Aurum: a two-tier retail CBDC system

The BIS Innovation Hub and the Hong Kong Monetary Authority have completed a retail CBDC technology prototype.

Project Aurum: a prototype for two-tier central bank digital currency (CBDC)

A technology stack that sets up two different types of retail tokens

The BIS Innovation Hub has completed its first retail central bank digital currency (CBDC) system. Project Aurum was carried out by the Innovation Hub's Hong Kong Centre in partnership with the Hong Kong Monetary Authority and in collaboration with the Hong Kong Applied Science and Technology Research Institute.

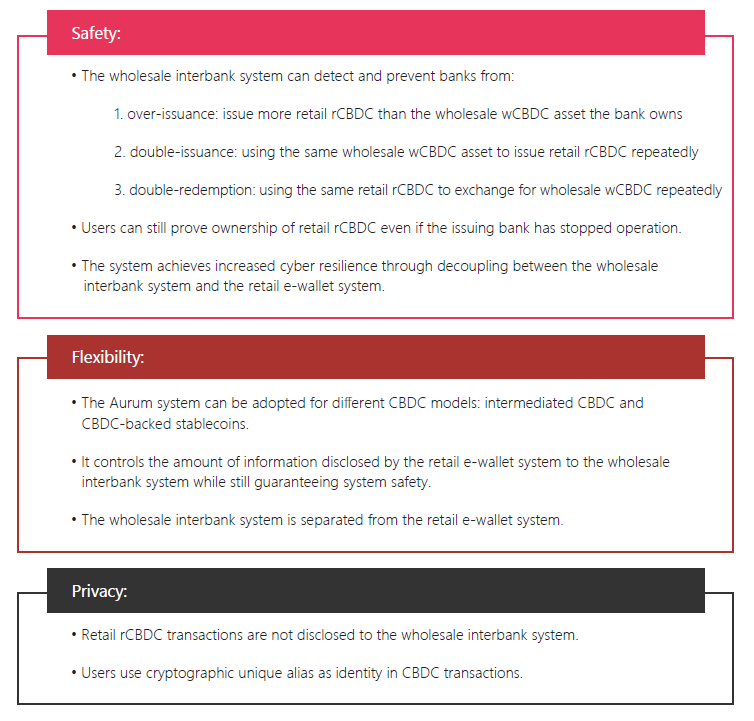

It was dubbed "Aurum", the Latin word for gold, to reflect the starting point that digital currency issued under the auspices of a central bank must be as robust and trustworthy as gold. The prototype system was successfully completed in July 2022, following the core principles of safety, flexibility and privacy.

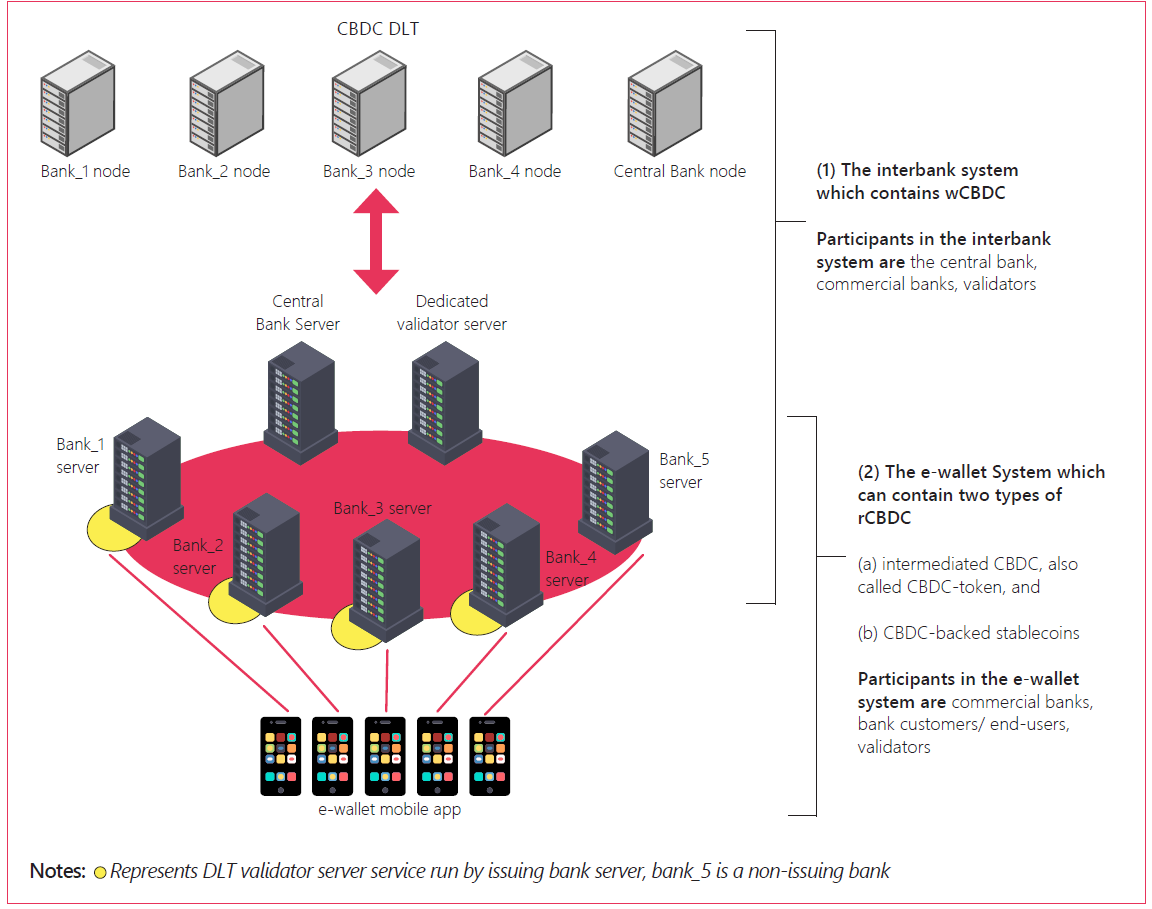

The project created a technology stack comprised of a wholesale interbank system and a retail e-wallet system, setting up two different types of tokens: intermediated CBDC and stablecoins backed by CBDC in the interbank system. The latter is unique in the study of CBDC to date. While intermediated CBDC is a direct liability of the central bank, CBDC-backed stablecoins are liabilities of the issuing bank, with its backing assets held by the central bank.

The project represents an in-depth exploration of a prototype CBDC system. The Aurum system is accompanied by technical manuals totalling over 250 pages that, together with the source code, are made accessible to all central banks on BIS Open Tech to serve as a public good for the further study of retail CBDC by the central banking community.