Interpreting FDI flows under the new balance of payments template

(Extract from page 75 of BIS Quarterly Review, December 2014)

The rapid pace of financial globalisation over the past few decades has changed many aspects of international capital flows. To improve the understanding of these capital movements, in 2009 the IMF and its members agreed on a new template for collecting international financial transactions data: the sixth edition of the IMF's Balance of Payments and International Investment Position Manual (BPM6). From January 2015, the IMF will only accept data submissions under BPM6. In the transition period, some countries will still be publishing their BoP data under the previous template (BPM5, introduced in 1993) and the IMF will simply convert those "old" data to the new standard. Using Brazil as an example, this box illustrates how the conversion between BPM5 and BPM6 affects the interpretation of FDI flows.

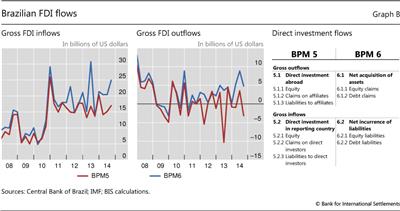

Data published under the two formats reflect somewhat different treatments of within-company loans, resulting in differences in reported gross FDI inflows and outflows (Graph B, left-hand and centre panels), even though net FDI flows remain unchanged. This is because, under BPM5, FDI transactions between affiliates are recorded on a residence versus non-residence basis, whereas BPM6 differentiates between the net acquisition of assets and the net incurrence of liabilities. Simply put, under BPM5, both headquarter lending to affiliates (which increases claims) and borrowing from affiliates (which increases liabilities) are counted as gross outflows, albeit with opposite signs. Under BPM6, by contrast, the two activities will fall into different categories. While headquarter lending to affiliates will continue to count as capital outflow, borrowing from affiliates will be counted as net incurrence of liabilities (capital inflow). Using the notation in Graph B (right-hand panel), net acquisition of debt claims under BPM6 (item 6.1.2) will be the sum of items 5.1.2 and 5.2.2 under BPM5.