The economics of market-making

(Extract from page 99 of BIS Quarterly Review, March 2015)

Market-makers follow a number of different business models, but broadly share some common features (CGFS (2014)). These include a sufficiently large client base to get a good view of the flow of orders; the capacity to take on large principal positions; continuous access to multiple markets, including funding and hedging markets; the ability to manage risk, especially the risk of holding assets in inventory; and market expertise in providing competitive quotes for a range of securities.

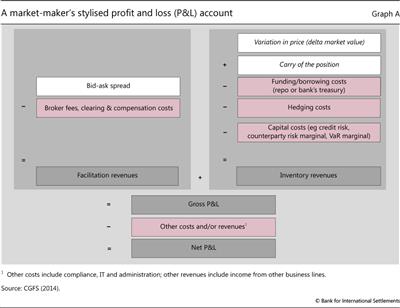

A stylised profit and loss (P&L) account (Graph A) maps these features into two broad revenue categories. One is called facilitation revenues. These reflect bid and ask spreads - that is, the difference between the market-maker's prices for buying and selling an asset, net of the cost of trading. The second is termed inventory revenues. These reflect changes in the value of an asset held in inventory, plus accrued interest, and funding and hedging costs. Regulatory requirements will affect profits via their impact on capital, funding and hedging costs, as well as the direct costs of compliance. It follows that market-makers will set their bid and ask prices based on their expectations of the cost and risk of holding assets in inventory. Spreads will tend to be narrow if market-makers believe they can execute trades quickly and cheaply, or if funding and hedging costs are low. Thus, a market's liquidity depends on the depth and efficiency of related markets, such as those for funding and hedging.

The difference between actual and desired inventory levels is important to market-makers, who all have risk management frameworks that set limits on holdings of different assets. When institutions approach those limits, they tend to adjust their quoted prices to realign their inventory. As a result, if an institution is trying to reduce risk, it may cut back on its market-making activity. If many market-makers are reducing risk at the same time, markets lose liquidity. Moreover, when market volatility rises, standard risk assessment models will signal that a market-maker's inventory has become riskier. That may prompt the market-maker to further trim its holdings. In turn, bid-ask spreads may widen, which could ultimately provoke additional volatility and diminish liquidity further.