Why do government debt figures differ so widely across data sets?

(Extract from pages 74-75 of BIS Quarterly Review, September 2015)

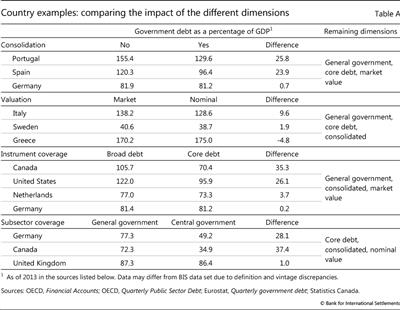

The wide variations in government debt figures produced by different statistical agencies can arise in several ways. These include differences in how agencies treat the structure of the government sector and consolidate its accounts, in accounting practices, in the types of activity undertaken by the government, and in the country's macroeconomic and financial conditions. In this box, we show how government debt figures produced for selected countries may be affected by differences along four of the five dimensions highlighted in this special feature: consolidation, valuation, instrument coverage and the sectoral perimeter (Table A).

Consolidation among general government institutions provides a simplified view of the government sector's overall debt obligations, by eliminating intrasector transactions and positions. Depending on the government's structure, the impact of consolidation on government debt in 2013 (keeping all other dimensions constant) is estimated to range from 26 percentage points of GDP, as in the case of Portugal, to just 1 percentage point for Germany.

Valuation differences also vary widely, as highlighted in the section on "Measuring valuation effects" in the main text. Keeping all other dimensions constant, Italian general government debt for 2013 turns out to be 10 percentage points of GDP higher at market prices, compared with nominal values, whereas for Sweden the difference is almost negligible. The case of Greece shows how these different valuation effects can reflect idiosyncratic macroeconomic conditions: whereas for most countries the recent decline in interest rates has pushed market values above nominal values, the market value of Greek government debt as of 2013 is 5 percentage points of GDP lower than its nominal value, reflecting adverse interest rate developments for that country, linked to concerns about its creditworthiness.

The scope of instrument coverage can also affect estimates. In the case of Germany, for example, using the general government's core debt instead of broad debt would have no significant effect. But the inclusion of non-core debt liabilities would increase government debt by more than 35 percentage points of GDP for Canada. Yet the implied deterioration of Canada's fiscal position, relative to that of other countries, may be misleading. The unfunded liabilities related to government-sponsored employment-related pension schemes in Canada are included in the financial accounts of the general government, which is in line with the standards and should be positively viewed from a fiscal transparency and sustainability perspective. However, many countries do not record such liabilities explicitly; moreover, there are cross-country discrepancies related to the sectoral classification of such pension schemes (funded or not), which should be in the general government sector when they are controlled by government, but may also be classified as pension funds in the financial corporations sector . In the current reporting, therefore, there are differences due to diverse institutional arrangements among countries. These types of discrepancy explain why the BIS data set focuses on core debt for the purpose of cross-country comparisons.

. In the current reporting, therefore, there are differences due to diverse institutional arrangements among countries. These types of discrepancy explain why the BIS data set focuses on core debt for the purpose of cross-country comparisons.

Finally, there are differences as to which subsectors should be included in debt figures for the general government as a whole, despite the clear recommendations contained in 2008 SNA. Considering just the central government instead of the general government sector reduces 2013 government debt by only 1 percentage point of GDP for the United Kingdom, but by up to 37 percentage points of GDP for Canada.

It should be noted, in addition, that general pension-related contingent liabilities associated with pay-as-you-go social security schemes are not recorded by most other countries. For details on these issues, see 2008 SNA, #17.191-206.

It should be noted, in addition, that general pension-related contingent liabilities associated with pay-as-you-go social security schemes are not recorded by most other countries. For details on these issues, see 2008 SNA, #17.191-206.