostly concentrated. The 2016 Triennial Central Bank Survey revealed that the already exceptionally large offshore share of over-the-counter (OTC) derivatives turnover in RMB had risen to 73%. That said, there have been significant changes in the composition of offshore trading by instrument and nationality that have reflected policy shifts and the dynamic nature of the RMB's internationalisation. There has been convergence between on- and offshore trading patterns in some, but not all, respects. And there have also been very significant developments since 2013 in the offshore trading of exchange-traded derivatives.

Cross-border RMB demand has increased through a number of channels. First, starting in July 2009, China allowed the use of the RMB in the settlement of its cross-border trade, which in terms of both imports and exports grew rapidly to CNY 7.23 trillion (ie to nearly 30% of trade) in 2015 before falling somewhat in 2016. Second, both outward and inward direct investment have grown rapidly, with RMB outward direct investment reaching CNY 736.2 billion in 2015. Third, offshore RMB can also serve as a vehicle for portfolio investment in China. Channels for such investment include dim sum bond issuance (offshore RMB-denominated bond issuance) and the RMB Qualified Foreign Institutional Investor (RQFII) scheme, which allows the RMB funds raised in Hong Kong by the subsidiaries of domestic fund management companies and securities companies to be invested in the mainland securities market. The RQFII scheme had 169 participants and an approved quota of CNY 511.34 billion by the end of September 2016.

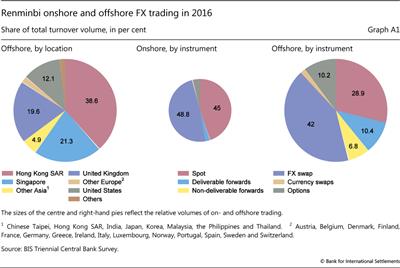

Looking at the location of offshore activity, the RMB is still traded mostly within the Asian region, but also spans a wider international dimension than before. The share of turnover in Hong Kong declined from 43% to 39% of total RMB offshore trading, although it is still much larger than in 2013 in absolute terms. At the same time, trading in Singapore and other Asian economies has increased, so that the share of total offshore trading taking place in Asia summed to 65% (Graph A1, left-hand pie). Offshore RMB trading outside Asia has also grown; while trading in the United Kingdom edged down from 21% to 20%, the share of RMB offshore turnover occurring in the United States rose from 7% to 12% in 2016.

In terms of instruments used in RMB trading, there has been some convergence between the off- and onshore markets since the preceding Triennial Survey in 2013 (Graph A1, centre and right-hand pies). This is particularly noticeable in the case of spot trading, which fell as a share of the onshore market from 60% to 45%, while it rose from 16% to 29% in the offshore market. At the same time, NDFs, which had accounted for nearly one fifth of all offshore trading in 2013, constituted only 7% of activity in 2016, a development examined by McCauley and Shu (2016). Offshore option trading also declined significantly. The one significant exception to the trend of convergence was deliverable forward transactions, which showed slightly larger shares of overseas trades (11% vs 10%) but collapsed in the onshore market (from 8% to 2%). Diminished turnover in onshore forwards may have been related to reserve requirements on forward transactions, which were instituted in August 2015 to discourage speculation in the RMB after a period of exceptional volatility.

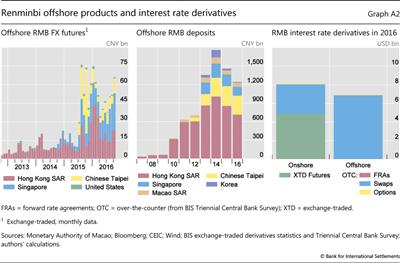

The rapid growth of the offshore market for the RMB and related derivatives is not limited to OTC FX market transactions covered by the Triennial Survey. Futures turnover grew strongly on the exchanges of Singapore and Chinese Taipei, in addition to Hong Kong (Graph A2, left-hand panel). RMB futures products, first offered more than 10 years ago on the Chicago Mercantile Exchange, were launched on the Hong Kong Exchange in September 2012, and in Singapore and Chinese Taipei in October 2014 and July 2015, respectively (as well as in Brazil in August 2011, South Africa in May 2013 and Korea in October 2015). The growth in these instruments, while still relatively small, has paralleled the growth of RMB deposits outside China, another component of China's capital account liberalisation (Graph A2, centre panel).

Both on- and offshore, RMB interest rate derivatives markets remain less developed than their FX counterparts. Average daily turnover in OTC and exchange-traded markets increased slightly, by $0.6 billion to $15 billion, between 2013 and 2016. The increase was entirely driven by onshore futures contracts, whereas turnover in OTC markets - mainly swaps - declined by $4 billion to $10 billion (Graph A2, right-hand panel). In comparison with the markets in advanced economies, the depth of the interest rate derivatives market remains very limited (Ehlers and Eren (2016)). While net bond issuance by Chinese residents has been similar to that by US residents in recent years, total RMB interest rate derivatives turnover in April 2016 was less than 1/300 of turnover in US dollar contracts. This suggests that the issuers and holders of RMB bonds, mainly Chinese residents, may not be actively hedging the underlying interest rate risks. In contrast to the key role of offshore markets in the rapid expansion of RMB FX markets, opportunities to hedge RMB interest rate risk may depend on developments in onshore markets - not least because most RMB bonds are held by domestic investors.