The short and long end of equity prices during the pandemic

Valuations and the shift in interest rates

Stock markets price in long-term information, stretching far beyond the short-term cyclical fluctuation in the growth outlook. The recent rally in equity prices has attracted attention, among other reasons, for its possible disconnect from the underlying prospects of economies still reeling from the pandemic shock. In this box, we use dividend derivatives to decompose the US and European equity benchmarks into short- and long-term components, corresponding to the value of the short- and long-term dividend stream. Our main goal is to explore whether this dimension, together with depressed interest rates, sheds some light on the apparent disconnection. In line with the subdued short-term economic outlook mentioned above, we find that the short-term components of both indices have seen a limited recovery since March. The benchmarks' strong recent performance is thus predicated on steady gains in their long-term components. Moreover, these gains are related, to a large extent, to the drop in the term structure of interest rates that followed the policy response of central banks to the pandemic shock.

The recent rally in equity prices has attracted attention, among other reasons, for its possible disconnect from the underlying prospects of economies still reeling from the pandemic shock. In this box, we use dividend derivatives to decompose the US and European equity benchmarks into short- and long-term components, corresponding to the value of the short- and long-term dividend stream. Our main goal is to explore whether this dimension, together with depressed interest rates, sheds some light on the apparent disconnection. In line with the subdued short-term economic outlook mentioned above, we find that the short-term components of both indices have seen a limited recovery since March. The benchmarks' strong recent performance is thus predicated on steady gains in their long-term components. Moreover, these gains are related, to a large extent, to the drop in the term structure of interest rates that followed the policy response of central banks to the pandemic shock.

A stock's price can be seen as the sum of the present value of the stream of all expected future dividend payments. Our analysis draws on a variation of such a present value model. The discount rate for each expected future dividend comprises two parts. First, a risk-free rate reflecting the "value of time" and usually taken from the government bond market - we use the term structure of zero coupon yields for the United States and the euro area.

Our analysis draws on a variation of such a present value model. The discount rate for each expected future dividend comprises two parts. First, a risk-free rate reflecting the "value of time" and usually taken from the government bond market - we use the term structure of zero coupon yields for the United States and the euro area. Second a risk premium, capturing the compensation that investors require for bearing the uncertainty surrounding future dividends.

Second a risk premium, capturing the compensation that investors require for bearing the uncertainty surrounding future dividends.

We decompose the pricing of the S&P 500 and the EURO STOXX 50 into a short- and a long-term component. The threshold separating them marks the boundary of investors' cyclical considerations about dividend growth. Before that point in time, investors can form relatively detailed expectations about dividend growth, based on their expectations for the broader economy. Beyond that threshold, we assume that they take a long-term view of dividend growth - a constant rate. For practical reasons, we choose that boundary to be five years, which coincides with the availability of reasonably liquid dividend futures contracts for both indices. That is, contracts on the actual annual dividend payout of the firms included in the respective index. Those dividend futures prices provide a direct market assessment of the present value of those dividend coupons.

That is, contracts on the actual annual dividend payout of the firms included in the respective index. Those dividend futures prices provide a direct market assessment of the present value of those dividend coupons.

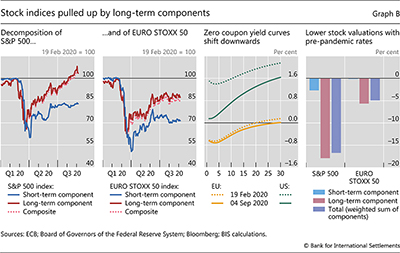

Thus, we construct the short-term component of both the S&P 500 and EURO STOXX 50 by adding up the futures prices of the respective annual dividends for 2020-24. The long-term component is obtained as a residual, as the difference between the full index price and the short-term component. After a parallel downward shift in late February that spanned most of March, the short-term components continued plunging into early April and subsequently displayed a tepid rebound (Graph B, first two panels). This path is consistent with survey data suggesting a subdued recovery of the real economy. In contrast, the long-term components reached a turning point in mid-March, followed by a relatively aggressive rally as the policy response gathered momentum.

The stock market rebound has been accompanied by an overall downward shift of yield curves, especially in the United States. Since the pandemic, the front end of the US zero coupon yield curve has declined by around 140 basis points (Graph B, third panel), while its euro area counterpart has barely moved. Long-term interest rates, as represented by 10-year tenor securities, have fallen by about 80 and 10 basis points in the United States and the euro area, respectively. In addition, long-run steady state interest rates have dropped by about 20 basis points in both.

In this context, a natural question concerns the relative contribution of lower interest rates to the rebound in equity prices. Using our simple model, we address that question empirically by recalculating the September prices of short- and long-term components after replacing the term structure of interest rates prevailing in [early September] with the term structure prevailing in February, before the outbreak of Covid. In addition, we keep unchanged the dividend growth rate and risk sentiment implicit in August prices. Notice that this ceteris paribus exercise does not imply any correlation between stock and bond returns, whose implications are at the centre of a lively debate.

The results suggest that the drop in interest rates has provided a significant boost to stock prices. Most gains were concentrated in the long-term components, which are naturally more sensitive to discount rate changes than their short-term counterparts. All else equal, in the absence of the fall in interest rates, the long-term components of US and European stock prices would have been roughly 18% and 6% lower than they were on 4 September, respectively (Graph B, fourth panel). The short-term components would have been only slightly lower. The estimated total impact - equal to the weighted average of the short- and long-term components - amounts to close to a half and a fifth of the rebound in the US and euro area equity prices, respectively.

See eg I Dew-Becker and S Giglio, "Asset pricing in the frequency domain: theory and empirics," The Review of Financial Studies, vol 29, issue 8, August 2016, pp 2029-68

See eg I Dew-Becker and S Giglio, "Asset pricing in the frequency domain: theory and empirics," The Review of Financial Studies, vol 29, issue 8, August 2016, pp 2029-68  Buybacks would affect the value of the stock only if they result in an increase in the dividend payout per share for the remaining shares.

Buybacks would affect the value of the stock only if they result in an increase in the dividend payout per share for the remaining shares.  The zero coupon yield curves for the United States and the euro area are obtained from the Federal Reserve Board and the ECB, respectively. Both fit a Nelson-Siegel-Svensson model to observed interest rates.

The zero coupon yield curves for the United States and the euro area are obtained from the Federal Reserve Board and the ECB, respectively. Both fit a Nelson-Siegel-Svensson model to observed interest rates.  As of the time of writing, the futures contracts for the annual dividends for the period 2020-24 (five annual contracts) had relatively high open interest, suggesting adequate liquidity.

As of the time of writing, the futures contracts for the annual dividends for the period 2020-24 (five annual contracts) had relatively high open interest, suggesting adequate liquidity.  See N Gormsen and R Koijen, "Coronavirus: impact on stock prices and growth expectations", University of Chicago, Becker Friedman Institute for Economics Working Paper, March 2020, use dividend futures data to examine investors' expectations about dividend growth.

See N Gormsen and R Koijen, "Coronavirus: impact on stock prices and growth expectations", University of Chicago, Becker Friedman Institute for Economics Working Paper, March 2020, use dividend futures data to examine investors' expectations about dividend growth.  See eg R Clarida, "Monetary policy, price stability, and equilibrium bond yields: success and consequences," remarks at the High-Level Conference on Global Risk, Uncertainty and Volatility, Zurich, November 2019.

See eg R Clarida, "Monetary policy, price stability, and equilibrium bond yields: success and consequences," remarks at the High-Level Conference on Global Risk, Uncertainty and Volatility, Zurich, November 2019.