Japan's growth and deflation: two lost decades?

(Extract from page 45 of BIS Quarterly Review, March 2015)

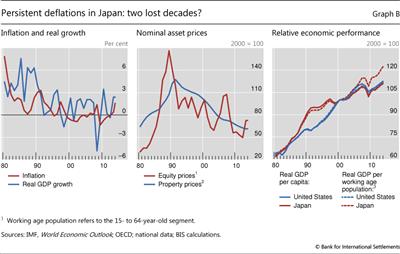

The most important case of persistent deflation in the postwar era is Japan since 1998. This deflation episode has been mild, with a cumulative fall in consumer prices of just 4% between 1998 and 2012, but very persistent, lasting for more than a decade (Graph B, left-hand panel).

This deflation episode has been mild, with a cumulative fall in consumer prices of just 4% between 1998 and 2012, but very persistent, lasting for more than a decade (Graph B, left-hand panel).  The deflation followed a sharp drop in share and land prices starting in the early 1990s, in the wake of a strong boom in asset prices and credit in the second half of the 1980s (Graph B, centre panel). The collapse in asset prices impaired bank balance sheets and ushered in a so-called lost decade for growth between 1991 and 2000. Since growth has, in fact, never returned to pre-bust rates, the entire post-1991 period is sometimes referred to as "two lost decades", with persistent deflation characterising the second.

The deflation followed a sharp drop in share and land prices starting in the early 1990s, in the wake of a strong boom in asset prices and credit in the second half of the 1980s (Graph B, centre panel). The collapse in asset prices impaired bank balance sheets and ushered in a so-called lost decade for growth between 1991 and 2000. Since growth has, in fact, never returned to pre-bust rates, the entire post-1991 period is sometimes referred to as "two lost decades", with persistent deflation characterising the second.

That said, the picture of Japan's uninterrupted economic decline since the early 1990s is qualified when demographic factors are considered. The growth slowdown and the rapid ageing of the population acted as a drag on growth from the turn of the millennium. This needs to be controlled for when assessing the relationship between deflation and economic performance. Indeed, on a per capita basis, real GDP growth slowed markedly during the 1990s, but actually rose during the 2000s. Between 1991 and 2000, cumulative per capita real GDP grew by a mere 6%, compared with 26% in the United States (Graph B, right-hand panel). Between 2000 and 2013, however, cumulative per capita real growth was 10%, compared with roughly 12% in the United States. Real GDP per working age population, a measure that also takes into account the effect of ageing on economic performance, shows an even stronger performance. It indicates that cumulative growth in the period 2000-13 exceeded 20% in Japan, compared with roughly 11% in the United States (Graph B, right-hand panel). This picture does not change when we exclude the Great Financial Crisis. In the period 2000-07, cumulative per capita real GDP growth in Japan and the United States were, respectively, about 9% and 11% and, when growth is measured in terms of working age population, about 15% and 8%.

The extensive literature on the causes and consequences of deflation in Japan includes Ahearne et al (2002), Ito and Mishkin (2004), Nishizaki et al (2012) and Shirakawa (2014).

The extensive literature on the causes and consequences of deflation in Japan includes Ahearne et al (2002), Ito and Mishkin (2004), Nishizaki et al (2012) and Shirakawa (2014).  Our empirical methodology treats the Japanese deflation as two separate episodes because of a price peak in 2008 (in addition to the one in 1998). The results of the empirical analysis, however, would not be affected if we were to treat Japan as a single case.

Our empirical methodology treats the Japanese deflation as two separate episodes because of a price peak in 2008 (in addition to the one in 1998). The results of the empirical analysis, however, would not be affected if we were to treat Japan as a single case.