Exchanges struggle to attract derivatives trading from OTC markets

(Extract from pages 33-34 of BIS Quarterly Review, September 2016)

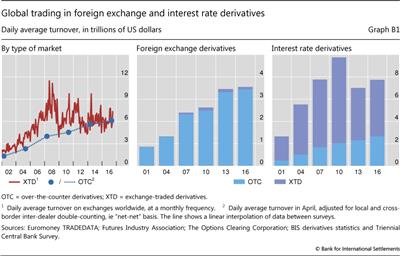

Exchanges have not won a bigger share of derivatives trading, according to the latest BIS Central Bank Triennial Survey of foreign exchange and over-the-counter (OTC) derivatives market activity. Since 2009, the trading of derivatives on exchanges has shown no trend, whereas their OTC trading has trended upwards (Graph B1, left-hand panel). The daily average turnover of foreign exchange and interest rate derivatives traded worldwide - on exchanges and OTC - rose from $10.5 trillion in April 2013 to $11.3 trillion in April 2016. The exchange-traded share remained roughly 46%.

The exchange-traded share remained roughly 46%.

The Triennial Survey is the most comprehensive source of information on the size and structure of OTC markets. Close to 1,300 financial institutions located in 52 countries participated in the latest survey, which was conducted in April 2016. When the results are combined with the BIS statistics on exchange-traded derivatives, they provide a global (albeit infrequent) snapshot of activity in derivatives markets.

Close to 1,300 financial institutions located in 52 countries participated in the latest survey, which was conducted in April 2016. When the results are combined with the BIS statistics on exchange-traded derivatives, they provide a global (albeit infrequent) snapshot of activity in derivatives markets.

Since the Great Financial Crisis of 2007-09, policymakers have sought to reduce systemic risks in OTC derivatives markets by promoting the trading of standardised contracts on exchanges or organised trading platforms and their clearing through central counterparties. While this might have been expected to lead to more trading on exchanges, the latest data suggest that innovations in OTC markets appear to have made OTC instruments more attractive. For example, exchange-like mechanisms have been introduced to trade OTC instruments, most notably swap execution facilities in the United States. Also, a growing share of OTC contracts is centrally cleared; the part of the Triennial Survey on outstanding amounts, to be published in November 2016, will provide comprehensive data on central clearing for the first time. Finally, dealers are compressing more and more OTC instruments - that is, market participants are working together to eliminate economically redundant contracts and thereby to reduce gross exposures.

While this might have been expected to lead to more trading on exchanges, the latest data suggest that innovations in OTC markets appear to have made OTC instruments more attractive. For example, exchange-like mechanisms have been introduced to trade OTC instruments, most notably swap execution facilities in the United States. Also, a growing share of OTC contracts is centrally cleared; the part of the Triennial Survey on outstanding amounts, to be published in November 2016, will provide comprehensive data on central clearing for the first time. Finally, dealers are compressing more and more OTC instruments - that is, market participants are working together to eliminate economically redundant contracts and thereby to reduce gross exposures.

Foreign exchange derivatives continue to be traded overwhelmingly in OTC markets. The daily average turnover of foreign exchange derivatives in OTC markets exceeded $3.4 trillion in April 2016, compared with only $0.1 trillion traded on exchanges (Graph B1, centre panel). OTC markets dominate owing in large part to foreign exchange swaps. These are popular as funding instruments because they do not change foreign exchange exposures and so can be used to roll over hedges. Moreover, OTC deals better serve customised demands in OTC markets, such as matching cash flows on odd dates or trading currency pairs not involving the US dollar. In only three currencies do exchanges account for a substantial share of FX derivatives activity: the Brazilian real, Indian rupee and Russian rouble, where exchanges accounted for 38%, 15% and 11% of turnover in April 2016, respectively.

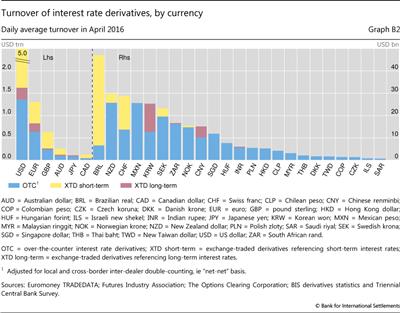

Interest rate derivatives are traded mainly on exchanges, but the share traded in OTC markets is increasing. The daily average turnover of interest rate derivatives in OTC markets was $2.7 trillion in April 2016, compared with $5.1 trillion traded on exchanges (Graph B1, right-hand panel). The proportion traded on exchanges declined from around 80% in the 2000s to 67% in April 2013 and to 66% in April 2016. This shift towards OTC markets is explained partly by weak activity in derivatives on short-term interest rates, which dominate trading on exchanges (Graph B2). The sustained period of low and stable policy rates in major economies has reduced hedging and positioning activity in short-term rates, especially in euro and yen rates. That said, while a maturity breakdown of OTC interest rate derivatives is not collected, various data sources suggest that activity across the term structure is shifting gradually to OTC markets. Even at the long end, market participants appear to be switching from contracts based on government bond yields to ones based on private yields, namely interest rate swap rates.

That said, while a maturity breakdown of OTC interest rate derivatives is not collected, various data sources suggest that activity across the term structure is shifting gradually to OTC markets. Even at the long end, market participants appear to be switching from contracts based on government bond yields to ones based on private yields, namely interest rate swap rates.

In emerging market economies, where activity is less likely to be dampened by persistently low policy rates, OTC markets are driving activity upwards in interest rate derivatives (Graph B2). The turnover of interest rate contracts denominated in EME currencies rose from $177 billion in April 2013 to $196 billion in April 2016 when measured at constant exchange rates, although the US dollar value of turnover fell owing to the depreciation of many EME currencies against the US dollar. Over the same period, the share of activity on exchanges fell from 58% to 30%. The only EME currencies where exchanges accounted for a sizeable share of activity in interest rate derivatives were the Brazilian real (86%), Korean won (50%) and Chinese renminbi (32%).

Turnover refers to notional amounts valued in US dollars. The appreciation of the US dollar against many currencies between 2013 and 2016 reduced the US dollar value of derivatives denominated in other currencies. When valued at April 2016 exchange rates, the turnover of foreign exchange and interest rate derivatives in April 2013 was $9.6 trillion.

Turnover refers to notional amounts valued in US dollars. The appreciation of the US dollar against many currencies between 2013 and 2016 reduced the US dollar value of derivatives denominated in other currencies. When valued at April 2016 exchange rates, the turnover of foreign exchange and interest rate derivatives in April 2013 was $9.6 trillion.  For data and more information about the Triennial Survey, see www.bis.org/publ/rpfx16.htm.

For data and more information about the Triennial Survey, see www.bis.org/publ/rpfx16.htm.  Financial Stability Board, OTC derivatives market reforms: tenth progress report on implementation, November 2015.

Financial Stability Board, OTC derivatives market reforms: tenth progress report on implementation, November 2015.  It has also shifted such trading further into the future. See L Kreicher and R McCauley, "Asset managers, eurodollars and unconventional monetary policy", BIS Working Papers, no 578, August 2016.

It has also shifted such trading further into the future. See L Kreicher and R McCauley, "Asset managers, eurodollars and unconventional monetary policy", BIS Working Papers, no 578, August 2016.  See L Kreicher, R McCauley and P Wooldridge, "Benchmark tipping in the global bond market", BIS Working Papers, no 466, October 2014.

See L Kreicher, R McCauley and P Wooldridge, "Benchmark tipping in the global bond market", BIS Working Papers, no 466, October 2014.