Hanging up the phone - electronic trading in fixed income markets and its implications

This article explores drivers and implications of the rising use of electronic and automated trading in fixed income markets - a process we refer to as "electronification". We take stock of the current state of electronic trading and how it has changed the market ecosystem, its resilience and its overall functioning. We argue that the impact of electronic and automated trading is visible in a number of dimensions of market liquidity and price efficiency. With market participants adjusting to the new market structure, several new challenges have emerged that warrant attention from policymakers.1

JEL classification: F31, G12, G15, C42, C82.

Electronic and automated trading have become an increasingly important part of fixed income markets in recent years. They have replaced voice trading as the new standard for many fixed income asset classes - market participants are literally "hanging up the phone". For the most actively traded instruments, the take-up of electronic and automated trading has reached levels similar to those observed in equity and foreign exchange markets, although other fixed income segments (eg high-yield corporate bonds) still lag behind.

"Electronification" (ie the rising use of electronic trading) is shaping the process of price formation and the nature of liquidity provision. It has facilitated automated trading (AT), particularly in the form of high-frequency trading (HFT) strategies in fixed income futures and wholesale markets for major benchmark bonds.2 New market participants (outside the traditional dealer community) have emerged and actively participate in these markets as liquidity providers and seekers. And, reinforced by changes in the nature of intermediation, innovative trading venues and protocols have proliferated. What many of these initiatives have in common is that they aim to overcome some of the liquidity challenges inherent in asset classes where trading is infrequent, such as corporate bonds.

These trends can have broad implications for the functioning of financial markets and the distribution of risks among their participants. Given the importance of fixed income markets for the funding of the real economy and financial stability more broadly, policymakers have a strong interest in assessing how electronification may be affecting market quality. By market quality, we mean the extent to which it is possible to transact at prices that accurately reflect the fundamental value of the asset, with immediacy, and in volume. The concept can be viewed as the amalgamation of price efficiency and market liquidity.3

Drawing from two recent reports by the Committee on the Global Financial System (CGFS) and the Markets Committee (MC), respectively, this feature takes stock of the current state of electronic trading in fixed income markets and investigates its drivers and the implications for the market ecosystem and its functioning.4 The remainder of the article is organised as follows. The first section describes how the market structure is evolving. The second looks at its current state based on an MC survey of electronic trading platforms (ETPs). The third explores the possible implications of these changes for market quality, the nature of liquidity and its monitoring. The last section concludes with a discussion of policy challenges.

How is the market structure evolving?

Traditionally, trading in fixed income securities has been centred on dealers (large banks or securities houses) and their network of trading relationships. Trades have been executed bilaterally - over the counter (OTC) - that is, without a centralised marketplace or exchange.5

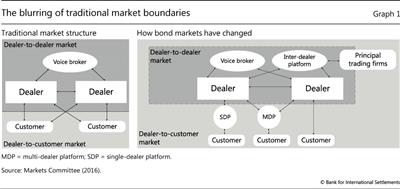

This market structure separated the dealer-to-dealer market, in which dealers trade exclusively with one another, and the dealer-to-customer market, in which they trade with customers, such as asset managers, pension funds, insurance companies and corporations (Graph 1, left-hand panel). Market participants predominantly negotiated terms of a trade via telephone or electronic chatting systems (ie bilaterally). The process of matching buyers and sellers involved significant search costs (Duffie (2012)). A customer needed to contact one or more dealers, asking for currently available prices and quantities to buy or sell a specific security. Within the dealer-to-dealer market, specialised voice brokers helped facilitate and anonymise the matching process by exchanging information on dealers' buy and sell interest.

Fixed income markets experienced a major shift starting in the late 1990s (Graph 1, right-hand panel). At that time, ETPs started to gain traction in dealer-to-dealer markets for the most actively traded sovereign bonds. One example was the launch of EuroMTS in 1998 as a pan-European platform for sovereign bonds, agency bonds and repos. eSpeed and BrokerTec, both founded in 1999, are examples of ETPs for dealer-to-dealer trading of benchmark ("on-the-run") US Treasury securities.

Electronic trading in the dealer-to-customer segment emerged around a similar time. It has taken two basic forms: single-dealer platforms (SDPs) and multi-dealer platforms (MDPs). SDPs are proprietary trading systems offered by a single dealer to its clients. Trading via SDPs essentially represents an electronic version of the bilateral dealer-client OTC market. MDPs, by contrast, allow end investors to request quotes from a number of dealers simultaneously, effectively putting dealers in competition for the transaction as in a multilateral auction. This mechanism tends to lower the costs of finding a counterparty with offsetting trading interest. MDPs also automate record-keeping, making it easier to audit best execution.6

The main driver of electronification has probably been the potential to reduce the cost of trading and improve market liquidity. One key advantage of ETPs is automating the processing and settlement of trades, so-called straight through processing. This reduces the need for human processing, lowering both the cost of trading and operational risks. That said, other factors, such as regulation, have also incentivised market participants to trade electronically (see the discussion in Box 1).

The shift towards electronic trading changed how market participants interacted in a variety of ways. One aspect is the change from on-the-phone bilateral negotiation to multilateral, often anonymous, interaction on screen. Trading on those ETPs geared towards the most liquid government securities, for example, is often based on a central limit order book (CLOB). A CLOB is a trading protocol where market participants submit limit orders that are stored in a queue based on predefined rules. Limit orders, if not cancelled, are executed against matching incoming market orders.7

Box 1

What is driving the electronification of fixed income markets?

Several factors have been supporting the rise of electronic trading in fixed income markets, including: (i) the reduction in trading costs due to technological advances; (ii) changes in the demand for liquidity services; and (iii) regulatory reforms, which provide both direct and indirect incentives to trade electronically.

Technological advances, such as the significant rise in computing speed and capacity, have enabled ETPs to match and process increasingly large numbers of trades. This has contributed to lowering the marginal and average costs of each individual trade as well as to reducing search costs, which in turn raises the incentives for market participants to trade on ETPs. In addition, the entry barriers for new platform providers, such as the fixed cost of building new trading systems, have declined and have benefited from favourable funding conditions. As a result, the number of ETPs offering trading in fixed income instruments has further increased. Even though this may reduce market liquidity by fragmenting trading activity, increasing competition among ETPs can be expected to reduce the price charged to market participants for trading, thereby reinforcing the push towards electronification.

Changes in the demand for liquidity services represent another driver of electronic trading. For one, the expansion of primary bond issuance over the past few years and increased bond holdings by market participants that seek to adjust their portfolio allocations at short notice (eg funds that face redemptions) have raised the potential size of secondary bond markets. This suggests greater opportunity for economies of scale to be realised by ETPs, in particular for standardised products that are traded frequently. Another trend, as emphasised by many market participants, is an increasing demand for price transparency. In this regard, ETPs provide an efficient means of monitoring markets, comparing prices (eg of multiple dealers) and documenting that trades have been executed at the best available price. Furthermore, the persistent decline in the level of yields over recent years has induced many fixed income investors to monitor their cost of trading more closely, incentivising greater use of electronic trading and automated execution of their portfolio reallocations.

The broader post-crisis response has provided additional impetus to the electronification of fixed income markets. Regulatory reforms to contain systemic risks in the financial system have provided both direct and indirect incentives for electronic trading. Mandatory clearing of standardised OTC derivatives and supplementary trade reporting requirements, for example, have directly induced a shift in trading activity to ETPs. In addition, ensuring compliance with enhanced pre- and post-trade transparency requirements provides another strong incentive to move trading activity. Other regulatory changes, arguably reinforcing market-driven adjustments after the crisis, have raised banks' costs of taking risk. Moving trading activity to ETPs is one way to compensate for the reduced liquidity provision by these traditional market-makers. This is because ETPs enable banks to provide liquidity at lower cost (see above) or offer the opportunity for other market participants to provide liquidity (see the section on market implications).

Electronification has also meant that AT - a common feature in other asset classes for more than a decade - has also become prevalent in some fixed income segments, such as on-the-run government securities and fixed income futures. AT is a trading technology in which order and trade execution decisions are generated autonomously by computer algorithms. A notable form of AT is high-frequency trading (HFT), which critically relies on high speed and tight intraday inventory positions.8 To gain an edge in terms of speed, market participants employing AT/HFT strategies - henceforth labelled principal trading firms (PTFs) - place their servers in the vicinity of the matching engine of the exchange or electronic platform. The universe of PTFs is fairly opaque and diverse.9 In addition, many of the traditional market participants have also invested in AT technology in recent years.

The growing presence of PTFs has affected the nature of liquidity provision on formerly exclusively dealer-to-dealer platforms and blurred the traditional market boundaries (Graph 1, right-hand panel). Some sovereign bond markets, especially the most liquid ones, have seen a significant rise in AT activity. Recent estimates suggest that over 50% of trading volumes in benchmark US Treasury securities on formerly exclusively dealer-to-dealer venues can be accounted for by PTFs (US Joint Staff Report (JSR) (2015)). The most advanced HFT strategies thrive in highly liquid markets with CLOBs, such as futures and benchmark sovereign debt. Firms pursuing HFT strategies tend to generate a large number of orders, hold open positions for short periods (often seconds or less) and cancel a large share of orders that they generate (often over 80%), which is possible only in markets that are very liquid at the outset.10

Dealer-to-customer platforms, by contrast, are usually based on the request for quote (RFQ) trading protocol, a multilateral electronic version of OTC trading. In this case, platform users may query market-makers to request prices on an order of a particular size. One alternative protocol is "click-to-trade" (CTT), where readily executable prices are streamed to platform participants, typically for smaller trade sizes. Trading protocols such as RFQ are amenable only to the subset of AT strategies in which speed is less critical. RFQ platforms, however, do not present algorithms with a continuous market. It is hence no surprise that bond market segments trading infrequently, such as non-benchmark sovereign or corporate bonds, which mostly trade via RFQ platforms, do not (currently) see much HFT. That said, AT is also prevalent on such platforms in the sense that dealers respond automatically to trading requests (auto-quoting) or submit algorithmically generated orders for risk management purposes. Most end users, however, interact manually with RFQ platforms.

Corporate credit markets have recently seen a wave of platform initiatives and innovative trading protocols which allow investors to negotiate with players outside the traditional dealer-intermediated market. A common objective is to pool liquidity outside the dealer community and enable multilateral communication of trading intentions. New trading protocols are largely based on variants of RFQ, as the illiquidity of some fixed income assets makes them unsuitable for CLOBs. Platform providers are also considering protocols that would allow members to negotiate with each other. Participants may submit indications of interest to a non-public order book and receive notice of indications of similar size and price from other market participants. Dark platforms - so called because they match participants anonymously - are allowing buyers and sellers to negotiate directly but anonymously. Others are looking to create standardised secondary market auctions (creating a window of liquidity in specific instruments) to centralise previously untapped pools of liquidity. The success of these new platform initiatives, however, has been limited thus far.

Overall, these developments have led to a more diverse market structure (Graph 1, right-hand panel). Today's market features greater connectivity among the different players, more transparency and a greater variety of trading protocols. That said, the share of electronic trading in many fixed income segments remains below that observed for other asset classes. Its share in cash equities and foreign exchange is estimated to be around 80% and 70%, respectively. In comparison, for US Treasuries and European government bonds the equivalent shares are 70% and 60%. For covered bonds, the share of trading that is done electronically is about one half (Greenwich Associates (2014)). A key factor behind the slower adoption of electronic trading in fixed income has been the greater heterogeneity of the traded instruments (eg different coupons, maturities, embedded options, covenants) and the resulting difficulty in finding matches in supply and demand.

A survey of electronic trading platforms

To shed further light on the current state of electronic trading in fixed income markets, we draw on a recent survey of trading platforms conducted by an MC study group. The survey targeted more than 30 fixed income ETPs operating worldwide, including some in emerging market economies. It covered different platform types (eg dealer-to-dealer and dealer-to-client) and instruments (eg sovereign, quasi-sovereign and corporate bonds as well as fixed income derivatives). Information was also collected on different trading protocols (CLOB, CTT and RFQ).

How have electronic trading volumes evolved?

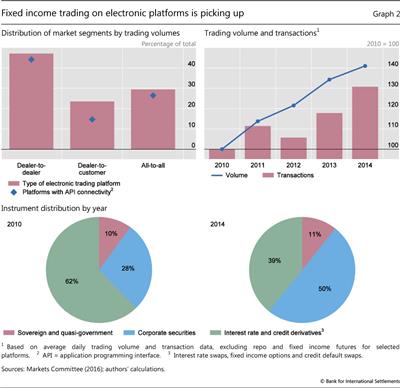

In the survey, dealer-to-dealer platforms account for the largest share of trading - roughly 45% in 2014 - whereas all-to-all (ie platforms that enable any member to trade with any other member) and dealer-to-customer platforms account for around 30% and 25%, respectively (Graph 2, top left-hand panel).

Fixed income electronification has been growing steadily over the past five years, and AT has become more prevalent. Average daily turnover on electronic platforms has been trending up for most types of instruments and across the different types of platforms. In aggregate, average daily trading volume rose by about 40% from 2010 to 2014 (Graph 2, top right-hand panel). The number of transactions, a key indicator of trading activity, also rose (same panel). Across all platforms, transactions went up by roughly one third. The evolution of average trade sizes has differed across market segments. It has fallen on platforms geared towards dealer-to-dealer trading and increased in the dealer-to-customer segment.

A major driver of the rise in electronic trading volumes has been a pickup in corporate bond trading (Graph 2, bottom panels). Trading of corporate securities has more than doubled over the past five years, although starting from a low base. Possible reasons include the record issuance of corporate securities during much of the post-crisis low-yield environment and the growing popularity of this asset class among asset managers. Electronic trading via platforms, in turn, may have helped overcome some of the liquidity challenges that have confronted credit markets, eg by facilitating the matching of buyers and sellers and by reducing the reliance on individual dealers. By comparison, electronic trading in other instruments has been less buoyant. That of sovereign and quasi-government securities grew at a slower rate, about 20% between 2010 and 2014. And trading volumes for derivatives products have actually fallen, contracting by about one third. This is consistent with a decline in outstanding positions in OTC derivatives markets more broadly, as documented elsewhere (eg Schrimpf (2015)).

How are electronic trades executed?

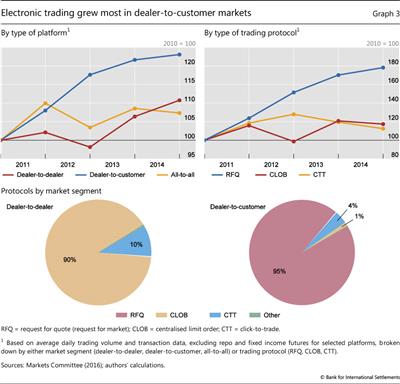

The survey shows that electronic trading volumes grew most in the dealer-to-customer segment, where end users can put multiple dealers in competition for a trade (Graph 3, top left-hand panel). This is further corroborated by data that distinguish platforms according to the prevailing trading protocol. Platforms relying on RFQ, as is commonly the case for MDPs, have seen the largest rise in volumes over the past five years (Graph 3, top right-hand panel). A smaller increase took place on dealer-to-dealer platforms; but even here volumes still rose by about a quarter from 2010 to 2014. All-to-all platforms, however, contributed little to the rise in aggregate volumes. This was also reflected in the sluggish growth of CLOB-based trading over the past years.

The survey confirms that on dealer-to-dealer platforms, about 90% of the trades were executed via a CLOB while the remainder relied on direct streaming of executable prices (CTT) (Graph 3, bottom left-hand panel). Similarly, on all-to-all platforms the majority of the trades are also done via CLOB. By comparison, the dealer-to-customer market relies predominantly on RFQ, accounting for more than 95% of trades on MDPs (Graph 3, bottom right-hand panel).

Survey data also point to an increase in AT. The proportion of trades executed via algorithms went from about a third in 2010 to roughly 45% in 2014. The majority of surveyed ETPs reported having application programming interface (API) connectivity, which is a prerequisite for AT. API connectivity is notably less prevalent on MDPs geared towards dealer-to-customer markets, but is a common feature of dealer-to-dealer platforms and all-to-all platforms.

Who trades electronically?

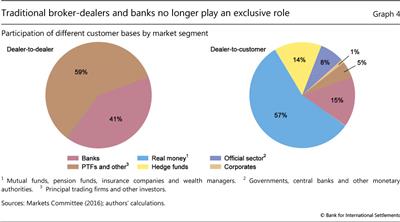

The survey results on platform trading by various types of market participants suggest that dealers' dominance has diminished. Indeed, on dealer-to-dealer platforms the share of volume generated by traditional players such as banks and broker-dealers has declined significantly. These players now account for only 41% of volume on dealer-to-dealer platforms (Graph 4, left-hand panel). The remainder is largely accounted for by PTFs. These have assumed a key role as liquidity providers on some formerly exclusively dealer-to-dealer venues, especially in the most liquid financial instruments. Many of the employed algorithms emulate a market-making strategy that relies on the submitting and cancelling of limit orders in rapid succession. The main purpose is to profit from the bid-ask spread, while ensuring tight risk control over inventory positions and minimising the risk of transacting with an informed counterparty. Limit orders offer an option to buy or sell a specified quantity, thereby providing immediacy to other market participants.

Non-bank financial institutions also play a key role as market participants on dealer-to customer platforms. These venues are used primarily by asset managers, which account for more than on half of the volumes (Graph 4, right-hand panel). The remainder is accounted for by several end user types, including banks, hedge funds, governments, central banks and other monetary authorities, whose combined trading activity amounts to approximately 37% of total volume.

Implications for market quality

Electronification can support market quality by enhancing both price efficiency and market liquidity. By reducing the need for human intervention, it enables market participants to detect and exploit arbitrage opportunities more quickly, ensuring that new information is readily accounted for in asset valuations across a broad range of markets.11 It also helps reduce trading costs by enabling greater transparency and, hence, increasing competition among market participants (eg Brogaard, Garriott and Pomeranets (2014)).12, 13 Moreover, execution algorithms have enabled market participants to optimise the implementation of their trading strategies, with large orders being split into multiple ones and/or routed towards the most liquid trading venues.

While these benefits are present during normal market conditions, a different question is how electronification affects the ability of markets to cope with stress (see also Box 2). During such episodes, market conditions hinge on the capacity and willingness of intermediaries to stand ready as suppliers of immediacy and on traders' ability (eg access to funding) to arbitrage across markets. How electronic trading shapes the business models of market-makers and arbitrageurs as well as of fundamental traders is thus crucial to understanding market dynamics during strained conditions.

In many fixed income segments, dealers remain the key liquidity providers. While PTFs employing market-making strategies have become supplementary suppliers of immediacy on some formerly exclusively dealer-to-dealer venues, they typically take on inventory risk only for very short periods. This is because most PTFs, thus far, have operated with little risk-bearing capital and lack the balance sheet capacity to warehouse inventory over longer periods of time - an important requirement to "make markets" in less frequently traded assets (eg off-the-run government bonds, corporate bonds). Thus, despite the transition from voice to electronic trading, liquidity conditions in many fixed income segments remain largely dependent on dealers' capacity and willingness to make markets. Indeed, as highlighted by the survey of ETPs, most trading in the dealer-to-customer market relies on dealers quoting prices either in response to a customer's request (RFQ) or continuously (CTT).

Current developments in fixed income trading also reflect a broader post-crisis response. Following the Great Financial Crisis and in response to regulatory reforms, dealers have raised their capital buffers and have reduced their trading book exposures (CGFS (2014, 2016), Fender and Lewrick (2015)). This has improved dealers' resilience while at the same time increasing the cost of supplying immediacy. Dealers have responded by adjusting the way they provide liquidity services, including by relying more on electronic means to interact with their clients. Automation of market-making and hedging, whereby large numbers of quotes are frequently updated in response to evolving market conditions, has been a key trend, as it helps dealers manage their inventory risk more efficiently and save costs. Some dealers are also reportedly shifting their immediacy services from a principal- to an agency-based model, ie executing customer orders by finding an offsetting order in the market, rather than taking exposures on their own balance sheets. These adjustments may contributed to falling dealer bond inventories amid broadly unchanged (or even increasing) trading volumes (CGFS (2014, 2016)).14 At the same time, the reduction in dealers' warehousing of assets implies that execution risks have been passed on to investors.15

Box 2

Is electronification harming market robustness?

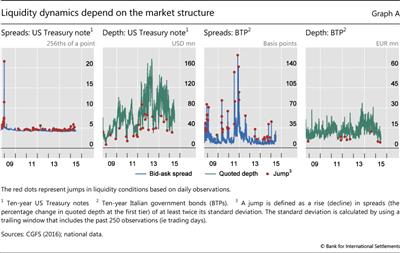

While electronic trading has clearly altered the provision of liquidity, it is difficult to assess empirically how these changes have affected market robustness, broadly defined as the market's ability to absorb shocks (eg large order imbalances). One reason is a lack of detailed data on trading activity prior to the advent of electronic trading. A second reason is that many factors can affect liquidity conditions, making it difficult to single out the impact of any individual one (CGFS (2016)). Some tentative insights, however, can be drawn from comparing electronic markets that differ with regard to how they source liquidity. Graph A depicts the bid-ask spreads and quoted depth since 2008 for 10-year US Treasury notes and 10-year Italian government bonds (buoni del tesoro poliennali (BTPs)), respectively. For the former, trading takes place on a fully automated CLOB, with PTFs accounting for a sizeable share of liquidity provision. For the latter, liquidity is exclusively provided by dealers that commit to quoting executable prices (CTT). Clearly, this comparison is subject to several caveats: each market was exposed to different conjunctural and systemic shocks (eg the euro area sovereign debt crisis), and each comprises different market participants that may be subject to varying constraints (eg funding liquidity conditions).

Keeping these big caveats in mind, some tentative observations may be drawn from the data. One is that transitory jumps in liquidity conditions occur in both markets. This reflects the fact that ETPs can help pool liquidity, but that they cannot generate liquidity when markets face order imbalances. A second observation is that liquidity conditions on the US Treasury market appear to be characterised by less volatile bid-ask spreads. While spreads do jump (the red dots in Graph A indicate changes by more than two standard deviations), they have remained in a narrow range, closely tied to the minimum tick size (1/64th of a point). Adverse changes in liquidity conditions, however, occur through adjustments in quoted depth. The BTP market, by comparison, appears to undergo larger adjustments in spreads during stressed periods, with quoted depth remaining fairly stable (Graph A, third and fourth panels).

It is difficult to judge, based on this comparison, which of the two market structures ensures more robustness. While, on the one hand, CLOBs with significant HFT presence may support trading at tight spreads throughout strained market conditions, market depth could prove shallow and fleeting if investors seek to trade large quantities. Quote-driven markets, on the other hand, benefit from the capacity of dealers to warehouse assets over an extended period of time (in contrast to the typical HFT liquidity providers), which may help absorb temporary order imbalances. Dealers, however, will seek to mitigate risks to their balance sheets by widening spreads in situations of elevated market uncertainty, implicitly charging investors for the cost of these higher risk exposures.

Changes in how dealers and, to an increasing extent, non-dealers provide immediacy also have a number of implications for the behaviour of market liquidity during strained conditions. One concern is that abrupt but short-lived price swings ("flash crashes") may become more frequent in highly automated fixed income markets. The activity of PTFs and the role of AT during specific episode of outsize volatility and extreme intraday movements such as the flash rally in the US Treasury market on 15 October 2014 are a case in point. While it has proved difficult to identify specific trigger events, a key finding of JSR (2015) is that trading algorithms may have contributed to extreme price swings on that day. PTFs and bank dealers both managed the risk of volatility by reducing liquidity to the market, with market depth (as measured by outstanding orders in the CLOB) declining to very low levels right before the period of extreme volatility. Notably, PTFs were the largest contributors to this decline in depth, but maintained narrow bid-ask spreads throughout the event. Bank dealers, by comparison, responded by widening their bid-ask spreads.

This event, among others, illustrates that the increasing complexity of trading algorithms and their possible interactions represent a source of risk that can act as an amplifier in stress episodes. For one, large price movements or price gapping during stressed periods can prove difficult to incorporate in trading algorithms. Liquidity providers' risk monitoring thus often includes measures to interrupt quoting ("panic buttons"). Yet, while suspending liquidity provision may appear rational from an individual market participant's point of view, it raises the risks for the remaining liquidity providers.

Overall, these developments imply that electronic trading may have changed the dynamics - particularly the speed and visibility - of market responses to imbalances in demand and supply. It is, however, important to note that the basic underlying economic mechanism of how illiquidity risks unfold (Borio (2004), Shin (2010)) appears to have remained largely unchanged. Indeed, irrespective of the underlying market microstructure, market conditions remain susceptible to a sudden evaporation of liquidity (Box 2). These are situations in which both human traders as well as PTFs as the "new market-makers" (eg Menkveld (2013)) have always been reluctant to step in as shock absorbers (eg Adrian et al (2013)).

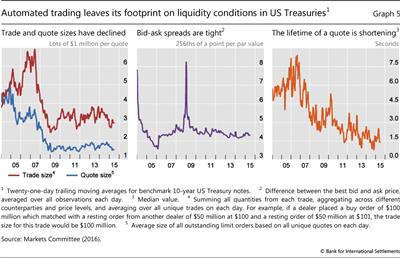

An important takeaway from the above discussion is that traditional gauges of liquidity conditions may be less suitable in the new market environment. HFT strategies enable the submission of highly competitive prices (resulting in narrow spreads), even in highly volatile conditions (eg JSR (2015)). These strategies manage the risk of being picked off by an informed market order by quoting in limited size and updating orders (ie cancelling and submitting new orders) at a very high frequency. This may lead to conflicting signs of liquidity conditions (Graph 5): while tight bid-ask spreads suggest ample market liquidity, limited quoted depth and small trade sizes indicate the opposite.16 The lifetime of orders in turn shortens, making it increasingly difficult to assess whether the market is actually liquid since orders could be cancelled instantaneously ("fleeting") as soon as market participants intend to trade. Given this new market environment, additional metrics may be needed to monitor liquidity conditions more accurately (O'Hara (2015)). One such measure could be implementation shortfall (eg Hendershott et al (2011), which captures the total costs of establishing a position in a security of a given size.

Conclusions

Trading in fixed income markets is becoming more automated as electronic platforms explore new ways to bring buyers and sellers together. In the most liquid markets, traditional dealers are increasingly competing with new market participants whose trading strategies rely exclusively on sophisticated computer algorithms and speed. Some dealers, in turn, have embraced automated trading to provide liquidity to customers at lower costs and with limited balance sheet exposure.

To some extent, these trends resemble those witnessed in other markets, where electronic and automated trading have long become the prevailing market standard. Indeed, much of the innovation in trading protocols and (HFT) algorithms is based on importing technology initially developed for equities that has subsequently spilled over to foreign exchange markets (Markets Committee (2011)). This suggests that many of the market implications - and the associated policy challenges - will increasingly shape trading in fixed income markets as well.

As discussed in Markets Committee (2016) and CGFS (2016), there are several areas that may warrant further policy attention. First, the impact of electronic trading needs to be appropriately monitored. The above discussion highlights how standard liquidity metrics need to be supplemented by alternative measures to reflect the changes in liquidity provision. Second, more research is needed to inform policymakers about the impact of automated trading on market quality and how to address any associated market failures. Third, with trading activity increasingly gravitating towards platforms, ensuring their robustness as well as their capacity to deal with market stress becomes a key financial stability issue. With dealers closing down traditional trading desks ("hanging up their phones"), while their e-trading desk algorithms connect to an expanding set of multilateral platforms, the fallback option of returning to voice trading may no longer be viable. Finally, regulation and best practice guidelines need to adapt as markets evolve. This could include assessing the scope and capacity of existing supervision as well as the effectiveness of existing mechanisms to deal with market stress episodes.

References

Adrian, T, M Fleming, J Goldberg, M Lewis, F Natalucci and J Wu (2013): "Dealer balance sheet capacity and market liquidity during the 2013 selloff in fixed-income markets", Liberty Street Economics, 16 October.

Bessembinder, H and W Maxwell (2008): "Markets: transparency and the corporate bond market", Journal of Economic Perspectives, vol 22, no 2, pp 217-34.

Biais, B and R Green (2007): "The microstructure of the bond market in the 20th century", Carnegie Mellon University working paper, August.

Borio, C (2004): "Market distress and vanishing liquidity: anatomy and policy options", BIS Working Papers, no 158, July.

Brogaard, J, C Garriott and A Pomeranets (2014): "High frequency trading competition", Bank of Canada Working Papers, 2014-19.

Brogaard, J, T Hendershott and R Riordan (2014): "High frequency trading and price discovery", Review of Financial Studies, vol 27, no 8, pp 2267-306.

Chaboud, A, B Chiquoine, E Hjalmarsson and C Vega (2014): "Rise of the machines: algorithmic trading in the foreign exchange market", Journal of Finance, vol 69, pp 2045-84.

Committee on the Global Financial System (1999): "Market liquidity: research findings and selected policy implications", CGFS Papers, no 11, May.

--- (2014): "Market-making and proprietary trading: industry trends, drivers and policy implications", CGFS Papers, no 52, November.

--- (2016): "Fixed income market liquidity", CGFS Papers, no 55, January.

Duffie, D (2012): Dark markets: asset pricing and information transmission in over-the-counter markets, Princeton University Press.

Fender, I and U Lewrick (2015): "Shifting tides - market liquidity and market-making in fixed income instruments", BIS Quarterly Review, March, pp 97-109.

Fleming, M, B Mizrach and G Nguyen (2014): "The microstructure of a US Treasury ETP: the BrokerTec platform", Federal Reserve Bank of New York, Staff Reports, no 381, May.

Greenwich Associates (2014): European fixed income study, July.

Hendershott, T, C Jones and A Menkveld (2011): "Does algorithmic trading improve liquidity?", Journal of Finance, vol 66, no 1, pp 1-33.

Hendershott, T and A Madhavan (2015): "Click or call? Auction versus search in the over-the-counter market", Journal of Finance, vol 70, pp 419-47.

Kyle, A (1985): "Continuous auctions and insider trading", Econometrica, vol 53, issue 6, November, pp 1315-36.

Markets Committee (2011): "High-frequency trading in the foreign exchange market", Bank for International Settlements, Markets Committee Publications, no 5, September.

--- (2016): "Electronic trading in fixed income markets", Bank for International Settlements, Markets Committee Publications, no 7, January.

Menkveld, A (2013): "High-frequency trading and the new-market makers", Journal of Financial Markets, no 16, pp 712-40.

Mizrach, B and C Neely (2006): "The transition to electronic communication networks in the secondary treasury market", Federal Reserve Bank of St Louis, Review, no 88, pp 527-41.

O'Hara, M (2015): "High frequency market microstructure", Journal of Financial Economics, vol 115, no 2, pp 257-70.

Scalia, A and V Vacca (2001): "Does market transparency matter? A case study", in "Market liquidity: proceedings of a workshop held at the BIS", BIS Papers, no 2, April.

Schrimpf, A (2015): "Outstanding OTC derivatives positions dwindle as compression gains further traction", BIS Quarterly Review, December, pp 24-5.

Shin, H S (2010): "Risk and liquidity", Clarendon Lectures in Finance, Oxford University Press.

US Department of the Treasury, Board of Governors of the Federal Reserve System, Federal Reserve Bank of New York, US Securities and Exchange Commission, and US Commodity Futures Trading Commission (2015): "The US Treasury market on October 15, 2014", Joint Staff Report, 13 July.

1 The authors would like to thank Claudio Borio, Ben Cohen (the editor), Dietrich Domanski, Michael Fleming, Corey Garriott, Eleonora Iachini, Bob McCauley, Ernst Schaumburg and Brian Weller for helpful comments. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements, the Committee on the Global Financial System or the Markets Committee.

2 For the purpose of this article, we define AT as a trading technology in which orders and trade decisions are made electronically and autonomously, ie with no human intervention (Markets Committee (2011)). HFT is a subset of AT in which orders (including order cancellations) are submitted and trades executed at high speed (Markets Committee (2016)).

3 "Market liquidity" can be broadly defined as the ability to rapidly execute large financial transactions at low cost with limited price impact (CGFS (1999)). The price of an asset is considered to be efficient if it reflects the asset's fundamental value based on all the information available to market participants at any given point in time (see Markets Committee (2016) for a discussion).

4 CGFS (2016) and Markets Committee (2016).

5 Interestingly, however, government and corporate bonds in the United States once traded actively on the New York Stock Exchange, and bond trading on the exchange was still active until the late 1940s, before migrating to OTC markets (Biais and Green (2007)). A detailed discussion of electronic trading in the US Treasury market is provided by Mizrach and Neely (2006) and Fleming et al (2014).

6 Examples of SDPs are Barclays' BARX, Deutsche Bank's Autobahn and Citibank's Velocity. Major MDPs include Tradeweb, MTS BondVision and Bloomberg.

7 Priority is usually given to the limit order with the best price, ie the lowest sales offer (best ask) and the highest buy offer (best bid). If the price of two orders is the same, priority is given to that submitted to the CLOB first ("price-time priority"). CLOBs are often "pre-trade transparent", in the sense that any participant may view the set of bids and offers at which one can sell or buy, respectively, at any time. Moreover, many platforms enable trading that remains anonymous before the trade, subject to predefined counterparty credit limits. Transaction prices and volumes are often disclosed post-trade ("post-trade transparency").

8 AT and HFT strategies can be roughly grouped in three categories: (i) trade execution; (ii) market-making; and (iii) directional, relative-value and arbitrage strategies (Markets Committee (2016)). Algorithms, however, often do not follow a single trading strategy, but may switch between strategies over time depending on market conditions. See also Markets Committee (2011) for a discussion of HFT in the foreign exchange market.

9 In some instances, PTFs have been set up by former floor or pit traders from stock and commodity exchanges, adopting similar types of trading strategies, yet based on computer algorithms.

10 In voice trading, many expressions of trading interest also do not ultimately result in a trade.

11 Research on the impact of electronic trading, and of AT in particular, on market quality is growing. Due to data limitations, work has mostly focused on asset classes other than fixed income, however. For FX markets, for example, Chaboud et al (2014) suggest that algorithmic traders eliminate arbitrage opportunities, thereby enforcing FX pricing relationships as well as contributing to lower volatility. Likewise, HFT activity has been found to support faster price discovery, as suggested by recent analysis of equity markets (eg Hendershott et al (2011), Menkveld (2013), Brogaard, Hendershott and Riordan (2014)).

12 Transaction costs for bonds with a high propensity to execute on platforms, for example, are significantly lower on platforms than for trades of the same securities executed via phone (Hendershott and Madhavan (2015)). Other studies, such as Mizrach and Neely (2006), also find that ETPs offer superior liquidity.

13 Bessembinder and Maxwell (2008), for example, discuss how improved post-trade transparency in the US corporate bond market following the introduction of mandatory trade reporting contributed to a significant decline in transaction costs. Choosing the degree of transparency, however, also implies a number of trade-offs, as discussed in Scalia and Vacca (2001).

14 The analysis by the CGFS points to a number of other drivers of dealer inventories: (i) a reassessment of the risk-return trade-off by banks following large losses on trading positions during recent crises; (ii) an increase in regulatory capital charges on risk exposures (eg due to the leverage ratio or the revised framework for market risk); and (iii) low returns on securities held in inventory (so-called "carry") given the low interest rate environment.

15 Execution risks include the risk of changes in the price of the underlying asset during the time between the placement of the order and its execution.

16 The proliferation of complex order types further complicates the assessment of liquidity conditions. One example is partially hidden orders ("iceberg" orders) that allow market participants to show only part of the quantity they are willing to trade. This implies that quoted depth provides only a partial picture of the available quantities that can be traded at the bid and ask price.