Implementation of Basel III - Executive Summary

Transitional arrangements and the RCAP process

Basel III is a comprehensive set of measures developed by the Basel Committee on Banking Supervision (BCBS) as a response to the Great Financial Crisis. It aims to increase the banking sector's ability to absorb shocks arising from financial and economic stress by strengthening regulation and supervision of banks. Basel III standards are minimum requirements that apply to internationally active banks, though some BCBS member jurisdictions apply parts or all of the framework to their non-internationally active banks as well.

BCBS members are committed to the full, timely and consistent adoption and implementation of Basel standards in their jurisdictions. The BCBS established a comprehensive Regulatory Consistency Assessment Programme (RCAP) in 2012 to closely monitor and assess the timeliness and consistency of implementation of the Basel III standards on a regular basis. The RCAP supports the Financial Stability Board's monitoring of the implementation of the agreed post-financial crisis reforms and complements the Financial Sector Assessment Program of the International Monetary Fund and World Bank.

Basel III phases and transitional arrangements

Basel III was finalised in late 2017 (early 2019 for the revised market risk framework). Its initial phase focused on addressing the most pressing shortcomings in the pre-crisis regulatory framework. These include the definition of capital and the level of capital. Basel III also introduced new measures: two liquidity ratios, a leverage ratio and macroprudential elements. The objectives of the revisions of the final phase were to restore credibility in the calculation of risk-weighted assets and improve the comparability of banks' capital ratios. This was achieved by:

- enhancing the robustness and risk sensitivity of the standardised approaches for credit risk, credit valuation adjustment (CVA) risk and operational risk

- constraining the use of the internal model approaches, by placing limits on certain inputs used to calculate capital requirements under the internal ratings-based (IRB) approach for credit risk and by removing the use of the internal model approaches for CVA risk and for operational risk

- replacing the existing Basel II output floor with a more robust risk-sensitive floor based on the BCBS's revised Basel III standardised approaches

- introducing a leverage ratio buffer to further limit the leverage of global systemically important banks (G-SIBs)

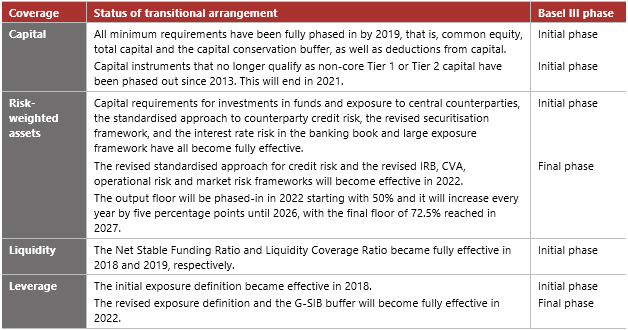

Similar to the initial phase of Basel III, the reforms associated with the final phase include transitional arrangements to support smooth implementation. These arrangements provide jurisdictions with the discretion to adopt domestic rules that are more stringent than the Basel minima and to implement Basel standards before the deadlines (see the following table).

RCAP process

The RCAP has two different focus areas. The first is to monitor, on a semiannual basis, the formal adoption of Basel III as each member jurisdiction transposes the Basel standards into domestic regulation with a focus on the timeliness of implementation. Second, the BCBS assesses and evaluates the completeness and consistency of the adopted standards. These assessments are carried out on a jurisdictional and thematic basis. While the former reviews the extent to which domestic regulations are aligned with the minimum Basel requirements agreed by the Basel Committee and helps identify material gaps in such regulations, the latter improves comparability across outcomes by examining the implementation of the Basel standards at the individual bank level across member jurisdictions.

The assessment of a jurisdiction's compliance with the Basel standards is performed by an assessment team comprising regulatory and supervisory experts drawn from the organisations of Basel Committee members or observers and is typically led by a member of the BCBS or a senior official of a member jurisdiction. This assessment includes a quantitative analysis of the current and potential impact of any (material) gaps or deviations in the domestic regulation on both financial stability and the level playing field across borders. This helps member jurisdictions to adjust domestic regulation and undertake necessary reforms to be in line with the internationally agreed Basel standards.

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.